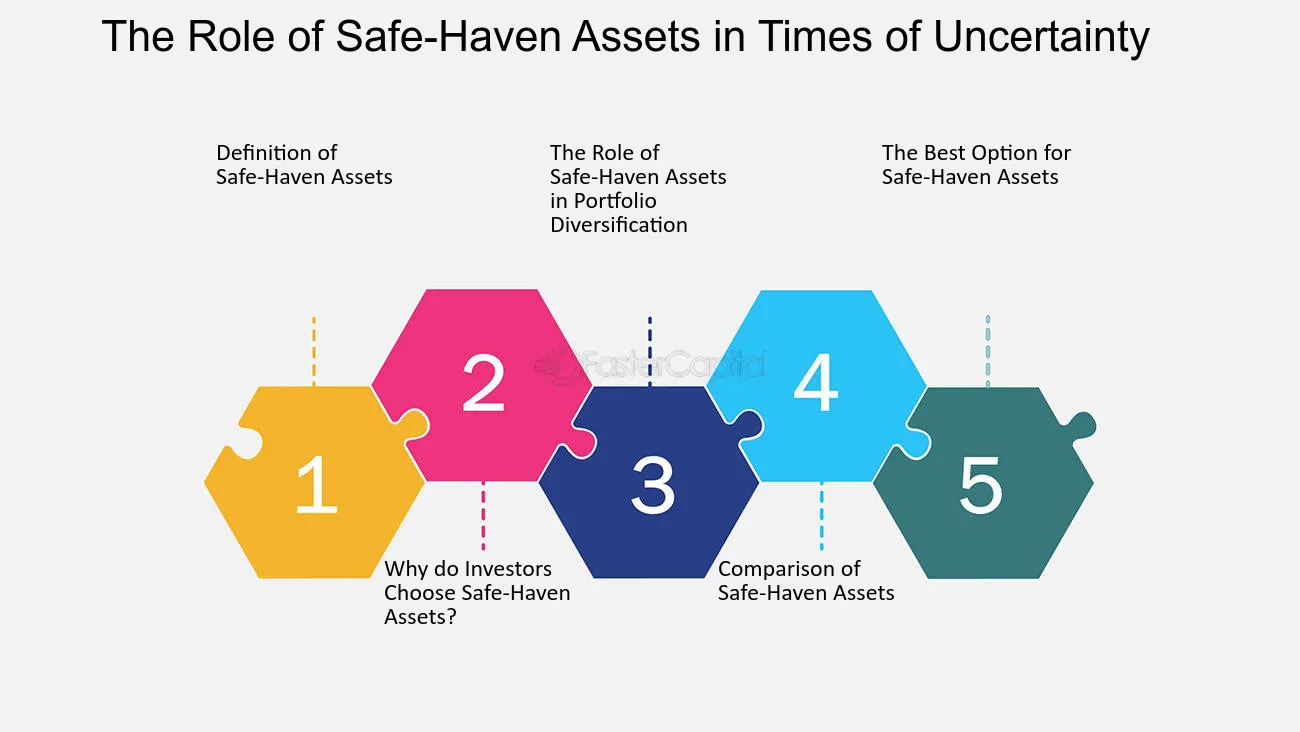

What is Safe Haven Investing?

Safe haven investing refers to the practice of investing in assets or securities that are considered to be relatively stable and less volatile during times of economic uncertainty or market turmoil. These investments are typically sought after by investors as a means of protecting their capital and minimizing potential losses.

During periods of economic uncertainty, such as a recession or financial crisis, investors often flock to safe haven investments as a way to preserve their wealth. This is because these assets are perceived to have a lower risk of loss compared to other investments that may be more closely tied to the overall health of the economy or financial markets.

Examples of Safe Haven Investments

There are several types of assets that are commonly considered to be safe haven investments. These include:

| Asset | Description |

|---|---|

| Gold | Gold has long been considered a safe haven investment due to its intrinsic value and limited supply. It is often seen as a hedge against inflation and currency fluctuations. |

| Treasuries | US Treasury bonds and notes are considered to be one of the safest investments available. They are backed by the full faith and credit of the US government. |

| Cash | Keeping cash on hand or in a savings account is often seen as a safe haven during times of economic uncertainty. It provides liquidity and can be easily accessed. |

| Stable Currencies | |

| Utility Stocks | Utility stocks, such as those in the energy or water sectors, are often seen as safe haven investments due to their stable earnings and dividends. |

These are just a few examples of safe haven investments, and there may be other assets or securities that can also provide stability and protection during times of market uncertainty.

