What are interest expenses?

Interest expenses refer to the costs incurred by a company or an individual for borrowing money. When a company or individual takes out a loan, they are required to pay interest on the borrowed amount. This interest is considered an expense because it represents the cost of using someone else’s money.

Interest expenses can arise from various sources, including:

- Bank loans: When a company or individual borrows money from a bank, they are obligated to pay interest on the loan.

- Bonds: Companies can issue bonds to raise capital, and they must pay interest to bondholders.

- Credit cards: Individuals who use credit cards to make purchases and carry a balance are subject to interest charges.

- Lines of credit: Companies or individuals with a line of credit can borrow money as needed and pay interest on the amount borrowed.

Interest expenses are recorded on the income statement as an operating expense. They reduce the company’s net income and can have a significant impact on profitability.

It is important for companies and individuals to manage their interest expenses effectively to ensure they can meet their financial obligations and maintain a healthy financial position.

How do interest expenses work?

Interest expenses are costs that a company incurs when it borrows money or uses credit to finance its operations. These expenses are typically associated with loans, bonds, or other forms of debt that a company may have.

When a company borrows money, it agrees to pay back the principal amount plus interest over a specified period of time. The interest rate is determined by various factors, including the company’s creditworthiness and prevailing market rates.

Interest expenses are calculated based on the outstanding balance of the debt and the interest rate. For example, if a company has a loan of $100,000 with an annual interest rate of 5%, its interest expense for the year would be $5,000 ($100,000 x 0.05).

Interest expenses can have a significant impact on a company’s financial performance. They reduce the company’s net income and can increase its debt burden. Therefore, it is important for companies to manage their interest expenses effectively.

One way to assess a company’s ability to cover its interest expenses is by calculating the coverage ratio. This ratio compares a company’s earnings before interest and taxes (EBIT) to its interest expenses. A higher coverage ratio indicates that the company is generating enough income to cover its interest expenses, while a lower ratio suggests that the company may be at risk of defaulting on its debt.

Explaining Coverage Ratio

The coverage ratio is a financial metric that helps assess a company’s ability to meet its interest expenses. It is an important indicator of a company’s financial health and its ability to generate enough income to cover its interest payments.

What is the coverage ratio?

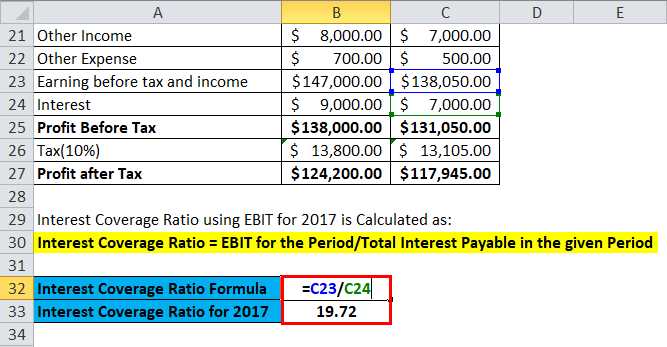

The coverage ratio is calculated by dividing a company’s earnings before interest and taxes (EBIT) by its interest expenses. This ratio shows how many times a company’s earnings can cover its interest payments. A higher coverage ratio indicates that a company is more capable of meeting its interest obligations.

Why is the coverage ratio important?

The coverage ratio is important because it provides insight into a company’s financial stability and its ability to service its debt. Lenders and investors use the coverage ratio to assess the risk associated with lending money to a company or investing in its securities. A higher coverage ratio is generally seen as a positive sign, indicating a lower risk of default.

How is the coverage ratio interpreted?

The coverage ratio is typically expressed as a number, such as 2.5 or 3. This means that a company’s earnings are 2.5 or 3 times higher than its interest expenses. A coverage ratio of 1 or less indicates that a company’s earnings are not sufficient to cover its interest payments, which may raise concerns about its financial stability and ability to meet its debt obligations.

What are the limitations of the coverage ratio?

What is the coverage ratio?

The coverage ratio is a financial metric that measures a company’s ability to cover its interest expenses with its earnings before interest and taxes (EBIT). It is a key indicator of a company’s financial health and its ability to meet its debt obligations.

The coverage ratio is calculated by dividing a company’s EBIT by its interest expenses. The resulting ratio represents the number of times a company’s earnings can cover its interest expenses. A higher coverage ratio indicates that a company has a greater ability to meet its interest payments, while a lower ratio suggests that a company may struggle to cover its interest expenses.

The coverage ratio is often used by investors, lenders, and analysts to assess a company’s creditworthiness and risk profile. It helps them determine whether a company can generate enough earnings to service its debt and whether it is a suitable investment or lending opportunity.

Additionally, the coverage ratio can be compared to industry benchmarks or historical data to evaluate a company’s performance relative to its peers or its own past performance. This analysis can provide insights into a company’s financial stability, profitability, and overall financial management.

Overall, the coverage ratio is an important financial metric that provides valuable information about a company’s ability to meet its interest obligations. It is a useful tool for assessing a company’s financial health, evaluating its creditworthiness, and making informed investment or lending decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.