Growth and Income Fund

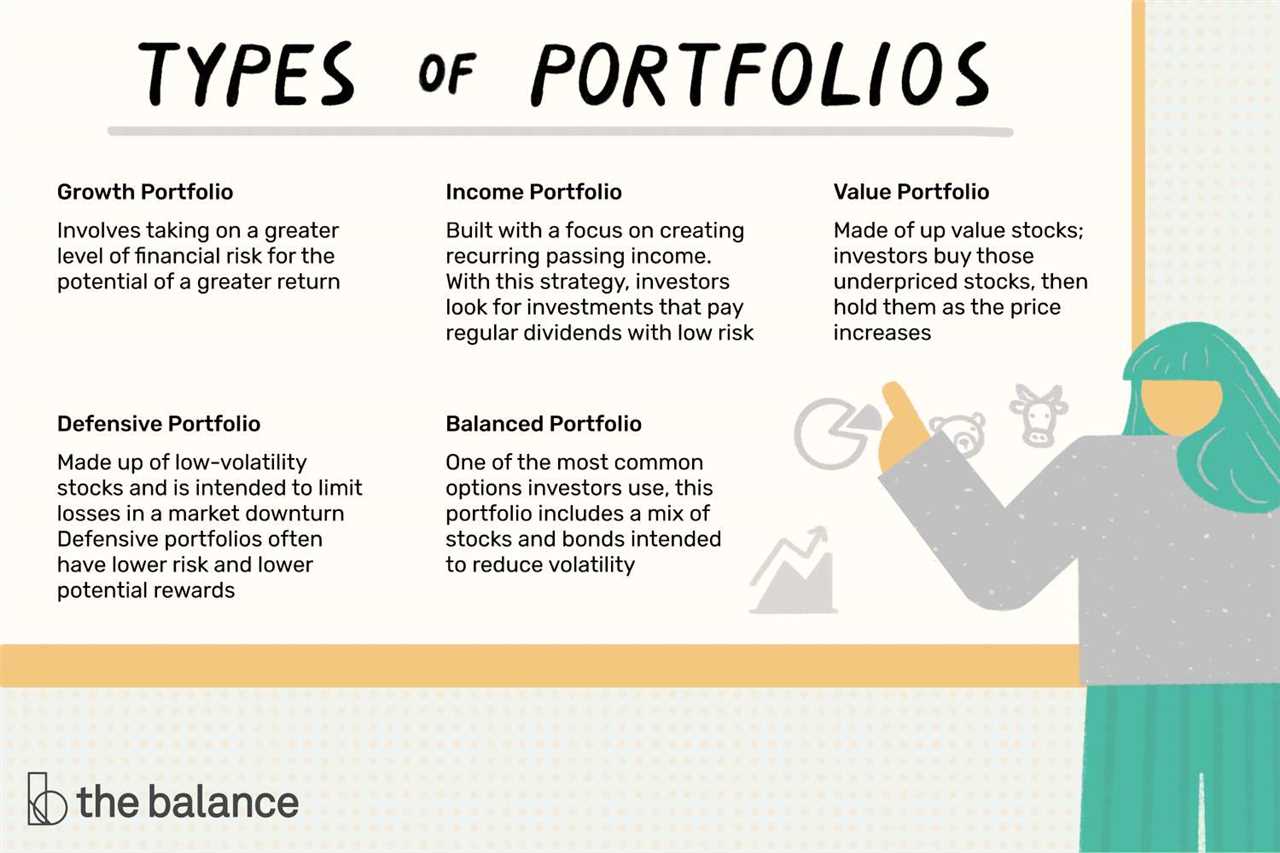

Definition and Purpose

The Growth and Income Fund is a diversified portfolio of stocks and bonds that seeks to achieve a balance between growth and income. The fund typically invests in a mix of large-cap stocks, which have the potential for capital appreciation, and high-quality bonds, which provide regular income through interest payments.

Investment Mix

The investment mix of a Growth and Income Fund typically includes a combination of stocks and bonds. The fund may allocate a larger portion of its assets to stocks, such as blue-chip companies, that have a history of stable earnings and dividend payments. This provides the potential for capital appreciation and dividend income.

Additionally, the fund may invest in high-quality bonds, such as government or corporate bonds, that offer regular interest payments. These bonds provide a steady stream of income and help to diversify the fund’s portfolio, reducing overall risk.

The specific allocation of stocks and bonds within the fund may vary depending on the fund manager’s investment strategy and market conditions. However, the overall goal is to achieve a balance between growth and income to meet the needs of investors.

Examples of Growth and Income Funds

Some examples of Growth and Income Funds include XYZ Growth and Income Fund, ABC Balanced Fund, and DEF Equity Income Fund. These funds have a track record of providing investors with a combination of capital appreciation and regular income.

Benefits of Investing in Growth and Income Funds

Investing in a Growth and Income Fund offers several benefits. Firstly, it provides investors with a balanced investment strategy that aims to generate both income and growth. This can help to diversify their investment portfolio and reduce risk.

Secondly, Growth and Income Funds offer the potential for long-term capital appreciation. By investing in a mix of stocks and bonds, investors can benefit from the growth potential of stocks while also receiving regular income from bonds.

Definition and Purpose

A Growth and Income Fund is a type of mutual fund that aims to provide investors with a combination of capital appreciation and regular income. It is designed for investors who seek a balance between growth and income in their investment portfolios.

