What is Invested Capital?

Invested capital is a financial metric that represents the total amount of money that a company has invested in its operations. It includes both equity and debt financing and is a measure of the resources that a company has available to generate profits.

Definition and Importance

Invested capital is an important metric for investors and analysts as it provides insights into a company’s financial health and efficiency. It helps determine how effectively a company is utilizing its resources to generate returns for its shareholders.

By calculating the invested capital, investors can assess the amount of money that has been put into a company and evaluate its ability to generate profits. It also helps in comparing the performance of different companies within the same industry.

How to Calculate Invested Capital

To calculate invested capital, you need to add the company’s total debt and equity financing. The formula for invested capital is:

Invested Capital = Total Debt + Total Equity

Total debt includes both short-term and long-term debt, such as loans and bonds. Total equity represents the shareholders’ equity, which includes common stock, retained earnings, and additional paid-in capital.

Definition and Importance of Invested Capital

Invested capital is a financial metric that represents the total amount of money invested in a company’s operations. It includes both equity and debt financing and is a key indicator of a company’s financial health and stability.

Invested capital is important because it provides insight into how efficiently a company is using its resources to generate returns. By analyzing the amount of capital invested in relation to the returns generated, investors and analysts can assess the company’s profitability and overall performance.

Invested capital is also used to evaluate a company’s ability to generate sustainable long-term returns. By comparing the returns on invested capital (ROIC) to the company’s cost of capital, investors can determine whether the company is creating value for its shareholders.

Furthermore, invested capital is a useful metric for comparing companies within the same industry. It allows investors to assess which companies are utilizing their resources more effectively and generating higher returns on their investments.

How to Calculate Invested Capital

Invested capital is a crucial metric for evaluating a company’s financial performance and determining its ability to generate returns for its investors. Calculating invested capital involves considering both the company’s debt and equity components.

Step 1: Determine the Company’s Total Debt

The first step in calculating invested capital is to determine the company’s total debt. This includes both short-term and long-term debt obligations. You can find this information on the company’s balance sheet, which is a financial statement that provides a snapshot of the company’s assets, liabilities, and shareholders’ equity.

Step 2: Calculate the Company’s Total Equity

Next, you need to calculate the company’s total equity. This includes the shareholders’ equity, which represents the ownership interest of the company’s shareholders. Shareholders’ equity can be found on the company’s balance sheet as well.

Step 3: Add the Total Debt and Total Equity

Once you have determined the company’s total debt and total equity, you need to add them together to calculate the invested capital. This sum represents the total amount of money that has been invested in the company by both debt and equity holders.

Step 4: Adjust for Non-Operating Assets and Liabilities

In some cases, it may be necessary to adjust the invested capital calculation for non-operating assets and liabilities. Non-operating assets and liabilities are items that are not directly related to the company’s core business operations. Examples of non-operating assets include investments in other companies or real estate properties, while non-operating liabilities may include outstanding legal claims or one-time expenses. Adjusting for these items can provide a more accurate picture of the company’s invested capital.

