What is an Exchange-Traded Fund (ETF)?

An Exchange-Traded Fund (ETF) is a type of investment fund and exchange-traded product that allows investors to buy and sell shares representing ownership in a diversified portfolio of securities, such as stocks, bonds, or commodities. ETFs are designed to track the performance of a specific index, sector, or asset class.

Unlike mutual funds, which are priced at the end of the trading day, ETFs can be bought and sold throughout the trading day on stock exchanges, just like individual stocks. This provides investors with the flexibility to enter or exit their positions at any time during market hours.

Structure and Operation

ETFs are structured as open-ended investment companies or unit investment trusts. Open-ended ETFs issue and redeem shares at their net asset value (NAV), which is calculated at the end of each trading day. This ensures that the market price of an ETF closely tracks its underlying assets.

On the other hand, unit investment trust ETFs issue a fixed number of shares during their initial offering and do not issue or redeem shares on an ongoing basis. Instead, these ETFs are bought and sold on secondary markets, and their prices may deviate from the NAV due to supply and demand factors.

Types of ETFs

There are various types of ETFs available to investors, catering to different investment strategies and asset classes. Some common types of ETFs include:

- Equity ETFs: These ETFs invest in a diversified portfolio of stocks, providing exposure to specific sectors, regions, or market indices.

- Bond ETFs: These ETFs invest in a diversified portfolio of bonds, providing exposure to different types of fixed-income securities.

- Commodity ETFs: These ETFs invest in physical commodities or commodity futures contracts, allowing investors to gain exposure to commodities such as gold, oil, or agricultural products.

- Sector ETFs: These ETFs focus on specific sectors of the economy, such as technology, healthcare, or energy.

- International ETFs: These ETFs provide exposure to international markets and allow investors to diversify their portfolios globally.

Advantages of ETFs

ETFs offer several advantages to investors:

- Liquidity: ETFs can be bought and sold throughout the trading day, providing investors with liquidity and flexibility.

- Diversification: ETFs typically hold a diversified portfolio of securities, reducing the risk associated with investing in individual stocks or bonds.

- Transparency: ETFs disclose their holdings on a daily basis, allowing investors to see exactly what assets they own.

- Lower Costs: ETFs generally have lower expense ratios compared to mutual funds, making them a cost-effective investment option.

- Tax Efficiency: ETFs are structured in a way that minimizes capital gains distributions, resulting in potential tax advantages for investors.

Overall, ETFs provide investors with a convenient and efficient way to gain exposure to a wide range of asset classes and investment strategies. They have become increasingly popular in recent years due to their flexibility, transparency, and cost-effectiveness.

Definition and Explanation

An Exchange-Traded Fund (ETF) is a type of investment fund and exchange-traded product, with shares that are traded on stock exchanges. It is designed to track the performance of a specific index, sector, commodity, or asset class. ETFs offer investors the opportunity to gain exposure to a diversified portfolio of assets without having to buy each individual security.

ETFs are similar to mutual funds, but they differ in the way they are traded. While mutual funds are bought and sold at the end of the trading day at the net asset value (NAV) price, ETFs can be bought and sold throughout the trading day at market prices. This provides investors with greater flexibility and liquidity.

ETFs offer a wide range of investment options, including equity ETFs, bond ETFs, commodity ETFs, sector ETFs, and international ETFs. They can be used by investors to achieve various investment objectives, such as diversification, income generation, capital appreciation, and hedging.

Overall, ETFs provide investors with a convenient and cost-effective way to gain exposure to different asset classes and markets. They offer transparency, flexibility, and liquidity, making them a popular choice among both individual and institutional investors.

