Gross Margin Return on Investment (GMROI): Definition and Formula

Gross Margin Return on Investment (GMROI) is a financial ratio that measures the profitability of a company’s inventory investment by comparing the gross margin generated from that investment to the cost of the inventory. It is a valuable metric for retailers and wholesalers to evaluate the effectiveness of their inventory management and purchasing decisions.

Formula for GMROI

The formula to calculate GMROI is:

GMROI = Gross Margin / Average Inventory Cost

Where:

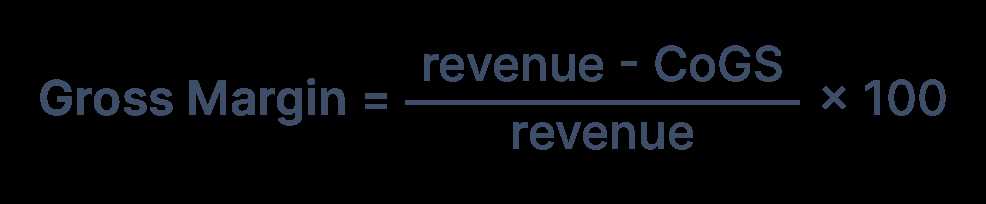

- Gross Margin is the difference between the net sales revenue and the cost of goods sold (COGS).

- Average Inventory Cost is the average cost of the inventory over a specific period of time. It can be calculated by adding the beginning inventory and ending inventory, and dividing the sum by 2.

Interpreting GMROI

A GMROI value greater than 1 indicates that the company is generating more gross margin from its inventory investment compared to the cost of the inventory. This suggests that the company is effectively managing its inventory and achieving a satisfactory return on investment.

On the other hand, a GMROI value less than 1 implies that the company is not generating enough gross margin to cover the cost of the inventory. This may indicate poor inventory management or pricing strategies, and further analysis and adjustments may be needed to improve profitability.

It is important to note that GMROI should be compared within the same industry or sector, as different industries may have varying levels of profitability and inventory turnover.

Overall, GMROI is a useful tool for businesses to assess the profitability of their inventory investment and make informed decisions regarding inventory management, pricing, and purchasing strategies.

What is Gross Margin Return on Investment (GMROI)?

Gross Margin Return on Investment (GMROI) is a financial ratio that measures the profitability of a company’s inventory investment. It provides insight into how effectively a company is managing its inventory and generating profits.

GMROI is calculated by dividing the gross margin (sales minus the cost of goods sold) by the average inventory cost. The result is then multiplied by 100 to express it as a percentage.

This ratio is commonly used by retailers and wholesalers to evaluate the performance of their inventory. It helps them determine which products are generating the highest returns and which ones may be tying up capital without generating sufficient profits.

How is GMROI calculated?

The formula for calculating GMROI is as follows:

| Gross Margin | ÷ | Average Inventory Cost | = | GMROI |

|---|

For example, if a company has a gross margin of $100,000 and an average inventory cost of $50,000, the GMROI would be 2. This means that for every dollar invested in inventory, the company generates $2 in gross margin.

Importance of GMROI

GMROI is an important metric for businesses as it helps them make informed decisions about their inventory management. By calculating and analyzing GMROI, companies can identify which products are the most profitable and adjust their inventory levels accordingly.

A high GMROI indicates that a company is effectively managing its inventory and generating strong profits. On the other hand, a low GMROI may indicate that a company is investing too much in inventory or not generating enough sales to cover the costs.

By monitoring GMROI over time, companies can track the performance of their inventory and make strategic decisions to optimize profitability. They can identify slow-moving or low-margin products and take steps to improve their performance or phase them out.

How to Calculate Gross Margin Return on Investment (GMROI)

Gross Margin Return on Investment (GMROI) is a financial ratio that measures the profitability of a company’s inventory investment. It helps businesses determine the effectiveness of their inventory management and purchasing decisions. Calculating GMROI involves a simple formula that takes into account the gross margin and the average inventory cost.

Formula for calculating GMROI:

The formula for calculating GMROI is as follows:

GMROI = Gross Margin / Average Inventory Cost

To calculate GMROI, you need to know the gross margin and the average inventory cost. The gross margin is the difference between the revenue generated from sales and the cost of goods sold. The average inventory cost is the average value of the inventory over a specific period of time.

Here are the steps to calculate GMROI:

- Determine the gross margin: Subtract the cost of goods sold (COGS) from the total revenue to find the gross margin.

- Calculate the average inventory cost: Add the beginning inventory value to the ending inventory value, and divide the sum by 2 to find the average inventory cost.

- Divide the gross margin by the average inventory cost: Divide the gross margin by the average inventory cost to calculate the GMROI.

For example, let’s say a company has a gross margin of $100,000 and an average inventory cost of $50,000. The GMROI would be calculated as follows:

GMROI = $100,000 / $50,000 = 2

A GMROI of 2 indicates that for every dollar invested in inventory, the company generates $2 in gross margin. A higher GMROI indicates better inventory management and higher profitability.

Importance of Gross Margin Return on Investment (GMROI)

Gross Margin Return on Investment (GMROI) is a financial ratio that measures the profitability of a company’s inventory investment. It is a crucial metric for retailers and wholesalers as it helps them evaluate the effectiveness of their inventory management and purchasing decisions.

1. Assessing Inventory Performance

GMROI allows businesses to assess the performance of their inventory by comparing the gross margin generated from sales to the investment made in inventory. It helps determine whether the company is generating enough profit from its inventory to cover the costs associated with purchasing and storing it.

By calculating GMROI, businesses can identify which products or product categories are generating the highest returns and focus on optimizing their inventory levels accordingly. This helps avoid overstocking slow-moving items and understocking high-demand products, leading to improved profitability.

2. Evaluating Purchasing Decisions

GMROI also plays a crucial role in evaluating purchasing decisions. By analyzing the ratio for different products or suppliers, businesses can determine which ones offer the best return on investment. This information enables them to negotiate better terms with suppliers and make informed decisions about which products to stock.

Furthermore, GMROI helps businesses identify the impact of discounts, promotions, and markdowns on their profitability. It allows them to assess whether these strategies are effective in generating higher gross margins and overall profitability.

3. Comparing Performance

GMROI is a valuable benchmarking tool that allows businesses to compare their performance against industry standards and competitors. By analyzing the ratio for similar businesses, companies can identify areas where they are underperforming and implement strategies to improve their profitability.

Additionally, GMROI can be used to evaluate the performance of different store locations or sales channels. This information helps businesses allocate resources effectively and make informed decisions about expansion or consolidation.

| Benefits of GMROI | Explanation |

|---|---|

| Optimized inventory levels | Helps avoid overstocking and understocking |

| Informed purchasing decisions | Identifies products and suppliers with the best ROI |

| Improved profitability | Enables effective pricing and promotion strategies |

| Benchmarking | Allows comparison against industry standards and competitors |

| Resource allocation | Helps allocate resources effectively across locations and channels |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.