Different Methods for Evaluating Stocks

Fundamental Analysis

One of the most common methods for evaluating stocks is through fundamental analysis. This approach involves analyzing a company’s financial statements, such as its balance sheet, income statement, and cash flow statement, to assess its overall financial health and performance. By examining key financial ratios, such as price-to-earnings ratio (P/E), return on equity (ROE), and debt-to-equity ratio, investors can determine whether a stock is undervalued or overvalued.

Technical Analysis

Another popular method for evaluating stocks is through technical analysis. This approach involves studying historical price and volume data to identify patterns and trends that can help predict future price movements. Technical analysts use various tools, such as charts, trend lines, and indicators, to analyze stock price patterns and make buy or sell decisions based on these patterns. This method is particularly useful for short-term traders who aim to profit from short-term price fluctuations.

Valuation Models

It is important for investors to understand that no single method can guarantee accurate predictions or eliminate all risks associated with investing in stocks. Each method has its strengths and limitations, and it is advisable to use a combination of methods to make well-informed investment decisions.

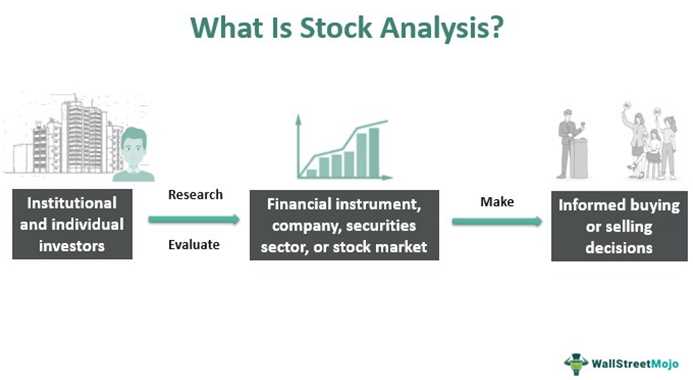

A Comprehensive Stock Analysis Guide

Fundamental Analysis

Fundamental analysis is one of the most commonly used methods for evaluating stocks. It involves analyzing a company’s financial statements, such as its balance sheet, income statement, and cash flow statement, to assess its financial health and performance. This method focuses on factors such as revenue growth, profitability, debt levels, and competitive advantages. By examining these fundamental factors, investors can determine the intrinsic value of a stock and make informed investment decisions.

Technical Analysis

Technical analysis is another popular method used by investors to evaluate stocks. Unlike fundamental analysis, which focuses on financial data, technical analysis involves studying stock price patterns, trends, and trading volume. This method relies on the belief that historical price and volume data can provide insights into future price movements. Technical analysts use various tools and indicators, such as moving averages, trendlines, and oscillators, to identify buying and selling opportunities in the stock market.

While fundamental analysis looks at the underlying value of a stock, technical analysis focuses on market sentiment and price trends. Both methods have their strengths and weaknesses, and many investors use a combination of both to make well-rounded investment decisions.

Qualitative Analysis

In addition to fundamental and technical analysis, investors can also employ qualitative analysis to evaluate stocks. This method involves assessing non-financial factors that can impact a company’s performance and stock price. Qualitative analysis considers factors such as industry trends, management quality, brand reputation, and competitive positioning. It involves conducting research, reading industry reports, and staying updated on news and developments that can affect the company and its stock.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.