Holding Period Return Yield

Holding Period Return Yield is a financial metric that measures the return on an investment over a specific period of time. It is commonly used by investors to evaluate the performance of their investments and make informed decisions.

Definition

Formula

The formula to calculate Holding Period Return Yield is:

Where:

- Ending Value is the value of the investment at the end of the holding period.

- Beginning Value is the value of the investment at the beginning of the holding period.

- Income is the total income generated by the investment during the holding period.

Example

Let’s say you bought a stock for $100 at the beginning of the year. Throughout the year, you received $5 in dividends from the stock. At the end of the year, the stock is worth $120. To calculate the Holding Period Return Yield, you would use the following formula:

Therefore, the Holding Period Return Yield for this investment is 25%.

By calculating the Holding Period Return Yield, investors can assess the profitability of their investments and compare them to other investment opportunities. It provides a standardized measure that takes into account both the capital appreciation and income generated by the investment.

Investors can use the Holding Period Return Yield to make informed decisions about buying, selling, or holding onto their investments. It helps them evaluate the performance of their portfolio and determine if adjustments need to be made.

Overall, Holding Period Return Yield is a valuable tool for investors to analyze the returns on their investments and make informed decisions based on their financial goals and risk tolerance.

Definition

Holding Period Return Yield is a financial metric used to calculate the return on an investment over a specific period of time. It measures the percentage increase or decrease in the value of an investment during the holding period, taking into account both capital gains and dividends.

Holding Period Return Yield is an important measure for investors as it helps them assess the performance of their investments and make informed decisions about buying or selling securities. It provides a clear picture of the profitability of an investment over a specific time frame.

Formula

The formula for calculating Holding Period Return Yield is:

| Holding Period Return Yield | = |

|---|

Where:

- Ending Value is the value of the investment at the end of the holding period.

- Beginning Value is the value of the investment at the beginning of the holding period.

- Dividends are any cash payments received from the investment during the holding period.

Example

Let’s say an investor purchased 100 shares of a stock at a price of $50 per share. After one year, the investor sold the shares at a price of $60 per share and received $200 in dividends during the holding period. Using the formula, the Holding Period Return Yield would be:

| Holding Period Return Yield | = | |

|---|---|---|

| = | 0.24 or 24% |

Therefore, the Holding Period Return Yield for this investment is 24%, indicating a 24% return on the initial investment over the one-year holding period.

Holding Period Return Yield is a useful tool for investors to evaluate the performance of their investments and compare them to other investment options. It provides a clear and standardized measure of return, allowing investors to make informed decisions based on the profitability of their investments.

Holding Period Return Yield Formula

The holding period return yield is a financial calculation that measures the return on an investment over a specific period of time. It is commonly used by investors to evaluate the performance of their investments and make informed decisions about buying or selling securities.

Definition

Formula

The formula for calculating the holding period return yield is:

Where:

- HPR is the holding period return yield

- Ending Value is the value of the investment at the end of the holding period

- Beginning Value is the value of the investment at the beginning of the holding period

- Dividends are any dividends or interest earned during the holding period

Example

Let’s say you bought 100 shares of a stock at $50 per share, and after one year, the stock price increased to $60 per share. During the year, you received $2 per share in dividends. To calculate the holding period return yield, you would use the following formula:

Therefore, the holding period return yield for this investment is 24%.

By using the holding period return yield formula, investors can assess the profitability of their investments and compare them to other investment options. It provides a standardized measure that takes into account both capital gains and income earned, allowing for a more comprehensive evaluation of investment performance.

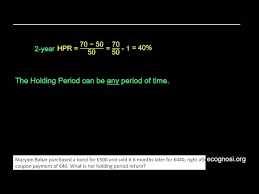

Holding Period Return Yield: Example

Let’s understand the concept of Holding Period Return (HPR) yield with an example. Suppose you purchased 100 shares of XYZ Company at a price of $50 per share. After holding the shares for one year, you decide to sell them at a price of $60 per share.

Step 1: Calculate the Initial Investment

To calculate the initial investment, multiply the number of shares purchased by the purchase price per share:

Initial Investment = Number of Shares * Purchase Price per Share

Initial Investment = 100 * $50 = $5000

Step 2: Calculate the Final Investment

To calculate the final investment, multiply the number of shares sold by the selling price per share:

Final Investment = Number of Shares * Selling Price per Share

Final Investment = 100 * $60 = $6000

Step 3: Calculate the Holding Period Return (HPR)

The HPR is calculated by subtracting the initial investment from the final investment and dividing the result by the initial investment:

Therefore, the Holding Period Return (HPR) yield for this investment is 20%. This means that you earned a 20% return on your initial investment over the one-year holding period.

Investing Basics

Investing in financial markets can be a profitable way to grow your wealth over time. However, it is important to understand the basics of investing before getting started. This article will provide an overview of some key concepts and strategies that every investor should be familiar with.

1. Diversification

Diversification is a risk management strategy that involves spreading your investments across different asset classes, industries, and geographic regions. By diversifying your portfolio, you can reduce the impact of any single investment on your overall returns. This can help protect your portfolio from volatility and potentially increase your chances of long-term success.

2. Risk and Return

Investing always involves some level of risk. Generally, the higher the potential return of an investment, the higher the risk. It is important to understand your risk tolerance and investment goals before making any investment decisions. By carefully considering the risk and return characteristics of different investments, you can build a portfolio that aligns with your financial objectives.

3. Asset Allocation

Asset allocation refers to the distribution of your investments across different asset classes, such as stocks, bonds, and cash. The goal of asset allocation is to create a diversified portfolio that balances risk and return. The specific allocation will depend on factors such as your age, time horizon, and risk tolerance. Regularly reviewing and rebalancing your asset allocation can help ensure that your portfolio remains aligned with your investment objectives.

Dollar-cost averaging is an investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the price of the investment. This approach can help reduce the impact of market volatility on your investment returns. By consistently investing over time, you can take advantage of market fluctuations and potentially lower your average cost per share.

Fundamental analysis is a method of evaluating investments by analyzing the financial statements, management team, and competitive position of a company. This approach aims to determine the intrinsic value of a security and identify potential investment opportunities. By conducting thorough research and analysis, investors can make more informed decisions and potentially achieve better investment results.

Investing Basics

Holding period return yield refers to the total return earned on an investment over a specific period of time. It takes into account both capital gains (or losses) and any income generated from the investment, such as dividends or interest payments. By calculating the holding period return yield, investors can assess the performance of their investments and compare them to alternative investment options.

The formula for calculating holding period return yield is as follows:

Let’s consider an example to illustrate this concept. Suppose you invested $10,000 in a stock at the beginning of the year. At the end of the year, the value of your investment has increased to $12,000, and you have received $500 in dividends. Using the formula, the holding period return yield would be:

This means that your investment has yielded a return of 25% over the holding period.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.