Negotiable Certificate of Deposit Definition

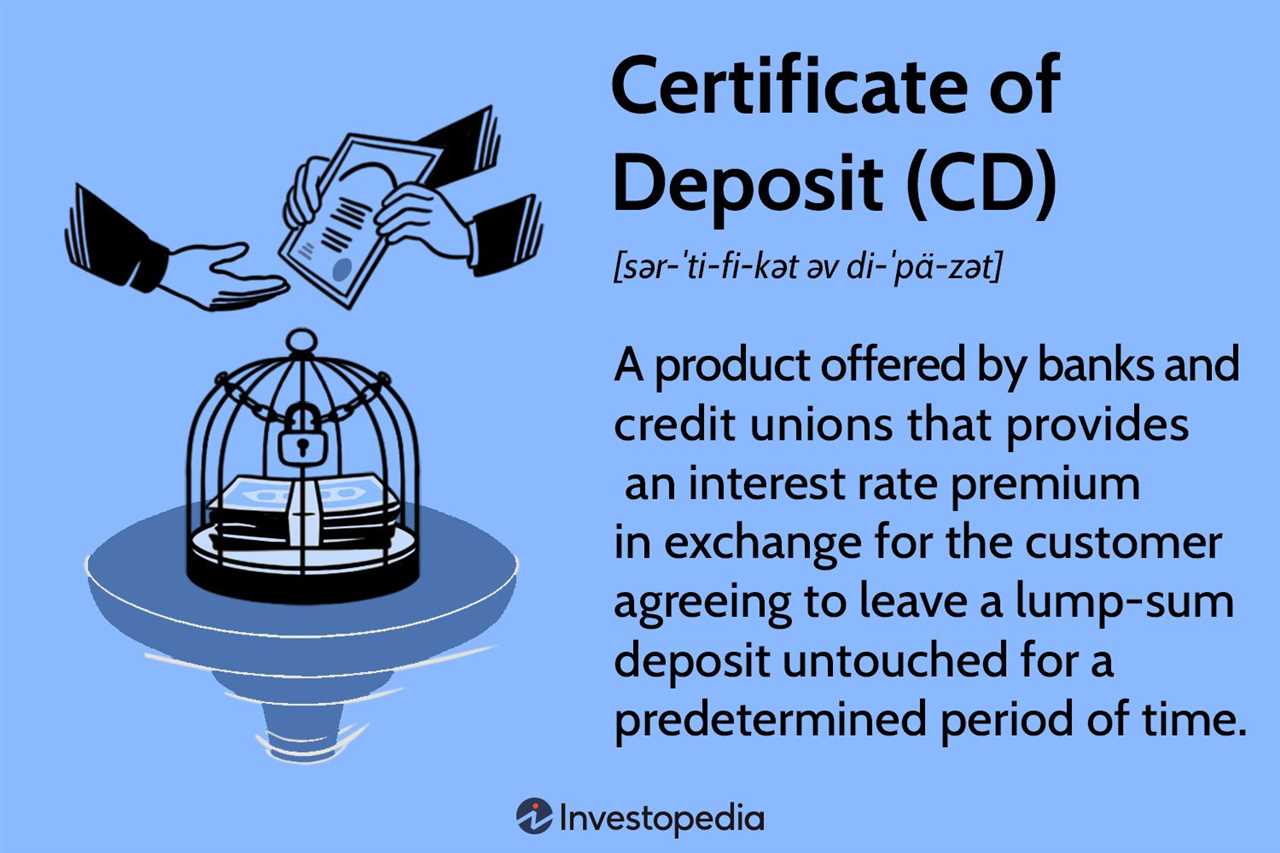

A negotiable certificate of deposit (CD) is a type of time deposit offered by banks and other financial institutions. It is a fixed-term investment that pays a specified interest rate over a predetermined period of time. Unlike regular CDs, negotiable CDs can be bought and sold on the secondary market before they reach maturity.

These certificates are typically issued in large denominations, such as $100,000 or more, and are mainly targeted towards institutional investors and wealthy individuals. The interest rates offered on negotiable CDs are generally higher than those offered on regular CDs due to the larger investment amounts and the ability to trade them on the secondary market.

Investors who purchase negotiable CDs can benefit from the security and stability of a fixed-income investment, while also having the potential for higher returns. However, it is important to note that these investments are not without risks.

One of the main risks associated with negotiable CDs is the potential for interest rate fluctuations. If interest rates rise, the value of the CD may decrease, as investors may be able to find higher-yielding investments elsewhere. On the other hand, if interest rates decline, the CD may become more attractive to investors, potentially increasing its value.

Another risk to consider is the credit risk of the issuing institution. While negotiable CDs are generally considered to be safe investments, there is always a possibility that the issuing bank or financial institution may default on its obligations. Investors should carefully research and evaluate the creditworthiness of the issuer before investing in negotiable CDs.

What is a Negotiable Certificate of Deposit?

NCDs are typically issued in large denominations, often starting at $100,000 or more. This makes them more suitable for institutional investors and high-net-worth individuals. However, some banks also offer NCDs with lower minimum investment amounts, allowing individual investors to participate.

