What is Form 5405?

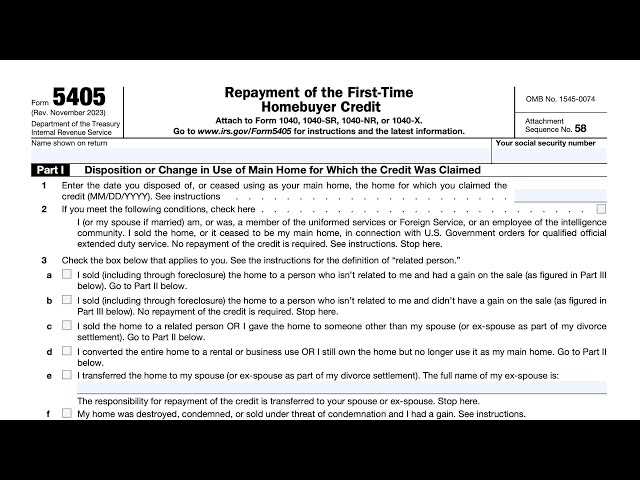

Form 5405 is a tax form issued by the Internal Revenue Service (IRS) in the United States. It is specifically designed for individuals who are claiming the First-Time Homebuyer Credit or need to repay the credit they previously received.

The First-Time Homebuyer Credit is a tax credit that was introduced to help first-time homebuyers afford the costs associated with purchasing a home. This credit was available for homes purchased between 2008 and 2010, and it provided a financial incentive for individuals to enter the housing market.

Form 5405 is used to determine the amount of the credit that a taxpayer is eligible for and to calculate any repayment obligations. It is important to note that this form is only applicable to individuals who meet the eligibility criteria for the credit.

It is important to carefully review the instructions provided with Form 5405 to ensure that all required information is provided accurately. Failure to properly complete the form may result in delays in processing the credit or repayment.

Overall, Form 5405 is a crucial document for individuals who are claiming the First-Time Homebuyer Credit or need to repay the credit. It helps the IRS determine the eligibility and repayment obligations of taxpayers, ensuring that the credit is properly administered.

The First-Time Homebuyer Credit is a tax credit offered by the Internal Revenue Service (IRS) to individuals who purchase a home for the first time. This credit was introduced as part of the Housing and Economic Recovery Act of 2008 to help stimulate the housing market and provide financial assistance to first-time homebuyers.

What is a tax credit?

A tax credit is a dollar-for-dollar reduction in the amount of tax owed. Unlike a tax deduction, which reduces the amount of income subject to tax, a tax credit directly reduces the tax liability. In the case of the First-Time Homebuyer Credit, eligible individuals can claim a credit of up to $8,000.

Who is eligible for the credit?

To be eligible for the First-Time Homebuyer Credit, individuals must meet certain criteria:

- They must be a first-time homebuyer, which means they have not owned a principal residence in the three years prior to the purchase.

- The home must be purchased between certain dates, depending on the specific legislation in effect at the time.

- The individual must meet certain income requirements, which may vary depending on the year the home was purchased.

How does the credit work?

Once eligible individuals have purchased a qualifying home, they can claim the First-Time Homebuyer Credit on their federal income tax return using Form 5405. The credit can be claimed for the tax year in which the home was purchased or for the previous year, if the home was purchased after the tax filing deadline.

The credit is refundable, which means that if the amount of the credit exceeds the individual’s tax liability, the excess will be refunded to them. However, if the home is sold within a certain period of time, the credit may need to be repaid.

What are the benefits of the credit?

Overall, the First-Time Homebuyer Credit is a valuable tax incentive for individuals who are looking to purchase their first home. It is important for eligible individuals to understand the criteria and requirements for claiming the credit to ensure they receive the maximum benefit.

Eligibility Criteria for the First-Time Homebuyer Credit

The First-Time Homebuyer Credit is a tax credit offered by the Internal Revenue Service (IRS) to individuals who purchase their first home. However, not everyone is eligible to claim this credit. There are certain criteria that must be met in order to qualify for the credit. Here are the eligibility requirements:

1. First-Time Homebuyer

In order to qualify for the credit, you must be a first-time homebuyer. This means that you have not owned a principal residence in the three years prior to the purchase of your new home. If you have previously owned a home but have not lived in it as your main residence, you may still be eligible for the credit.

