What is Triple Net Lease?

Unlike traditional leases where the landlord is responsible for these expenses, a triple net lease shifts the financial burden to the tenant. This arrangement is typically seen in long-term leases for commercial properties such as retail stores, office buildings, and industrial facilities.

Under a triple net lease, the tenant has more control over the property and is responsible for its upkeep. This can be advantageous for both the tenant and the landlord. For the tenant, it provides a sense of ownership and allows them to customize the space to meet their specific needs. For the landlord, it reduces their financial obligations and ensures a steady stream of income.

Overall, a triple net lease is a beneficial arrangement for both parties involved. It provides stability and predictability in terms of expenses for the tenant, while offering a reliable source of income for the landlord. It is important for both parties to carefully review and negotiate the terms of the lease to ensure that their interests are protected.

Benefits of Triple Net Lease

A Triple Net Lease (NNN) is a type of lease agreement commonly used in commercial real estate investing. It offers several benefits for both landlords and tenants. Let’s explore the advantages of a Triple Net Lease:

1. Stable Income

2. Reduced Landlord Responsibilities

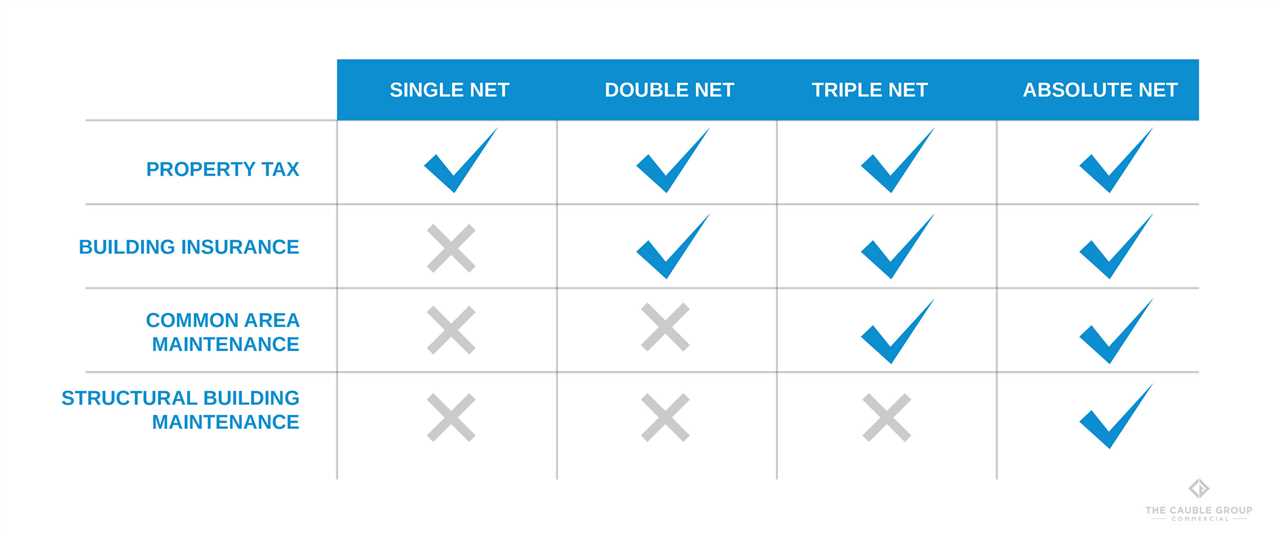

With a Triple Net Lease, the landlord’s responsibilities are significantly reduced. Unlike traditional leases where the landlord is responsible for property taxes, insurance, and maintenance, in a Triple Net Lease, these obligations are transferred to the tenant. This frees up the landlord’s time and resources, allowing them to focus on other aspects of their real estate investment portfolio.

3. Long-Term Stability

Triple Net Leases are commonly used for long-term agreements, often ranging from 10 to 20 years. This provides stability for both the landlord and the tenant. For the landlord, it means a consistent income stream for an extended period. For the tenant, it offers the security of a long-term lease, allowing them to establish and grow their business without the fear of being forced to relocate in the near future.

4. Tax Benefits

Triple Net Leases can also offer tax benefits for both landlords and tenants. Landlords may be able to deduct property expenses such as repairs, maintenance, and property management fees. Tenants, on the other hand, may be able to deduct their lease payments as a business expense. It is important to consult with a tax professional to understand the specific tax advantages that apply to your situation.

Applications of Triple Net Lease

A triple net lease is a popular choice for investors in the real estate industry due to its numerous benefits. This type of lease is commonly used in commercial properties, such as retail spaces, office buildings, and industrial facilities. Here are some applications of triple net lease:

Retail Spaces

Triple net leases are commonly used in retail spaces, such as shopping malls and strip centers. Retailers often prefer this type of lease as it allows them to have more control over the property and its operations. With a triple net lease, the tenant is responsible for paying not only the rent but also the property taxes, insurance, and maintenance costs.

Office Buildings

Office buildings are another popular application for triple net leases. Many businesses prefer to lease office space rather than owning a property, and triple net leases provide them with a stable and predictable monthly expense. With this type of lease, the tenant is responsible for the property’s operating expenses, including taxes, insurance, and maintenance.

