Average Cost Method: Definition, Formula, Example

The average cost method is a commonly used accounting method for determining the value of inventory. It is based on the principle that the cost of inventory should be allocated evenly across all units in stock, regardless of when they were purchased or produced.

To calculate the average cost, the total cost of inventory is divided by the total number of units. This provides a per-unit cost, which is then used to value the inventory.

The formula for calculating the average cost is as follows:

| Total Cost of Inventory | Total Number of Units |

|---|---|

| Cost per Unit = —————————— |

For example, let’s say a company has 100 units of inventory with a total cost of $10,000. The average cost per unit would be $100 ($10,000 divided by 100 units).

The average cost method is often used in industries where inventory costs fluctuate frequently, such as retail or manufacturing. It provides a more accurate representation of the cost of goods sold and the value of remaining inventory.

One of the benefits of using the average cost method is that it smooths out the impact of price fluctuations. This can be particularly useful when determining the cost of goods sold during periods of inflation or deflation.

What is the Average Cost Method?

The Average Cost Method is a technique used in accounting to determine the value of inventory. It is based on the assumption that the cost of goods sold and the remaining inventory have an average cost per unit. This method is commonly used in businesses that deal with perishable or interchangeable goods, such as grocery stores or manufacturing companies.

Under the Average Cost Method, the cost of goods sold and the value of the remaining inventory are calculated by taking the average cost per unit of the goods available for sale. This average cost is determined by dividing the total cost of the goods available for sale by the total number of units. The average cost per unit is then multiplied by the number of units sold to calculate the cost of goods sold, while the remaining units are multiplied by the same average cost per unit to determine the value of the remaining inventory.

However, it is important to note that the Average Cost Method may not be suitable for all businesses. Certain industries, such as those dealing with unique or high-value items, may require more precise tracking of inventory costs. Additionally, the use of this method may result in different financial statements and tax implications compared to other inventory valuation methods.

How to Calculate Average Cost?

The average cost method is a way to calculate the cost of inventory items. It is commonly used in accounting to determine the value of goods sold and the ending inventory balance. Calculating the average cost involves a simple formula:

Formula:

To calculate the average cost, you need to divide the total cost of goods available for sale by the total quantity of goods available for sale.

Average Cost = Total Cost of Goods Available for Sale / Total Quantity of Goods Available for Sale

Let’s break down the formula into steps:

- Step 1: Determine the total cost of goods available for sale. This includes the cost of the beginning inventory plus any additional purchases made during the accounting period.

- Step 2: Determine the total quantity of goods available for sale. This includes the quantity of the beginning inventory plus any additional units purchased during the accounting period.

- Step 3: Divide the total cost of goods available for sale by the total quantity of goods available for sale to get the average cost per unit.

Here’s an example to illustrate the calculation:

Example:

Let’s say a company had a beginning inventory of 100 units at a cost of $10 per unit. During the accounting period, they purchased an additional 200 units at a cost of $12 per unit. The total cost of goods available for sale would be calculated as follows:

Total Cost of Goods Available for Sale = (100 units * $10 per unit) + (200 units * $12 per unit) = $1000 + $2400 = $3400

The total quantity of goods available for sale would be calculated as:

Total Quantity of Goods Available for Sale = 100 units + 200 units = 300 units

Finally, to calculate the average cost per unit, divide the total cost of goods available for sale by the total quantity of goods available for sale:

Average Cost = $3400 / 300 units = $11.33 per unit

By using the average cost method, the company can assign a value to each unit of inventory based on the average cost per unit. This helps in determining the cost of goods sold and the ending inventory balance accurately.

Overall, calculating the average cost is a straightforward process that involves determining the total cost and quantity of goods available for sale and dividing them to get the average cost per unit. This method provides a fair and accurate representation of the cost of inventory items.

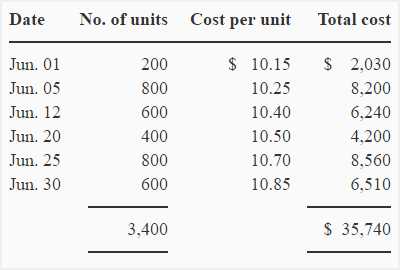

Example of Average Cost Method

The average cost method is a commonly used inventory valuation method in accounting. It calculates the average cost of each unit in inventory by dividing the total cost of goods available for sale by the total number of units available for sale.

Let’s consider an example to understand how the average cost method works:

Company XYZ sells widgets. At the beginning of the month, they had 100 widgets in inventory with a total cost of $1,000. Throughout the month, they purchased an additional 200 widgets for a total cost of $2,000. At the end of the month, they had 150 widgets remaining in inventory.

To calculate the average cost per widget, we add the beginning inventory cost and the purchases cost, and then divide by the total number of widgets:

Total cost of goods available for sale: $1,000 + $2,000 = $3,000

Total number of units available for sale: 100 + 200 = 300

Average cost per widget: $3,000 / 300 = $10

Using the average cost method, each widget in inventory is valued at $10. If Company XYZ sells 50 widgets, the cost of goods sold would be $10 * 50 = $500. The remaining 100 widgets in inventory would still be valued at $10 each.

The average cost method provides a simple and straightforward way to value inventory. It smooths out the fluctuations in purchase costs and helps companies determine the cost of goods sold and the value of remaining inventory.

Benefits of Using the Average Cost Method

The average cost method is a widely used accounting technique that offers several benefits to businesses. By using this method, companies can effectively manage their inventory and make informed financial decisions. Here are some of the key advantages of utilizing the average cost method:

- Simple Calculation: The average cost method is relatively straightforward to calculate. It involves dividing the total cost of inventory by the number of units to determine the average cost per unit. This simplicity makes it easy for businesses to implement and maintain accurate records.

- Smooths Out Price Fluctuations: In industries where the cost of raw materials or goods can vary significantly, the average cost method helps smooth out price fluctuations. Instead of valuing inventory based on the most recent purchase price, this method takes into account the average cost over a period of time. This can provide a more accurate representation of the true value of inventory.

- Reduces Volatility in Financial Statements: By using the average cost method, businesses can avoid sudden spikes or drops in their financial statements. This can be particularly beneficial for companies that experience significant price fluctuations in their industry. It provides a more stable and predictable financial picture, which can be important for investors, lenders, and other stakeholders.

- Conforms to Generally Accepted Accounting Principles (GAAP): The average cost method is an accepted accounting practice that conforms to the Generally Accepted Accounting Principles (GAAP). By using this method, businesses can ensure that their financial statements are in compliance with industry standards and regulations.

- Accurate Cost Allocation: The average cost method allows for a more accurate allocation of costs to inventory. It takes into account the total cost of inventory, including the cost of goods sold, and provides a fair representation of the cost of each unit. This can help businesses make informed pricing decisions and assess the profitability of their products.

- Flexible Inventory Valuation: The average cost method offers flexibility in inventory valuation. It allows businesses to choose the most appropriate method for their specific needs, whether it’s FIFO (First-In, First-Out), LIFO (Last-In, First-Out), or average cost. This flexibility can be particularly beneficial for companies with diverse inventory types or complex supply chains.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.