Investment Income Definition

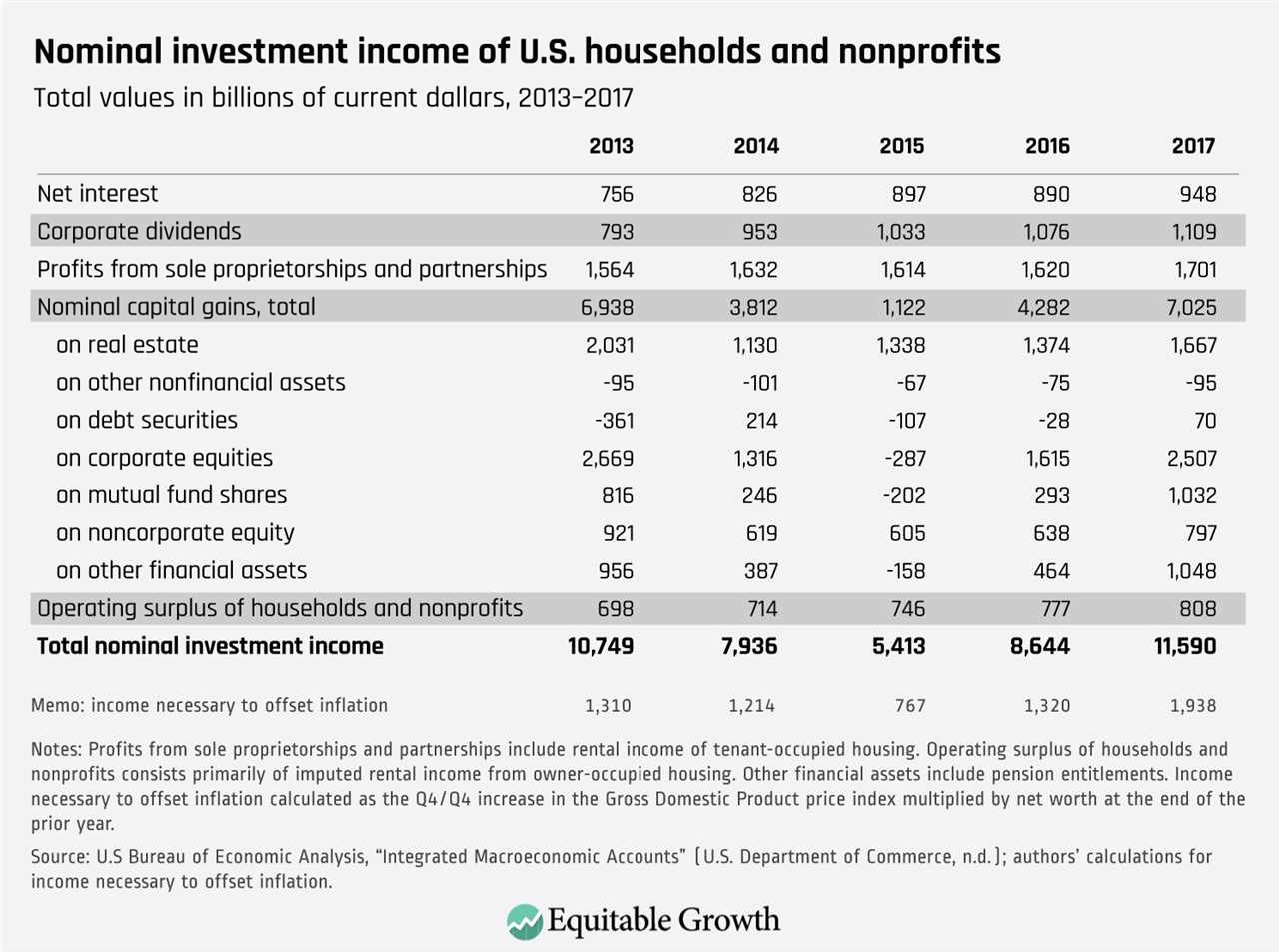

Investment income refers to the money earned from various types of investments, such as stocks, bonds, real estate, and mutual funds. It is the return on investment that an individual or entity receives for putting their money into these assets.

Types of Investment Income

There are several types of investment income:

- Dividends: Dividends are payments made by a corporation to its shareholders. They are typically a portion of the company’s profits and are distributed on a per-share basis.

- Interest: Interest is the money earned on loans or fixed-income securities, such as bonds or certificates of deposit (CDs). It is usually calculated as a percentage of the principal amount.

- Rental Income: Rental income is the money received from leasing out real estate properties, such as residential or commercial buildings.

- Capital Gains: Capital gains are the profits made from selling an investment at a higher price than its original purchase price. They can be realized when selling stocks, real estate, or other assets.

Tax Treatment of Investment Income

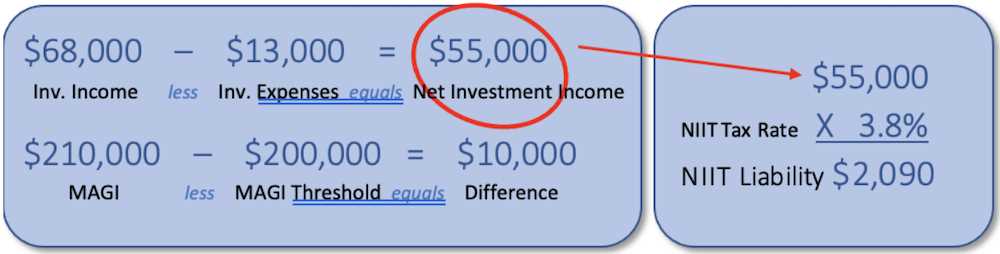

The tax treatment of investment income varies depending on the type of income and the jurisdiction. In many countries, investment income is subject to taxation, either at the individual or corporate level.

