Terminal Value Definition

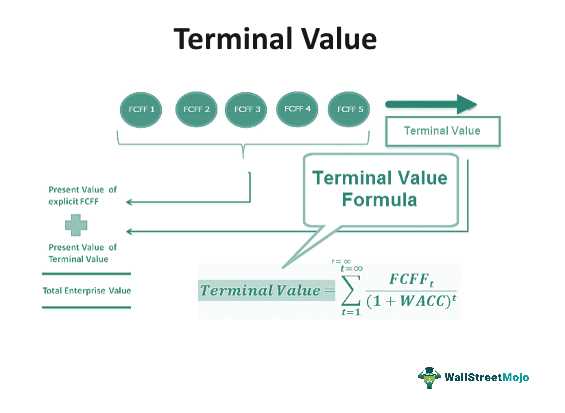

Terminal value is a financial concept used in fundamental analysis to estimate the value of an investment or business at the end of a specific period. It represents the present value of all future cash flows beyond that period, assuming a stable growth rate. Terminal value is an important component in valuing a company or investment because it accounts for the long-term potential and sustainability of the business.

Importance of Terminal Value in Financial Analysis

Terminal value plays a crucial role in financial analysis as it provides a more comprehensive valuation of a company or investment. By including the future cash flows beyond the projection period, it captures the long-term potential and sustainability of the business. This is especially important for industries with high growth rates or companies with significant growth prospects.

Furthermore, terminal value allows investors and analysts to compare different investment opportunities on an equal basis. It provides a common metric to evaluate the long-term value creation potential of various investments, helping in decision-making and resource allocation.

How to Find The Value With Formula

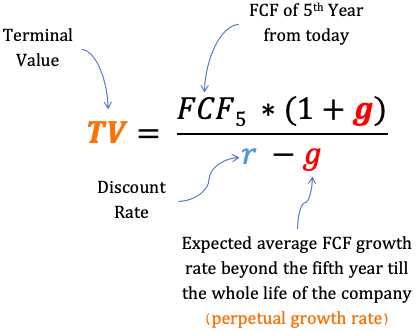

There are several formulas and methods to calculate terminal value, depending on the specific approach used. One commonly used formula is the Gordon Growth Model, which calculates the terminal value as:

Where:

- FCF is the free cash flow generated in the last projected year

- g is the expected long-term growth rate of the business

- r is the discount rate or required rate of return

Another method is the Exit Multiple Method, which estimates the terminal value based on the multiples of comparable companies. This method involves identifying similar companies in terms of size, industry, and growth prospects, and applying their valuation multiples to the subject company’s projected earnings or cash flows.

Terminal value is a crucial concept in financial analysis that helps determine the long-term worth of an investment or business. It represents the estimated value of an investment at the end of a specific period, typically after a forecasted period of cash flows. Terminal value is important because it accounts for the future cash flows beyond the forecasted period and provides a more comprehensive valuation of the investment.

To understand terminal value, it is essential to grasp the concept of the time value of money. The time value of money states that a dollar received in the future is worth less than a dollar received today due to factors such as inflation and the opportunity cost of capital. Therefore, when calculating terminal value, future cash flows are discounted to their present value to reflect their worth at the end of the forecasted period.

There are several methods to estimate terminal value, including the Gordon Growth Model and the Exit Multiple Method. The Gordon Growth Model assumes that the company’s cash flows will grow at a constant rate indefinitely. It calculates terminal value by dividing the expected cash flow in the next period by the difference between the discount rate and the growth rate. The Exit Multiple Method, on the other hand, determines terminal value by applying a multiple to a financial metric such as earnings or revenue.

Importance of Terminal Value in Financial Analysis

Terminal value plays a crucial role in financial analysis for several reasons. Firstly, it helps investors and analysts determine the intrinsic value of an investment by considering its long-term potential. By including the terminal value in the valuation, analysts can assess whether the investment is undervalued or overvalued.

Secondly, terminal value allows for a more accurate assessment of the investment’s profitability and return on investment. By considering the future cash flows beyond the forecasted period, analysts can better evaluate the investment’s potential for generating long-term returns.

Furthermore, terminal value is essential for making informed investment decisions. It provides a comprehensive picture of the investment’s value, taking into account both the forecasted cash flows and the potential for future growth. This information is crucial for investors looking to make strategic investment decisions and allocate their capital effectively.

Calculating Terminal Value Using the Gordon Growth Model

The Gordon Growth Model is one method to calculate terminal value. It is based on the assumption that the company’s cash flows will grow at a constant rate indefinitely. To calculate terminal value using this model, the following formula can be used:

| Terminal Value | = | Expected Cash Flow in Next Period | / |

|---|

Where:

- Expected Cash Flow in Next Period is the estimated cash flow for the next period.

- Discount Rate is the rate used to discount future cash flows to their present value.

- Growth Rate is the expected growth rate of the company’s cash flows.

By plugging in the appropriate values, analysts can calculate the terminal value using the Gordon Growth Model. This value can then be added to the present value of the forecasted cash flows to determine the overall value of the investment.

Importance of Terminal Value in Financial Analysis

Terminal value is a crucial concept in financial analysis as it helps determine the long-term value of an investment or a company. It represents the estimated value of all future cash flows beyond the explicit forecast period. By calculating the terminal value, analysts can assess the overall worth of an investment and make informed decisions.

Here are some reasons why terminal value is important in financial analysis:

1. Long-Term Perspective

Terminal value allows investors and analysts to take a long-term perspective when evaluating an investment. It considers the cash flows that will continue to generate value beyond the forecast period, providing a more comprehensive assessment of the investment’s potential.

