10-Year Treasury Bonds: Definition, Historical Background, and Illustrative Examples

Definition:

The issuance of 10-Year Treasury Bonds began in 1790 when the U.S. government needed to finance the Revolutionary War. Since then, these bonds have played a crucial role in funding various government projects, including infrastructure development, education, and defense.

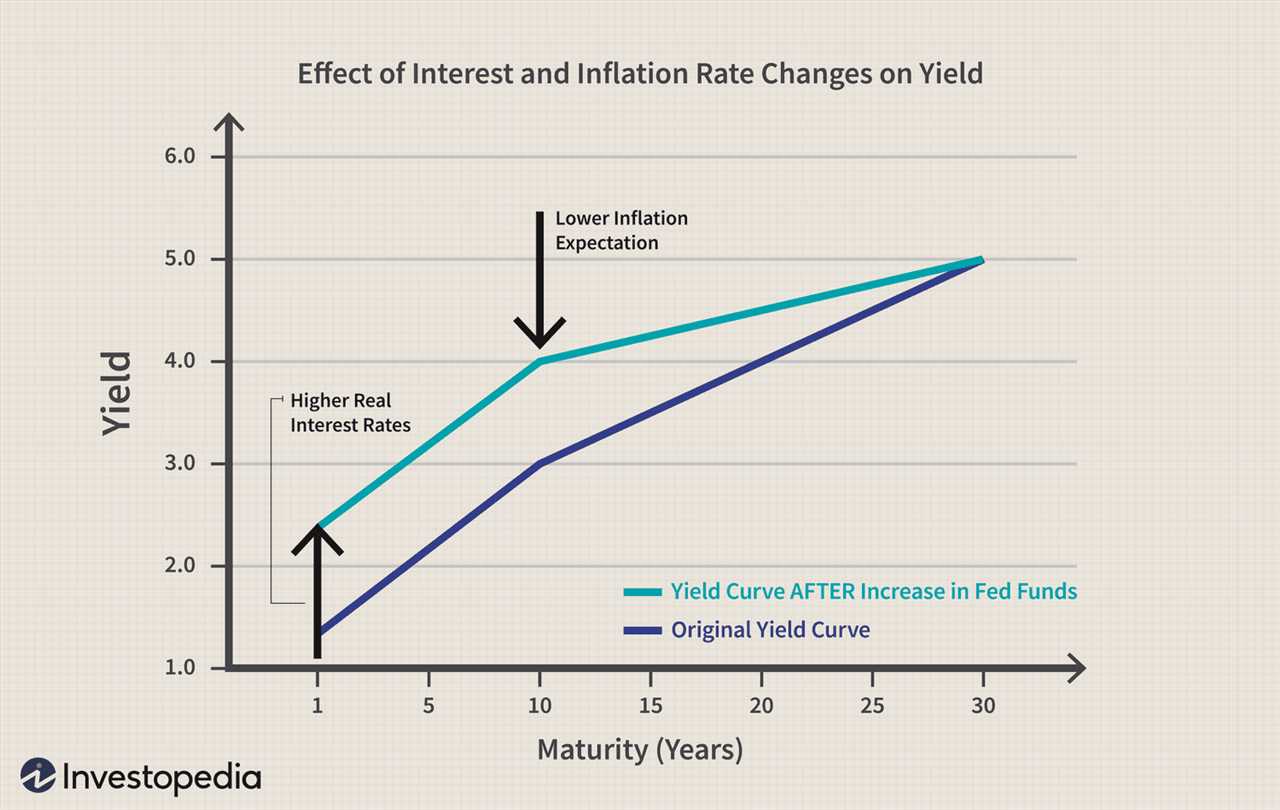

Over the years, the interest rates on 10-Year Treasury Bonds have fluctuated depending on economic conditions and the Federal Reserve’s monetary policy. They are influenced by factors such as inflation, economic growth, and investor demand for safe-haven assets.

Benefits of Investing in 10-Year Treasury Bonds:

3. Diversification: Investing in 10-Year Treasury Bonds can help diversify an investment portfolio. They have a low correlation with other asset classes, such as stocks, which can help reduce overall portfolio risk.

4. Liquidity: 10-Year Treasury Bonds are highly liquid, meaning they can be easily bought or sold in the secondary market. This provides investors with flexibility and the ability to access their funds when needed.

Risks of Investing in 10-Year Treasury Bonds:

1. Interest Rate Risk: The value of 10-Year Treasury Bonds can fluctuate inversely with changes in interest rates. If interest rates rise, the market value of existing bonds may decrease, potentially resulting in capital losses for investors who sell before maturity.

2. Inflation Risk: Inflation erodes the purchasing power of fixed-income investments like 10-Year Treasury Bonds. If inflation exceeds the bond’s interest rate, the real return on investment may be negative.

