Investment Time Horizon: The Foundation of Successful Investing

For example, if you are investing for retirement and have several decades until you plan to retire, you may have a longer time horizon. This longer time frame allows you to take on more risk and potentially earn higher returns through investments such as stocks. On the other hand, if you are saving for a down payment on a house in the next few years, you will likely have a shorter time horizon and may want to focus on more conservative investments with lower volatility.

The Impact of Time Horizon on Risk Tolerance

Your investment time horizon also plays a significant role in determining your risk tolerance. Risk tolerance refers to your ability to withstand fluctuations in the value of your investments. Generally, the longer your time horizon, the higher your risk tolerance can be.

When you have a longer time horizon, you have more time to recover from any short-term market downturns. This means you can afford to take on more risk and potentially earn higher returns over the long term. However, if your time horizon is shorter, you may not have the luxury of waiting for the market to recover, and therefore, you may want to take a more conservative approach to protect your capital.

Creating a Diversified Investment Portfolio

Once you have determined your investment time horizon and risk tolerance, it is crucial to create a diversified investment portfolio. Diversification involves spreading your investments across different asset classes, industries, and geographic regions to reduce risk.

For example, if you have a longer time horizon and higher risk tolerance, you may choose to allocate a larger portion of your portfolio to stocks. However, it is still important to diversify within the stock market by investing in different sectors, such as technology, healthcare, and finance. Additionally, you may want to consider adding bonds, real estate, or other asset classes to further diversify your portfolio.

| Time Horizon | Risk Tolerance | Recommended Investments |

|---|---|---|

| Long-term (10+ years) | High | Stocks, mutual funds, real estate |

| Medium-term (5-10 years) | Moderate | Mix of stocks and bonds, index funds |

| Short-term (less than 5 years) | Low | Bonds, certificates of deposit (CDs), money market funds |

By diversifying your investments, you can reduce the impact of any single investment performing poorly and increase the likelihood of achieving your financial goals.

What is an investment time horizon?

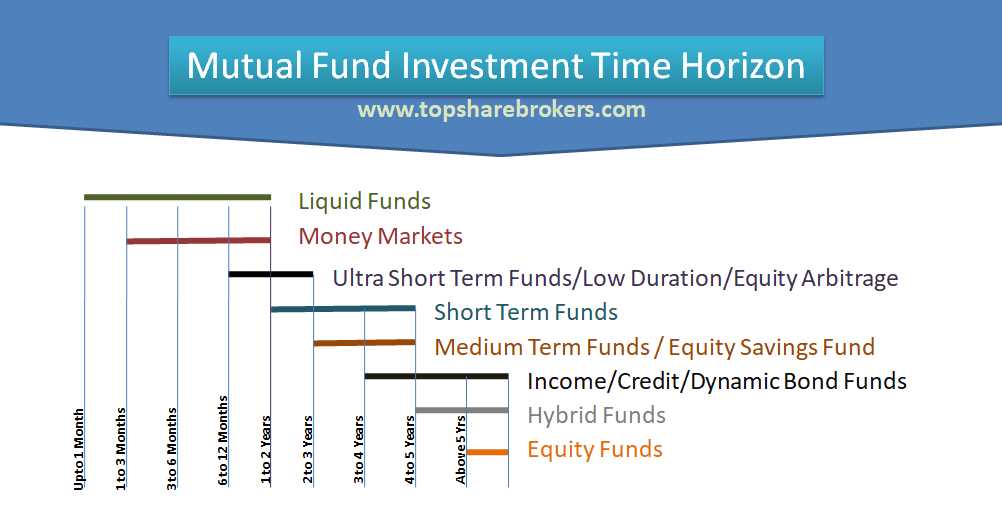

Your investment time horizon is the period of time you are willing to leave your money invested before needing to use it for a specific goal or expense. It can range from short-term (a few months to a year) to long-term (several years to decades). The length of your investment time horizon will greatly influence the types of investments you should consider.

Short-term investment time horizon: If you have a short-term investment time horizon, you should focus on investments that are relatively low-risk and easily accessible. Examples include savings accounts, money market funds, and short-term bonds. These investments provide stability and liquidity, allowing you to access your funds quickly when needed.

Long-term investment time horizon: If you have a long-term investment time horizon, you can afford to take on more risk and potentially earn higher returns. This is because you have a longer period of time to ride out market fluctuations and recover from any losses. Long-term investments may include stocks, mutual funds, real estate, and retirement accounts.

- Asset allocation: Knowing your investment time horizon helps determine the appropriate asset allocation for your portfolio. Asset allocation refers to the mix of different asset classes (stocks, bonds, cash, etc.) in your investment portfolio. A longer investment time horizon allows for a more aggressive asset allocation, while a shorter time horizon may require a more conservative approach.

- Risk tolerance: Your investment time horizon also affects your risk tolerance. If you have a longer time horizon, you may be more willing to take on higher levels of risk in pursuit of higher returns. However, if you have a shorter time horizon, you may want to prioritize capital preservation and choose investments with lower volatility.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.