What is Branch Banking?

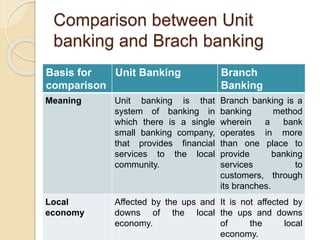

Branch banking is a system in which a bank operates multiple branches in different locations to provide banking services to its customers. Each branch functions as a separate entity, offering a range of financial services such as deposits, loans, investments, and customer support.

Definition and Overview

Branch banking is a traditional model of banking that has been in existence for many years. It involves the establishment of physical branches in various locations, allowing customers to access banking services conveniently.

Advantages of Branch Banking

Branch banking offers several advantages to both customers and the bank itself.

Convenience and Accessibility

One of the key advantages of branch banking is the convenience and accessibility it provides to customers. With multiple branches spread across different areas, customers can easily access banking services without having to travel long distances. This makes it easier for individuals and businesses to manage their finances and carry out transactions.

Personalized Customer Service

Another advantage of branch banking is the personalized customer service it offers. With dedicated staff at each branch, customers can receive personalized attention and assistance with their banking needs. This helps to build strong relationships between the bank and its customers, leading to increased customer satisfaction and loyalty.

Range of Services

Branch banking also offers a wide range of services to customers. In addition to basic banking services such as deposits and withdrawals, branches often provide additional services such as loans, investments, and insurance. This allows customers to fulfill their various financial needs in one place, making banking more convenient and efficient.

Definition and Overview

Branch banking refers to a system of banking where a single bank operates multiple branches in different locations. Each branch functions as an independent unit, providing a range of banking services to customers.

This system allows customers to access banking services conveniently, regardless of their location. It also enables the bank to provide personalized customer service, as each branch can cater to the specific needs of its local customers.

Branch banking offers various advantages over other banking models, such as unit banking. These advantages include convenience and accessibility, personalized customer service, and a wide range of services.

Overall, branch banking is a widely adopted model that allows banks to expand their reach, serve diverse customer needs, and provide efficient and effective banking services.

Advantages of Branch Banking

Branch banking offers numerous advantages that make it a preferred choice for customers. Here are some key benefits:

Convenience and Accessibility

One of the main advantages of branch banking is the convenience and accessibility it provides to customers. With a network of branches spread across different locations, customers can easily access banking services without having to travel long distances. This makes it convenient for individuals to carry out their banking transactions, such as depositing or withdrawing money, making payments, or seeking assistance from bank personnel.

Personalized Customer Service

Branch banking also offers personalized customer service, which is highly valued by customers. In a branch setting, customers can interact face-to-face with bank staff who can provide personalized assistance and guidance. Whether it’s opening a new account, applying for a loan, or resolving a banking issue, customers can rely on the expertise and support of branch staff to meet their specific needs.

Furthermore, branch banking allows customers to establish a relationship with a specific branch and its staff, fostering a sense of trust and familiarity. This personal touch enhances customer satisfaction and loyalty.

Additionally, branch banking provides an opportunity for customers to receive financial advice and guidance from experts. Bank staff can offer insights on various banking products and services, helping customers make informed decisions based on their individual financial goals and needs.

Overall, the personalized customer service offered by branch banking ensures that customers receive the attention and support they require, enhancing their overall banking experience.

These advantages make branch banking an attractive option for individuals who value convenience, accessibility, and personalized service. With a network of branches and dedicated staff, branch banking continues to play a crucial role in meeting the diverse banking needs of customers.

Convenience and Accessibility

24/7 Access to Services

One of the main advantages of branch banking is that it provides customers with 24/7 access to banking services. With branches located in various locations, customers can easily find a branch near them and access services at any time of the day or night. This means that customers can deposit or withdraw money, make payments, and perform other banking transactions whenever they need to, without having to wait for specific banking hours.

Multiple Service Points

Branch banking also offers multiple service points, which means that customers have access to a wide range of services in one place. Whether it’s opening a new account, applying for a loan, or seeking financial advice, customers can find all these services under one roof. This eliminates the need to visit multiple locations or deal with different institutions for different banking needs, saving time and effort.

Moreover, branch banking provides customers with the convenience of accessing various self-service options, such as ATMs, online banking, and mobile banking. These options allow customers to perform transactions and manage their accounts from the comfort of their own homes or while on the go, further enhancing convenience and accessibility.

Personalized Customer Service

One of the key advantages of branch banking is the personalized customer service that it offers. Unlike online banking or unit banking, branch banking allows customers to interact face-to-face with bank representatives who can provide personalized assistance and guidance.

Whether it’s opening a new account, applying for a loan, or resolving a banking issue, branch banking provides customers with the opportunity to speak directly with knowledgeable professionals who can offer personalized solutions tailored to their specific needs.

This personalized customer service not only helps customers feel valued and appreciated, but it also ensures that their banking needs are met effectively and efficiently. Bank representatives at branches are trained to provide excellent customer service and are equipped with the knowledge and resources to address a wide range of banking inquiries and concerns.

Overall, the personalized customer service offered by branch banking sets it apart from other banking options and provides customers with a level of support and assistance that cannot be replicated through online or unit banking. It ensures that customers receive the attention and care they deserve, making their banking experience more convenient, reliable, and satisfying.

Range of Services

1. Personal and Business Accounts

Branch banking offers both personal and business accounts, allowing individuals and businesses to manage their finances effectively. Whether you need a checking account for your personal expenses or a business account to handle your company’s transactions, branch banking has got you covered.

2. Loans and Mortgages

Need a loan for a new car or a mortgage for your dream home? Branch banking provides various loan options, including personal loans, auto loans, and mortgages. You can discuss your financial goals with a branch representative who will guide you through the loan application process.

Pro tip: Make sure to bring all the necessary documents, such as proof of income and identification, when applying for a loan or mortgage.

3. Investment Services

Branch banking also offers investment services to help you grow your wealth. Whether you’re a beginner or an experienced investor, you can rely on the expertise of branch representatives to provide you with investment advice and assist you in creating a diversified portfolio.

Did you know? Many branch banking institutions have dedicated investment advisors who can help you make informed decisions about your investments.

4. Credit and Debit Cards

With branch banking, you can easily apply for credit and debit cards that suit your financial needs. Whether you prefer a rewards credit card or a debit card with added security features, branch banking offers a variety of options to choose from.

Pro tip: Before applying for a credit or debit card, make sure to compare the features, benefits, and fees associated with each card to find the best fit for you.

Overall, branch banking provides a comprehensive range of services that go beyond basic banking needs. From everyday transactions to long-term financial planning, branch banking offers the convenience and flexibility you need to manage your finances effectively.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.