Net Income After Taxes (NIAT) Definition

Net Income After Taxes (NIAT) is a financial metric that represents the amount of profit a company has earned after deducting all applicable taxes. It is a key indicator of a company’s financial performance and is often used by investors, analysts, and stakeholders to evaluate the profitability of a business.

To calculate NIAT, the company’s total revenue is first determined by summing up all the income generated from its operations. Then, all expenses, including operating expenses, interest expenses, and taxes, are subtracted from the total revenue to arrive at the net income before taxes.

Finally, the applicable taxes, such as income tax or corporate tax, are deducted from the net income before taxes to calculate the net income after taxes. This figure represents the actual profit that the company has earned, which can be distributed to shareholders as dividends or reinvested back into the business for growth and expansion.

Net Income After Taxes is an important measure as it provides insight into a company’s ability to generate profit and manage its tax obligations. It is often compared to previous periods or industry benchmarks to assess the company’s financial health and performance.

Investors and analysts use NIAT to evaluate the profitability and sustainability of a company’s earnings. A higher NIAT indicates that a company is generating more profit after taxes, which can be a positive sign for investors. On the other hand, a lower NIAT may raise concerns about the company’s ability to generate sustainable profits.

What is Net Income After Taxes?

Net Income After Taxes (NIAT) is a financial metric that represents the amount of profit a company has earned after deducting all applicable taxes. It is a key indicator of a company’s financial performance and is often used by investors, analysts, and lenders to assess the profitability and sustainability of a business.

