What is the Government Securities Clearing Corporation (GSCC)?

The Government Securities Clearing Corporation (GSCC) is a financial institution that plays a crucial role in the government and policy sector. It is responsible for providing clearing and settlement services for government securities transactions.

The GSCC acts as an intermediary between buyers and sellers of government securities, ensuring the smooth and efficient settlement of transactions. It operates a centralized clearinghouse where trades are matched, netted, and settled. This helps to reduce counterparty risk and promote market stability.

In addition to clearing and settlement services, the GSCC also provides risk management services. It calculates and collects margin requirements from its members to ensure that they have sufficient collateral to cover their obligations. It also monitors market participants for compliance with regulatory requirements and takes appropriate action in case of non-compliance.

The GSCC operates under a regulatory framework established by the government and relevant regulatory authorities. It is subject to oversight and supervision to ensure the safety and integrity of the government securities market.

Overview of the GSCC

The Government Securities Clearing Corporation (GSCC) is a vital institution in the financial market that plays a crucial role in the clearing and settlement of government securities transactions. It acts as a central counterparty, ensuring the smooth functioning of the government and policy sector.

The GSCC provides a secure and efficient platform for market participants to trade government securities, such as treasury bonds and treasury bills. It acts as an intermediary between buyers and sellers, guaranteeing the completion of transactions and mitigating counterparty risk.

Clearing and Settlement Process

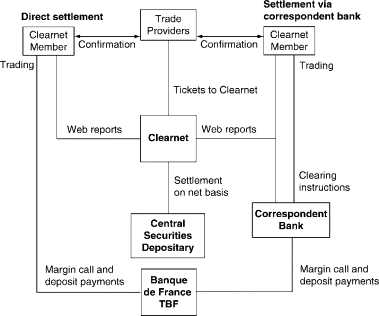

The GSCC operates a robust clearing and settlement process that ensures the timely and accurate transfer of securities and funds between market participants. When a trade is executed, the GSCC steps in to become the buyer to every seller and the seller to every buyer, effectively eliminating the need for multiple bilateral transactions.

Once a trade is matched, the GSCC verifies the availability of securities and funds, ensuring that both parties can fulfill their obligations. It then facilitates the transfer of securities from the seller’s account to the buyer’s account and the transfer of funds from the buyer’s account to the seller’s account. This process guarantees the finality and irrevocability of transactions, reducing settlement risk.

Risk Management

The GSCC operates a comprehensive risk management framework to safeguard the integrity of the government securities market. It employs sophisticated risk models and monitoring systems to identify and manage various types of risks, including credit risk, liquidity risk, and operational risk.

Market participants are required to meet certain membership criteria and maintain sufficient collateral with the GSCC to mitigate potential losses. The GSCC also imposes margin requirements, which serve as a buffer against adverse market movements. These risk management measures ensure the stability and resilience of the government securities market.

Transparency and Reporting

The GSCC promotes transparency in the government securities market by providing market participants with access to comprehensive trade data and reports. It publishes daily trade volumes, prices, and other relevant information, allowing participants to make informed decisions and assess market trends.

Additionally, the GSCC complies with regulatory reporting requirements, submitting timely and accurate reports to relevant authorities. This transparency and reporting framework enhance market integrity and facilitate effective oversight of the government securities market.

Conclusion

The Government Securities Clearing Corporation (GSCC) plays a vital role in the government and policy sector by providing a secure and efficient platform for the clearing and settlement of government securities transactions. Its robust clearing and settlement process, comprehensive risk management framework, and commitment to transparency contribute to the stability and integrity of the government securities market.

Role of the GSCC in the Government & Policy Sector

The Government Securities Clearing Corporation (GSCC) plays a crucial role in the government and policy sector by providing clearing and settlement services for government securities. As a central counterparty, the GSCC acts as an intermediary between buyers and sellers, ensuring the smooth and efficient transfer of ownership of government securities.

One of the main responsibilities of the GSCC is to mitigate counterparty risk. By acting as a central counterparty, the GSCC becomes the buyer to every seller and the seller to every buyer, effectively guaranteeing the performance of each trade. This reduces the risk of default and enhances market stability.

The GSCC also provides netting services, which allow market participants to consolidate their trades and settle them on a net basis. This means that instead of settling each individual trade separately, the GSCC calculates the net obligations of each participant and facilitates the settlement of the resulting amounts. Netting reduces the number of transactions and the associated costs, making the market more efficient.

In addition, the GSCC plays a crucial role in ensuring the integrity of the government securities market. It establishes and enforces rules and regulations that govern the trading and settlement of government securities. These rules help maintain fair and orderly markets, protect investors, and promote transparency.

Furthermore, the GSCC provides risk management services to market participants. It offers various risk mitigation tools, such as margin requirements and collateral management, to help participants manage their exposure to market and credit risks. By providing these services, the GSCC promotes the safety and soundness of the government securities market.