Industrial Facilities

Triple net leases are also commonly used in industrial facilities, such as warehouses and manufacturing plants. These types of properties often require specialized maintenance and have higher operating costs. By entering into a triple net lease, the tenant takes on the responsibility of these expenses, allowing the property owner to have a more predictable cash flow.

Overall, triple net leases are versatile and can be applied to various types of commercial properties. They provide benefits for both tenants and property owners, making them a popular choice in the real estate industry.

Real Estate Investing

Real estate investing is a lucrative and popular investment strategy that involves purchasing, owning, managing, renting, or selling properties for profit. It is a long-term investment strategy that can provide investors with a stable income and potential appreciation in property value.

There are various ways to invest in real estate, including residential properties, commercial properties, and real estate investment trusts (REITs). Each type of investment offers its own advantages and considerations.

Residential Properties

Investing in residential properties involves purchasing houses, apartments, or condominiums with the intention of renting them out to tenants. This type of investment can provide a steady rental income and potential tax benefits. Additionally, residential properties are often in high demand, making it easier to find tenants.

Commercial Properties

Investing in commercial properties involves purchasing office buildings, retail spaces, or industrial properties with the intention of leasing them to businesses. Commercial properties typically offer higher rental rates and longer lease terms compared to residential properties. This can provide investors with a stable and predictable income stream.

Furthermore, commercial properties often have triple net leases (NNN leases), which require tenants to pay for property taxes, insurance, and maintenance expenses in addition to rent. This can reduce the landlord’s responsibilities and expenses, making it an attractive investment option.

Commercial Properties

Commercial properties are a vital component of the real estate market and offer unique investment opportunities for savvy investors. These properties include office buildings, retail spaces, industrial warehouses, and more. Unlike residential properties, commercial properties are primarily used for business purposes, generating income through rent or lease agreements.

Types of Commercial Properties

There are several types of commercial properties that investors can consider for their real estate portfolios:

- Office Buildings: These properties are designed to accommodate businesses and professionals. They can range from single-tenant buildings to large office complexes.

- Retail Spaces: Retail properties include shopping malls, strip malls, and standalone stores. They cater to businesses in the retail industry, such as clothing stores, restaurants, and grocery stores.

- Industrial Warehouses: These properties are used for manufacturing, storage, and distribution purposes. They can be standalone buildings or part of an industrial park.

- Hotels: Hotel properties cater to travelers and tourists, providing accommodation and related services. They can range from small boutique hotels to large luxury resorts.

- Medical Facilities: These properties include hospitals, clinics, and medical office buildings. They cater to healthcare providers and offer specialized spaces for medical practices.

Investing in commercial properties can provide several advantages, such as higher rental income, longer lease terms, and potential appreciation in value. However, it’s essential to conduct thorough research and due diligence before investing in any commercial property to ensure its profitability and suitability for your investment goals.

Advantages for Investors

Investing in commercial properties through a Triple Net Lease (NNN) arrangement offers several advantages for investors:

- Reduced Management Responsibilities: Since the tenant is responsible for the property’s operating expenses, the investor’s management responsibilities are significantly reduced. This frees up time and resources for the investor to focus on other investment opportunities or enjoy a passive income stream.

- Long-Term Lease Agreements: Triple Net Leases typically have long-term lease agreements, ranging from 10 to 20 years or more. This provides investors with a steady income stream and reduces the risk of vacancy or turnover, as tenants are more likely to stay for the duration of the lease.

- Preservation of Property Value: Since the tenant is responsible for property maintenance and repairs, the property’s value is more likely to be preserved. This can result in higher resale value for the investor in the future.

- Diversification of Investment Portfolio: Investing in commercial properties through Triple Net Leases allows investors to diversify their investment portfolio. By spreading their investments across different properties and tenants, investors can reduce risk and potentially increase their overall returns.

Overall, Triple Net Leases provide investors with a passive income stream, reduced management responsibilities, and the potential for long-term stability and growth. It is important for investors to carefully evaluate the terms and conditions of each Triple Net Lease agreement to ensure it aligns with their investment goals and risk tolerance.

Advantages for Investors

Investing in triple net lease properties offers several advantages for investors. Here are some key benefits:

1. Stable Income

Triple net lease properties provide investors with a stable and predictable income stream. The tenants are responsible for paying not only the rent but also the property taxes, insurance, and maintenance costs. This means that the investor can rely on consistent cash flow without having to worry about additional expenses.

2. Reduced Risk

With triple net lease properties, the risk is spread out between the investor and the tenant. Since the tenant is responsible for the property expenses, the investor doesn’t have to worry about unexpected costs or repairs. This reduces the risk associated with owning a property and provides a more secure investment.

3. Long-Term Leases

Triple net lease agreements typically have long-term leases, often ranging from 10 to 20 years. This provides investors with a stable and reliable income stream for an extended period of time. Long-term leases also reduce the risk of vacancy and turnover, ensuring a consistent cash flow.

4. Passive Investment

Investing in triple net lease properties is considered a passive investment. Once the lease agreement is in place, the investor can sit back and collect the rent without having to actively manage the property. This makes it an attractive option for investors who want to generate passive income without the hassle of day-to-day property management.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.