What are Bat Stocks?

Investing in Bat Stocks can provide investors with the opportunity to participate in the growth of the technology sector and potentially earn substantial returns. However, it is important to note that investing in any stock carries risks, and investors should carefully consider their investment goals and risk tolerance before making any investment decisions.

Why Invest in Bat Stocks?

Investing in Bat Stocks can be a lucrative opportunity for investors looking to diversify their portfolio and potentially earn high returns. Bat Stocks, which stands for “Big Tech Stocks,” refer to stocks of large technology companies such as Facebook, Apple, Amazon, and Tesla.

There are several reasons why investing in Bat Stocks can be beneficial:

1. Growth Potential

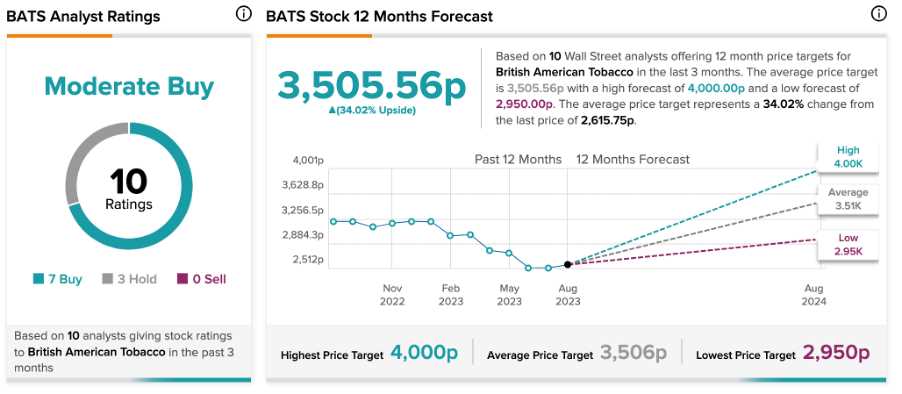

Bat Stocks have shown significant growth potential over the years. These companies are at the forefront of technological advancements and have a track record of innovation. As technology continues to play a crucial role in our daily lives, the demand for their products and services is expected to increase, leading to potential growth in their stock prices.

2. Market Dominance

Many Bat Stocks have established themselves as market leaders in their respective industries. They have a strong competitive advantage, brand recognition, and a large customer base. This market dominance provides them with a solid foundation for future growth and profitability.

3. Diversification

Investing in Bat Stocks allows investors to diversify their portfolio. These stocks often have low correlation with other sectors, such as finance or energy, which can help reduce overall portfolio risk. By including Bat Stocks in their investment strategy, investors can potentially benefit from the growth of the technology sector while spreading their risk across different industries.

4. Dividends and Share Buybacks

Many Bat Stocks not only offer potential capital appreciation but also provide dividends and engage in share buybacks. Dividends are regular payments made to shareholders, providing them with a steady income stream. Share buybacks, on the other hand, reduce the number of outstanding shares, increasing the value of each remaining share.

5. Access to Innovative Technologies

Investing in Bat Stocks allows individuals to be part of the technological revolution. These companies are at the forefront of developing innovative technologies that have the potential to transform various industries. By investing in Bat Stocks, individuals can support and participate in the growth of these groundbreaking technologies.

What are Bat Stocks?

Examples of Bat Stocks include industry giants like Apple, Microsoft, and Amazon, as well as smaller, up-and-coming companies that have the potential for significant growth.

Why Invest in Bat Stocks?

Investing in Bat Stocks can offer several advantages. Firstly, the technology sector is known for its rapid growth and innovation, which can lead to substantial returns for investors. Additionally, technology companies often have a competitive advantage due to their intellectual property and strong brand recognition.

Furthermore, the increasing reliance on technology in various industries, such as healthcare, finance, and entertainment, creates a favorable market environment for Bat Stocks. As society becomes more digitally connected, the demand for technology products and services is expected to continue growing.

How do Bat Stocks Work?

Investors can make money from Bat Stocks through capital appreciation, which occurs when the stock price increases over time. Additionally, some companies may also pay dividends to their shareholders, providing a steady stream of income.

Key Factors to Consider

When investing in Bat Stocks, there are several key factors to consider:

- Company Performance: Evaluate the financial health and growth potential of the company. Look at factors such as revenue, earnings, and market share.

- Industry Trends: Stay informed about the latest trends and developments in the technology sector. This will help you identify companies that are well-positioned for future growth.

- Risk Management: Diversify your portfolio to reduce risk. Consider investing in different types of technology stocks, as well as other sectors.

By carefully considering these factors and staying informed, you can make more informed investment decisions and increase your chances of success in the Bat Stocks market.

How do Bat Stocks Work?

