Financial Portfolio: Creating and Managing Your Investment Portfolio

Portfolio management is the process of selecting and managing a collection of investments that align with your financial objectives. It involves assessing your risk tolerance, determining your investment goals, and diversifying your investments to minimize risk. Effective portfolio management allows you to optimize returns while minimizing potential losses.

Key Steps to Creating an Effective Investment Portfolio

2. Assess Your Risk Tolerance: Assessing your risk tolerance is crucial in determining the mix of investments in your portfolio. Consider your age, financial situation, and comfort level with market fluctuations. A higher risk tolerance may lead to a more aggressive portfolio, while a lower risk tolerance may result in a more conservative approach.

3. Diversify Your Investments: Diversification is key to managing risk in your portfolio. By investing in a variety of asset classes, such as stocks, bonds, and real estate, you can spread out your risk and potentially enhance your returns. Diversification helps to offset losses in one investment with gains in another.

5. Monitor and Rebalance Your Portfolio: Regularly monitor your portfolio to ensure it remains aligned with your investment goals. Rebalance your portfolio periodically to maintain the desired asset allocation. Market conditions and changes in your financial situation may warrant adjustments to your portfolio.

Strategies for Managing and Monitoring Your Portfolio

1. Regularly Review Performance: Monitor the performance of your investments on a regular basis. Track the returns, compare them to relevant benchmarks, and evaluate whether they are meeting your expectations. Make adjustments as necessary to optimize your portfolio’s performance.

2. Stay Informed: Stay updated on market trends, economic news, and changes in the investment landscape. This will help you make informed decisions and adapt your portfolio strategy accordingly. Consider subscribing to financial publications, attending seminars, or consulting with a financial advisor.

3. Rebalance When Necessary: Rebalancing involves adjusting the weightings of your investments to maintain the desired asset allocation. As market conditions change, certain investments may outperform or underperform, causing your portfolio to deviate from its original allocation. Regularly rebalancing ensures that your portfolio remains aligned with your investment goals.

4. Consider Tax Implications: Be mindful of the tax implications of your investment decisions. Certain investments may have tax advantages or disadvantages. Consult with a tax professional to understand the potential tax consequences and optimize your after-tax returns.

Portfolio management is a crucial aspect of financial planning and investment strategy. It involves the careful selection, monitoring, and adjustment of investments in order to achieve specific financial goals. Whether you are an individual investor or a financial institution, portfolio management plays a vital role in maximizing returns and minimizing risks.

What is Portfolio Management?