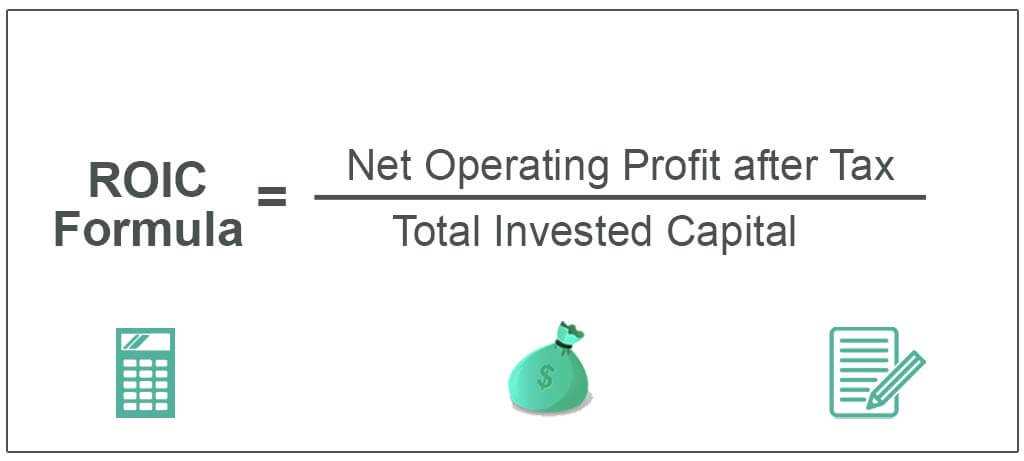

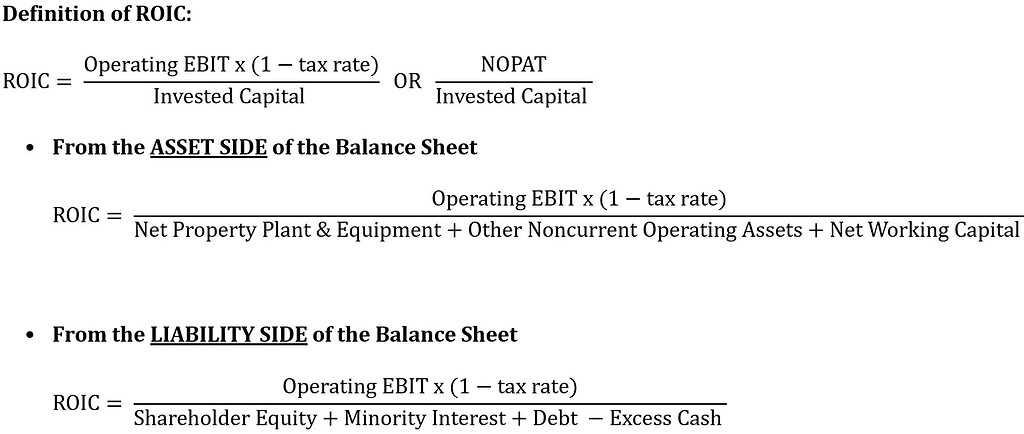

ROIC Formula and Calculation

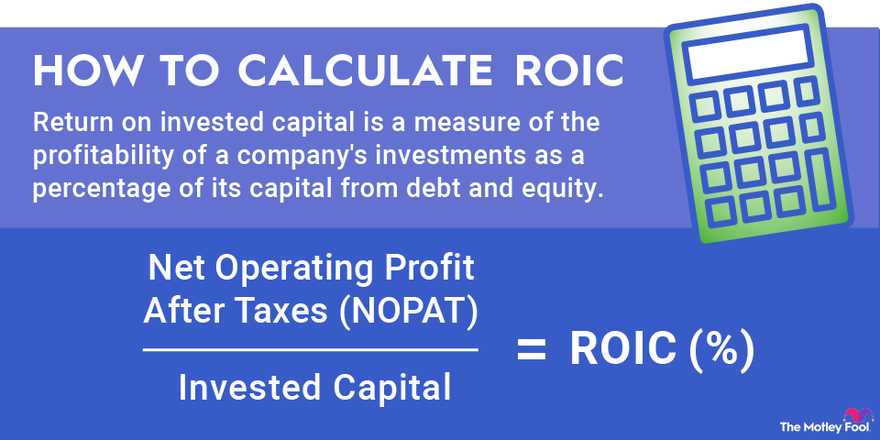

Return on Invested Capital (ROIC) is a financial metric that measures the profitability of a company’s investments. It shows how efficiently a company is using its invested capital to generate returns.

The formula to calculate ROIC is:

- First, you need to determine the net operating profit after taxes (NOPAT). This can be found on the company’s income statement.

- Next, you need to calculate the invested capital. This includes both debt and equity. You can find this information on the company’s balance sheet.

- Finally, divide the NOPAT by the invested capital and multiply by 100 to get the ROIC percentage.

ROIC = (NOPAT / Invested Capital) * 100

For example, let’s say a company has a NOPAT of $1 million and an invested capital of $10 million. The calculation would be:

ROIC = ($1,000,000 / $10,000,000) * 100 = 10%

A higher ROIC indicates that a company is generating more returns for each dollar of invested capital. It is a measure of efficiency and profitability.

ROIC is a useful metric for investors and analysts to evaluate the financial performance of a company. It can be compared to the company’s cost of capital to determine if it is creating value for shareholders.

By analyzing the ROIC of a company over time, investors can assess the company’s ability to generate consistent returns and make informed investment decisions.

Using Invested Capital to Evaluate Returns

Why is Invested Capital Important?

Invested capital represents the total amount of money that has been used to acquire and maintain a company’s assets, including both debt and equity. It is an important measure because it shows how effectively a company is utilizing its resources to generate returns.

By comparing the return on invested capital (ROIC) to the cost of capital, investors can determine if a company is generating value. If the ROIC is higher than the cost of capital, it suggests that the company is generating positive returns on its investments. Conversely, if the ROIC is lower than the cost of capital, it indicates that the company is not generating sufficient returns to cover its costs.

Calculating ROIC

To calculate the return on invested capital (ROIC), you need to divide the company’s net operating profit after tax (NOPAT) by its invested capital. NOPAT is a measure of a company’s operating profitability and can be found in its financial statements.

The formula for calculating ROIC is as follows:

| ROIC = | NOPAT | ÷ | Invested Capital |

|---|

By analyzing a company’s ROIC, investors can gain insights into its ability to generate returns on the capital invested. A higher ROIC indicates that the company is generating more profits relative to the capital invested, while a lower ROIC suggests that the company is less efficient in generating returns.

Investors can use ROIC as a benchmark to compare the performance of different companies within the same industry. It can also be used to assess a company’s performance over time and to identify trends or patterns that may affect future returns.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.