Interest Rate Sensitivity: Definition, Measurement, and Types

Interest rate sensitivity refers to the degree of change in the value of an investment or a portfolio in response to changes in interest rates. It is an important concept in finance and investment management, as it helps investors and financial institutions understand the potential impact of interest rate fluctuations on their investments.

There are several ways to measure interest rate sensitivity, including duration, convexity, and yield curve analysis. Duration measures the price sensitivity of a fixed-income security or portfolio to changes in interest rates. It provides an estimate of how much the price of the security or portfolio will change for a given change in interest rates.

Convexity, on the other hand, measures the curvature of the price-yield relationship of a fixed-income security or portfolio. It provides additional information about the price sensitivity of the security or portfolio, especially for larger changes in interest rates.

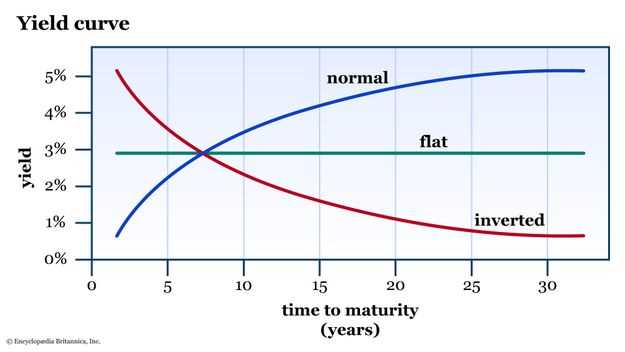

Yield curve analysis involves examining the relationship between the yields of different maturities of fixed-income securities. It helps investors understand the expectations and sentiment of market participants regarding future interest rate movements.

Interest rate sensitivity can be categorized into two main types: price sensitivity and reinvestment risk. Price sensitivity refers to the impact of interest rate changes on the market value of fixed-income securities or portfolios. When interest rates rise, the market value of fixed-income securities tends to decrease, and vice versa.

Reinvestment risk, on the other hand, refers to the risk that future cash flows from fixed-income securities will have to be reinvested at lower interest rates. This can result in lower returns for investors, especially if the original investment had a higher interest rate.

There are several factors that can affect interest rate sensitivity, including the time to maturity of the fixed-income security, the coupon rate, and the current level of interest rates. Generally, the longer the time to maturity, the higher the interest rate sensitivity. Similarly, the lower the coupon rate and the higher the current level of interest rates, the higher the interest rate sensitivity.

Managing interest rate sensitivity is an important aspect of investment management. Investors and financial institutions can use various strategies to mitigate the impact of interest rate fluctuations on their investments, such as diversification, hedging, and active portfolio management.

Interest rate sensitivity refers to the degree to which the price of a financial instrument, such as a bond, changes in response to changes in interest rates. It is an important concept for investors and financial institutions to understand, as it can have a significant impact on the value of their investments.

When interest rates rise, the price of fixed-income securities, such as bonds, generally falls. This is because investors can earn a higher yield by investing in newly issued bonds with higher interest rates. Conversely, when interest rates fall, the price of fixed-income securities tends to rise, as investors are willing to pay a premium for the higher yield offered by these securities.

The sensitivity of a financial instrument to changes in interest rates is influenced by a variety of factors, including the time to maturity, the coupon rate, and the creditworthiness of the issuer. Generally, the longer the time to maturity, the greater the sensitivity to changes in interest rates. This is because longer-term bonds have a higher duration, which measures the weighted average time it takes to receive the bond’s cash flows.

The creditworthiness of the issuer also plays a role in interest rate sensitivity. Bonds issued by companies with lower credit ratings are generally more sensitive to changes in interest rates, as investors demand a higher yield to compensate for the increased risk of default. Conversely, bonds issued by companies with higher credit ratings are typically less sensitive to changes in interest rates, as investors are willing to accept a lower yield due to the lower risk of default.

Measuring Interest Rate Sensitivity

Measuring interest rate sensitivity is an important aspect of financial analysis and risk management. It involves assessing the impact of changes in interest rates on the value of financial instruments, such as bonds, loans, and derivatives.

Duration

One commonly used measure of interest rate sensitivity is duration. Duration measures the weighted average time it takes to receive the cash flows from a financial instrument, taking into account the present value of each cash flow. It provides an estimate of how sensitive the instrument’s price or value is to changes in interest rates.

The formula for calculating duration is:

Duration = (PV1 * T1 + PV2 * T2 + … + PVn * Tn) / V

Where PV1, PV2, …, PVn are the present values of the cash flows at times T1, T2, …, Tn, and V is the current value of the instrument.

Convexity

Another measure of interest rate sensitivity is convexity. Convexity measures the curvature of the relationship between a financial instrument’s price or value and changes in interest rates. It provides additional information beyond duration by capturing the non-linear relationship between price and yield.