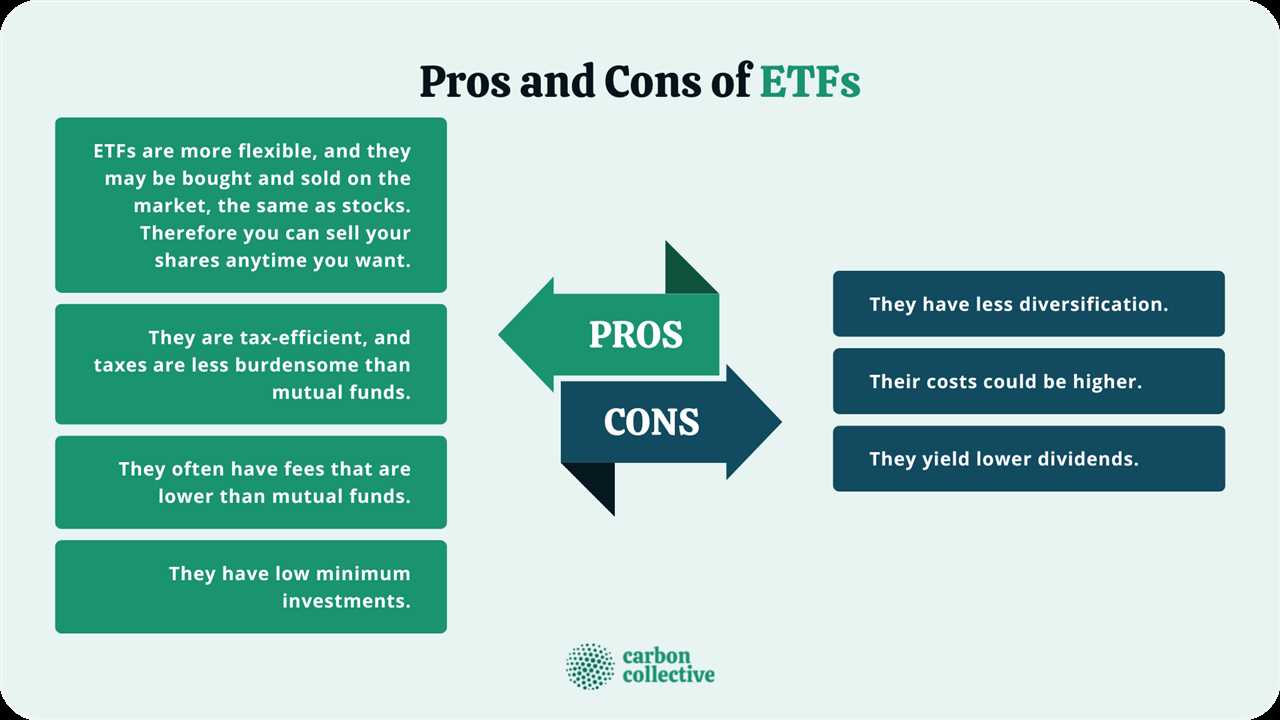

Pros of ETFs

Exchange-Traded Funds (ETFs) offer several advantages that make them an attractive investment option for both individual and institutional investors.

1. Diversification:

One of the key benefits of ETFs is their ability to provide diversification. ETFs typically hold a basket of securities, such as stocks, bonds, or commodities, which allows investors to gain exposure to a wide range of assets with a single investment. This diversification helps to reduce the risk associated with investing in individual securities.

2. Liquidity:

ETFs are traded on stock exchanges, which means they can be bought and sold throughout the trading day at market prices. This liquidity makes it easy for investors to enter or exit their positions quickly, providing flexibility and convenience.

3. Lower Costs:

Compared to mutual funds, ETFs generally have lower expense ratios. This is because ETFs are passively managed and aim to replicate the performance of an underlying index, rather than actively selecting and managing securities. Additionally, ETFs do not have sales loads or redemption fees, making them a cost-effective investment option.

4. Transparency:

ETFs disclose their holdings on a daily basis, allowing investors to see exactly what assets the fund holds. This transparency is beneficial for investors who want to know what they are investing in and helps to prevent any surprises or hidden risks.

5. Tax Efficiency:

ETFs are structured in a way that allows for tax-efficient investing. Due to their unique creation and redemption process, ETFs can minimize capital gains distributions, resulting in potentially lower tax liabilities for investors.