2. Purchase Date

The purchase of the home must have been made between certain dates in order to qualify for the credit. The specific dates vary depending on when the home was purchased. It is important to check the IRS guidelines or consult with a tax professional to determine the correct dates for your situation.

3. Income Limits

There are income limits that determine whether or not you are eligible for the credit. These limits are based on your modified adjusted gross income (MAGI). If your MAGI exceeds the specified limit, you may not be eligible for the credit. The income limits vary depending on your filing status.

4. Home Purchase Price

The purchase price of the home must also fall within certain limits in order to qualify for the credit. The specific limits vary depending on the location of the home and the year it was purchased. It is important to check the IRS guidelines or consult with a tax professional to determine the correct limits for your situation.

5. Repayment of Previous Credit

If you have previously claimed the First-Time Homebuyer Credit and have not yet repaid the full amount, you may not be eligible for the credit again. The credit is generally required to be repaid over a 15-year period, starting with the second tax year after the year the credit was claimed.

It is important to note that these are just some of the eligibility criteria for the First-Time Homebuyer Credit. There may be additional requirements or exceptions depending on your individual circumstances. It is recommended to review the IRS guidelines or consult with a tax professional to determine your eligibility for the credit.

How to Claim the Credit

Claiming the First-Time Homebuyer Credit is a relatively simple process. Here are the steps you need to follow:

Step 1: Determine Your Eligibility

Before claiming the credit, make sure you meet all the eligibility criteria. You must be a first-time homebuyer, meaning you haven’t owned a home in the past three years. Additionally, your modified adjusted gross income (MAGI) must be below the specified limits.

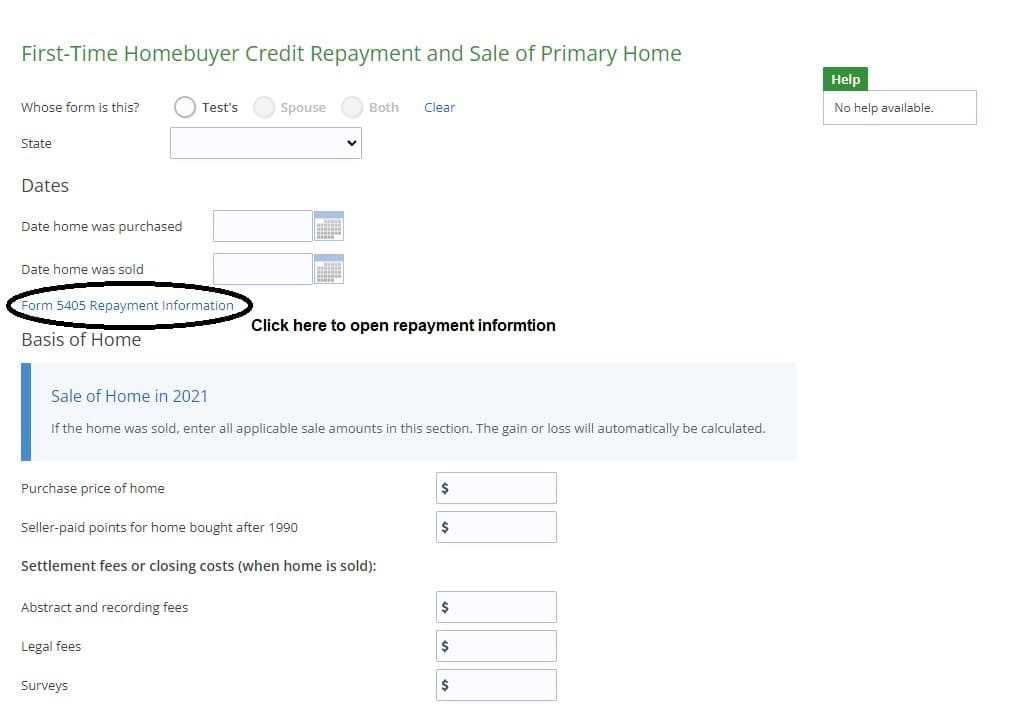

Step 2: Complete Form 5405

To claim the credit, you need to fill out Form 5405, First-Time Homebuyer Credit and Repayment of the Credit. This form is available on the IRS website or can be obtained from your tax professional. Make sure to provide accurate and complete information to avoid any delays or issues.

