What is Private Equity Real Estate?

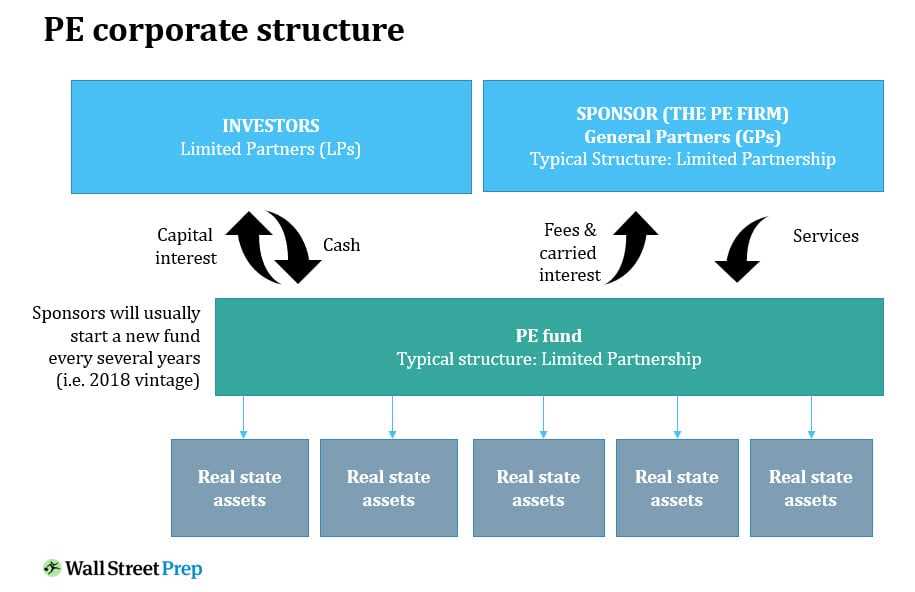

Private equity real estate refers to the investment in real estate assets by private equity firms. These firms raise capital from institutional investors, such as pension funds and endowments, and use it to acquire and manage various types of real estate properties.

Private equity real estate investments can include residential properties, commercial buildings, industrial facilities, and even undeveloped land. The goal of these investments is to generate attractive returns for investors by improving the properties, increasing their value, and eventually selling them for a profit.

Key Features of Private Equity Real Estate:

- Professional Management: Private equity real estate investments are managed by experienced professionals who have in-depth knowledge of the real estate market and can identify lucrative opportunities.

- Long-Term Investment Horizon: Unlike public real estate investments, private equity real estate investments typically have a longer-term investment horizon, ranging from 5 to 10 years or more. This allows investors to take advantage of potential appreciation in property values over time.

- Active Asset Management: Private equity real estate firms actively manage their investments by implementing strategies to enhance the value of the properties. This can include renovations, repositioning, and leasing efforts to maximize rental income.

Overall, private equity real estate offers investors the opportunity to participate in the potentially lucrative real estate market with the expertise and resources of professional investment firms. It allows for diversification in an asset class that has historically provided attractive returns and can be a valuable addition to an investment portfolio.

Benefits of Private Equity Real Estate

Private equity real estate offers several benefits that make it an attractive investment option:

1. Potential for Higher Returns:

Private equity real estate investments have the potential to generate higher returns compared to traditional investments such as stocks and bonds. This is because real estate investments can provide both rental income and appreciation in property value over time.

2. Diversification:

Investing in private equity real estate allows investors to diversify their portfolios. By adding real estate to their investment mix, investors can reduce their overall risk and potentially increase their returns. Real estate investments have historically shown low correlation with other asset classes, such as stocks and bonds, which means they can help to offset losses in other areas of the portfolio.

3. Tangible Asset:

Real estate is a tangible asset that provides a sense of security for investors. Unlike stocks or bonds, which are intangible, real estate investments offer a physical property that can be seen and touched. This can provide peace of mind and a sense of stability during times of market volatility.

4. Potential for Cash Flow:

5. Inflation Hedge:

Overall, private equity real estate offers a range of benefits, including the potential for higher returns, diversification, tangible assets, cash flow, and protection against inflation. These advantages make it an appealing investment option for investors looking to build wealth and secure their financial future.

Higher Potential Returns

In addition, private equity real estate investments often generate income through rental payments or property sales. This income can provide a steady cash flow and further enhance the overall returns.

Case Study: Residential Real Estate Investment

Let’s consider a case study to illustrate the potential returns of private equity real estate investing. Imagine you invest in a residential property for $200,000, which is below its market value of $250,000.

Over the next five years, the property appreciates by an average of 5% per year. At the end of the investment period, the property is worth $305,255. This represents a total return of $105,255, or 52.6%.

In addition to the appreciation, let’s assume that you receive rental income of $1,000 per month, or $12,000 per year. Over the five-year investment period, this amounts to an additional $60,000 in income.

