Imputed Interest: Calculate, FAQs, and More

Imputed interest refers to the interest that is considered to have been paid on a loan, even if no actual interest payment has been made. This concept is important for tax purposes and is used to determine the taxable income of the borrower.

What is Imputed Interest?

Imputed interest is a concept used by the Internal Revenue Service (IRS) to ensure that borrowers are not avoiding taxes by receiving interest-free loans. It is based on the idea that if a borrower receives a loan with no or below-market interest rates, they are effectively receiving a financial benefit that should be treated as taxable income.

For example, if a friend lends you money without charging any interest, the IRS considers this as if you received an interest payment and you should report it as taxable income.

How to Calculate Imputed Interest

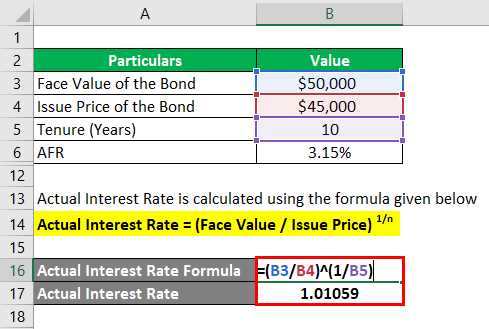

Calculating imputed interest can be a complex process, but it generally involves determining the fair market value of the loan and comparing it to the applicable federal rate (AFR) set by the IRS. The AFR is the minimum interest rate that should be charged on a loan to avoid imputed interest.

To calculate imputed interest, you need to know the loan amount, the term of the loan, and the applicable federal rate. You can use online calculators or consult with a tax professional to ensure accurate calculations.

Why is Imputed Interest Important?

Imputed interest is important because it ensures that borrowers are not able to avoid taxes by receiving interest-free or below-market interest loans. By imputing interest, the IRS ensures that borrowers are reporting the appropriate amount of taxable income and paying the correct amount of taxes.

FAQs about Imputed Interest

1. Is imputed interest always taxable?

Yes, imputed interest is generally considered taxable income.

2. Are there any exceptions to imputed interest rules?

Yes, there are certain exceptions and exclusions for specific types of loans, such as qualified student loans and loans below a certain threshold amount. It is important to consult with a tax professional to understand the specific rules and exceptions that may apply to your situation.

3. Can imputed interest be deducted on taxes?

No, imputed interest is not deductible on taxes. It is treated as taxable income.

4. What happens if I do not report imputed interest?

If you fail to report imputed interest, you may be subject to penalties and interest charges by the IRS. It is important to accurately report all taxable income to avoid any potential issues.

Additional Resources on Imputed Interest

For more information on imputed interest and its implications, you can refer to the following resources:

– IRS Publication 550: Investment Income and Expenses

– IRS Publication 936: Home Mortgage Interest Deduction

– IRS Form 1098: Mortgage Interest Statement

Consulting with a tax professional is always recommended to ensure compliance with tax laws and regulations.

What is Imputed Interest?

Imputed interest refers to the interest that is considered to be earned on an investment or loan, even if no actual interest payments are made. It is a concept used by tax authorities to ensure that individuals and businesses do not avoid paying taxes on income that is in the form of imputed interest.

How is Imputed Interest Calculated?

The calculation of imputed interest depends on the specific situation and the applicable tax rules. In the case of loans between related parties, the imputed interest rate is usually determined by the tax authorities based on the prevailing market rates for similar loans. The imputed interest is then calculated by applying this rate to the outstanding loan balance.

For bonds or other debt instruments with below-market coupon rates, the imputed interest is calculated by comparing the coupon rate to the prevailing market rate for similar bonds. The difference between the two rates is then multiplied by the bond’s face value to determine the imputed interest.

Why is Imputed Interest Important?

Imputed interest is important because it ensures that individuals and businesses are not able to avoid paying taxes on income that is in the form of imputed interest. By imputing or calculating the interest that would have been earned at market rates, tax authorities can ensure that the appropriate amount of tax is paid on these transactions.

Imputed interest also helps to maintain fairness in the tax system by preventing individuals and businesses from taking advantage of below-market interest rates or coupon rates to reduce their tax liability. It helps to level the playing field and ensure that everyone pays their fair share of taxes.

Overall, imputed interest is an important concept in taxation that helps to ensure that individuals and businesses are not able to avoid paying taxes on income that is in the form of imputed interest. It helps to maintain fairness in the tax system and ensure that everyone pays their fair share of taxes.

