S&P 500 Index: The Ultimate Guide to Successful Investing

Investing in the S&P 500 Index is relatively easy. One option is to invest in an index fund or exchange-traded fund (ETF) that tracks the performance of the index. These funds allow investors to gain exposure to the entire index without having to buy individual stocks. Another option is to invest directly in the individual companies that make up the index, although this requires more research and monitoring.

However, it is important to consider the risks and considerations associated with investing in the S&P 500 Index. Like any investment, there is always the potential for loss. The value of the index can fluctuate based on various factors such as economic conditions, market sentiment, and company performance. It is important for investors to carefully assess their risk tolerance and investment goals before investing in the S&P 500 Index.

To maximize returns with the S&P 500 Index, there are a few tips to keep in mind. Firstly, it is important to have a long-term investment strategy. The S&P 500 Index is best suited for investors with a long-term horizon, as short-term fluctuations can be unpredictable. Secondly, it is important to regularly review and rebalance your portfolio to ensure it aligns with your investment goals. Finally, it is important to stay informed about market trends and developments that may impact the performance of the index.

The S&P 500 Index is a widely recognized benchmark for the performance of the U.S. stock market. It is composed of 500 of the largest publicly traded companies in the United States, representing a wide range of industries and sectors. The index is market capitalization-weighted, meaning that the companies with the highest market value have a greater impact on the index’s performance.

Investors often use the S&P 500 Index as a benchmark to compare the performance of their own investment portfolios. By comparing their returns to the index, investors can assess how well their investments are performing relative to the broader market. This can help them make informed decisions about their investment strategies and identify areas for improvement.

Furthermore, it is essential to understand the risks associated with investing in the S&P 500 Index. Like any investment, the index is subject to market volatility and can experience periods of decline. It is important for investors to have a diversified portfolio and to consider their risk tolerance before investing in the index.

Benefits of Investing in the S&P 500 Index

Investing in the S&P 500 Index can offer numerous benefits for investors. The index is widely regarded as a benchmark for the overall performance of the U.S. stock market, and it includes 500 of the largest publicly traded companies in the country. Here are some of the key benefits of investing in the S&P 500 Index:

1. Diversification

One of the main advantages of investing in the S&P 500 Index is the built-in diversification it provides. By investing in a broad range of companies across various sectors, investors can reduce their exposure to individual stock risk. This diversification can help to mitigate the impact of any one company’s poor performance on the overall portfolio.

2. Broad Market Exposure

The S&P 500 Index offers investors exposure to the entire U.S. stock market. This means that by investing in the index, investors can benefit from the overall growth and performance of the U.S. economy. The index includes companies from a wide range of sectors, including technology, healthcare, finance, and consumer goods, providing investors with exposure to different areas of the economy.

3. Historical Performance

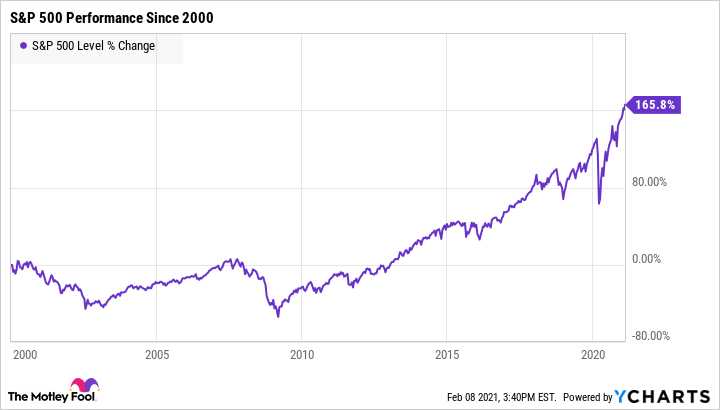

The S&P 500 Index has a long history of delivering strong returns to investors over the long term. While past performance is not indicative of future results, the index has consistently outperformed many other investment options over time. This historical performance can provide investors with confidence in the potential for long-term growth and returns.

4. Low Costs

Investing in the S&P 500 Index can be a cost-effective option for investors. Many index funds and exchange-traded funds (ETFs) are available that track the performance of the index. These funds often have low expense ratios, meaning that investors can minimize the costs associated with investing while still gaining exposure to the S&P 500 companies.

5. Liquidity

The S&P 500 Index is highly liquid, meaning that investors can easily buy and sell shares of the index. This liquidity provides investors with flexibility and the ability to quickly adjust their investment positions if needed. Additionally, the high trading volume of the index can help to ensure that prices are fair and transparent.