Investors should carefully consider their risk tolerance and investment goals before allocating a portion of their portfolio to safe haven investments. Diversification and a balanced approach to investing are often recommended to mitigate risk and maximize potential returns.

Safe haven investing refers to the strategy of investing in assets that are considered to be relatively stable and less prone to market volatility during times of economic uncertainty or market downturns. These assets are often sought after by investors as a means of preserving capital and minimizing potential losses.

The importance of safe haven investing lies in its ability to provide a level of protection and stability to an investor’s portfolio. By allocating a portion of their investments to safe haven assets, investors can potentially mitigate the impact of market fluctuations and reduce the overall risk in their portfolio.

Characteristics of Safe Haven Investments

Safe haven investments typically possess certain characteristics that make them attractive to investors during times of economic turmoil. These characteristics include:

| Characteristics | Explanation |

|---|---|

| Low Correlation with Traditional Investments | Safe haven assets tend to have a low or negative correlation with traditional investments such as stocks and bonds. This means that their performance is not strongly influenced by the movements of the broader market, providing diversification benefits. |

| Perceived Store of Value | Safe haven assets are often viewed as a store of value, meaning they are expected to retain their worth or even increase in value during times of economic uncertainty. This perception can make them attractive to investors seeking to protect their wealth. |

| Liquidity | Safe haven assets are typically liquid, meaning they can be easily bought or sold without significantly impacting their market price. This liquidity allows investors to quickly adjust their portfolio allocations in response to changing market conditions. |

| Perceived Safety | Safe haven assets are often perceived as safe investments due to their stability and low volatility. This perception can provide investors with a sense of security and peace of mind during times of market uncertainty. |

Examples of Safe Haven Investments

1. Gold

Gold is often considered a safe haven investment due to its long history as a store of value. During times of economic uncertainty, investors tend to flock to gold as a safe asset. Gold has a limited supply and is not subject to the same risks as other investments, such as stocks or bonds. It has proven to be a reliable hedge against inflation and currency fluctuations.

2. U.S. Treasury Bonds

3. Cash and Cash Equivalents

Keeping cash or cash equivalents, such as money market funds or certificates of deposit (CDs), can be considered a safe haven investment. Cash provides liquidity and can be easily accessed during times of financial stress. However, it is important to consider inflation risk, as cash may lose value over time due to rising prices.

4. High-Quality Bonds

High-quality bonds, such as investment-grade corporate bonds or government bonds, are often seen as safe haven investments. These bonds have a lower risk of default compared to lower-rated bonds and provide a steady income stream through regular interest payments. They can offer stability and income during uncertain market conditions.

5. Defensive Stocks

Defensive stocks are stocks of companies that are less affected by economic downturns. These companies typically operate in industries that are considered essential or provide goods and services that are in demand regardless of the economic climate. Examples of defensive stocks include consumer staples, healthcare, and utilities.

It is important to note that while these investments are generally considered safe havens, they are not completely risk-free. Market conditions and individual circumstances can impact the performance of these investments. It is advisable to diversify your portfolio and consult with a financial advisor before making any investment decisions.

Exploring Different Options for Investors

- Gold: Gold has long been considered a safe haven investment. It is seen as a store of value and a hedge against inflation. Investors can invest in physical gold, such as bars or coins, or they can invest in gold exchange-traded funds (ETFs) or gold mining stocks.

- Government Bonds: Government bonds, particularly those issued by stable countries, are often seen as safe investments. These bonds are backed by the government and are considered to have a low risk of default. Investors can invest in government bonds directly or through bond funds.

- US Treasury Bonds: US Treasury bonds are considered one of the safest investments in the world. They are backed by the US government and are seen as a risk-free investment. Investors can invest in Treasury bonds with various maturities, ranging from short-term to long-term.

- Cash: Holding cash is another safe haven option. Cash provides liquidity and can be easily accessed in times of need. However, holding cash for a long period of time may result in a loss of purchasing power due to inflation.

- Defensive Stocks: Defensive stocks are stocks of companies that are less affected by economic downturns. These companies are often in industries such as utilities, healthcare, or consumer staples. Investing in defensive stocks can provide stability to a portfolio during times of market volatility.