The Role of Technology

Technology plays a crucial role in the success of Bat Stocks. These companies rely on technological advancements to develop new products, improve existing ones, and stay ahead of the competition. The constant innovation in the technology sector creates opportunities for investors to profit from the growth of these companies.

For example, companies like Apple, Amazon, and Microsoft have revolutionized the way we live and work through their innovative products and services. Their stocks have experienced significant growth over the years, making them attractive investments for many.

Risk and Reward

Investing in Bat Stocks can be rewarding, but it also comes with risks. The technology sector is known for its volatility, and stock prices can fluctuate rapidly. It is important to carefully research and analyze the companies you are considering investing in to understand their potential risks and rewards.

It is also advisable to diversify your portfolio by investing in a variety of stocks from different sectors to mitigate risk.

Key Factors to Consider

When investing in Bat Stocks, there are several key factors that you should consider. These factors can help you make informed decisions and maximize your potential returns. Here are some important factors to keep in mind:

1. Company Fundamentals

Before investing in Bat Stocks, it’s essential to research and understand the fundamentals of the company. This includes analyzing its financial statements, such as revenue, earnings, and cash flow. Additionally, consider the company’s competitive position, management team, and growth prospects.

2. Market Trends

3. Risk Management

4. Long-Term Outlook

When investing in Bat Stocks, it’s crucial to have a long-term outlook. While short-term market fluctuations can be unpredictable, focusing on the long-term prospects of the company can help you make better investment decisions. Consider the company’s growth potential, competitive advantages, and ability to adapt to changing market conditions.

5. Valuation

Assessing the valuation of Bat Stocks is essential before making an investment. Look at key valuation metrics such as price-to-earnings ratio, price-to-sales ratio, and price-to-book ratio. Compare these metrics to industry peers and historical averages to determine if the stock is undervalued or overvalued.

By considering these key factors, you can make more informed investment decisions when investing in Bat Stocks. Remember to conduct thorough research, stay updated on market trends, and have a long-term perspective to maximize your potential returns.

Mechanics of Bat Stocks

Unlike traditional stocks, which can only be bought and sold, Bat Stocks provide traders with the opportunity to take advantage of market volatility. This means that even if the overall market is experiencing a downturn, traders can still make a profit by short selling or betting against the market.

Short Selling

Short selling is a key strategy used in Bat Stocks. It involves borrowing shares from a broker and selling them at the current market price. The trader then waits for the stock price to decline before buying back the shares at a lower price and returning them to the broker. The difference between the selling price and the buying price is the trader’s profit.

Short selling is a popular strategy among experienced traders because it allows them to profit from a declining market. However, it is important to note that short selling carries a higher level of risk compared to traditional buying and holding strategies.

Options Trading

Another important aspect of Bat Stocks is options trading. Options are financial derivatives that give traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time period.

Options trading can be used to hedge against potential losses or to speculate on the future direction of a stock. Traders can buy call options if they believe the stock price will rise, or buy put options if they expect the stock price to fall.

Table: Key Features of Bat Stocks

| Feature | Description |

|---|---|

| Profit from both rising and falling markets | Unlike traditional stocks, Bat Stocks allow traders to profit from market volatility. |

| Short selling | Traders can borrow shares and sell them at the current market price, profiting from a declining market. |

| Options trading | Options can be used to hedge against losses or speculate on the future direction of a stock. |

Trading Strategies

1. Trend Following

This strategy involves identifying and following the trend of Bat Stocks. Traders analyze historical price data and use technical indicators to determine the direction of the trend. They then enter trades in the direction of the trend, aiming to profit from the price movement.

2. Breakout Trading

In breakout trading, traders look for significant price movements or breakouts above resistance levels or below support levels. They enter trades when the price breaks out of these levels, expecting the price to continue moving in the same direction.

3. Swing Trading

Swing traders aim to capture short-term price swings within the overall trend of Bat Stocks. They enter trades when they believe the price is about to reverse or make a significant move in the opposite direction. Swing traders typically hold their positions for a few days to a few weeks.

4. Momentum Trading

Momentum traders focus on stocks that are experiencing significant price momentum. They look for stocks that are making new highs or lows and enter trades in the direction of the momentum. Momentum traders aim to profit from the continuation of the price trend.

5. Value Investing

Value investors look for Bat Stocks that are undervalued based on fundamental analysis. They analyze financial statements, earnings reports, and other factors to determine the intrinsic value of the stock. Value investors aim to buy stocks at a discount and hold them for the long term, expecting the price to eventually reflect the true value of the company.

| Pros | Cons |

|---|---|

| Can potentially generate significant profits | Requires time and effort for research and analysis |

| Allows for flexibility in trading approach | Carries a risk of financial loss |

| Can be adapted to different market conditions | May require experience and expertise |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.