Step 3: Attach Supporting Documents

Along with Form 5405, you may need to attach certain supporting documents, such as a copy of your settlement statement or a certificate of occupancy. These documents serve as proof of your eligibility and help the IRS verify the information provided.

Step 4: File Your Tax Return

Include Form 5405 with your annual tax return. Make sure to file your return by the deadline to avoid any penalties or interest charges. If you are e-filing, follow the instructions provided by your tax software to attach Form 5405 to your return.

Step 5: Wait for Confirmation

After filing your tax return, the IRS will process your claim and determine if you are eligible for the credit. If everything is in order, you will receive a confirmation notice or a refund check, depending on whether you claimed the credit as a refund or applied it to your tax liability.

By following these steps and providing accurate information, you can successfully claim the First-Time Homebuyer Credit and enjoy the benefits it offers. Remember to consult with a tax professional or refer to the IRS guidelines if you have any specific questions or concerns.

Repayment of the Credit

One important aspect of the First-Time Homebuyer Credit is the requirement for repayment. If you claimed the credit for a home you purchased in 2008, 2009, or 2010, you are generally required to repay the credit over a period of 15 years, starting with your 2010 tax return.

The repayment amount for each year is equal to 1/15th of the credit you received. For example, if you claimed a $8,000 credit, your repayment amount would be $533.33 per year. This repayment is added to your tax liability for the year, meaning you will owe more in taxes.

However, there are certain circumstances that may exempt you from repaying the credit. If you sell your home before the 15-year repayment period is over, you may be required to repay the remaining balance of the credit. However, if you sell your home and no longer have a tax liability, you may not have to repay the credit.

If you stop using the home as your main residence, such as converting it into a rental property or using it for business purposes, you may also be required to repay the credit. Additionally, if you experience a loss on the sale of the home, you may be exempt from repayment.

Repayment Calculation

To calculate your repayment amount, you will need to complete Form 5405. This form will help you determine the total amount of credit you claimed, the amount you have repaid so far, and the remaining balance to be repaid.

It is important to keep track of your repayment obligations and report them accurately on your tax returns. Failure to repay the credit as required may result in penalties and interest charges.

Tip: If you are unsure about your repayment obligations or need assistance with completing Form 5405, consider consulting a tax professional or utilizing tax preparation software.

Tips for Completing Form 5405

Completing Form 5405, First-Time Homebuyer Credit and Repayment of the Credit, can be a complex process. However, by following these tips, you can ensure that you accurately complete the form and claim the appropriate credit:

1. Gather all necessary documents:

Before starting to fill out Form 5405, make sure you have all the required documents handy. This includes documents such as your settlement statement, Form 1098 (Mortgage Interest Statement), and any other relevant paperwork.

2. Read the instructions carefully:

Form 5405 comes with detailed instructions that explain how to fill out each section. Take the time to read and understand these instructions before you begin. This will help you avoid mistakes and ensure that you provide the correct information.

3. Double-check your information:

Accuracy is crucial when completing Form 5405. Double-check all the information you enter, including your personal details, the purchase price of the home, and any amounts you are claiming or repaying. Mistakes can lead to delays or even penalties.

4. Use the correct tax year:

Make sure you are using the correct tax year for Form 5405. The form may vary from year to year, so always use the most recent version available on the IRS website.

5. Seek professional help if needed:

If you find the process of completing Form 5405 overwhelming or if you have any doubts, consider seeking assistance from a tax professional. They can guide you through the process and ensure that you claim the credit correctly.

6. Keep copies of all documents:

After completing Form 5405, make sure to keep copies of all the documents you used to support your claim. This includes the form itself, as well as any supporting documents like your settlement statement and Form 1098. Keeping these records will be helpful in case of any future inquiries or audits.

7. Submit the form on time:

Finally, make sure to submit Form 5405 by the appropriate deadline. The deadline may vary depending on the tax year, so check the IRS website or consult a tax professional to ensure you meet the deadline.

By following these tips, you can navigate the process of completing Form 5405 with confidence and ensure that you claim the First-Time Homebuyer Credit accurately.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.