Investing in NCDs carries some risks. The main risk is the possibility of the issuing bank defaulting on its obligations. While NCDs are generally considered safe due to the backing of the issuing bank, there is still a small chance of default. Investors should carefully evaluate the financial strength and creditworthiness of the issuing bank before investing in NCDs.

Negotiable Certificate of Deposit Risk

A negotiable certificate of deposit (CD) is a type of short-term investment vehicle offered by banks and financial institutions. While it can provide investors with a relatively safe and stable return, there are still risks associated with investing in negotiable CDs.

1. Interest Rate Risk

One of the main risks of negotiable CDs is interest rate risk. The interest rate on a negotiable CD is fixed for a specific period of time, typically ranging from a few months to a few years. If interest rates rise during the term of the CD, the investor may miss out on higher returns available in the market. On the other hand, if interest rates decline, the investor may be locked into a lower rate of return.

2. Liquidity Risk

Another risk associated with negotiable CDs is liquidity risk. Unlike regular savings accounts or money market accounts, negotiable CDs have a fixed term and cannot be easily accessed before maturity without incurring penalties. If an investor needs to access their funds before the CD matures, they may face significant penalties or loss of interest.

3. Credit Risk

Credit risk is also a concern when investing in negotiable CDs. While negotiable CDs are generally considered to be safe investments, there is still a risk that the issuing bank or financial institution may default on their obligations. It is important for investors to research the creditworthiness of the issuing institution before investing in a negotiable CD.

4. Inflation Risk

Inflation risk is another factor to consider when investing in negotiable CDs. The fixed interest rate on a negotiable CD may not keep pace with inflation, meaning that the purchasing power of the investment may decrease over time. This can erode the real value of the investment and result in a lower return in terms of purchasing power.

Overall, while negotiable CDs can offer a relatively safe and stable return, investors should be aware of the risks involved. It is important to carefully consider these risks and assess whether a negotiable CD aligns with their investment goals and risk tolerance.

A Negotiable Certificate of Deposit (NCD) is a type of time deposit offered by banks and financial institutions. It is a promissory note issued by the bank, guaranteeing the payment of a fixed amount of money with interest at a specified maturity date. While NCDs can be an attractive investment option for many individuals, it is important to understand the risks associated with them.

1. Interest Rate Risk

One of the main risks of investing in NCDs is interest rate risk. The interest rate on NCDs is fixed at the time of issuance, which means that if interest rates rise in the market, the fixed rate on the NCD may become less attractive compared to other investment options. This can result in a decrease in the market value of the NCD and potential losses for the investor.

2. Liquidity Risk

NCDs are typically less liquid compared to other investment options such as stocks or bonds. Once you invest in an NCD, your money is locked in for the duration of the maturity period. If you need access to your funds before the maturity date, you may face penalties or restrictions on withdrawing your money. It is important to consider your liquidity needs before investing in NCDs.

3. Credit Risk

Another risk associated with NCDs is credit risk. NCDs are issued by banks and financial institutions, and there is always a chance that the issuer may default on their payment obligations. It is important to research and evaluate the creditworthiness of the issuer before investing in their NCDs. Higher-risk issuers may offer higher interest rates, but they also come with a higher chance of default.

4. Market Risk

NCDs are subject to market risk, which means that their market value can fluctuate based on various factors such as changes in interest rates, economic conditions, and investor sentiment. If the market value of the NCD decreases, you may experience losses if you decide to sell the NCD before maturity. It is important to carefully monitor market conditions and make informed investment decisions.

Overall, while NCDs can offer attractive interest rates and a fixed return on investment, it is important to be aware of the risks involved. It is advisable to diversify your investment portfolio and consult with a financial advisor before investing in NCDs to ensure they align with your financial goals and risk tolerance.

Certificate of Deposit Catname

A Certificate of Deposit (CD) is a type of financial product that allows individuals to earn interest on their savings over a fixed period of time. It is considered a low-risk investment option, as it is insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per depositor.

Features of Certificate of Deposit Catname

- Fixed Interest Rate: Certificate of Deposit Catname offers a fixed interest rate for the duration of the investment. This means that the rate will not change, regardless of any fluctuations in the market.

- Maturity Date: Like any other CD, Certificate of Deposit Catname has a maturity date, which is the date when the investment period ends. At this point, the investor can choose to withdraw the principal amount along with the accrued interest or reinvest it.

- Secondary Market Trading: One of the key features of Certificate of Deposit Catname is its ability to be traded in the secondary market. This provides investors with the opportunity to sell their CD before its maturity date, allowing them to access their funds if needed.

Risks of Certificate of Deposit Catname

While Certificate of Deposit Catname offers certain advantages, it is important to be aware of the risks associated with this investment:

- Interest Rate Risk: If interest rates rise after purchasing a Certificate of Deposit Catname, the fixed interest rate may become less attractive compared to other investment options.

- Liquidity Risk: Although Certificate of Deposit Catname can be traded in the secondary market, there is no guarantee that there will be a buyer available at the desired price. This can limit the investor’s ability to access their funds before the maturity date.

- Early Withdrawal Penalty: If an investor decides to withdraw their funds before the maturity date, they may be subject to an early withdrawal penalty, which can reduce the overall return on investment.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.