Types of Capital Markets

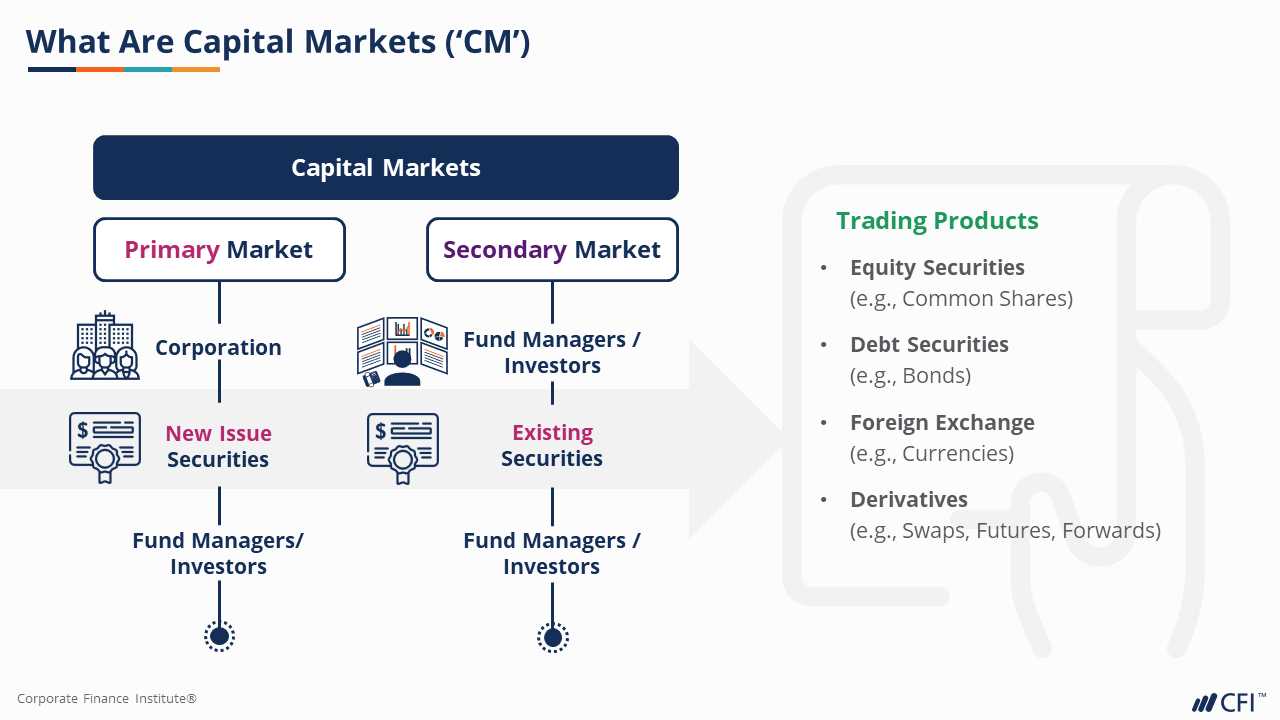

Capital markets can be categorized into two main types: primary markets and secondary markets.

1. Primary Markets:

When a company decides to go public and offer its shares to the public for the first time, it does so through an initial public offering (IPO) in the primary market. In an IPO, the company sells its shares directly to investors, and the proceeds from the sale go to the company.

Companies can also issue bonds in the primary market to raise funds. Bonds are debt securities that companies issue to borrow money from investors. Investors who buy these bonds become creditors to the company and receive regular interest payments until the bond matures.

2. Secondary Markets:

The secondary market is where previously issued securities are bought and sold among investors. This is where investors can trade stocks, bonds, and other financial instruments after they have been issued in the primary market.

The secondary market provides liquidity to investors, allowing them to buy and sell securities at market prices. It also provides an opportunity for investors to exit their investments and realize any gains or losses.

The most well-known secondary market is the stock market, where shares of publicly traded companies are bought and sold. Other examples of secondary markets include bond markets, commodity markets, and foreign exchange markets.

Conclusion:

| Primary Markets | Secondary Markets |

|---|---|

| New securities are issued and sold for the first time | Previously issued securities are bought and sold among investors |

| Companies raise capital through IPOs | Investors can trade stocks, bonds, and other financial instruments |

| Deals with initial issuance of securities | Provides liquidity to investors |

| Companies issue stocks and bonds | Investors can exit their investments and realize gains or losses |

How Capital Markets Function

Capital markets are an essential part of the global financial system, facilitating the buying and selling of various financial instruments, such as stocks, bonds, and derivatives. These markets play a crucial role in allocating capital and enabling businesses and governments to raise funds for their operations and investments.

Primary and Secondary Markets

Capital markets can be divided into two main categories: primary markets and secondary markets. In the primary market, new securities are issued and sold for the first time. This is where companies and governments raise capital by issuing stocks or bonds to investors. The secondary market, on the other hand, is where previously issued securities are traded among investors. This market provides liquidity to investors by allowing them to buy and sell securities after the initial offering.