6. Flexibility:

ETFs offer investors the flexibility to trade throughout the day at market prices. This allows investors to take advantage of short-term trading opportunities or adjust their investment strategies as market conditions change.

Benefits and Advantages of Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs) offer several benefits and advantages that make them an attractive investment option for both individual and institutional investors. Here are some key advantages of investing in ETFs:

- Diversification: ETFs provide investors with instant diversification by holding a basket of different securities, such as stocks, bonds, or commodities. This diversification helps to spread the investment risk and reduces the impact of any single security on the overall portfolio.

- Liquidity: ETFs are traded on stock exchanges, which means they can be bought and sold throughout the trading day at market prices. This liquidity makes it easy for investors to enter or exit their positions quickly, providing flexibility and convenience.

- Transparency: ETFs are required to disclose their holdings on a daily basis, allowing investors to see exactly what assets the fund holds. This transparency helps investors make informed decisions and understand the underlying investments.

- Lower Costs: ETFs typically have lower expense ratios compared to mutual funds. This is because ETFs are passively managed and aim to replicate the performance of a specific index, rather than actively selecting and managing individual securities. The lower costs result in higher net returns for investors.

- Tax Efficiency: ETFs are structured in a way that allows for greater tax efficiency compared to mutual funds. This is because ETFs have the ability to redeem shares “in-kind,” which helps to minimize capital gains distributions. Additionally, investors have more control over when they realize capital gains or losses by choosing when to buy or sell shares.

- Flexibility: ETFs offer investors the flexibility to invest in a wide range of asset classes and sectors. There are ETFs available for various investment strategies, including equity ETFs, bond ETFs, sector ETFs, and international ETFs. This flexibility allows investors to tailor their portfolios to their specific investment goals and preferences.

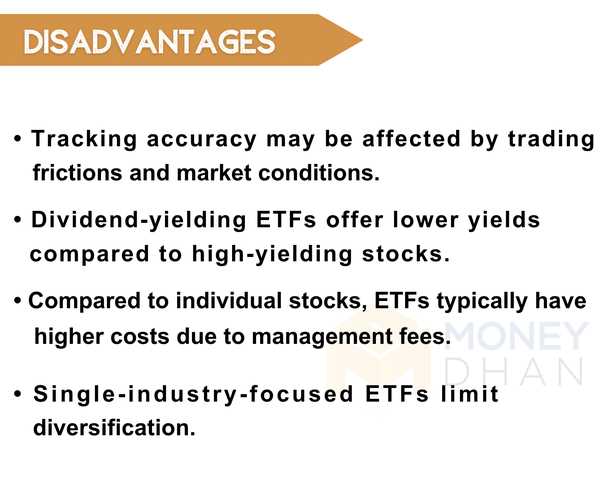

Cons of ETFs

While exchange-traded funds (ETFs) offer several benefits and advantages, they also come with some drawbacks and risks that investors should be aware of.

1. Lack of Active Management

One of the main cons of ETFs is that they are passively managed, meaning they aim to replicate the performance of a specific index or asset class rather than actively selecting individual securities. This can limit the potential for outperformance compared to actively managed funds.

2. Tracking Error

ETFs are designed to track the performance of an underlying index, but they may not perfectly replicate the index due to tracking error. This can result in the ETF’s returns deviating from the index’s returns, which can impact investor returns.

3. Liquidity and Trading Risks

While ETFs are traded on stock exchanges like individual stocks, their liquidity can vary depending on the underlying assets and market conditions. This can lead to wider bid-ask spreads and potential difficulty in buying or selling shares at desired prices, especially for less liquid ETFs.

4. Concentration Risk

Some ETFs may be heavily concentrated in a particular sector, industry, or country. This concentration can increase the risk of losses if that sector, industry, or country experiences negative performance or economic downturns.

5. Tax Considerations

ETFs can have tax implications for investors, especially if they are structured as “non-qualified” or “actively managed” funds. Investors may be subject to capital gains taxes when the ETF sells securities within its portfolio, even if the investor did not sell their shares.

