Credit Spread Explained

Options can be used to create various trading strategies, including credit spreads. A credit spread involves selling one option contract and simultaneously buying another option contract with the same expiration date but at a different strike price. The goal is to generate income from the premium received from selling the option while limiting potential losses through the purchase of another option.

How Credit Spreads Work

When implementing a credit spread strategy, an investor sells an option with a higher strike price and buys an option with a lower strike price. The options can be either calls or puts, depending on the investor’s outlook on the underlying asset. If the investor believes the price of the underlying asset will remain below the higher strike price, they would sell a call option and buy a call option with a lower strike price.

The difference in the premiums received from selling the higher strike option and buying the lower strike option represents the potential profit of the credit spread. This profit is realized if the price of the underlying asset remains below the higher strike price at expiration. If the price exceeds the higher strike price, the investor may incur losses.

Benefits and Risks of Credit Spreads

Credit spreads offer several benefits to investors. First, they provide a way to generate income from options trading without taking on excessive risk. Second, they can be used to hedge against potential losses in a portfolio. Third, credit spreads have defined risk and reward, making them suitable for risk management purposes.

However, credit spreads also come with risks. If the price of the underlying asset moves against the investor’s position, they may incur losses. Additionally, the potential profit from credit spreads is limited to the premium received, which may not be significant compared to the potential losses.

Implementing Credit Spreads in Your Investment Strategy

Bonds

A bond is a debt instrument issued by a company, municipality, or government entity to raise capital. When an investor purchases a bond, they are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity. Bonds are considered fixed-income securities because they provide a fixed stream of income to the investor.

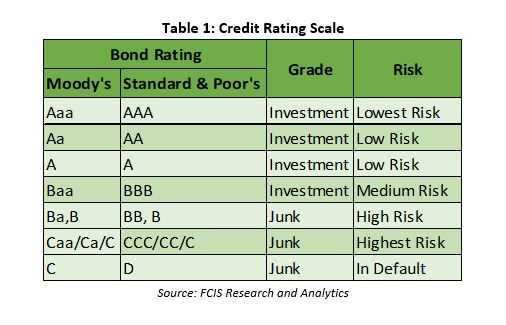

Bonds have different characteristics such as maturity date, coupon rate, and credit rating. The maturity date is the date on which the issuer must repay the principal amount to the bondholder. The coupon rate is the interest rate that the issuer pays to the bondholder. The credit rating indicates the creditworthiness of the issuer and helps investors assess the risk associated with the bond.

Options Strategy

Options are financial derivatives that give investors the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified period. Options can be used to speculate on the price movement of the underlying asset or to hedge an existing position.

There are two types of options: call options and put options. A call option gives the holder the right to buy the underlying asset, while a put option gives the holder the right to sell the underlying asset. Options have an expiration date, after which they become worthless.

Options strategies involve combining different options contracts to create a specific risk-reward profile. One popular options strategy is the credit spread, which involves selling one option contract and buying another option contract with the same expiration date but at a different strike price. The goal of a credit spread is to generate income by collecting the premium from the sold option while limiting the potential loss with the purchased option.

Combining Bonds and Options Strategy: Credit Spread

The credit spread strategy allows investors to generate income from the premium collected while potentially benefiting from the appreciation of the bond’s price. However, it is important to note that credit spreads also come with risks. If the bond’s price declines significantly, the investor may face losses, and if the bond defaults, the investor may lose their entire investment.

| Benefits of Credit Spreads | Risks of Credit Spreads |

|---|---|

| – Income generation through premium collection | – Potential loss if the bond’s price declines |

| – Limited risk due to the purchased option | – Risk of bond default |

| – Potential for capital appreciation |

How Credit Spreads Work

A credit spread is a popular options strategy that involves the simultaneous purchase and sale of two options contracts with different strike prices. This strategy allows investors to generate income by collecting the premium from the sold option while limiting their potential losses.

When implementing a credit spread, the investor sells an option with a higher strike price and buys an option with a lower strike price. The options can be either calls or puts, depending on the investor’s outlook on the underlying asset.

The difference in the premium received from selling the higher strike option and the premium paid for buying the lower strike option is the net credit received. This net credit is the maximum profit potential of the credit spread.

The credit spread strategy profits from the passage of time and a decrease in the volatility of the underlying asset. As time passes, the options lose value, which benefits the investor who sold the options. Additionally, a decrease in volatility reduces the likelihood of the options reaching their strike prices, resulting in a higher probability of the options expiring worthless.