The primary purpose of a Growth and Income Fund is to generate long-term capital growth by investing in a diversified portfolio of stocks and bonds. The fund manager carefully selects securities that have the potential for both capital appreciation and income generation.

These funds typically invest in a mix of growth-oriented stocks and income-generating bonds. The allocation between stocks and bonds may vary depending on market conditions and the fund’s investment objectives.

By investing in a Growth and Income Fund, investors can benefit from the potential for capital appreciation through the growth of the underlying stocks, as well as regular income through the interest payments from the bonds held in the portfolio.

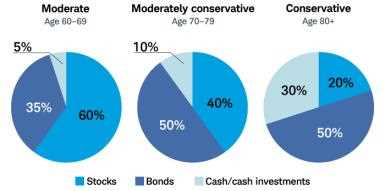

Growth and Income Funds are suitable for investors who have a moderate risk tolerance and a long-term investment horizon. They are particularly attractive for individuals who are looking to generate a steady stream of income while also participating in the potential growth of the stock market.

Overall, a Growth and Income Fund offers investors the opportunity to achieve a balance between growth and income in their investment portfolios, making it a valuable addition to a well-diversified investment strategy.

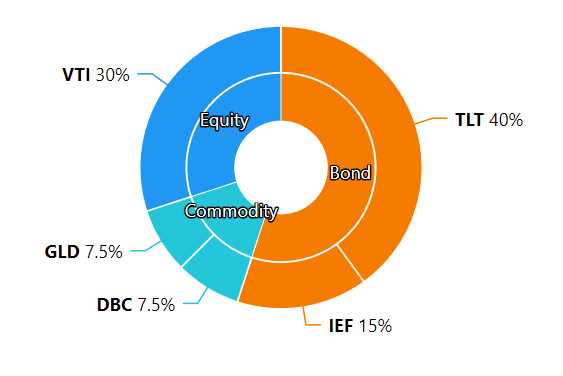

Investment Mix of Growth and Income Funds

Growth and Income Funds are a type of mutual fund that seeks to provide investors with a combination of capital appreciation and income. These funds typically invest in a mix of stocks and bonds, with the goal of achieving both growth and income for investors.

Stock Investments

Growth and Income Funds allocate a portion of their portfolio to stocks. These stocks are carefully selected by fund managers based on their potential for growth and income. The fund managers may invest in a diversified range of stocks from various sectors and industries, including large-cap, mid-cap, and small-cap companies. By investing in stocks, the fund aims to generate capital appreciation over the long term.

Bond Investments

In addition to stocks, Growth and Income Funds also invest a portion of their portfolio in bonds. Bonds are fixed-income securities issued by governments, municipalities, and corporations. The fund managers select bonds with different maturities and credit ratings to diversify the risk. Bonds provide a steady stream of income through regular interest payments. The income generated from bond investments helps to supplement the capital appreciation from stocks.

| Investment Mix | Percentage Allocation |

|---|---|

| Stocks | 60% |

| Bonds | 40% |

The specific allocation to stocks and bonds may vary depending on the fund’s investment strategy and market conditions. The fund managers constantly monitor and adjust the investment mix to optimize returns and manage risk.

Examples of Growth and Income Funds

1. Vanguard Dividend Growth Fund (VDIGX): This fund focuses on investing in companies with a history of increasing dividends over time. It aims to provide investors with both capital appreciation and a steady stream of income.

2. T. Rowe Price Dividend Growth Fund (PRDGX): This fund seeks to invest in companies that have the potential for long-term dividend growth. It aims to provide investors with a combination of capital appreciation and a growing stream of income.

3. Fidelity Growth & Income Portfolio (FGRIX): This fund aims to provide investors with a balance of capital appreciation and income. It invests in a mix of growth-oriented stocks and income-producing assets, such as dividend-paying stocks and bonds.

4. American Funds Washington Mutual Investors Fund (AWSHX): This fund focuses on investing in companies with a history of consistent dividend payments. It aims to provide investors with a combination of capital appreciation and a steady stream of income.

5. BlackRock Equity Dividend Fund (MDDVX): This fund seeks to invest in companies that have the potential for both dividend growth and capital appreciation. It aims to provide investors with a balance of income and long-term growth.

Benefits of Investing in Growth and Income Funds

Investing in growth and income funds can offer several benefits for investors looking to diversify their portfolio and achieve long-term financial goals.

1. Income Generation: Growth and income funds are designed to provide a regular income stream through dividends and interest payments. This can be especially beneficial for investors who rely on investment income to cover living expenses or supplement their salary.

2. Capital Appreciation: Growth and income funds aim to achieve capital appreciation over the long term by investing in a mix of growth-oriented and income-generating assets. This can help investors grow their initial investment and potentially outpace inflation.

3. Diversification: Growth and income funds typically invest in a diversified portfolio of stocks, bonds, and other income-producing securities. This diversification can help reduce the risk associated with investing in a single asset class and potentially provide more stable returns.

4. Professional Management: Growth and income funds are managed by experienced investment professionals who have the expertise to identify attractive investment opportunities and make informed decisions on behalf of investors. This can save individual investors time and effort in researching and managing their own investment portfolio.

5. Flexibility: Growth and income funds offer investors the flexibility to choose between different investment options, such as growth-focused or income-focused funds, depending on their individual investment objectives and risk tolerance.

6. Convenience: Investing in growth and income funds is relatively easy and convenient. Investors can buy and sell fund shares through their brokerage account, and the funds are typically available for purchase or redemption on any business day.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.