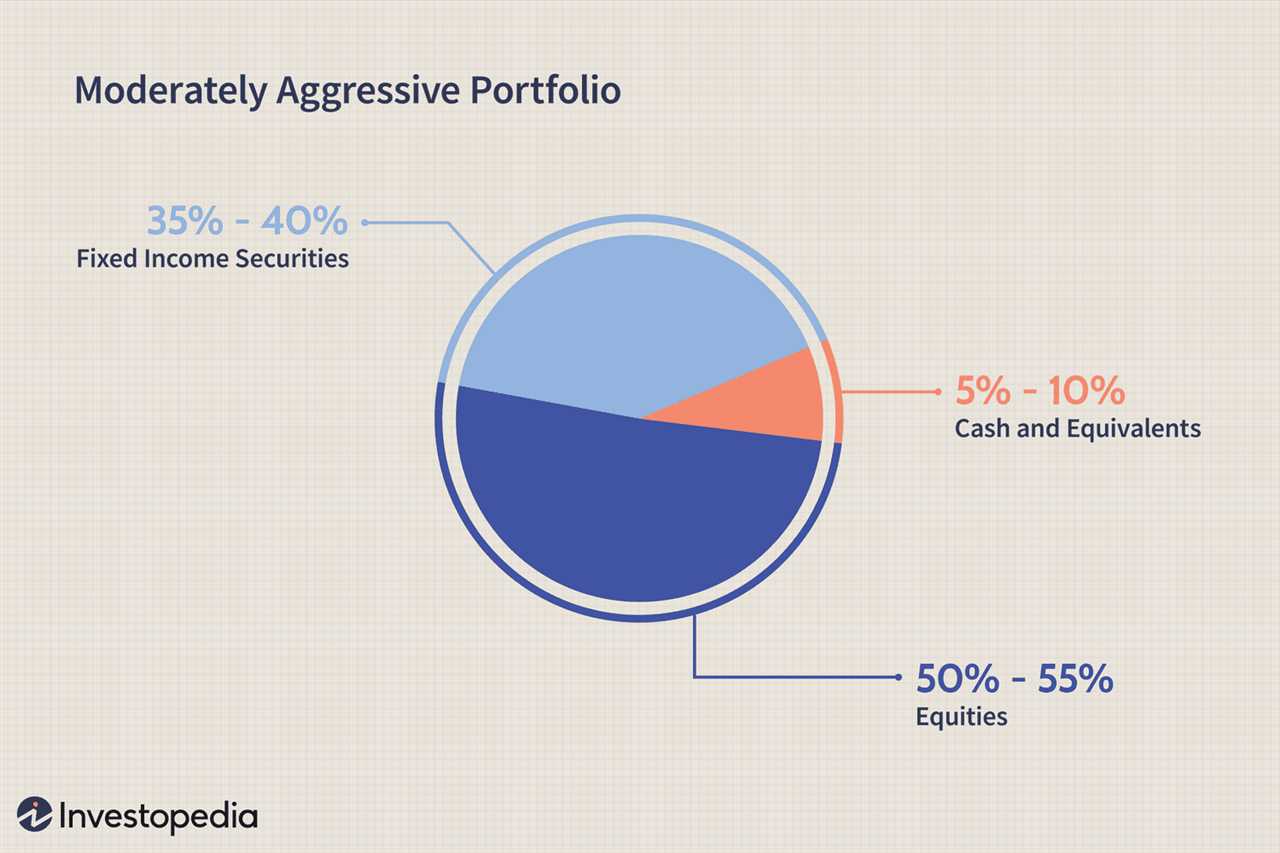

Asset allocation is the strategic distribution of investments across different asset classes, such as stocks, bonds, and real estate. By diversifying investments across various asset classes, investors can reduce the risk associated with any single investment. This helps to protect against market volatility and potential losses.

Risk management is another important aspect of portfolio management. It involves assessing and mitigating the risks associated with different investments. This may include monitoring market trends, analyzing financial data, and adjusting the portfolio accordingly.

Why is Portfolio Management Important?

Portfolio management is important for several reasons:

1. Maximizing Returns: Effective portfolio management aims to maximize returns by strategically allocating investments. By diversifying across different asset classes and carefully selecting investments, investors can potentially increase their overall returns.

2. Minimizing Risks: Portfolio management helps to minimize risks by spreading investments across different assets. This diversification helps to protect against losses in any single investment and reduces the overall risk of the portfolio.

3. Achieving Financial Goals: Portfolio management is essential for achieving specific financial goals. Whether it’s saving for retirement, funding a child’s education, or buying a house, effective portfolio management can help investors reach their desired financial milestones.

4. Adapting to Market Conditions: The financial markets are constantly changing, and portfolio management allows investors to adapt to these changes. By regularly monitoring and adjusting the portfolio, investors can take advantage of new opportunities and mitigate potential risks.

5. Providing Peace of Mind: Effective portfolio management provides investors with peace of mind. By having a well-managed portfolio, investors can feel confident in their financial decisions and have a sense of security about their future financial well-being.

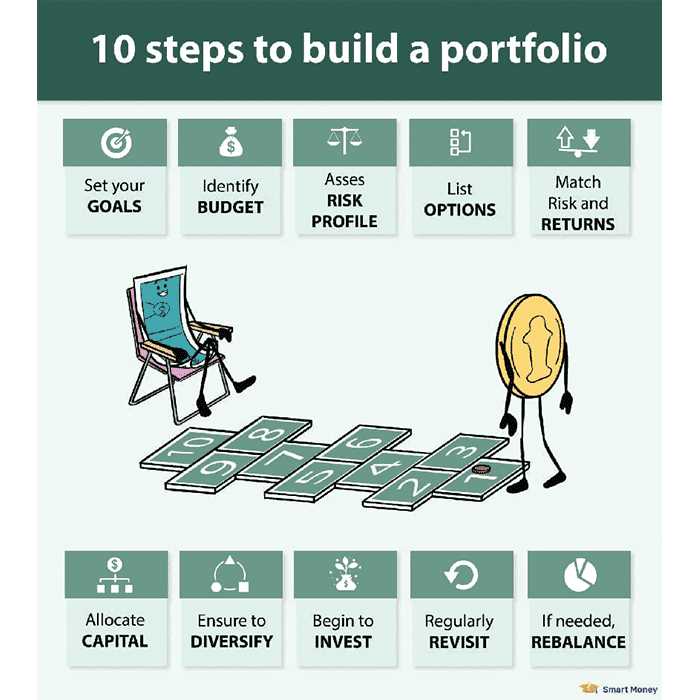

Key Steps to Creating an Effective Investment Portfolio

Creating an effective investment portfolio requires careful planning and consideration. By following these key steps, you can build a portfolio that aligns with your financial goals and risk tolerance.