3. Opportunity Cost: Investing in 10-Year Treasury Bonds may limit potential returns compared to riskier investments like stocks or corporate bonds. Investors should consider their risk tolerance and investment goals before allocating a significant portion of their portfolio to Treasury bonds.

1. John, a conservative investor nearing retirement, decides to invest a portion of his savings in 10-Year Treasury Bonds. He values the safety and fixed income provided by these bonds to supplement his retirement income.

2. Sarah, a young investor with a long investment horizon, includes 10-Year Treasury Bonds in her portfolio to diversify her holdings and reduce overall risk. She plans to hold the bonds until maturity to benefit from the fixed interest payments.

3. Michael, an experienced investor, monitors the interest rate environment and decides to sell his 10-Year Treasury Bonds before maturity when he expects interest rates to rise. He believes he can reinvest the proceeds in higher-yielding assets.

What are 30-Year Treasury Bonds?

These bonds have a maturity period of 30 years, meaning that the principal amount invested is repaid to the bondholder after three decades. During this time, the bondholder receives regular interest payments, typically on a semi-annual basis.

These bonds can be purchased directly from the U.S. Department of the Treasury through an auction process or from secondary markets. They are considered a low-risk investment due to the backing of the U.S. government, which has never defaulted on its debt obligations.

Investing in 30-Year Treasury Bonds can provide a reliable source of income for investors, especially those who are planning for retirement or have long-term financial goals. The interest payments received from these bonds are generally higher compared to shorter-term Treasury bonds, making them an attractive option for income-focused investors.

Historical Background of 30-Year Treasury Bonds

In the following decades, 30-Year Treasury Bonds continued to be an essential tool for the government to raise capital. They were used to finance various initiatives, including the expansion of the military, the development of space exploration programs, and the funding of social welfare programs.

Throughout the years, 30-Year Treasury Bonds have proven to be a reliable investment option for both individual and institutional investors. They offer a fixed interest rate and a guaranteed return of principal at maturity, making them an attractive choice for those seeking long-term stability.

Benefits and Risks of Investing in 30-Year Treasury Bonds

Investing in 30-Year Treasury Bonds can offer several benefits and risks that investors should consider before making any investment decisions. Here are some key points to keep in mind:

Benefits:

1. Stability: 30-Year Treasury Bonds are backed by the U.S. government, which is considered one of the most creditworthy entities in the world. This provides a high level of stability and security for investors.

3. Diversification: Including 30-Year Treasury Bonds in a portfolio can help diversify risk. These bonds have historically shown a low correlation with other asset classes, such as stocks, which can help reduce overall portfolio volatility.

4. Liquidity: Treasury bonds are highly liquid, meaning they can be easily bought and sold in the secondary market. This provides investors with the flexibility to adjust their investment strategy as needed.

Risks:

1. Interest Rate Risk: One of the main risks associated with investing in long-term bonds is interest rate risk. If interest rates rise, the value of existing bonds may decrease, leading to potential capital losses for investors.

2. Inflation Risk: Inflation erodes the purchasing power of fixed-income investments. While Treasury bonds offer a fixed interest rate, the real return may be diminished if inflation outpaces the interest earned.

3. Opportunity Cost: Investing in long-term bonds ties up capital for an extended period. This can limit the ability to take advantage of other investment opportunities that may arise in the meantime.

| Benefits | Risks |

|---|---|

| Stability | Interest Rate Risk |

| Fixed Income | Inflation Risk |

| Diversification | Opportunity Cost |

| Liquidity | Call Risk |

Illustrative Examples of 30-Year Treasury Bonds

Example 1: John’s Retirement Portfolio

John, a 55-year-old investor, is planning for his retirement and wants to ensure a steady income stream in his golden years. He decides to invest a portion of his savings in 30-Year Treasury Bonds. By purchasing these bonds, John can count on regular interest payments every six months, providing him with a predictable cash flow. Additionally, when the bonds mature after 30 years, John will receive the full face value of the bonds, allowing him to further grow his retirement nest egg.

John understands that while the interest rates on 30-Year Treasury Bonds may be lower compared to other investments, the safety and stability they offer make them an attractive option for his long-term financial goals.

Example 2: Sarah’s College Fund

Sarah, a new parent, wants to start saving for her child’s college education. She decides to invest in 30-Year Treasury Bonds as a way to grow her savings over time. By purchasing these bonds, Sarah can benefit from the compounding effect of interest over the 30-year period. This allows her to maximize her returns while maintaining a low-risk investment strategy.

As Sarah’s child grows older, she can rely on the regular interest payments from the bonds to fund educational expenses. Additionally, when the bonds mature, Sarah will have a significant amount of money available to cover tuition costs or other college-related expenses.

Conclusion

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.