What is a Forward Market?

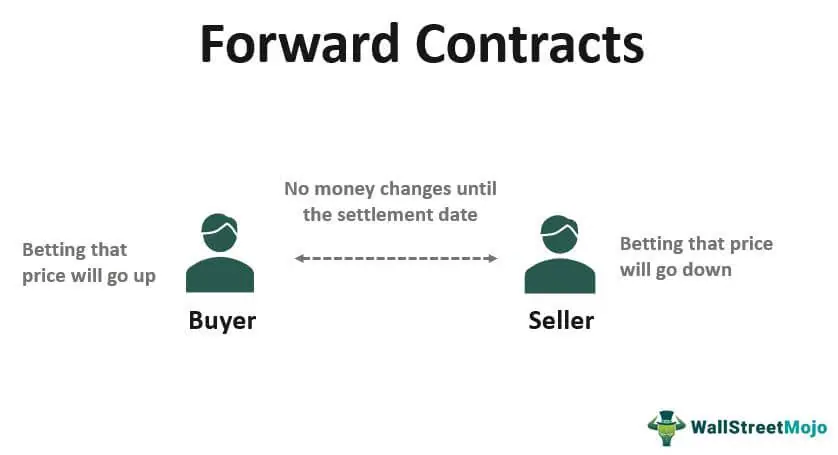

In a forward market, the terms of the contract, including the price, quantity, and delivery date, are agreed upon by the buyer and seller. These contracts are typically not standardized and are negotiated directly between the two parties involved, which allows for more flexibility in terms of the specific terms and conditions.

Forward markets are commonly used by businesses and investors to manage their exposure to price fluctuations in the underlying asset. For example, a company that imports goods from another country may enter into a forward contract to buy a certain amount of foreign currency at a specified exchange rate on a future date. This allows the company to lock in a favorable exchange rate and protect against potential currency fluctuations.

Overall, the forward market provides a mechanism for participants to hedge their risks and manage their exposure to price movements in various assets. It allows for customized contracts that can be tailored to the specific needs of the participants, making it a valuable tool in risk management and financial planning.

How Does the Forward Market Work?

These contracts are typically used by businesses and investors to hedge against currency fluctuations. For example, a company that imports goods from another country may enter into a forward contract to buy a specific amount of foreign currency at a future date, ensuring that they can purchase the goods at a known exchange rate and avoid potential losses due to currency volatility.

Similarly, investors who have foreign investments may use forward contracts to protect their returns from currency fluctuations. By entering into a contract to sell a specific amount of foreign currency at a future date, they can lock in the exchange rate and mitigate the risk of losing money when converting their profits back into their home currency.

The forward market operates through a network of financial institutions, such as banks and brokers, who act as intermediaries between buyers and sellers. These institutions facilitate the trading of forward contracts and ensure that both parties fulfill their obligations on the delivery date.

Overall, the forward market provides participants with a way to manage their currency risk and protect themselves against potential losses. By entering into forward contracts, businesses and investors can secure future exchange rates and plan their financial strategies accordingly.

Foreign Exchange Example

In the context of the forward market, a foreign exchange example refers to a scenario where two parties agree to exchange currencies at a future date and a predetermined exchange rate. This example helps to illustrate the workings of the forward market and how it is used to manage currency risk.

Let’s consider a hypothetical situation where a US-based company, Company A, plans to purchase goods from a supplier in Europe in six months. The supplier quotes the price in euros, but Company A operates in US dollars. Both parties are concerned about potential fluctuations in the exchange rate between the US dollar and the euro over the next six months.

To mitigate this risk, Company A and the supplier decide to enter into a forward contract. They agree to exchange a specific amount of US dollars for euros at a predetermined exchange rate on the settlement date, which is six months from now.

For example, let’s say the current exchange rate is 1 euro = 1.10 US dollars. Company A and the supplier agree to a forward exchange rate of 1 euro = 1.15 US dollars for the settlement date. This means that Company A will pay 1.15 US dollars for every euro received at the settlement date, regardless of the prevailing exchange rate at that time.

Now, let’s fast forward to the settlement date. If the exchange rate at that time is 1 euro = 1.20 US dollars, Company A would have benefited from entering into the forward contract. They would be able to purchase euros at a lower rate than the prevailing market rate, saving them money on their purchase from the European supplier.

On the other hand, if the exchange rate at the settlement date is 1 euro = 1.10 US dollars, Company A would not have gained any advantage from the forward contract. They would still have to pay 1.15 US dollars for every euro received, even though they could have purchased euros at a lower rate in the spot market.

This example demonstrates how the forward market can be used to manage currency risk. By entering into a forward contract, Company A is able to lock in a specific exchange rate and protect themselves from potential fluctuations in the exchange rate. This allows them to plan their budget and make more accurate cost projections for their purchase from the European supplier.

The main participants in the foreign exchange market are banks, financial institutions, corporations, governments, and individual traders. They engage in currency trading to facilitate international trade, investment, and speculation.

Trading in the foreign exchange market can be done in different ways. The most common method is through spot transactions, where currencies are bought and sold for immediate delivery. Another method is through forward contracts, which involve the exchange of currencies at a future date and a predetermined exchange rate.

Example of Foreign Exchange in the Forward Market

In the forward market, foreign exchange transactions take place between two parties to buy or sell a specific amount of currency at a predetermined exchange rate on a future date. This allows businesses and individuals to hedge against potential currency fluctuations and manage their foreign exchange risk.

Let’s consider an example to understand how foreign exchange works in the forward market:

Scenario:

A US-based company, XYZ Corp, is planning to import goods from a supplier in Europe in six months. The supplier quotes the price in euros, and XYZ Corp wants to protect itself from potential currency fluctuations that could increase the cost of the imported goods.

Step 1: Forward Contract

XYZ Corp enters into a forward contract with a financial institution to buy euros at a predetermined exchange rate on the delivery date, which is six months from now. The predetermined exchange rate is agreed upon by both parties based on the current market rate and factors such as interest rate differentials between the two currencies.

Step 2: Exchange Rate Movement

Over the next six months, the exchange rate between the US dollar and the euro fluctuates due to various economic factors. However, XYZ Corp is not affected by these fluctuations because they have locked in the exchange rate through the forward contract. This provides them with certainty in terms of the cost of the imported goods.

Step 3: Delivery and Payment

On the delivery date, XYZ Corp receives the imported goods from the European supplier and makes the payment in euros as per the agreed exchange rate. The financial institution settles the transaction by delivering the euros to XYZ Corp and receiving the US dollars.

By using the forward market for foreign exchange, XYZ Corp effectively hedged their currency risk and protected themselves from potential losses due to exchange rate fluctuations. This allows them to plan their budget and pricing with more certainty, ensuring a smoother import process.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.