Basics of Out of the Money Options

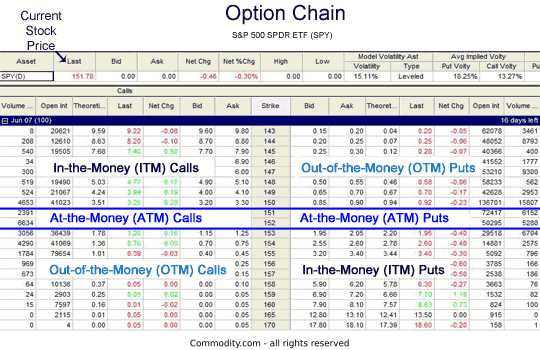

Out of the money options are a type of financial derivative that can be traded on various markets. These options get their name because the strike price of the option is higher (for call options) or lower (for put options) than the current market price of the underlying asset. As a result, these options have no intrinsic value and are considered to be “out of the money”.

When an option is out of the money, it means that exercising the option would not result in a profit for the holder. For example, if a call option has a strike price of $50 and the current market price of the underlying asset is $40, the option is out of the money because it would not be profitable to exercise the option and buy the asset at $50 when it can be purchased for $40 on the market.

Out of the money options are typically less expensive to purchase compared to options that are in the money or at the money. This is because there is no intrinsic value in the option, only extrinsic value, which is based on factors such as time remaining until expiration, volatility of the underlying asset, and market conditions.

Traders and investors may choose to trade out of the money options for various reasons. One reason is that these options can provide leverage, allowing traders to control a larger position in the underlying asset with a smaller investment. Additionally, out of the money options can offer the potential for higher returns if the price of the underlying asset moves in the desired direction.

However, it is important to note that out of the money options also carry a higher level of risk compared to options that are in the money or at the money. This is because the option must move significantly in the desired direction in order to become profitable. If the price of the underlying asset does not move as anticipated, the option may expire worthless, resulting in a loss for the holder.

Examples of Out of the Money Options

Out of the money options are a type of financial derivative that can be used in trading strategies. These options have a strike price that is higher (for call options) or lower (for put options) than the current market price of the underlying asset. As a result, they have no intrinsic value and are considered to be “out of the money”.

Here are a few examples of out of the money options:

1. Call Option Example:

Let’s say you are interested in buying a call option on a stock that is currently trading at $50 per share. You decide to purchase a call option with a strike price of $60 and an expiration date of one month. Since the strike price is higher than the current market price, this call option is considered to be out of the money.

If the stock price remains below $60 until the expiration date, the call option will expire worthless. However, if the stock price increases above $60, the call option may become in the money and you could potentially make a profit.

2. Put Option Example:

Now let’s consider a put option example. Suppose you want to buy a put option on a stock that is currently trading at $100 per share. You decide to purchase a put option with a strike price of $90 and an expiration date of three months. Since the strike price is lower than the current market price, this put option is considered to be out of the money.

If the stock price remains above $90 until the expiration date, the put option will expire worthless. However, if the stock price decreases below $90, the put option may become in the money and you could potentially make a profit.

Benefits of Trading Out of the Money Options

Out of the money options can offer several benefits to traders and investors. While they may seem risky at first, they can provide unique opportunities for profit and risk management. Here are some of the key benefits of trading out of the money options:

1. Lower Cost

One of the main advantages of trading out of the money options is that they are typically cheaper to buy compared to in the money or at the money options. This lower cost allows traders to control a larger number of contracts for the same amount of capital, potentially increasing their profit potential.

2. Higher Potential Returns

Although out of the money options have a lower probability of expiring in the money, they also have the potential for higher returns. If the underlying asset moves significantly in the desired direction, the value of the out of the money option can increase exponentially. This can result in substantial profits for traders who correctly anticipate market movements.

3. Risk Management

Out of the money options can also be used as a risk management tool. By purchasing out of the money put options, traders can protect their long positions in the underlying asset from potential downside risks. This allows them to limit their losses in case the market moves against their expectations.

4. Flexibility

Trading out of the money options provides traders with flexibility in their trading strategies. They can use these options to create various combinations and strategies, such as vertical spreads or butterfly spreads, to take advantage of different market conditions. This flexibility allows traders to adapt to changing market dynamics and potentially profit from different scenarios.

5. Diversification

Adding out of the money options to a portfolio can also help diversify risk. By including options with different strike prices and expiration dates, traders can spread their risk across multiple positions. This diversification can help reduce the impact of adverse market movements on the overall portfolio performance.

Conclusion

While out of the money options may not be suitable for all traders, they offer unique benefits that can enhance trading strategies. The lower cost, higher potential returns, risk management capabilities, flexibility, and diversification opportunities make trading out of the money options worth considering for those looking to expand their trading toolkit.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.