The formula for calculating convexity is:

Convexity = (PV1 * T1^2 + PV2 * T2^2 + … + PVn * Tn^2) / V

Where PV1, PV2, …, PVn are the present values of the cash flows at times T1, T2, …, Tn, and V is the current value of the instrument.

A higher convexity indicates that the instrument’s price or value is more sensitive to changes in interest rates, especially when interest rates are significantly different from the instrument’s yield.

Limitations

It is important to note that duration and convexity are mathematical models and have certain limitations. They assume a linear relationship between price and yield, which may not hold true in all cases. Additionally, they do not capture other factors that can affect interest rate sensitivity, such as credit risk, liquidity risk, and market conditions.

Conclusion

Measuring interest rate sensitivity through duration and convexity provides valuable insights into the potential impact of changes in interest rates on the value of financial instruments. However, it is essential to consider these measures in conjunction with other risk factors and market conditions to make informed investment and risk management decisions.

Types of Interest Rate Sensitivity

Interest rate sensitivity refers to the degree to which the price of a financial instrument, such as a bond or a loan, changes in response to changes in interest rates. There are several types of interest rate sensitivity that investors and borrowers should be aware of:

3. Convexity:

Convexity measures the curvature of the relationship between bond prices and yields. It provides a more accurate estimate of the bond’s price sensitivity to changes in interest rates than duration alone. Bonds with positive convexity are less sensitive to interest rate changes, while bonds with negative convexity are more sensitive.

4. Option-Adjusted Spread (OAS):

OAS is a measure of the spread over the risk-free rate that compensates investors for the embedded optionality in a bond, such as a call or put option. It takes into account the potential changes in cash flows due to changes in interest rates and the exercise of the embedded options. A higher OAS indicates higher interest rate sensitivity.

5. Yield Curve Sensitivity:

Factors Affecting Interest Rate Sensitivity

1. Time to Maturity: The longer the time to maturity of a financial instrument, the higher its interest rate sensitivity. This is because longer-term investments are exposed to interest rate fluctuations for a longer period, increasing the potential impact on their value.

2. Coupon Rate: The coupon rate, or the interest rate paid by a bond, affects its interest rate sensitivity. Bonds with higher coupon rates are less sensitive to changes in interest rates compared to those with lower coupon rates. This is because higher coupon payments provide a cushion against potential losses in market value.

3. Market Interest Rates: The level of market interest rates directly affects the interest rate sensitivity of financial instruments. When market interest rates rise, the value of existing bonds and other fixed-income securities typically decreases, resulting in higher interest rate sensitivity.

4. Credit Quality: The credit quality of a financial instrument also influences its interest rate sensitivity. Higher-quality bonds, such as those issued by governments or highly-rated corporations, tend to have lower interest rate sensitivity compared to lower-quality bonds. This is because investors perceive higher-quality bonds as less risky and demand for them remains relatively stable even when interest rates change.

7. Macroeconomic Factors: Macroeconomic factors such as inflation, economic growth, and monetary policy decisions can also influence interest rate sensitivity. For example, higher inflation expectations may lead to higher interest rates, increasing the interest rate sensitivity of financial instruments.

By considering these factors, investors and borrowers can assess the potential impact of interest rate changes on their portfolios and make appropriate adjustments to manage their interest rate risk effectively.

Managing Interest Rate Sensitivity

Managing interest rate sensitivity is crucial for individuals and businesses alike. By effectively managing interest rate risk, they can minimize the impact of changing interest rates on their financial positions.

There are several strategies that can be employed to manage interest rate sensitivity:

1. Diversification:

Diversification is a key strategy to manage interest rate sensitivity. By diversifying their investments across different asset classes, individuals and businesses can reduce their exposure to interest rate fluctuations. For example, instead of investing solely in fixed-income securities, they can also allocate a portion of their portfolio to equities or real estate.

2. Hedging:

Hedging involves using financial instruments to offset the impact of interest rate changes. For instance, individuals and businesses can enter into interest rate swaps or options contracts to protect themselves against adverse interest rate movements. These instruments allow them to lock in a fixed interest rate or limit their exposure to interest rate fluctuations.

3. Duration Management:

Duration is a measure of the sensitivity of a fixed-income security to changes in interest rates. By managing the duration of their bond portfolios, individuals and businesses can control their interest rate sensitivity. For example, they can invest in bonds with shorter durations to reduce the impact of interest rate changes.

4. Refinancing:

Refinancing is another strategy to manage interest rate sensitivity. By refinancing their existing debt at lower interest rates, individuals and businesses can reduce their interest expenses. This can be particularly beneficial when interest rates are expected to decrease.

5. Monitoring and Analysis:

Regularly monitoring and analyzing interest rate trends is essential for effective interest rate sensitivity management. By staying informed about market conditions and interest rate movements, individuals and businesses can make informed decisions regarding their financial positions. This includes staying updated on economic indicators, central bank policies, and other factors that influence interest rates.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.