Fund: Definition, How It Works, Types and Ways to Invest

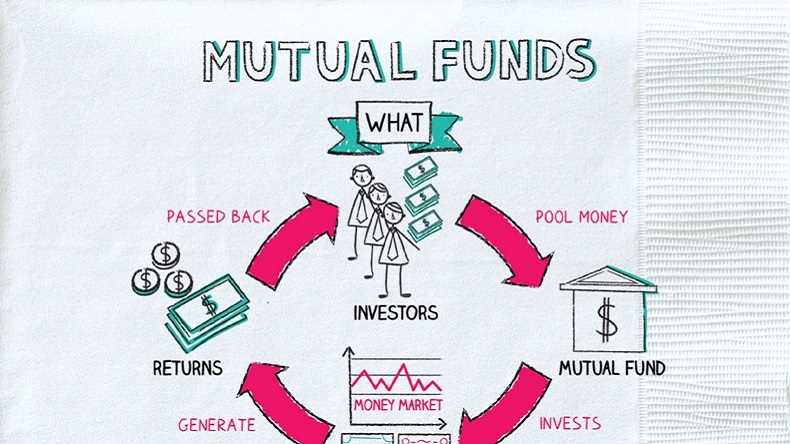

A fund is a financial vehicle that pools money from multiple investors to invest in various assets. It is managed by a professional investment manager or a team of managers who make decisions about how to allocate the funds. Funds can be structured in different ways and can invest in different types of assets, such as stocks, bonds, real estate, or commodities.

The main purpose of a fund is to provide diversification and professional management to individual investors who may not have the time, knowledge, or resources to invest directly in the financial markets. By pooling their money together, investors can access a larger pool of assets and benefit from economies of scale.

There are different types of funds available to investors, including mutual funds, exchange-traded funds (ETFs), hedge funds, and private equity funds. Each type has its own characteristics and investment strategies. Mutual funds, for example, are open-ended investment vehicles that allow investors to buy or sell shares at the net asset value (NAV) of the fund. ETFs, on the other hand, are traded on stock exchanges and can be bought or sold throughout the trading day.

Investors can choose to invest in funds based on their investment goals, risk tolerance, and time horizon. Some funds may focus on specific sectors or industries, while others may have a broader investment mandate. It is important for investors to carefully consider their investment objectives and do thorough research before investing in a fund.

There are several ways to invest in funds. Investors can buy shares of a fund directly from the fund company or through a broker. They can also invest in funds through employer-sponsored retirement plans, such as 401(k) plans, or through individual retirement accounts (IRAs). Additionally, some funds offer automatic investment plans, where investors can contribute a fixed amount of money on a regular basis.

What is a Fund?

A fund is a financial vehicle that pools together money from multiple investors to invest in a variety of assets, such as stocks, bonds, real estate, or commodities. It is managed by a professional fund manager who makes investment decisions on behalf of the investors.

Funds are commonly used by individuals, institutions, and companies to diversify their investments and achieve specific financial goals. They offer investors the opportunity to access a diversified portfolio of assets that they may not be able to invest in individually.

Funds can be classified into different types based on their investment strategies, asset classes, and investment objectives. Some common types of funds include mutual funds, exchange-traded funds (ETFs), hedge funds, and index funds.

Investing in a fund provides several advantages. Firstly, it allows investors to benefit from professional management and expertise. Fund managers have the knowledge and experience to analyze market trends, select suitable investments, and actively manage the fund’s portfolio to maximize returns.

Secondly, funds offer diversification. By pooling together money from multiple investors, funds can invest in a wide range of assets, spreading the risk across different sectors and industries. This helps to reduce the impact of any individual investment’s performance on the overall fund.

Furthermore, funds provide liquidity. Investors can buy or sell their shares in a fund at any time, allowing them to access their money quickly and easily. This is particularly beneficial compared to investing directly in individual assets, which may have limited liquidity.

How Does a Fund Work?

A fund is a type of investment vehicle that pools money from multiple investors to invest in various financial assets, such as stocks, bonds, or real estate. The fund is managed by a professional fund manager or a team of managers who make investment decisions on behalf of the investors.