Combining the appreciation and rental income, your total return on investment would be $165,255, or 82.6% over five years. This is significantly higher than the returns you might expect from other investment options such as stocks or bonds.

| Investment | Amount |

|---|---|

| Initial Investment | $200,000 |

| Appreciation | $105,255 |

| Rental Income | $60,000 |

| Total Return | $165,255 |

Diversification

When you invest in private equity real estate, you have the opportunity to invest in a wide range of properties, including residential, commercial, industrial, and retail properties. This allows you to spread your risk across different sectors of the real estate market.

In addition, private equity real estate funds often invest in properties located in different geographic regions. This geographic diversification helps to further reduce risk by spreading investments across different markets that may be influenced by different economic factors.

By diversifying your real estate investments, you can potentially reduce the impact of any single property or market on your overall investment performance. This can help to protect your investment capital and potentially enhance your returns.

Risks of Private Equity Real Estate

Investing in private equity real estate carries certain risks that investors should be aware of. These risks include:

1. Illiquidity: Unlike publicly traded real estate investment trusts (REITs), private equity real estate investments are not easily bought or sold on a public exchange. This lack of liquidity means that investors may not be able to access their funds quickly in the event of a financial emergency or other unforeseen circumstances.

2. Market Volatility: The real estate market can be subject to significant fluctuations in value due to various factors such as economic conditions, interest rates, and changes in supply and demand. These market fluctuations can impact the value of private equity real estate investments, potentially leading to losses for investors.

3. Lack of Diversification: Investing in private equity real estate typically involves a significant amount of capital, which can limit an investor’s ability to diversify their portfolio. This lack of diversification can increase the risk of loss if a particular investment performs poorly.

4. Operational Risk: Private equity real estate investments often involve the acquisition and management of physical properties. This can expose investors to operational risks such as property damage, tenant defaults, and changes in local regulations. These risks can impact the financial performance of the investment.

5. Limited Transparency: Private equity real estate investments are typically not subject to the same level of regulatory oversight and reporting requirements as publicly traded investments. This limited transparency can make it more difficult for investors to fully understand the risks and potential returns associated with a particular investment.

Despite these risks, many investors are attracted to private equity real estate for its potential for higher returns and diversification benefits. It is important for investors to carefully consider their risk tolerance and investment goals before committing capital to private equity real estate.

Risks of Private Equity Real Estate

Investing in private equity real estate carries certain risks that investors should be aware of:

1. Illiquidity: One of the main risks of private equity real estate is the lack of liquidity. Unlike publicly traded real estate investment trusts (REITs), private equity real estate investments are not easily bought or sold on a daily basis. Investors may have to wait for several years before they can exit their investment and realize their returns.

2. Market Volatility: Private equity real estate investments are subject to market fluctuations and volatility. The value of the underlying real estate assets can be affected by various factors such as economic conditions, interest rates, and supply and demand dynamics. Investors should be prepared for potential fluctuations in the value of their investments.

3. Limited Transparency: Private equity real estate investments often have limited transparency compared to publicly traded investments. Investors may not have access to detailed information about the underlying assets, the investment strategy, or the performance of the investment. This lack of transparency can make it difficult for investors to fully evaluate the risks and potential returns of the investment.

4. Higher Risk Profile: Private equity real estate investments generally have a higher risk profile compared to traditional real estate investments. These investments often involve higher leverage, development or repositioning risks, and exposure to specific sectors or markets. Investors should carefully consider their risk tolerance and investment goals before investing in private equity real estate.

5. Limited Control: When investing in private equity real estate, investors typically have limited control over the management and decision-making process. The investment is usually managed by a professional investment manager or a real estate development company. Investors should carefully evaluate the track record and expertise of the investment manager before committing their capital.

Despite these risks, private equity real estate can offer potential benefits such as higher potential returns and diversification. However, it is important for investors to thoroughly research and assess the risks before making any investment decisions.

Risks of Private Equity Real Estate

Investing in private equity real estate carries certain risks that investors should be aware of:

1. Market Volatility: The real estate market can be subject to fluctuations and volatility, which can affect the value of investments. Economic factors, changes in interest rates, and market conditions can all impact the performance of private equity real estate investments.

2. Illiquidity: Private equity real estate investments are typically illiquid, meaning they cannot be easily bought or sold. Unlike publicly traded real estate investment trusts (REITs), which can be bought and sold on stock exchanges, private equity real estate investments often have lock-up periods and limited liquidity options. This lack of liquidity can make it difficult for investors to access their capital when needed.

3. Limited Transparency: Private equity real estate investments often have limited transparency compared to publicly traded investments. Investors may have limited access to information about the underlying assets, the fund’s performance, and the fees and expenses associated with the investment. This lack of transparency can make it challenging for investors to fully evaluate the risks and potential returns of the investment.

4. Operational Risk: Private equity real estate investments involve the management and operation of physical properties. There are inherent risks associated with property management, including maintenance and repair costs, tenant turnover, and regulatory compliance. These operational risks can impact the financial performance of the investment.

It is important for investors to carefully consider these risks and conduct thorough due diligence before investing in private equity real estate. Working with experienced professionals and diversifying investments can help mitigate some of these risks and increase the likelihood of achieving desired returns.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.