What is a Qualifying Investment?

A qualifying investment refers to an investment that meets certain criteria set by a specific program or institution. These criteria are typically designed to encourage investment in certain areas or industries, and in return, investors may receive certain benefits or incentives.

The definition of a qualifying investment can vary depending on the program or institution. It is important to understand the specific criteria and requirements to ensure that an investment qualifies for the desired benefits.

Qualifying investments are often important for individuals who are planning for retirement. These investments can help individuals build wealth and secure their financial future. By investing in qualifying assets, individuals may be able to take advantage of tax benefits, capital gains, or other incentives.

The Process of Qualifying Investment

The process of qualifying investment typically involves several steps. First, individuals need to identify the specific program or institution they want to invest in. This could be a government-sponsored retirement plan, a private investment fund, or a specific industry or sector.

Once the program or institution is identified, individuals need to review the eligibility criteria and requirements. This may include minimum investment amounts, specific asset classes, or other qualifications. It is important to carefully review these criteria to ensure that the investment meets the necessary requirements.

After reviewing the criteria, individuals can then proceed with the investment process. This may involve completing paperwork, transferring funds, or working with a financial advisor or institution. It is important to follow the necessary steps and provide any required documentation to ensure that the investment qualifies.

Examples of Qualifying Investments

There are various types of qualifying investments that individuals can consider. Some common examples include:

- Real Estate: Investing in residential or commercial properties can be a qualifying investment, especially in certain designated areas or development projects.

- Stocks: Investing in stocks of specific companies or industries may qualify for certain benefits or incentives.

- Government Bonds: Purchasing government bonds can be a qualifying investment, especially if they are issued for specific purposes such as infrastructure development or renewable energy projects.

- Small Business Investments: Investing in small businesses or startups can be a qualifying investment, especially if it contributes to job creation or economic growth.

These are just a few examples, and the specific qualifying investments may vary depending on the program or institution.

Benefits of Qualifying Investments

Qualifying investments can offer various benefits to investors. These benefits may include:

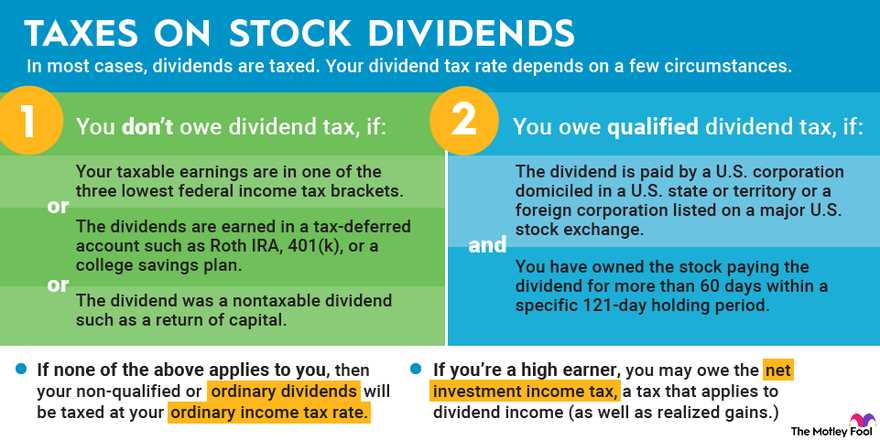

- Tax advantages: Qualifying investments may offer tax deductions, credits, or deferrals, which can help individuals reduce their overall tax liability.

- Capital gains: Some qualifying investments may offer the potential for capital gains, allowing investors to earn a profit when they sell their investment.

- Incentives: Certain programs or institutions may offer additional incentives or rewards for qualifying investments, such as matching contributions or bonus payments.

- Long-term growth: Qualifying investments can help individuals build long-term wealth and secure their financial future, especially when combined with a comprehensive retirement plan.

A qualifying investment refers to an investment that meets specific criteria set by a government or regulatory body in order to qualify for certain benefits or privileges. These benefits can include tax incentives, residency or citizenship rights, or eligibility for certain programs.

