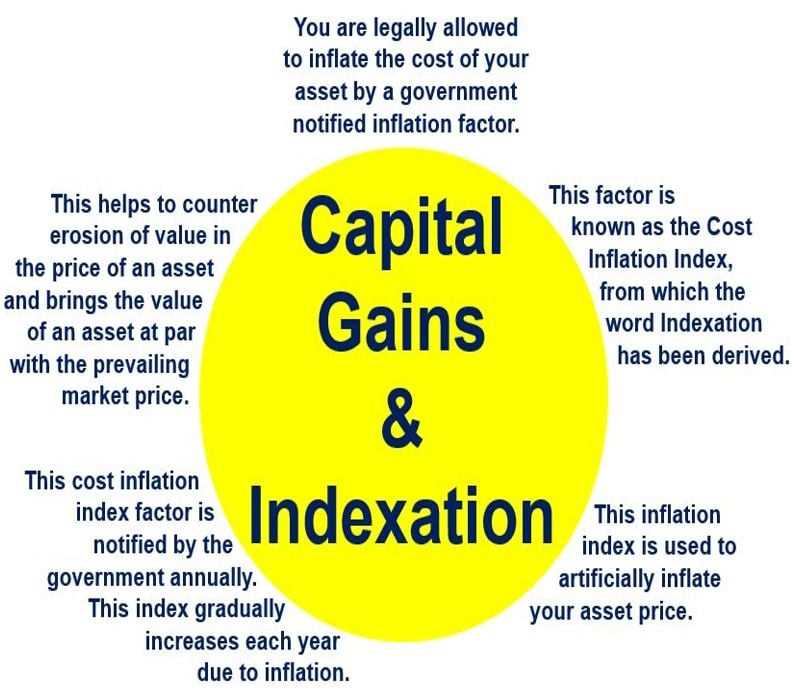

What is Indexation?

The concept of indexation is based on the idea that the value of a variable should be adjusted to reflect changes in the general price level or other relevant factors. By linking the value to an index, indexation ensures that the variable maintains its purchasing power over time.

Indexation is particularly important in situations where the value of a variable is subject to inflation or other economic fluctuations. Without indexation, the real value of the variable would erode over time, leading to a decrease in purchasing power.

Indexation Examples

There are various examples of indexation in different areas of economics. One common example is the indexing of wages to inflation. Collective bargaining agreements may include provisions for wage increases based on changes in the CPI or other inflation measures. This ensures that workers’ wages keep up with the rising cost of living.

Another example is the indexation of tax brackets. In many countries, tax brackets are adjusted annually based on changes in the average wage or the CPI. This prevents individuals from being pushed into higher tax brackets solely due to inflation, ensuring that the tax system remains fair and equitable.

Real-life Applications and Benefits

Indexation has several real-life applications and benefits. It helps protect individuals and businesses from the erosion of purchasing power caused by inflation. By adjusting values to reflect changes in the general price level, indexation ensures that individuals can maintain their standard of living and businesses can accurately account for inflation in their financial planning.

Indexation also promotes fairness and equity in various economic transactions. By linking values to objective indices, indexation prevents one party from gaining an unfair advantage over another due to changes in the general price level. This is particularly important in situations involving long-term contracts or fixed payments.

Indexation in Economics

Indexation is a widely studied concept in economics. It is often analyzed in relation to inflation, as it provides a mechanism for adjusting values to account for changes in the general price level. Economists study the effects of indexation on various economic variables, such as wages, pensions, and tax systems, to understand its impact on individuals, businesses, and the overall economy.

Overall, indexation plays a crucial role in maintaining the stability and fairness of economic transactions. By adjusting values based on objective indices, indexation ensures that individuals and businesses can navigate the challenges posed by inflation and other economic fluctuations.

Exploring the Role and Significance

The role and significance of indexation extend beyond the realm of economics. Indexation has implications for public policy, social welfare, and financial planning. Governments use indexation to determine the appropriate adjustments for various benefits and payments, such as social security benefits and pensions. Financial planners use indexation to account for inflation when creating long-term investment strategies.

Indexation also has implications for monetary policy and central banking. Central banks often consider the effects of indexation when formulating monetary policy, as it can influence inflation expectations and the overall stability of the economy.

The main purpose of indexation is to ensure that the value of certain payments or obligations remains constant in real terms, accounting for changes in the overall price level. By linking these values to an index, adjustments can be made periodically to maintain their purchasing power.

Importance of Indexation

Indexation plays a crucial role in maintaining economic stability and fairness. Without indexation, the purchasing power of wages, pensions, and other fixed payments would gradually erode over time as prices rise. This can lead to a decline in the standard of living for individuals and create income inequality.

Indexation also has implications for businesses and the overall economy. By adjusting prices based on changes in the cost of production or inflation, businesses can maintain their profit margins and avoid losses. This promotes stability and prevents excessive price fluctuations that can disrupt markets.

Furthermore, indexation can contribute to macroeconomic stability by reducing the impact of inflation on the economy. When wages and prices are indexed, individuals and businesses can anticipate and plan for changes in the cost of living, reducing uncertainty and minimizing the potential for inflationary spirals.

