What is Securities Lending?

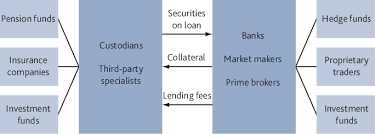

In the world of finance, securities lending refers to the practice of temporarily transferring securities, such as stocks or bonds, from one party (the lender) to another party (the borrower). This transaction is usually facilitated by a third-party intermediary, such as a custodian or a securities lending agent.

During the lending period, the borrower pays a fee or provides collateral to the lender as compensation for the temporary use of the securities. The borrower may have various reasons for borrowing securities, such as short-selling, hedging, or meeting settlement obligations.

Key Points:

- Securities lending involves the temporary transfer of securities from a lender to a borrower.

- A fee or collateral is provided by the borrower to compensate the lender.

- Borrowers may borrow securities for various purposes, such as short-selling or hedging.

Securities lending plays a crucial role in the financial markets by enhancing market liquidity, facilitating short-selling, and supporting various trading strategies. It allows market participants to efficiently access securities they need for their investment or trading activities.

Overall, securities lending is an important practice that contributes to the smooth functioning of the financial markets and provides benefits to both lenders and borrowers.

Importance of Securities Lending

Securities lending plays a crucial role in the financial markets, providing various benefits to market participants. It facilitates the smooth functioning of the market by enhancing liquidity, supporting short-selling activities, and enabling efficient price discovery.

One of the key reasons for the importance of securities lending is its role in increasing market liquidity. By allowing investors to borrow and lend securities, it ensures that there is a constant supply of securities available for trading. This helps to improve market efficiency and reduces the impact of large buy or sell orders on the market price.

Securities lending also supports short-selling activities, which are essential for market participants to hedge their positions or speculate on the decline in the value of a security. Short-selling helps to maintain market balance and provides opportunities for investors to profit from market downturns.

Furthermore, securities lending contributes to efficient price discovery. When securities are available for borrowing, it allows investors to take short positions, which can help reveal the true market sentiment. This information is valuable for market participants in making informed investment decisions.

In addition to the benefits mentioned above, securities lending provides an additional source of revenue for institutional investors. By lending out their securities, they can earn fees or interest on the borrowed securities, which can enhance their overall investment returns.

Overall, the importance of securities lending cannot be overstated. It plays a vital role in ensuring market liquidity, supporting short-selling activities, facilitating price discovery, and generating additional revenue for investors. It is an essential practice that contributes to the efficient functioning of the financial markets.

Benefits of Securities Lending

Securities lending is a practice that offers numerous benefits to market participants. By lending out their securities, investors can generate additional revenue while still maintaining ownership of their assets. Let’s explore some of the key benefits of securities lending:

1. Increased Returns

One of the primary benefits of securities lending is the potential for increased returns. By lending out their securities, investors can earn fees or interest on the borrowed assets. This additional income can enhance the overall performance of their investment portfolio.

2. Diversification of Revenue

Securities lending provides investors with an opportunity to diversify their revenue streams. Instead of relying solely on capital appreciation or dividends, investors can generate income through lending their securities. This can help to reduce reliance on traditional investment strategies and provide a more stable and diversified income source.

3. Risk Mitigation

Securities lending can also serve as a risk management tool. By lending out their securities, investors can offset potential losses or volatility in their portfolio. This is particularly beneficial for long-term investors who are looking to hedge against market downturns or fluctuations.

4. Enhanced Market Liquidity

Another significant benefit of securities lending is the increased liquidity it brings to the market. By allowing investors to borrow securities, the practice facilitates easier and more efficient trading. This enhanced liquidity can lead to tighter bid-ask spreads and improved overall market functioning.

5. Cost Reduction

Securities lending can also help to reduce costs for market participants. For example, short sellers can borrow securities instead of purchasing them outright, saving on transaction costs. Additionally, institutional investors can lend out their idle securities to earn fees, offsetting some of the expenses associated with holding those assets.

| Benefits of Securities Lending |

|---|

| Increased Returns |

| Diversification of Revenue |

| Risk Mitigation |

| Enhanced Market Liquidity |

| Cost Reduction |

Increased Liquidity

One of the key benefits of securities lending is the increased liquidity it provides to the market. When investors are able to lend their securities to other market participants, it allows for a more efficient allocation of capital and facilitates the smooth functioning of financial markets.