How to Invest in the S&P 500 Index

Investing in the S&P 500 Index can be a smart move for both novice and experienced investors. The S&P 500 Index is a widely recognized benchmark for the U.S. stock market and includes 500 of the largest publicly traded companies. Here are some steps to help you get started with investing in the S&P 500 Index:

1. Choose an investment vehicle:

There are several ways to invest in the S&P 500 Index. One option is to buy shares of an exchange-traded fund (ETF) that tracks the index. Another option is to invest in a mutual fund that mirrors the performance of the S&P 500 Index. You can also consider investing in index funds or index-linked certificates.

2. Open an investment account:

To invest in the S&P 500 Index, you will need to open an investment account with a brokerage firm or a financial institution. Research different options and choose a reputable firm that offers low fees and a user-friendly platform.

3. Determine your investment strategy:

4. Set a budget:

5. Monitor and review your investments:

6. Consider dollar-cost averaging:

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of the price of the index. This can help mitigate the impact of market volatility and potentially lower your average cost per share over time.

7. Seek professional advice if needed:

If you are unsure about investing in the S&P 500 Index or need guidance, consider seeking professional advice from a financial advisor. They can help you assess your financial situation, determine your investment goals, and create a personalized investment plan.

Investing in the S&P 500 Index can be a long-term strategy for building wealth and achieving financial goals. By following these steps and staying informed, you can make informed investment decisions and potentially benefit from the growth of the U.S. stock market.

Risks and Considerations of Investing in the S&P 500 Index

Investing in the S&P 500 Index can offer numerous benefits, but it is important to understand the risks and considerations associated with this type of investment. By being aware of these factors, investors can make informed decisions and minimize potential losses.

1. Market Volatility: The S&P 500 Index is subject to market volatility, which means that its value can fluctuate significantly over short periods of time. This volatility can be influenced by various factors such as economic conditions, political events, and investor sentiment. Investors should be prepared for the possibility of experiencing significant swings in the value of their investments.

2. Diversification: While the S&P 500 Index provides exposure to a broad range of companies across different sectors, it is still a concentrated investment. This means that if a particular sector or group of companies performs poorly, it can have a significant impact on the overall performance of the index. Investors should consider diversifying their portfolios to reduce the risk associated with a single investment.

3. Market Timing: Timing the market is a challenging task, and attempting to do so with the S&P 500 Index can be particularly difficult. The index is influenced by numerous factors, and accurately predicting its short-term movements is nearly impossible. Investors should focus on a long-term investment strategy rather than trying to time the market.

4. Fees and Expenses: Investing in the S&P 500 Index typically involves paying fees and expenses, such as management fees and transaction costs. These costs can eat into investment returns over time. Investors should carefully consider the fees associated with investing in the index and compare them to other investment options.

5. Potential for Losses: Like any investment, there is always the potential for losses when investing in the S&P 500 Index. While the index has historically provided positive returns over the long term, past performance is not indicative of future results. Investors should be prepared for the possibility of losing money and should only invest funds that they can afford to lose.

6. Lack of Control: When investing in the S&P 500 Index, investors do not have direct control over the individual companies included in the index. This means that they cannot influence the management decisions or strategies of these companies. Investors should be comfortable with the idea of relinquishing control over their investments.

7. Market Bias: The S&P 500 Index is weighted by market capitalization, which means that larger companies have a greater influence on the index’s performance. This can result in a bias towards certain sectors or industries. Investors should be aware of this bias and consider whether it aligns with their investment objectives.

Overall, investing in the S&P 500 Index can be a viable option for long-term investors seeking broad market exposure. However, it is important to carefully consider the risks and considerations associated with this type of investment and to consult with a financial advisor if needed.

Tips for Maximizing Returns with the S&P 500 Index

Investing in the S&P 500 Index can be a smart move for long-term investors looking to maximize their returns. Here are some tips to help you make the most of your investment:

- Diversify your portfolio: While the S&P 500 Index provides exposure to a wide range of companies across different sectors, it’s still important to diversify your portfolio. Consider investing in other asset classes, such as bonds or international stocks, to spread your risk and potentially increase your returns.

- Consider dollar-cost averaging: Dollar-cost averaging is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of the market price. This strategy can help you mitigate the impact of market volatility and potentially increase your returns over time.

- Monitor your investments: Stay informed about the companies in the S&P 500 Index and the overall market conditions. Regularly review your investment performance and make adjustments as needed. Stay updated on news and events that may impact the companies in the index.

- Consider tax implications: Before investing in the S&P 500 Index, consider the tax implications of your investment. Depending on your country and tax laws, you may be subject to capital gains taxes or other taxes on your investment returns. Consult with a tax professional to understand the tax implications of your investment.

- Seek professional advice: If you’re unsure about investing in the S&P 500 Index or managing your portfolio, consider seeking advice from a financial advisor. A professional can help you develop an investment strategy based on your financial goals and risk tolerance.

By following these tips, you can maximize your returns with the S&P 500 Index and potentially achieve your long-term investment goals.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.