Front-End Load: Definition

Front-end loads are typically expressed as a percentage of the total investment amount. For example, if a mutual fund has a front-end load of 5% and an investor wants to invest $10,000, they would have to pay a front-end load fee of $500.

Types of Front-End Load

There are different types of front-end loads that investors may encounter when investing in mutual funds. The most common types include:

- Class B Load Funds: These funds do not charge a front-end load fee at the time of purchase. Instead, they charge a contingent deferred sales charge (CDSC) if the investor sells the shares within a certain period, usually around 5 to 7 years.

- Class C Load Funds: These funds charge a lower front-end load fee compared to Class A load funds. However, they may have higher ongoing fees, such as higher expense ratios or 12b-1 fees.

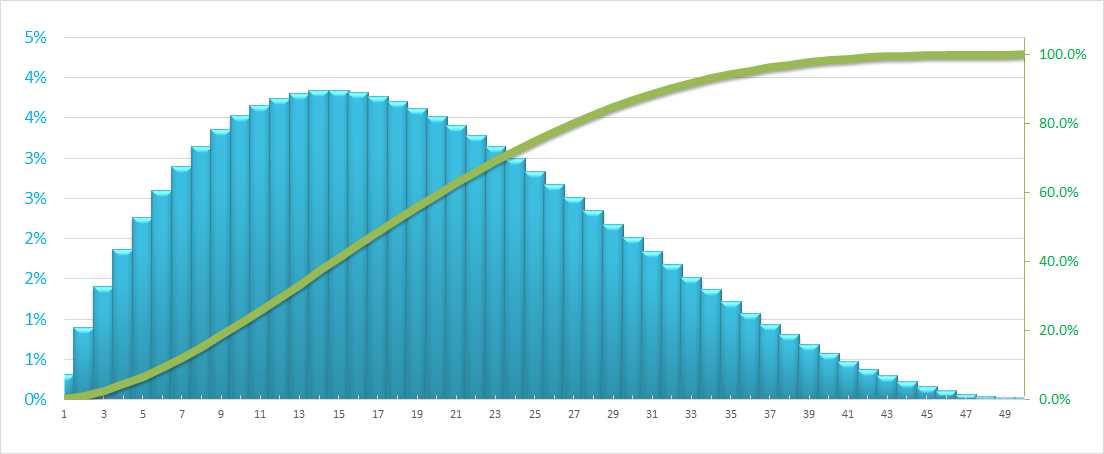

Front-end loads can vary in percentage, typically ranging from 1% to 5.75% of the total investment amount. The specific percentage depends on the mutual fund and the share class chosen by the investor.

Investors should carefully consider the impact of front-end loads on their investment returns. While these fees are paid upfront, they can significantly reduce the initial investment amount and, consequently, the potential returns. It is important to weigh the benefits of the mutual fund against the cost of the front-end load.

Front-end loads are most commonly associated with Class A shares of mutual funds. Class A shares typically have higher front-end loads but lower ongoing expenses compared to other share classes. Class B and Class C shares may also have front-end loads, but they often have lower upfront fees and higher ongoing expenses.

It is essential for investors to review the prospectus and other relevant documents of a mutual fund before making an investment decision. These documents provide detailed information about the front-end load, as well as other fees and expenses associated with the fund.

| Advantages | Disadvantages |

|---|---|

| Compensates financial advisors or brokers | Reduces initial investment amount |

| May provide access to certain mutual funds | Can impact investment returns |

| Typically associated with Class A shares | May have higher ongoing expenses |

Types of Front-End Load

- Class A Load Funds: Class A load funds charge a front-end load at the time of purchase. The percentage of the load varies depending on the fund and can range from 1% to 5.75% or more. Class A load funds often offer lower annual expenses compared to other classes of load funds.

- Class B Load Funds: Class B load funds do not charge a front-end load at the time of purchase. Instead, they typically have a contingent deferred sales charge (CDSC) that is incurred when shares are sold. The CDSC decreases over time and eventually reaches zero after a certain number of years. Class B load funds may also have higher annual expenses compared to Class A load funds.

- Class C Load Funds: Class C load funds do not charge a front-end load or a CDSC. Instead, they have higher annual expenses and may impose a small redemption fee if shares are sold within a certain period of time. Class C load funds are often chosen by investors who plan to hold their shares for a shorter period of time.

Class A, Class B, and Class C Load Funds

Front-end load mutual funds can be further categorized into different classes, namely Class A, Class B, and Class C load funds. Each class has its own unique characteristics and fee structure.

3. Class C Load Funds: Class C load funds do not charge a front-end load fee or a CDSC. Instead, they have higher ongoing expenses compared to Class A and Class B load funds. Class C load funds are designed for short-term investors who do not plan to hold the fund for an extended period. However, if investors hold Class C shares for a certain period, typically 1 to 2 years, they may convert to Class A shares, which have lower ongoing expenses.

It is important for investors to carefully consider the fee structure and investment objectives of each class before making a decision. Class A load funds may be more suitable for long-term investors, while Class B and Class C load funds may be more suitable for investors with shorter investment horizons.

Average Percentage of Front-End Load

When investing in mutual funds with a front-end load, it is important to understand the average percentage of the load fee. The front-end load is a fee that is charged upfront when purchasing mutual fund shares. This fee is typically a percentage of the total investment amount and is deducted from the initial investment.

The average percentage of the front-end load can vary depending on the mutual fund and the share class. Class A, Class B, and Class C load funds may have different front-end load percentages. It is essential to research and compare different funds to determine the average percentage that best suits your investment goals.

For example, a Class A load fund may have an average front-end load percentage of 5%. This means that if you invest $10,000 in the fund, $500 will be deducted as a front-end load fee, and the remaining $9,500 will be used to purchase shares of the mutual fund.

It is important to note that the front-end load is a one-time fee and is not an ongoing expense like other fees associated with mutual funds. However, it can significantly impact the overall return on investment, especially in the short term.

What to Expect in Terms of Fees

When investing in mutual funds with front-end loads, it is important to understand the fees associated with these types of funds. Front-end loads are fees that investors pay when they purchase shares of a mutual fund. These fees are typically a percentage of the total amount invested and are deducted upfront.

The average percentage of front-end load fees can vary depending on the type of mutual fund and the investment company. Generally, front-end load fees range from 1% to 5% of the total investment amount. It is important to note that these fees are separate from other expenses, such as management fees and operating expenses, that are associated with mutual funds.

Investors should carefully consider the fees associated with front-end load funds before making an investment decision. While front-end loads can be a deterrent for some investors, they can also provide certain benefits. For example, front-end load funds may have lower ongoing expenses compared to funds without front-end loads.

Additionally, some investment companies may offer breakpoints or reduced front-end load fees for larger investments. These breakpoints allow investors to receive a discount on the front-end load fee if they invest a certain amount of money. It is important to review the prospectus of a mutual fund to understand if breakpoints are available and how they may impact the overall fees.

Investors should also be aware of any potential charges or penalties associated with selling shares of a front-end load fund. Some funds may have redemption fees or back-end loads that investors need to consider before selling their shares. These fees can impact the overall return on investment and should be taken into account when evaluating the potential profitability of a mutual fund.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.