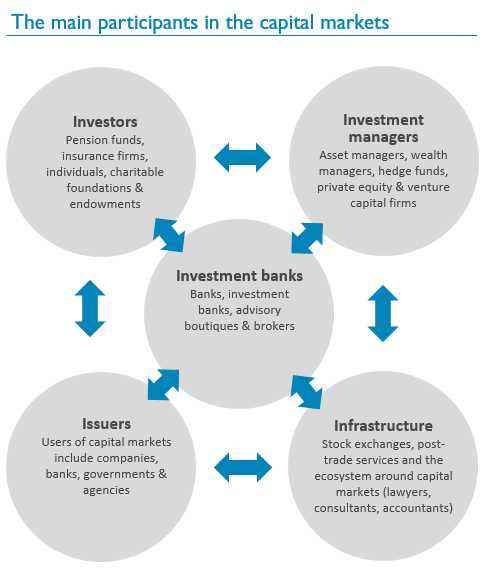

Market Participants

Capital markets involve various participants, each playing a specific role in the functioning of these markets. Some of the key participants include:

- Investors: Individuals, institutions, or entities that purchase securities in the capital markets with the aim of earning a return on their investments.

- Issuers: Companies or governments that offer securities for sale in the capital markets to raise funds for their operations or investments.

- Intermediaries: Financial institutions, such as banks, brokerage firms, and investment banks, that facilitate the buying and selling of securities in the capital markets.

- Regulators: Government agencies or regulatory bodies that oversee and regulate the activities of participants in the capital markets to ensure fair and transparent trading.

Market Functions

Capital markets serve several important functions:

- Capital Allocation: Capital markets help allocate financial resources to businesses and governments that need funds for their operations, expansion, or investment projects. Investors provide the capital, and issuers use the funds to finance their activities.

- Pricing: Capital markets determine the prices of securities based on supply and demand. The prices reflect investors’ expectations about the future performance and prospects of the issuers.

- Liquidity: Secondary markets provide liquidity to investors by allowing them to buy and sell securities. This liquidity enables investors to convert their investments into cash when needed.

- Risk Management: Capital markets offer various financial instruments, such as derivatives, that allow investors to manage and hedge their risks. These instruments help investors protect themselves against adverse market movements.

- Information Dissemination: Capital markets provide a platform for the dissemination of information about issuers and their securities. Investors rely on this information to make informed investment decisions.

Overall, capital markets play a vital role in the global economy by facilitating the flow of capital and enabling businesses and governments to raise funds. They provide a platform for investors to invest their capital and participate in the growth and development of various companies and economies.

The Role of Participants in Capital Markets

In capital markets, there are various participants who play important roles in the functioning and development of the market. These participants include:

1. Investors: Investors are individuals or institutions who provide capital to the market by purchasing financial instruments such as stocks, bonds, and derivatives. They aim to generate returns on their investments and may have different investment strategies and risk tolerance levels.

2. Issuers: Issuers are entities, such as corporations or governments, that raise capital by issuing financial instruments in the market. They may issue stocks to raise equity capital or bonds to raise debt capital. Issuers use the capital raised to fund their operations, investments, or projects.

4. Regulators: Regulators are government agencies or bodies that oversee and regulate the activities in capital markets. They aim to ensure fair and transparent markets, protect investors, and maintain market integrity. Regulators set rules and regulations that govern the conduct of participants and enforce compliance.

5. Exchanges: Exchanges are platforms where financial instruments are traded. They provide a centralized marketplace where buyers and sellers can come together to execute transactions. Exchanges play a crucial role in establishing market prices, ensuring liquidity, and providing transparency.

6. Clearinghouses: Clearinghouses act as intermediaries between buyers and sellers in the settlement of trades. They ensure the smooth and efficient transfer of ownership of financial instruments and manage the associated risks. Clearinghouses also provide services such as risk management and collateral management.

7. Rating Agencies: Rating agencies assess the creditworthiness of issuers and their financial instruments. They assign credit ratings based on their analysis of the issuer’s ability to meet its financial obligations. These ratings help investors make informed decisions and manage their risk exposure.

8. Financial Analysts: Financial analysts analyze and evaluate financial instruments, issuers, and market trends. They provide research and recommendations to investors and issuers, helping them make informed investment decisions. Financial analysts play a crucial role in providing market insights and assessing the value of financial instruments.

9. Market Participants: Market participants include traders, brokers, and other individuals or entities that actively participate in buying and selling financial instruments in the market. They contribute to market liquidity and price discovery through their trading activities.

10. Market Data Providers: Market data providers collect and disseminate information about financial instruments, market prices, and trading activities. They provide real-time data, news, and analysis that help participants make informed decisions and stay updated with market developments.

Overall, the participation of these various entities and individuals in capital markets is essential for the efficient functioning, liquidity, and growth of the market. Each participant has a unique role and contributes to the overall dynamics of the market.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.