Indexation Examples

Indexation is a concept that is widely used in various fields, including economics, finance, and government policies. It involves adjusting the value of a variable or a payment based on changes in a specific index. Here are some examples of indexation in different contexts:

1. Cost of Living Adjustments (COLA)

One common example of indexation is the Cost of Living Adjustments (COLA) made to wages, pensions, and social security benefits. In many countries, these payments are adjusted annually based on the Consumer Price Index (CPI) or another inflation index. This ensures that the purchasing power of individuals receiving these payments remains relatively constant over time, taking into account the rising prices of goods and services.

2. Tax Brackets

Another example of indexation is seen in tax brackets. Tax systems in many countries have progressive tax rates, where the tax rate increases as income rises. However, these tax brackets are often adjusted periodically to account for inflation. This prevents individuals from being pushed into higher tax brackets solely due to inflation, ensuring that their tax burden remains fair and equitable.

3. Bond Yields

In the field of finance, indexation is also used in the calculation of bond yields. Bond yields are often adjusted based on changes in interest rates or inflation rates. This allows investors to compare the performance of different bonds accurately and make informed investment decisions.

4. Rent Control

5. Minimum Wage

Indexation can also be applied to minimum wage laws. Some countries have implemented automatic adjustments to the minimum wage based on changes in the cost of living or inflation. This helps to ensure that the minimum wage keeps pace with the rising prices of goods and services, providing workers with a fair and livable income.

These examples illustrate the practical applications of indexation in various aspects of our lives. By adjusting variables and payments based on relevant indices, indexation helps to maintain fairness, stability, and accuracy in economic and financial systems.

Real-life Applications and Benefits of Indexation

Indexation, as a concept in economics, has several real-life applications and benefits. It is widely used in various sectors and industries to ensure fairness, stability, and accuracy in financial transactions and agreements. Here are some of the key applications and benefits of indexation:

- Contractual Agreements: Indexation is commonly used in contractual agreements, such as rent agreements or loan contracts. By indexing the payment terms to an appropriate index, both parties can ensure that the payments adjust automatically based on changes in the index. This reduces the risk of disputes or disagreements arising from changes in economic conditions.

- Government Policies: Indexation plays a crucial role in government policies, particularly in areas like taxation and social security. By indexing tax brackets or social security benefits to an index, the government can ensure that individuals are not unfairly burdened by inflation. This helps in maintaining social welfare and reducing income inequality.

- Investment Strategies: Indexation is widely used in investment strategies, especially in the field of passive investing. Index funds, for example, track a specific market index and aim to replicate its performance. By investing in index funds, investors can gain exposure to a diversified portfolio at a relatively low cost, while also benefiting from the overall market trends.

- Financial Planning: Indexation is also valuable in financial planning. By considering the effects of inflation and using indexed data, individuals can make more accurate projections and set realistic financial goals. This helps in effective budgeting, retirement planning, and wealth management.

Indexation in Economics

Indexation is a concept in economics that refers to the adjustment of prices, wages, or other economic variables based on changes in a specific index. This index is typically a measure of inflation or some other economic indicator. The purpose of indexation is to account for the effects of inflation and ensure that the purchasing power of individuals or the value of assets remains relatively stable over time.

Indexation plays a crucial role in various aspects of the economy. One of its main applications is in the adjustment of wages. By indexing wages to inflation, employers can ensure that their employees’ purchasing power does not erode over time. This helps maintain a fair and equitable compensation system, as it takes into account the rising cost of living.

Another important application of indexation is in the financial sector. Bonds and other fixed-income securities often have their interest payments indexed to inflation. This protects investors from losing purchasing power due to inflation and provides them with a stable income stream. Indexation also allows governments to adjust tax brackets and social security benefits to keep pace with inflation, ensuring that individuals are not unfairly burdened by rising prices.

Indexation can have both advantages and disadvantages. On the one hand, it helps protect individuals and businesses from the negative effects of inflation, such as eroding purchasing power. It also provides stability and predictability in economic transactions, as parties can rely on indexation to adjust prices or wages. On the other hand, indexation can lead to higher costs for businesses, especially if wages or other expenses are automatically adjusted based on an index. This can potentially hinder economic growth and competitiveness.

Exploring the Role and Significance of Indexation

Indexation plays a crucial role in the field of economics and has significant implications for various aspects of the economy. It is a method used to adjust the value of a variable, such as wages, prices, or taxes, based on changes in a specific index.

Indexation also plays a vital role in the financial sector, particularly in the context of investments. Many financial instruments, such as bonds or pensions, are indexed to inflation or other economic indicators. This helps to protect investors from the negative effects of inflation and ensures that their investments retain their value over time.

Furthermore, indexation has significant implications for government policies and fiscal management. By indexing tax brackets or social welfare benefits, governments can ensure that these measures keep pace with changes in the economy. This helps to maintain fairness and prevent individuals or groups from being disproportionately affected by inflation or other economic fluctuations.

Overall, indexation is a powerful tool in economics that helps to maintain stability, fairness, and predictability in various aspects of the economy. By adjusting variables based on changes in specific indices, indexation ensures that individuals, businesses, and governments can adapt to economic fluctuations and maintain their financial well-being.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.