The definition of a qualifying investment can vary depending on the country or jurisdiction. In some cases, it may include investments in specific industries or sectors, such as real estate, technology, or renewable energy. In other cases, it may require a certain minimum investment amount or a specific investment vehicle, such as a government-approved fund or program.

The importance of qualifying investments lies in the opportunities they provide for individuals and businesses. By meeting the criteria set by the government or regulatory body, investors can gain access to a range of benefits that can enhance their financial position or provide them with new opportunities.

For individuals, qualifying investments can offer a pathway to residency or citizenship in a foreign country, which can provide them with greater freedom of movement, access to better healthcare and education systems, and increased political and economic stability. These investments can also provide tax advantages, such as reduced or deferred tax liabilities, which can help individuals preserve and grow their wealth.

For businesses, qualifying investments can offer access to new markets, resources, and talent. By investing in a specific industry or sector, businesses can gain a competitive advantage and position themselves for growth and expansion. These investments can also provide access to government incentives or grants, which can help businesses reduce costs and increase profitability.

The Process of Qualifying Investment

1. Research and Identify Potential Investments

The first step in the process is to research and identify potential qualifying investments. This can include various options such as real estate, stocks, bonds, mutual funds, or business ventures. It is essential to consider your financial goals, risk tolerance, and investment timeline when selecting the right investment for you.

2. Evaluate the Eligibility Criteria

Once you have identified potential investments, it is crucial to evaluate the eligibility criteria for each investment option. Different investments may have specific requirements, such as a minimum investment amount, a certain level of income or net worth, or specific qualifications for investors. Make sure to thoroughly review and understand these criteria to determine if you meet the requirements.

3. Consult with Financial Advisors

Before making any investment decisions, it is advisable to consult with financial advisors who specialize in qualifying investments. They can provide valuable insights and guidance based on your individual financial situation and goals. Financial advisors can help you understand the risks and potential returns associated with different investment options and assist you in making informed decisions.

4. Complete the Necessary Paperwork

Once you have selected an investment and confirmed your eligibility, the next step is to complete the necessary paperwork. This may include filling out application forms, providing supporting documents, and complying with any legal or regulatory requirements. It is important to carefully review and accurately complete all paperwork to avoid any delays or complications in the investment process.

5. Fund Your Investment

After completing the paperwork, you will need to fund your investment. This typically involves transferring the required funds to the designated investment account or entity. Depending on the investment option, you may have the flexibility to choose between a lump sum payment or periodic contributions. It is essential to ensure that you have the necessary funds available and follow the designated funding process.

6. Monitor and Manage Your Investment

Once your investment is funded, it is important to regularly monitor and manage your investment. Stay informed about market trends, economic conditions, and any changes that may impact your investment. Consider working with a financial advisor to develop a comprehensive investment strategy and make any necessary adjustments to optimize your returns.

By following these steps, you can navigate the process of qualifying investment successfully. Remember to stay informed, seek professional advice, and make informed decisions based on your financial goals and risk tolerance. Qualifying investments can provide significant benefits and help you achieve your long-term financial objectives.

Step-by-Step Guide to Becoming Eligible for a Qualifying Investment

Investing in a qualifying investment can be a great way to secure your financial future and potentially benefit from tax advantages. However, before you can start reaping the rewards, you need to go through a step-by-step process to become eligible for a qualifying investment. Here’s a guide to help you navigate the process:

| Step 1: Understand the Requirements | |

| Step 2: Determine Your Eligibility | Check if you meet the eligibility criteria set by the investment program. This may include factors such as your age, income level, and net worth. It’s crucial to ensure that you qualify before proceeding further. |

| Step 3: Research Investment Options | Explore the different investment options available to you. This could include real estate, stocks, bonds, or other eligible assets. Consider factors such as risk tolerance, potential returns, and liquidity when making your decision. |

| Step 4: Seek Professional Advice | Consult with a financial advisor or tax professional who specializes in qualifying investments. They can provide valuable insights and guidance tailored to your specific financial situation. |

| Step 5: Complete the Application | Once you have chosen your qualifying investment and gathered all the necessary documentation, complete the application process. This may involve submitting forms, providing financial statements, and undergoing background checks. |

