What Are Corporate Bonds?

Corporate bonds are considered relatively safe investments compared to stocks because they are backed by the issuing company’s assets and cash flow. They are typically rated by credit rating agencies, such as Standard & Poor’s or Moody’s, to assess their creditworthiness and the risk of default.

Investors can purchase corporate bonds directly from the issuing company or through a broker. The bond’s face value, interest rate, and maturity date are specified in the bond’s prospectus. The face value is the amount that the bondholder will receive when the bond matures, and the interest rate determines the coupon payments.

How Are Corporate Bonds Bought and Sold?

1. Over-the-Counter (OTC) Market

The majority of corporate bond transactions take place in the over-the-counter (OTC) market. This is a decentralized market where buyers and sellers trade directly with each other or through intermediaries such as broker-dealers. The OTC market allows for flexibility in terms of pricing and negotiation, as well as access to a wide range of bond issuers and maturities.

2. Electronic Trading Platforms

In recent years, electronic trading platforms have gained popularity in the corporate bond market. These platforms provide a centralized marketplace where buyers and sellers can place orders and execute trades electronically. Electronic trading platforms offer increased transparency, efficiency, and speed of execution, making it easier for investors to buy and sell corporate bonds.

3. Bond Exchanges

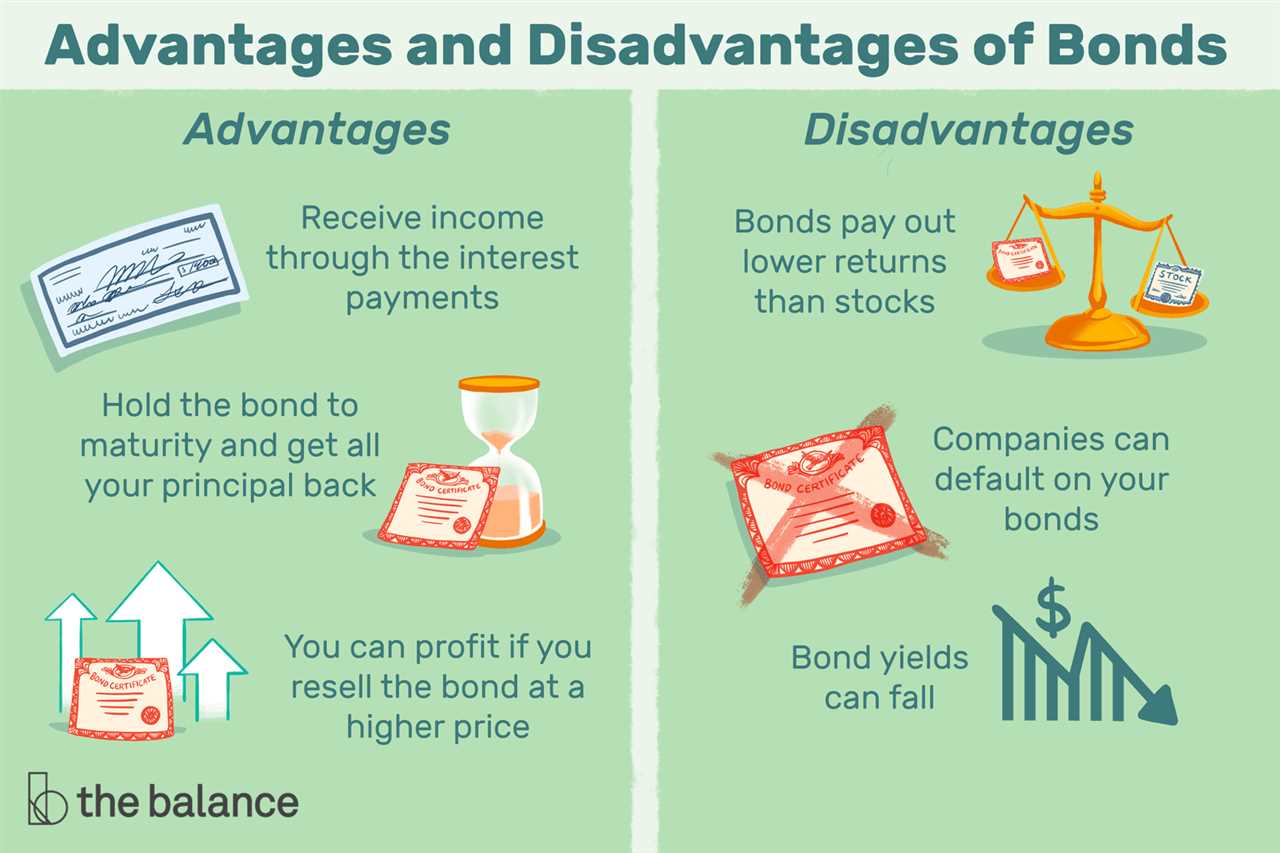

| Advantages | Disadvantages |

|---|---|

| Flexibility in pricing and negotiation | May require the services of a financial advisor or broker |

| Access to a wide range of bond issuers and maturities | Market liquidity can vary |

| Increased transparency and efficiency | Market volatility can impact prices |

| Liquidity and price discovery |

Overall, the buying and selling of corporate bonds can be done through various channels, each with its own advantages and considerations. Investors should carefully evaluate their investment goals and risk tolerance before engaging in bond transactions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.