Overall, the GSCC’s role in the government and policy sector is essential for the smooth functioning of the market. It ensures the efficient clearing and settlement of government securities, mitigates counterparty risk, promotes market integrity, and provides risk management services. By performing these functions, the GSCC contributes to the stability and development of the government securities market.

Benefits of the GSCC for Market Participants

Market participants in the government securities sector can greatly benefit from the services provided by the Government Securities Clearing Corporation (GSCC). The GSCC plays a crucial role in ensuring the smooth functioning of the market and provides several advantages for its participants.

1. Risk Reduction

One of the key benefits of the GSCC is the reduction of counterparty risk. By acting as a central counterparty, the GSCC becomes the buyer to every seller and the seller to every buyer, effectively guaranteeing the settlement of trades. This eliminates the risk of default by any individual participant, increasing overall market stability.

2. Operational Efficiency

The GSCC streamlines the settlement process for government securities, improving operational efficiency for market participants. By providing a centralized platform for trade matching, confirmation, and settlement, the GSCC eliminates the need for participants to individually communicate and reconcile trades. This reduces operational costs and minimizes the potential for errors or discrepancies.

3. Liquidity Enhancement

Through its role as a central counterparty, the GSCC enhances liquidity in the government securities market. By guaranteeing settlement, the GSCC reduces the need for participants to hold excess capital as a buffer against potential default. This frees up capital that can be used for other investment opportunities, thereby increasing overall market liquidity.

4. Risk Management Tools

The GSCC offers market participants various risk management tools to mitigate their exposure to market risks. These tools include margin requirements, collateral management, and netting arrangements. By utilizing these tools, participants can better manage their risk profiles and protect themselves against adverse market movements.

5. Transparency and Reporting

The GSCC provides market participants with access to transparent and reliable trade data. Participants can access detailed information on trade volumes, prices, and settlement statistics, which facilitates better decision-making and market analysis. The GSCC also ensures accurate and timely reporting of trade data to regulatory authorities, promoting market integrity and regulatory compliance.

| Benefits | Explanation |

|---|---|

| Risk Reduction | By acting as a central counterparty, the GSCC guarantees settlement, reducing counterparty risk. |

| Operational Efficiency | The GSCC streamlines the settlement process, eliminating the need for individual trade communication and reconciliation. |

| Liquidity Enhancement | The GSCC frees up capital by guaranteeing settlement, increasing overall market liquidity. |

| Risk Management Tools | The GSCC offers various risk management tools, such as margin requirements and netting arrangements, to help participants mitigate market risks. |

| Transparency and Reporting | The GSCC provides access to transparent trade data and ensures accurate reporting to regulatory authorities. |

Regulatory Framework for the GSCC

The Government Securities Clearing Corporation (GSCC) operates within a comprehensive regulatory framework that ensures transparency, efficiency, and stability in the government and policy sector. The regulatory framework for the GSCC consists of various laws, regulations, and guidelines that govern its operations and ensure the smooth functioning of the market.

One of the key regulatory bodies overseeing the GSCC is the Securities and Exchange Commission (SEC). The SEC is responsible for enforcing securities laws and regulations, including those that apply to the GSCC. It ensures that the GSCC operates in compliance with these laws and regulations, protecting the interests of market participants and maintaining the integrity of the market.

The regulatory framework for the GSCC includes rules and regulations related to risk management, capital adequacy, and operational standards. These rules are designed to mitigate risks, promote financial stability, and protect market participants from potential losses.

The GSCC is required to maintain robust risk management practices to identify, measure, and manage risks associated with its operations. It must also maintain sufficient capital to absorb potential losses and ensure the continuity of its operations. These requirements help to safeguard the financial system and maintain confidence in the government securities market.

Furthermore, the GSCC is subject to operational standards that govern its day-to-day operations. These standards cover areas such as trade processing, settlement, and reporting. By adhering to these standards, the GSCC ensures the smooth functioning of the market and minimizes operational risks.

Overall, the regulatory framework for the GSCC plays a vital role in maintaining the integrity and stability of the government securities market. It ensures that the GSCC operates in a transparent and efficient manner, protecting the interests of market participants and contributing to the overall stability of the financial system.

Future Outlook for the GSCC

One of the key areas of focus for the GSCC in the future is technology. The corporation recognizes the importance of staying up-to-date with the latest advancements in technology to enhance its operations and provide better services to market participants. This includes exploring the use of blockchain technology and other innovative solutions to streamline processes and improve transparency.

The GSCC also recognizes the importance of international cooperation and collaboration. As financial markets become increasingly interconnected, it is crucial for the GSCC to work closely with international counterparts to harmonize regulations and standards. This will not only facilitate cross-border transactions but also promote the stability and efficiency of the global government securities market.

In summary

The future outlook for the Government Securities Clearing Corporation is bright. With a focus on technology, regulatory enhancements, and international cooperation, the GSCC is well-positioned to adapt to the changing needs of the government and policy sector. By continuing to provide efficient clearing and settlement services, the GSCC will play a vital role in maintaining the integrity and stability of the government securities market.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.