| Step 6: Wait for Approval | After submitting your application, you will need to wait for approval from the relevant authorities. The processing time can vary depending on the investment program and the volume of applications they receive. |

| Step 7: Fund Your Investment | Once your application is approved, you will need to fund your qualifying investment. This may involve transferring funds from your bank account or liquidating other assets. |

| Step 8: Monitor and Manage Your Investment |

By following this step-by-step guide, you can navigate the process of becoming eligible for a qualifying investment with confidence. Remember to do thorough research, seek professional advice, and carefully consider your financial goals before making any investment decisions.

Examples of Qualifying Investments

- Real Estate: Investing in properties such as residential homes, commercial buildings, or land can be considered a qualifying investment. Rental properties or properties held for appreciation can also qualify.

- Stocks and Bonds: Investing in publicly traded stocks or bonds can be a qualifying investment. This includes investments in individual stocks, mutual funds, or exchange-traded funds (ETFs).

- Retirement Accounts: Contributions to retirement accounts such as Individual Retirement Accounts (IRAs) or 401(k) plans can be considered qualifying investments. These accounts are designed to provide income during retirement.

- Government Securities: Investing in government-issued securities such as Treasury bonds or Treasury bills can be a qualifying investment. These investments are considered safe and low-risk.

- Commodities: Investing in commodities such as gold, silver, oil, or agricultural products can be considered a qualifying investment. These investments can provide diversification and potential for growth.

Examples of Qualifying Investments

2. Stocks and Bonds: Investing in stocks and bonds can also be considered qualifying investments. Stocks represent ownership in a company, while bonds are a form of debt issued by a company or government. Both can provide income through dividends or interest payments.

3. Mutual Funds: Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Investing in mutual funds can be a qualifying investment as it provides the opportunity for growth and income.

5. Retirement Accounts: Contributing to retirement accounts, such as 401(k) plans or Individual Retirement Accounts (IRAs), can also be considered qualifying investments. These accounts offer tax advantages and the opportunity to grow your savings over time.

6. Business Ventures: Starting or investing in a business can be considered a qualifying investment. This can include purchasing a franchise, starting a new business from scratch, or investing in an existing business.

7. Precious Metals: Investing in precious metals, such as gold, silver, or platinum, can be considered a qualifying investment. These metals have intrinsic value and can act as a hedge against inflation and economic uncertainty.

Benefits of Qualifying Investments

Qualifying investments offer a range of benefits for individuals planning for retirement. These investments are specifically designed to help individuals grow their wealth and secure their financial future. Here are some key benefits of qualifying investments:

1. Tax Advantages

One of the major benefits of qualifying investments is the potential for tax advantages. Many qualifying investments, such as retirement accounts like IRAs and 401(k)s, offer tax-deferred growth. This means that individuals can contribute pre-tax dollars to these accounts, allowing their investments to grow tax-free until they are withdrawn during retirement. This can result in significant tax savings over time.

2. Diversification

Qualifying investments provide individuals with the opportunity to diversify their investment portfolio. Diversification is important because it helps to spread risk and reduce the impact of market fluctuations. By investing in a variety of assets, such as stocks, bonds, real estate, and mutual funds, individuals can minimize the risk associated with any single investment and increase their chances of achieving long-term financial success.

3. Potential for Growth

Another benefit of qualifying investments is the potential for growth. These investments are typically designed to generate returns over the long term, allowing individuals to accumulate wealth and achieve their financial goals. Whether it’s through the appreciation of real estate, the dividends from stocks, or the interest from bonds, qualifying investments have the potential to provide individuals with a steady income stream and help them build a substantial nest egg for retirement.

4. Retirement Security

5. Access to Professional Guidance

Many qualifying investments offer individuals access to professional guidance and advice. Whether it’s through a financial advisor, a retirement planner, or an investment firm, individuals can benefit from the expertise and knowledge of professionals who specialize in retirement planning. These professionals can help individuals make informed investment decisions, navigate complex financial markets, and optimize their investment strategies to achieve their retirement goals.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.