If the options expire worthless, the investor keeps the net credit received as profit. However, if the options end up in-the-money at expiration, the investor may incur losses. The maximum loss potential of a credit spread is the difference between the strike prices minus the net credit received.

Credit spreads can be implemented in various market conditions and can be used to generate income, hedge positions, or speculate on the direction of an underlying asset. However, it’s crucial for investors to thoroughly understand the risks and rewards associated with credit spreads before incorporating them into their investment strategy.

Benefits and Risks of Credit Spreads

One of the main benefits of credit spreads is the ability to generate income. By selling options contracts, investors can collect premiums, which can provide a steady stream of cash flow. This can be especially beneficial in a low-interest-rate environment where traditional fixed-income investments may not offer attractive yields.

Another benefit of credit spreads is the ability to limit risk. When implementing a credit spread strategy, investors can define their maximum loss upfront. This is because credit spreads involve selling options contracts, which means that the investor’s potential losses are limited to the difference between the strike prices of the options contracts minus the premium received.

Credit spreads also offer the advantage of flexibility. Investors can choose different strike prices and expiration dates to tailor the strategy to their specific risk tolerance and investment goals. This allows for greater customization and the ability to adjust the strategy as market conditions change.

However, it is important to note that credit spreads also come with risks that investors should be aware of. One of the main risks is the potential for loss if the underlying security moves against the investor’s position. While the maximum loss is defined upfront, there is still the possibility of incurring losses if the market moves in an unfavorable direction.

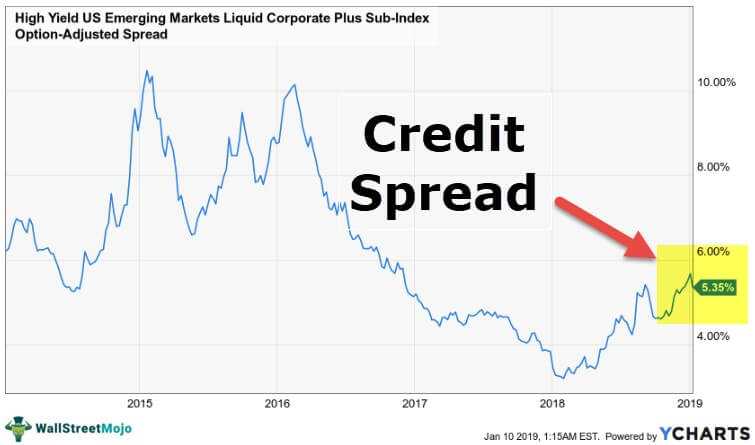

Additionally, credit spreads are subject to market and credit risk. Market risk refers to the overall volatility and fluctuations in the market, which can impact the value of the underlying security. Credit risk, on the other hand, refers to the risk of default by the issuer of the underlying bond. If the issuer defaults, it can result in a loss of principal for the investor.

Overall, credit spreads can be a valuable strategy for investors looking to generate income and manage risk. However, it is important to thoroughly understand the benefits and risks associated with this strategy before implementing it in an investment portfolio.

| Benefits | Risks |

|---|---|

| Generate income | Potential loss if the underlying security moves against the investor’s position |

| Limit risk | Market risk |

| Flexibility | Credit risk |

Implementing Credit Spreads in Your Investment Strategy

- Choose a Broker: Find a reputable broker that offers options trading and allows you to trade credit spreads. Look for a broker with competitive fees, a user-friendly trading platform, and good customer support.

- Define Your Risk Tolerance: Determine how much risk you are willing to take on with credit spreads. This will help you decide on the size of your positions and the amount of capital you allocate to each trade.

- Select Underlying Assets: Choose the underlying assets you want to trade credit spreads on. This could be individual stocks, exchange-traded funds (ETFs), or indexes.

- Identify Opportunities: Use technical and fundamental analysis to identify potential opportunities for credit spreads. Look for stocks or assets that have a high probability of staying within a certain price range.

- Construct Your Spreads: Once you have identified an opportunity, construct your credit spreads. This involves selecting the strike prices and expiration dates for your options contracts.

- Monitor and Adjust: Monitor your credit spreads regularly and make adjustments as needed. If the underlying asset moves against you, you may need to close or adjust your positions to limit losses.

- Review and Learn: After each trade, review your performance and learn from your mistakes. This will help you improve your trading skills and become a better credit spread trader over time.

Remember, implementing credit spreads in your investment strategy requires practice and experience. Start small and gradually increase your position sizes as you become more comfortable with the strategy. It’s also a good idea to consult with a financial advisor or professional trader before getting started.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.