Dividends and interest income are often taxed as ordinary income, meaning they are subject to the same tax rates as wages or salary. Rental income is also typically subject to income tax.

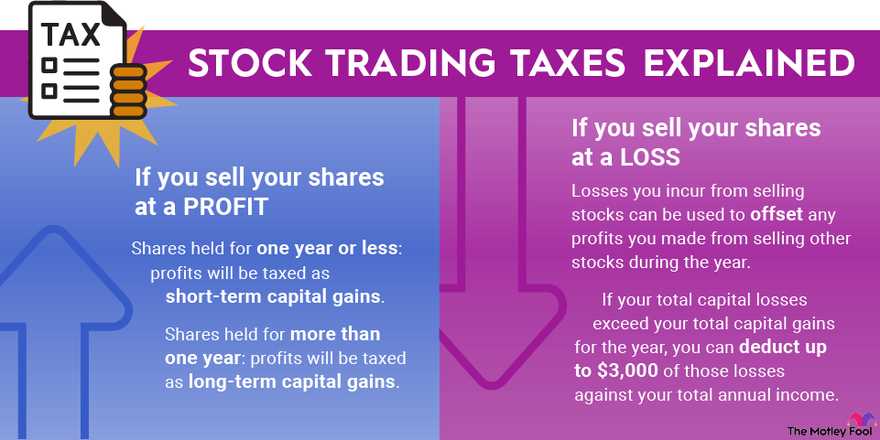

Capital gains, on the other hand, may be subject to different tax rates. In some jurisdictions, capital gains are taxed at a lower rate than ordinary income, incentivizing long-term investment. However, the tax treatment of capital gains can vary significantly between countries.

It is important for investors to understand the tax implications of their investment income and consult with a tax professional to ensure compliance with the applicable tax laws.

Investment income refers to the earnings or returns generated from various types of investments, such as stocks, bonds, mutual funds, real estate, and other financial instruments. It is a key component of an individual’s overall income and can play a significant role in building wealth and achieving financial goals.

There are several types of investment income, including:

1. Dividends

Dividends are payments made by corporations to their shareholders as a share of the company’s profits. They are usually paid out on a regular basis, such as quarterly or annually. Dividend income is considered a form of investment income and is subject to taxation.

2. Interest

Interest income is earned from investments such as bonds, savings accounts, certificates of deposit (CDs), and other fixed-income securities. It is the amount paid by the borrower to the lender for the use of their money. Interest income is generally taxable, although certain types of bonds may be exempt from federal income tax.

3. Capital Gains

Capital gains are the profits realized from the sale of an investment, such as stocks, real estate, or mutual funds. It is the difference between the purchase price and the selling price of the asset. Capital gains can be either short-term (held for less than a year) or long-term (held for more than a year). The tax treatment of capital gains depends on the holding period and the individual’s tax bracket.

It is important to note that investment income is subject to taxation. The tax treatment of investment income varies depending on the type of income, the holding period, and the individual’s tax bracket. It is advisable to consult with a tax professional or financial advisor to understand the specific tax implications of your investment income.

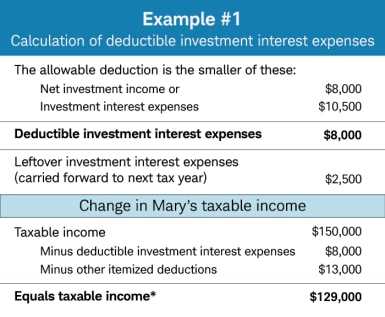

Example and Tax Treatment

Let’s consider an example to understand how investment income is taxed. Suppose you have invested in stocks and bonds, and over the course of a year, you earned $10,000 in dividends and $5,000 in interest.

Dividends are a form of investment income that companies distribute to their shareholders. They are typically paid out of the company’s profits and can be received in cash or additional shares of stock. Dividends are subject to different tax rates depending on whether they are classified as qualified or non-qualified dividends.

Qualified dividends are taxed at the same rates as long-term capital gains, which are typically lower than ordinary income tax rates. On the other hand, non-qualified dividends are taxed at the individual’s ordinary income tax rates.

In our example, let’s assume that $8,000 of the $10,000 in dividends are qualified dividends, and the remaining $2,000 are non-qualified dividends. If you fall into the 15% tax bracket for ordinary income and the 20% tax bracket for long-term capital gains, the tax treatment for your dividends would be as follows:

- The $8,000 in qualified dividends would be taxed at the long-term capital gains rate of 20%, resulting in a tax liability of $1,600.

- The $2,000 in non-qualified dividends would be taxed at the ordinary income tax rate of 15%, resulting in a tax liability of $300.

Interest income, on the other hand, is generally taxed at the individual’s ordinary income tax rates. In our example, the $5,000 in interest income would be subject to the ordinary income tax rate of 15%, resulting in a tax liability of $750.

It is important to note that tax treatment may vary depending on the individual’s tax bracket and the type of investment income. It is always advisable to consult with a tax professional or accountant to ensure accurate tax reporting and compliance with applicable tax laws.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.