Calculation of Net Income After Taxes

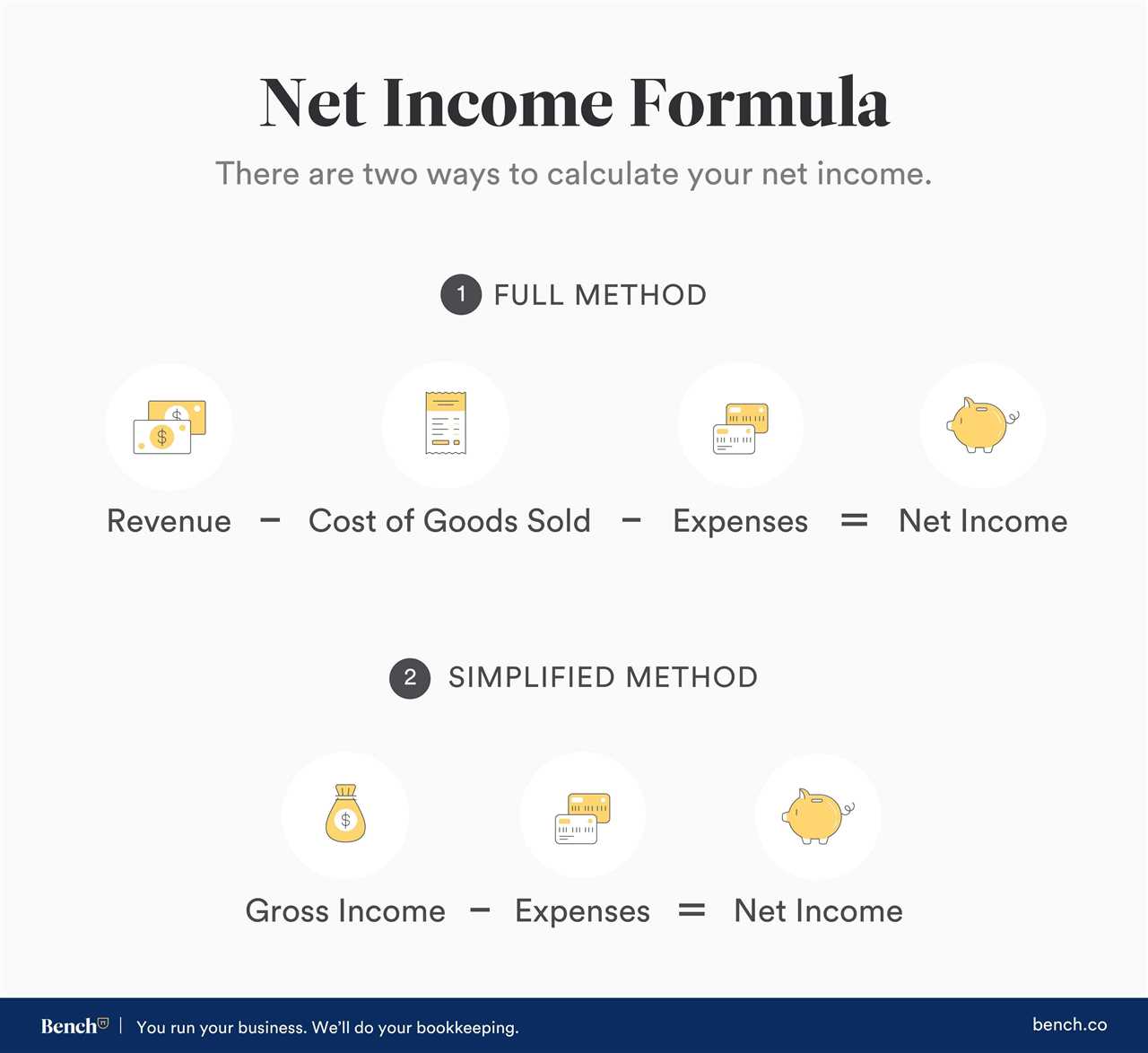

To calculate Net Income After Taxes, you need to start with the company’s total revenue and deduct all the expenses incurred during a specific period. These expenses include the cost of goods sold, operating expenses, interest expenses, and taxes.

The formula for calculating Net Income After Taxes is as follows:

- Start with the company’s total revenue

- Deduct the cost of goods sold (COGS)

- Deduct operating expenses

- Deduct interest expenses

- Deduct taxes

After deducting all these expenses, you will arrive at the Net Income Before Taxes. To calculate Net Income After Taxes, you need to further deduct the applicable tax amount from the Net Income Before Taxes.

Example of Net Income After Taxes Calculation

Let’s consider an example to understand the calculation of Net Income After Taxes. Company XYZ has a total revenue of $1,000,000. The cost of goods sold is $500,000, operating expenses are $200,000, interest expenses are $50,000, and taxes are $100,000.

Using the formula mentioned above, we can calculate Net Income Before Taxes as follows:

- Total Revenue: $1,000,000

- Cost of Goods Sold: $500,000

- Operating Expenses: $200,000

- Interest Expenses: $50,000

- Taxes: $100,000

Now, to calculate Net Income After Taxes, we need to deduct the taxes from the Net Income Before Taxes:

Therefore, the Net Income After Taxes for Company XYZ is $50,000.

Net Income After Taxes is an important metric for investors and stakeholders as it provides insights into a company’s profitability and tax obligations. It helps in evaluating the financial health and performance of a business, and can be used to compare different companies within the same industry.

Calculation of Net Income After Taxes

To calculate Net Income After Taxes (NIAT), you need to start with the company’s total revenue and subtract all the expenses and taxes. This calculation is an essential part of the financial statements and provides a clear picture of a company’s profitability after accounting for taxes.

To begin the calculation, you need to gather the necessary financial information, including the company’s revenue, cost of goods sold, operating expenses, interest expenses, and tax rate.

The formula for calculating Net Income After Taxes is as follows:

Let’s break down each component of the formula:

- Revenue: This is the total amount of money generated from the sale of goods or services. It includes all sales revenue, such as product sales, service fees, and any other income generated by the company.

- Cost of Goods Sold: This represents the direct costs associated with producing or delivering the company’s products or services. It includes expenses such as raw materials, labor, and manufacturing overhead.

- Operating Expenses: These are the costs incurred in running the day-to-day operations of the business. It includes expenses such as salaries, rent, utilities, marketing, and administrative expenses.

- Interest Expenses: This refers to the interest paid on any outstanding debts or loans. It is important to include this expense as it directly affects the company’s profitability.

- Taxes: This represents the amount of taxes owed by the company. The tax rate used in the calculation should be the effective tax rate, which takes into account any tax deductions or credits.

By subtracting all these components from the company’s revenue, you will arrive at the Net Income After Taxes. This figure represents the final profit generated by the company after accounting for all expenses and taxes.

Calculating Net Income After Taxes is crucial for evaluating a company’s financial performance and determining its profitability. It provides valuable insights into the company’s ability to generate profits and manage its expenses effectively.

It is important to note that Net Income After Taxes is reported on the income statement, which is one of the financial statements that companies prepare regularly to provide an overview of their financial performance.

Example of Net Income After Taxes Calculation

Net Income After Taxes (NIAT) is a financial metric that represents the amount of profit a company has earned after deducting all applicable taxes. It is a crucial figure in assessing a company’s financial performance and profitability.

To calculate Net Income After Taxes, you need to follow a specific formula:

The Gross Income refers to the total revenue generated by a company during a specific period, which includes sales, service fees, and other sources of income. Taxes, on the other hand, represent the amount of money a company is required to pay to the government based on its taxable income.

Let’s consider an example to better understand the calculation of Net Income After Taxes:

Company XYZ generated a Gross Income of $1,000,000 during the year. The applicable tax rate for the company is 25%. To calculate the Net Income After Taxes, we can use the formula:

Net Income After Taxes is an essential metric for investors, creditors, and other stakeholders as it provides insights into a company’s profitability and financial health. It helps evaluate the company’s ability to generate profits and manage its tax obligations effectively.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.