2. Capturing Future Growth

Terminal value captures the potential future growth of a company or investment. It takes into account the expected growth rate and cash flows beyond the forecast period, providing a more accurate representation of the investment’s value.

3. Comparable Analysis

Terminal value is essential for conducting comparable analysis. By estimating the terminal value, analysts can compare the value of different investments or companies over the long term. This helps in making informed investment decisions and identifying potential opportunities.

4. Sensitivity Analysis

5. Valuation Methods

How to Find The Value With Formula

Calculating the terminal value of a company is an essential step in financial analysis. It helps investors and analysts determine the long-term value of a business beyond the projection period. There are several methods to calculate the terminal value, and one common approach is using the Gordon Growth Model.

Gordon Growth Model

Where:

- FCF represents the free cash flow of the company in the final year of the projection period.

- g is the expected growth rate of the company’s cash flows.

- r is the discount rate or required rate of return.

It is important to note that the Gordon Growth Model assumes a constant growth rate, which may not always be realistic. Therefore, it is crucial to consider other factors and perform sensitivity analysis to account for different scenarios.

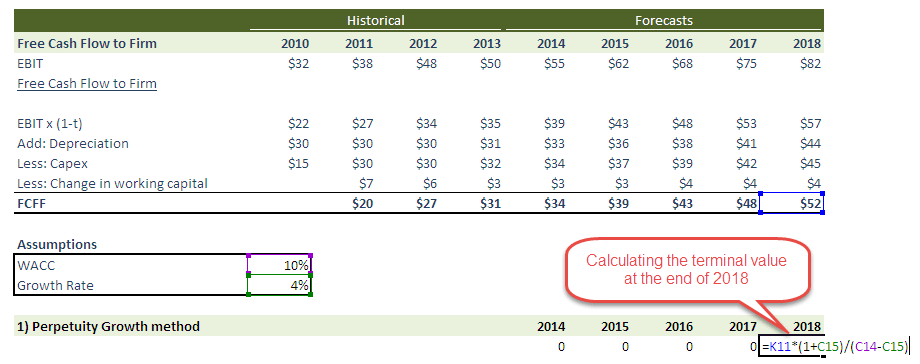

Example Calculation

Let’s say we are analyzing a company that is expected to generate a free cash flow of $10 million in the final year of the projection period. The expected growth rate is 3%, and the discount rate is 10%. Using the Gordon Growth Model, we can calculate the terminal value as follows:

Therefore, the estimated terminal value of the company is $130 million.

Calculating Terminal Value Using the Gordon Growth Model

The Gordon Growth Model is a commonly used method to calculate the terminal value of a company. This model assumes that the company’s cash flows will grow at a constant rate indefinitely. The formula for calculating the terminal value using the Gordon Growth Model is as follows:

- FCF: Free Cash Flow of the company

- g: Growth rate of the company’s cash flows

- r: Discount rate or required rate of return

To calculate the terminal value using this model, you need to estimate the company’s free cash flow, growth rate, and discount rate. The free cash flow can be calculated by subtracting the company’s capital expenditures from its operating cash flow. The growth rate can be estimated based on the company’s historical growth rate or industry growth rate. The discount rate is typically the company’s weighted average cost of capital (WACC).

Once you have these values, you can plug them into the formula to calculate the terminal value. The terminal value represents the value of the company’s cash flows beyond the projection period. It is an important component in financial analysis as it accounts for the long-term value of the company.

However, it is important to note that the Gordon Growth Model has certain limitations. It assumes a constant growth rate, which may not be realistic for all companies. It also assumes that the company will continue to generate positive cash flows indefinitely, which may not always be the case. Therefore, it is important to use this model with caution and consider other factors when valuing a company.

Estimating Terminal Value Using the Exit Multiple Method

The exit multiple method is one of the approaches used to estimate the terminal value in financial analysis. It is based on the assumption that a company’s value can be determined by applying a multiple to a certain financial metric, such as earnings or cash flow, in the terminal year.

The exit multiple method assumes that the value of a company in the terminal year can be estimated by multiplying a financial metric by a certain multiple. This multiple is typically derived from the valuation of comparable companies in the same industry or market. By using this method, analysts can estimate the future value of a company based on its current financial performance and market conditions.

When using the exit multiple method, it is important to select an appropriate multiple that reflects the market’s perception of the company’s future prospects. This multiple can vary depending on factors such as industry growth rates, competitive landscape, and risk profile. It is crucial to conduct thorough research and analysis to ensure the selected multiple is reasonable and supported by market data.

Calculating Terminal Value Using the Exit Multiple Method

To calculate the terminal value using the exit multiple method, the following steps can be followed:

- Estimate the financial metric (e.g., earnings or cash flow) for the terminal year.

- Research and identify comparable companies in the same industry or market.

- Obtain the multiples (e.g., price-to-earnings ratio or enterprise value-to-EBITDA ratio) of the comparable companies.

- Calculate the average multiple based on the multiples obtained from the comparable companies.

- Apply the average multiple to the estimated financial metric for the terminal year to calculate the terminal value.

It is important to note that the exit multiple method is just one of the approaches to estimate the terminal value, and it has its limitations. The accuracy of the estimated terminal value depends on the quality of the selected multiple and the assumptions made about the future performance of the company. Therefore, it is recommended to use multiple valuation methods and perform sensitivity analysis to assess the range of possible terminal values.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.