| Step | Description |

|---|---|

| 1 | Set Your Investment Goals |

| 2 | Assess Your Risk Tolerance |

| 3 | Diversify Your Investments |

| 4 | Allocate Your Assets |

| 5 | Research and Select Investments |

| 6 | Monitor and Rebalance Your Portfolio |

Step 1: Set Your Investment Goals

Step 2: Assess Your Risk Tolerance

Step 3: Diversify Your Investments

Diversification is key to managing risk in an investment portfolio. Spread your investments across different asset classes, such as stocks, bonds, and real estate, as well as different industries and geographical regions. This can help reduce the impact of any single investment on your overall portfolio.

Step 4: Allocate Your Assets

Once you have determined your risk tolerance and investment goals, it’s time to allocate your assets. This involves deciding how much of your portfolio to allocate to different asset classes. For example, you may decide to allocate 60% to stocks, 30% to bonds, and 10% to real estate.

Step 5: Research and Select Investments

Thoroughly research potential investments before adding them to your portfolio. Consider factors such as historical performance, management team, and future growth prospects. Select investments that align with your investment goals and risk tolerance.

Step 6: Monitor and Rebalance Your Portfolio

Regularly monitor your portfolio to ensure it remains aligned with your investment goals. Rebalance your portfolio periodically to maintain the desired asset allocation. This involves buying and selling investments to bring your portfolio back in line with your target allocation.

By following these key steps, you can create an effective investment portfolio that reflects your financial goals and risk tolerance. Remember to regularly review and adjust your portfolio as your financial situation and investment goals change.

Strategies for Managing and Monitoring Your Portfolio

Once you have created your investment portfolio, it is important to have strategies in place for managing and monitoring it. This will help you make informed decisions and ensure that your portfolio remains aligned with your financial goals. Here are some key strategies to consider:

1. Diversification

Diversification is a fundamental strategy in portfolio management. It involves spreading your investments across different asset classes, industries, and geographical regions. By diversifying your portfolio, you can reduce the risk of significant losses in case one investment performs poorly. It is important to carefully analyze and select a mix of investments that align with your risk tolerance and financial objectives.

2. Regular Review

Regularly reviewing your portfolio is crucial to ensure that it remains on track. This involves monitoring the performance of your investments, assessing their alignment with your goals, and making any necessary adjustments. It is recommended to review your portfolio at least once a year, or more frequently if there are significant market changes or life events that may impact your financial situation.

3. Rebalancing

Rebalancing involves adjusting the allocation of your investments to maintain the desired asset mix. Over time, certain investments may outperform others, causing your portfolio to become unbalanced. By rebalancing, you can sell some of the investments that have performed well and reinvest the proceeds into underperforming assets. This helps to maintain your desired risk level and ensures that your portfolio remains aligned with your long-term goals.

4. Risk Management

Managing risk is a crucial aspect of portfolio management. It involves assessing the risk associated with each investment and determining the appropriate level of risk for your portfolio. This can be done through diversification, as mentioned earlier, as well as through careful analysis of the risk-return tradeoff of each investment. It is important to regularly evaluate the risk in your portfolio and make adjustments as needed to protect your investments.

5. Stay Informed

Staying informed about the financial markets and economic trends is essential for effective portfolio management. This includes keeping up with news, reading financial publications, and staying informed about any changes in regulations or policies that may impact your investments. By staying informed, you can make informed decisions about your portfolio and take advantage of opportunities or mitigate risks.

| Key Strategies for Managing and Monitoring Your Portfolio: |

|---|

| 1. Diversification |

| 2. Regular Review |

| 3. Rebalancing |

| 4. Risk Management |

| 5. Stay Informed |

By implementing these strategies, you can effectively manage and monitor your investment portfolio, ensuring that it remains aligned with your financial goals and objectives.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.