How to Calculate Imputed Interest

Calculating imputed interest can be a complex process, but it is important to understand how it works. Here are the steps to calculate imputed interest:

Step 1: Determine the Applicable Federal Rate (AFR)

The first step in calculating imputed interest is to determine the Applicable Federal Rate (AFR). The AFR is the minimum interest rate that must be charged on certain loans to avoid imputed interest. It is set by the Internal Revenue Service (IRS) and can vary depending on the length of the loan and the type of transaction.

Step 2: Calculate the Imputed Interest

Once you have determined the AFR, you can calculate the imputed interest. The imputed interest is the difference between the interest actually paid on the loan and the interest that would have been paid at the AFR. To calculate the imputed interest, subtract the interest actually paid from the interest that would have been paid at the AFR.

Step 3: Report the Imputed Interest

After calculating the imputed interest, it is important to report it correctly. The lender is responsible for reporting the imputed interest on Form 1099-INT, which is then provided to the borrower and the IRS. The borrower must include the imputed interest as income on their tax return.

It is important to note that imputed interest rules can be complex and may vary depending on the specific circumstances. It is recommended to consult with a tax professional or refer to the IRS guidelines for more detailed instructions on calculating and reporting imputed interest.

Why is Imputed Interest Important?

Here are some key reasons why imputed interest is important:

- Tax implications: Imputed interest is often subject to taxation, even though it is not actually received as cash. This means that borrowers may need to report imputed interest as income on their tax returns, while lenders may need to report imputed interest as interest income. Failing to properly account for imputed interest can result in penalties and legal consequences.

- Fairness and transparency: Imputed interest helps ensure fairness and transparency in financial transactions. By calculating and attributing interest based on market rates, imputed interest helps prevent parties from avoiding or manipulating interest payments. It helps create a level playing field and promotes trust in the financial system.

- Accurate valuation: Imputed interest is used to accurately value certain financial instruments, such as zero-coupon bonds or convertible debt. By imputing interest, these instruments can be properly priced and traded in the market. Without imputed interest, the true value of these instruments may be distorted, leading to incorrect pricing and potential financial losses.

- Compliance with regulations: Many countries have regulations in place that require imputed interest to be calculated and reported. These regulations are designed to prevent tax evasion and ensure that all parties involved in a financial transaction are accountable for their obligations. Compliance with imputed interest regulations is essential to avoid legal issues and maintain a good reputation in the financial industry.

FAQs about Imputed Interest

Here are some frequently asked questions about imputed interest:

| Question | Answer |

| What is imputed interest? | Imputed interest refers to the interest that is not explicitly stated or paid on a loan or investment, but is instead calculated and added to the principal amount. It is used to account for the time value of money and ensure that the lender or investor is adequately compensated. |

| How is imputed interest calculated? | Imputed interest is calculated using the applicable federal rate (AFR) set by the Internal Revenue Service (IRS). The AFR is based on the prevailing market rates for similar loans or investments. The imputed interest amount is determined by multiplying the AFR by the outstanding principal balance. |

| Why is imputed interest important? | Imputed interest is important for tax purposes and to ensure fairness in financial transactions. By imputing interest, the IRS can ensure that lenders and borrowers are not avoiding taxes by disguising interest as other forms of payment. It also ensures that investors are receiving a fair return on their investments. |

| When is imputed interest applicable? | Imputed interest is applicable in various situations, such as below-market loans between family members, interest-free loans, and employee loans. It is also relevant for certain types of investments, such as original issue discount (OID) bonds. |

| Are there any exceptions to imputed interest? | Yes, there are certain exceptions to imputed interest. For example, loans below a certain threshold may be exempt from imputed interest rules. Additionally, certain types of loans, such as qualified student loans, may have specific provisions that allow for lower interest rates. |

These are just a few of the frequently asked questions about imputed interest. It is important to consult with a financial advisor or tax professional to fully understand the implications and requirements related to imputed interest in your specific situation.

For more information and resources on imputed interest, you can refer to the additional resources section at the end of this article.

Additional Resources on Imputed Interest

Here are some additional resources that can provide more information on imputed interest:

1. Internal Revenue Service (IRS)

The IRS website offers detailed information on imputed interest, including regulations, forms, and guidance for taxpayers. You can visit their website at www.irs.gov to access the relevant resources.

2. Financial Institutions

Many financial institutions, such as banks and credit unions, provide educational materials and resources on imputed interest. Check with your local bank or credit union to see if they have any information available.

3. Investment Websites

Various investment websites offer articles, calculators, and tools related to imputed interest. Websites like Investopedia, The Motley Fool, and Bloomberg provide valuable insights into this topic.

4. Tax Professionals

If you have specific questions or need personalized advice regarding imputed interest, it is recommended to consult a tax professional. They can provide expert guidance based on your individual circumstances.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.