What are Investment Vehicles?

Investment vehicles are financial instruments or assets that individuals or organizations use to invest their money and potentially earn a return. These vehicles can range from traditional options like stocks and bonds to alternative investments like real estate or commodities.

Investment vehicles serve as a means for individuals to allocate their funds and participate in various markets. They offer different levels of risk and return, allowing investors to choose options that align with their financial goals and risk tolerance.

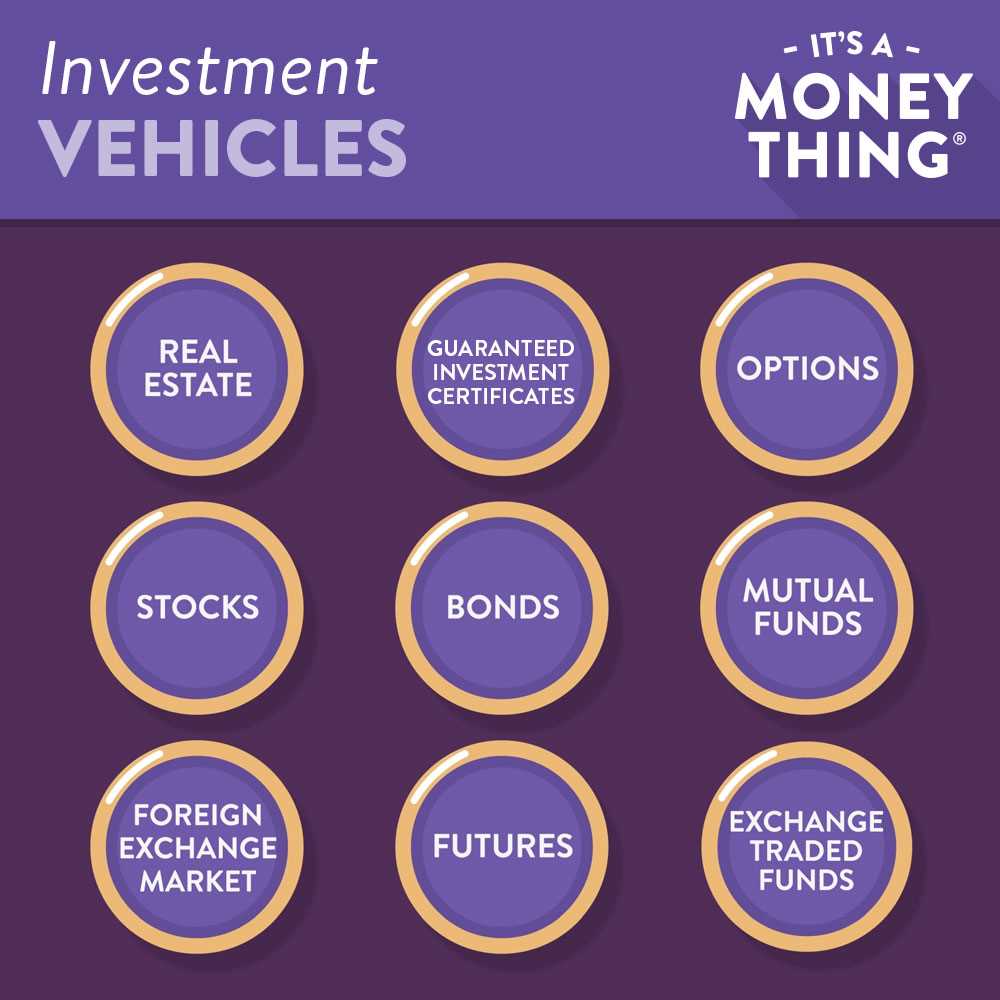

Some common types of investment vehicles include:

1. Stocks: Stocks represent ownership in a company and provide investors with a share of its profits and losses. They can be bought and sold on stock exchanges.

2. Bonds: Bonds are debt securities issued by governments or corporations to raise capital. Investors who purchase bonds are essentially lending money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity.

3. Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They are managed by professional fund managers.

4. Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer diversification and can track specific indexes or sectors.

5. Real Estate Investment Trusts (REITs): REITs are companies that own, operate, or finance income-generating real estate properties. Investors can buy shares of REITs on stock exchanges.

6. Commodities: Commodities include physical goods like gold, oil, or agricultural products. Investors can trade commodities directly or invest in commodity futures contracts.

7. Options: Options give investors the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific timeframe. They can be used for hedging or speculation.

Explanation and Types of Investment Vehicles

1. Stocks: Stocks represent ownership in a company and are bought and sold on stock exchanges. They offer the potential for high returns but also come with a higher level of risk.

2. Bonds: Bonds are debt instruments issued by governments, municipalities, or corporations to raise capital. They pay interest over a fixed period and are considered less risky than stocks.

3. Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They are managed by professional fund managers and offer diversification and professional expertise.

4. Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer diversification and can be bought and sold throughout the trading day.

5. Real Estate Investment Trusts (REITs): REITs allow investors to invest in real estate without directly owning properties. They generate income through rental properties or real estate-related assets.

6. Options: Options are financial derivatives that give investors the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time frame.

7. Commodities: Commodities include physical goods like gold, oil, or agricultural products. Investors can invest in commodities through futures contracts or exchange-traded funds.

8. Cryptocurrencies: Cryptocurrencies like Bitcoin or Ethereum are digital assets that use cryptography for security. They offer the potential for high returns but also come with a higher level of volatility.

9. Certificates of Deposit (CDs): CDs are time deposits offered by banks with a fixed interest rate and maturity date. They are considered low-risk investments.

10. Money Market Funds: Money market funds invest in short-term debt securities like Treasury bills or commercial paper. They aim to provide stability and liquidity.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.