6. Overlapping Holdings

Investors who hold multiple ETFs may find that there is overlap in the underlying holdings of these funds. This can result in unintended concentration or duplication of positions, which may not align with the investor’s desired diversification strategy.

Despite these cons, ETFs continue to be popular investment vehicles due to their low costs, diversification benefits, and ease of trading. However, investors should carefully consider their investment objectives, risk tolerance, and time horizon before investing in ETFs.

Cons of ETFs: Drawbacks and Risks

While exchange-traded funds (ETFs) offer several advantages, they also come with certain drawbacks and risks that investors should be aware of.

1. Lack of Flexibility

One of the main drawbacks of ETFs is their lack of flexibility compared to individual stocks. ETFs are designed to track a specific index or sector, which means that investors have limited control over the underlying assets in the fund. This lack of flexibility can be a disadvantage for investors who prefer to have more control over their investments.

2. Tracking Error

Another potential drawback of ETFs is tracking error. While ETFs are designed to closely track the performance of their underlying index, there can be small discrepancies between the ETF’s performance and the index it is supposed to track. This can be due to factors such as fees, trading costs, and the timing of rebalancing. Investors should carefully consider the tracking error of an ETF before investing.

3. Liquidity Risks

ETFs are traded on exchanges, which means that their liquidity can be affected by market conditions. In times of market stress or volatility, the liquidity of certain ETFs may decrease, making it more difficult to buy or sell shares at a fair price. This liquidity risk can be a concern for investors who need to access their funds quickly.

4. Concentration Risk

Some ETFs are designed to track specific sectors or industries, which can lead to concentration risk. If an investor holds a significant portion of their portfolio in a single sector ETF, they are exposed to the performance and risks of that sector. This concentration risk can be mitigated by diversifying across different sectors or asset classes.

5. Counterparty Risk

ETFs use derivatives and other financial instruments to track their underlying index. This introduces counterparty risk, which is the risk that the counterparty to the derivative contract may default on their obligations. While this risk is generally low, it is still a factor that investors should consider when investing in ETFs.

Overall, while ETFs offer many benefits, investors should carefully consider the drawbacks and risks associated with these investments. It is important to thoroughly research and understand the specific ETF before making any investment decisions.

Why Consider ETFs as Alternative Investments?

Exchange-Traded Funds (ETFs) have gained significant popularity as alternative investments in recent years. There are several reasons why investors should consider including ETFs in their investment portfolios.

Diversification

One of the key advantages of ETFs is their ability to provide diversification. ETFs typically hold a basket of different securities, such as stocks, bonds, or commodities, which allows investors to gain exposure to a wide range of assets without having to buy each individual security separately. This diversification can help reduce the risk associated with investing in a single security or asset class.

Liquidity

ETFs are traded on stock exchanges, which means they can be bought and sold throughout the trading day at market prices. This liquidity makes it easy for investors to enter or exit positions quickly, providing flexibility and allowing for efficient portfolio management.

Additionally, the liquidity of ETFs is supported by the creation and redemption process. Authorized participants, typically large financial institutions, can create or redeem ETF shares in large blocks, ensuring that the supply of ETF shares remains in line with investor demand.

Lower Costs

Compared to mutual funds, ETFs generally have lower expense ratios. This is because ETFs are passively managed and aim to replicate the performance of an underlying index, rather than actively selecting and managing individual securities. The lower costs associated with ETFs can result in higher net returns for investors over the long term.

Transparency

ETFs provide transparency in terms of their holdings. The underlying securities of an ETF are disclosed daily, allowing investors to know exactly what they own. This transparency can help investors make informed decisions and better understand the risks and potential returns associated with their investments.

Tax Efficiency

ETFs are structured in a way that can provide tax advantages to investors. Due to the creation and redemption process, ETFs can minimize capital gains distributions, which can result in lower tax liabilities for investors. Additionally, investors have the ability to control the timing of capital gains recognition by buying or selling ETF shares.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.