By lending their securities, investors can help to meet the demand for borrowed securities from other market participants, such as short sellers or institutional investors looking to hedge their positions. This increased availability of securities for borrowing helps to ensure that there is a sufficient supply of securities in the market, which in turn helps to prevent excessive price volatility and promotes market stability.

Furthermore, securities lending can also help to enhance market liquidity by providing market participants with the ability to access securities that they may not otherwise be able to obtain. This can be particularly beneficial for investors who are looking to execute specific trading strategies or gain exposure to certain securities that may be in high demand.

Overall, increased liquidity resulting from securities lending can have a positive impact on market efficiency, price discovery, and overall market functioning.

Additional Revenue Opportunities

Securities lending offers investors the opportunity to generate additional revenue by lending out their securities to borrowers. When an investor lends their securities, they receive a fee in return. This fee can be a significant source of additional income for investors, especially in times of low interest rates or market volatility.

By participating in securities lending, investors can take advantage of the demand for borrowed securities in the market. Borrowers, such as hedge funds or other institutional investors, may need to borrow securities for various reasons, such as short selling or hedging strategies. By lending out their securities, investors can earn a fee based on the demand and duration of the loan.

Benefits of Additional Revenue Opportunities

There are several benefits to taking advantage of the additional revenue opportunities offered by securities lending:

- Increased Returns: By earning a fee from securities lending, investors can enhance their overall returns on their investment portfolio. This can be particularly beneficial in a low-interest-rate environment where traditional investment returns may be limited.

- Diversification of Income: Securities lending provides investors with an alternative source of income that is not directly tied to market performance. This can help diversify their income streams and reduce reliance on traditional investment strategies.

- Flexibility: Investors have the flexibility to choose which securities they want to lend and for how long. They can tailor their lending strategy to their specific investment goals and risk tolerance.

Overall, participating in securities lending can provide investors with additional revenue opportunities and enhance their overall investment returns. It is important for investors to carefully consider the risks and rewards associated with securities lending before deciding to participate.

Risk Management

Risk management is a crucial aspect of securities lending. By engaging in securities lending, investors can effectively manage and mitigate various risks associated with their investment portfolios. Here are some key points to consider:

Diversification:

Securities lending allows investors to diversify their portfolios by lending out securities that they own. This diversification strategy helps spread the risk across different assets and can potentially reduce the overall risk of the portfolio.

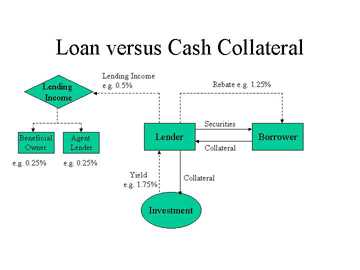

Collateral:

When engaging in securities lending, borrowers are required to provide collateral to the lender. This collateral serves as a security deposit and helps protect the lender against potential default by the borrower. The collateral is typically in the form of cash or other high-quality securities, which adds an additional layer of protection for the lender.

Risk Monitoring:

Lenders closely monitor the risk associated with securities lending activities. They employ sophisticated risk management systems and processes to assess and monitor the creditworthiness of borrowers, the quality of collateral, and the overall market conditions. This proactive risk monitoring helps lenders identify and address potential risks in a timely manner.

Contractual Agreements:

Securities lending transactions are governed by contractual agreements between the lender and the borrower. These agreements outline the terms and conditions of the lending arrangement, including the duration of the loan, the fees involved, and the rights and responsibilities of both parties. These contractual agreements provide legal protection and help mitigate potential risks.

Securities Lending Process

The securities lending process typically involves the following steps:

| Step | Description |

|---|---|

| 1 | |

| 2 | Collateral: The borrower provides collateral, typically in the form of cash or other securities, to the lender as security for the loan. |

| 3 | Transfer: The lender transfers the securities to the borrower, who can then use them for various purposes, such as short selling or covering existing short positions. |

| 4 | |

| 5 | Termination: At the end of the agreed-upon lending period, the borrower returns the securities to the lender, and the collateral is returned. |

The securities lending process is governed by various regulations and industry best practices to ensure transparency, fairness, and risk management. It is an essential tool for market participants to enhance liquidity, generate additional revenue, and manage risk effectively.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.