- Real Estate: Real estate can be a safe haven investment, particularly in times of economic uncertainty. Investing in properties can provide a stable income stream and potential appreciation over time. However, it is important to carefully consider location, market conditions, and potential risks before investing in real estate.

It is important for investors to carefully evaluate their risk tolerance and investment goals when considering safe haven investments. Each option has its own benefits and risks, and what may be suitable for one investor may not be suitable for another. Diversification is also key, as spreading investments across different asset classes can help mitigate risk.

Benefits and Risks of Safe Haven Investing

Safe haven investing offers several benefits to investors, particularly during times of economic uncertainty. Here are some of the key advantages:

1. Capital Preservation

One of the primary benefits of safe haven investing is capital preservation. Safe haven assets are typically less volatile and more stable compared to other investments. They provide a way for investors to protect their capital and minimize potential losses during market downturns.

2. Diversification

Safe haven investments often have a low correlation with other asset classes, such as stocks or bonds. This means that they can help diversify an investment portfolio and reduce overall risk. By including safe haven assets, investors can potentially achieve a more balanced and stable portfolio.

3. Hedge Against Inflation

Some safe haven investments, such as gold or real estate, have historically acted as a hedge against inflation. When the value of traditional currencies decreases due to inflationary pressures, these assets tend to hold their value or even appreciate. This can help investors maintain their purchasing power over time.

4. Psychological Comfort

Investing in safe haven assets can provide psychological comfort to investors during times of market volatility or uncertainty. Knowing that a portion of their portfolio is allocated to assets that are considered safe can help investors feel more secure and less prone to making impulsive investment decisions.

However, safe haven investing also comes with its own set of risks:

1. Lower Potential Returns

Safe haven investments generally offer lower potential returns compared to riskier assets, such as stocks or high-yield bonds. While they provide stability and capital preservation, investors may miss out on higher returns during periods of economic growth.

2. Market Timing

Timing the market and correctly identifying when to allocate funds to safe haven assets can be challenging. If an investor moves their funds into safe haven assets too early, they may miss out on potential gains in other asset classes. On the other hand, if they move too late, they may not fully benefit from the protective nature of safe haven investments.

3. Limited Options

The universe of safe haven investments is relatively limited compared to other asset classes. Investors may have to choose from a smaller pool of options, which could limit their ability to diversify or find suitable investments that align with their risk tolerance and investment goals.

Overall, safe haven investing can be a valuable strategy for investors looking to protect their capital and reduce risk during uncertain times. However, it is important for investors to carefully consider the benefits and risks associated with safe haven investments and to align their investment decisions with their individual financial goals and risk tolerance.

Weighing the Pros and Cons

Safe haven investing offers several benefits and risks that investors should carefully consider before making any decisions. Here, we will explore the pros and cons of this investment strategy.

Benefits of Safe Haven Investing

- Capital Preservation: One of the main advantages of safe haven investments is their ability to preserve capital. These assets tend to be less volatile and more stable compared to riskier investments, which can help protect investors’ principal.

- Diversification: Safe haven investments can provide diversification benefits to a portfolio. By adding assets that have low or negative correlations with traditional investments, investors can potentially reduce overall portfolio risk.

- Income Generation: Some safe haven investments, such as government bonds, can provide a reliable source of income through interest payments. This can be particularly attractive for investors seeking regular cash flow.

- Hedge Against Market Turbulence: Safe haven assets often perform well during times of market turbulence or economic uncertainty. They can act as a hedge against potential losses in other parts of the portfolio, providing stability and protection.

Risks of Safe Haven Investing

- Lower Returns: Safe haven investments typically offer lower returns compared to riskier assets. While they may provide stability and capital preservation, investors may miss out on potential higher returns from other investments.

- Inflation Risk: Some safe haven investments, such as cash or government bonds, may be vulnerable to inflation risk. If the rate of inflation exceeds the return on these investments, the purchasing power of the invested capital may erode over time.

- Interest Rate Risk: Safe haven investments, especially bonds, are sensitive to changes in interest rates. When interest rates rise, the value of existing bonds may decline, leading to potential capital losses for investors.

- Limited Growth Potential: Safe haven investments may have limited growth potential compared to riskier assets, such as stocks. While they can provide stability, they may not offer the same opportunities for capital appreciation.

It is important for investors to carefully assess their risk tolerance, investment goals, and time horizon before deciding to allocate a portion of their portfolio to safe haven investments. Balancing the potential benefits and risks is crucial in creating a well-diversified and resilient investment strategy.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.