When an investor invests in a fund, they purchase shares or units of the fund, which represent their ownership in the fund. The value of these shares or units is determined by the performance of the underlying assets held by the fund.

The fund manager is responsible for selecting and buying the assets that make up the fund’s portfolio. They aim to generate returns for the investors by investing in assets that are expected to increase in value over time or generate income, such as dividends or interest payments.

One of the key advantages of investing in a fund is diversification. By pooling money from multiple investors, a fund can invest in a wide range of assets, reducing the risk associated with investing in a single asset. This diversification helps to spread the risk and potentially increase the overall return of the fund.

Types of Funds

There are various types of funds available to investors, each with its own investment strategy and objective. Some common types of funds include:

- Equity Funds: These funds invest primarily in stocks or shares of companies. They aim to provide long-term capital appreciation by investing in companies with growth potential.

- Bond Funds: These funds invest in fixed-income securities, such as government bonds or corporate bonds. They aim to generate income for investors through regular interest payments.

- Real Estate Funds: These funds invest in properties or real estate investment trusts (REITs). They aim to generate income through rental payments or capital appreciation.

- Money Market Funds: These funds invest in short-term, low-risk securities, such as Treasury bills or commercial paper. They aim to provide stability and liquidity.

Ways to Invest in Funds

There are several ways to invest in funds:

- Directly: Investors can directly invest in funds by purchasing shares or units through a fund management company or an online investment platform.

- Through a Broker: Investors can also invest in funds through a brokerage firm, which acts as an intermediary between the investor and the fund.

- Through an Employer: Some employers offer retirement plans, such as 401(k) plans, that allow employees to invest in funds.

- Through a Financial Advisor: Investors can seek the assistance of a financial advisor who can help them choose suitable funds based on their investment goals and risk tolerance.

Before investing in a fund, it is important to carefully review the fund’s prospectus, which provides detailed information about the fund’s investment objective, strategy, fees, and risks. It is also advisable to consider one’s investment goals, risk tolerance, and time horizon before making any investment decisions.

| Advantages of Investing in Funds | Disadvantages of Investing in Funds |

|---|---|

|

|

Overall, funds can be a convenient and effective way for investors to gain exposure to a diversified portfolio of assets and achieve their investment goals. However, it is important to carefully consider the risks and potential rewards before investing in any fund.

Types of Funds and Ways to Invest

There are various types of funds available for investors to choose from, each with its own investment strategy and risk profile. Here are some of the most common types of funds:

| Type of Fund | Description |

|---|---|

| 1. Mutual Funds | These funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. |

| 2. Exchange-Traded Funds (ETFs) | Similar to mutual funds, ETFs also pool money from multiple investors. However, they are traded on stock exchanges like individual stocks. |

| 3. Index Funds | |

| 4. Hedge Funds | Hedge funds are typically only available to accredited investors and employ more complex investment strategies, such as short selling and derivatives. |

| 5. Bond Funds | Bond funds invest in a portfolio of bonds issued by governments, municipalities, or corporations. They provide income through regular interest payments. |

| 6. Money Market Funds | Money market funds invest in short-term, low-risk securities, such as Treasury bills and commercial paper. They aim to preserve capital and provide liquidity. |

- Directly through a fund provider: Many fund companies allow investors to buy their funds directly through their websites or by contacting their customer service.

- Through a brokerage account: Investors can also buy funds through online brokerage accounts, which offer a wide range of fund options from different providers.

- Through employer-sponsored retirement plans: Many employers offer retirement plans, such as 401(k)s, that allow employees to invest in a selection of funds.

- Through financial advisors: Investors can seek the guidance of a financial advisor who can help them choose suitable funds based on their investment goals and risk tolerance.

Before investing in any fund, it is important to carefully review its prospectus, which provides detailed information about the fund’s investment objectives, strategies, fees, and risks. Additionally, investors should consider their own financial goals, time horizon, and risk tolerance before making any investment decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.