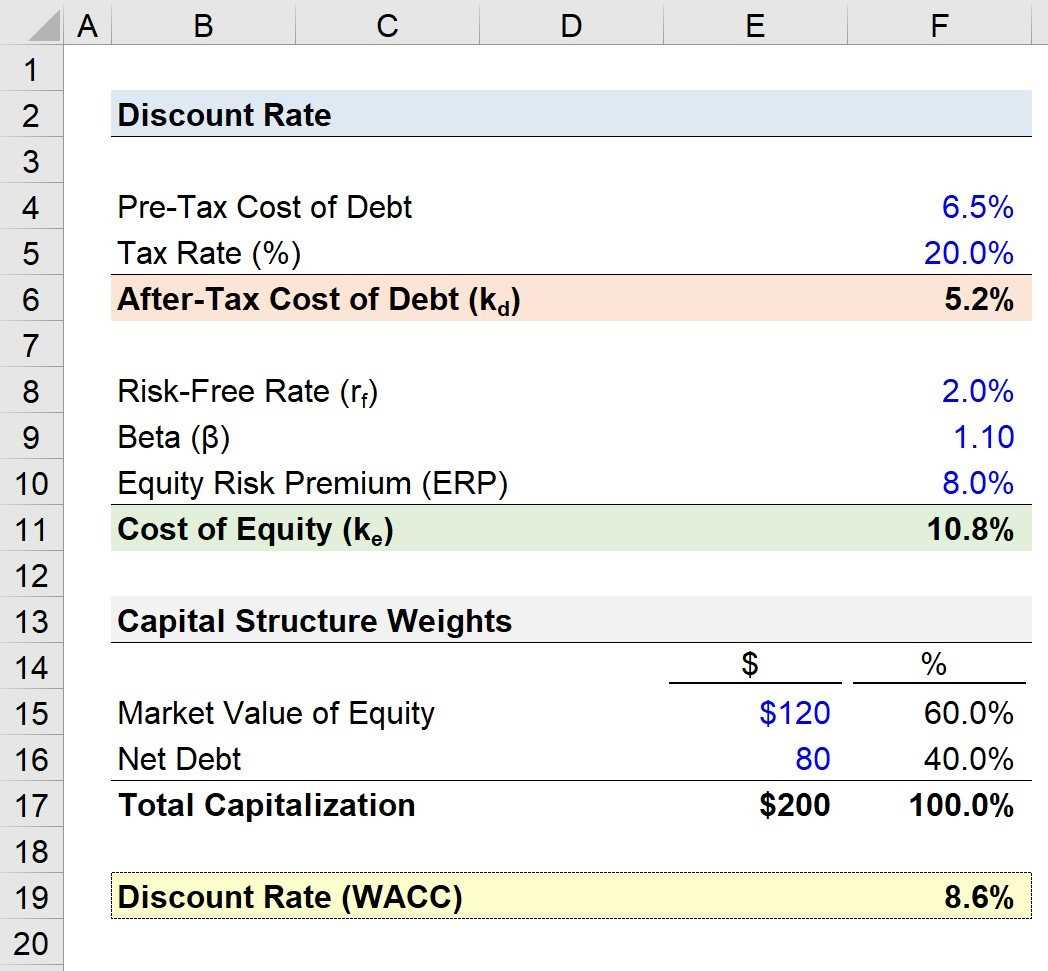

Discount Yield Formula

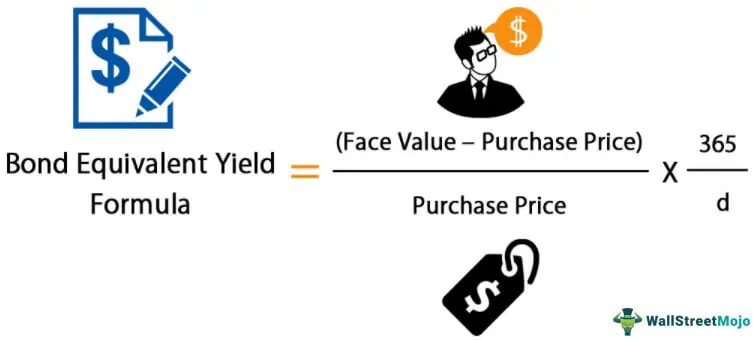

The discount yield formula is used to calculate the yield on a discounted bond or other fixed-income security. It is a measure of the annualized rate of return that an investor can expect to earn by purchasing the bond at a discount to its face value and holding it until maturity.

Formula

The discount yield formula is given by:

| Discount Yield | = |

|---|

Where:

- Discount Yield is the annualized rate of return on the bond.

- Face Value is the nominal value of the bond.

- Purchase Price is the price at which the bond was purchased.

Example

Let’s say you purchase a bond with a face value of $1,000 for $900. To calculate the discount yield, you would use the formula:

| Discount Yield | = | |

|---|---|---|

| = | 0.1 or 10% |

Therefore, the discount yield on the bond is 10%. This means that by purchasing the bond at a discount and holding it until maturity, you can expect to earn an annualized rate of return of 10%.

Meaning and Definition

When a bond is purchased at a price lower than its face value, it is said to be trading at a discount. This discount is essentially the difference between the purchase price and the face value of the bond. The discount yield is calculated by dividing this discount by the face value of the bond and multiplying it by 100 to express it as a percentage.

The discount yield is an important metric for investors as it helps them assess the potential return on their investment in a bond. It allows investors to compare the yields of different bonds and make informed decisions about which bonds to invest in.

Calculation of Discount Yield

The discount yield can be calculated using the following formula:

| Discount Yield Formula |

|---|

Where:

- Face Value is the nominal value of the bond, which is the amount that will be repaid to the bondholder at maturity.

- Purchase Price is the price at which the bond is purchased in the market.

For example, if a bond with a face value of $1,000 is purchased for $950, the discount yield would be calculated as follows:

| Discount Yield Calculation |

|---|

Therefore, the discount yield for this bond would be 5%.

Examples of Discount Yield in BONDS

Discount yield is a measure used to calculate the rate of return on a bond investment. It represents the difference between the face value of a bond and its discounted purchase price. The discount yield formula is commonly used by investors to determine the profitability of a bond investment.

Example 1: Corporate Bond

Let’s consider a corporate bond with a face value of $1,000 and a discounted purchase price of $900. The discount yield can be calculated using the formula:

| Face Value | Purchase Price | Discount Yield |

|---|---|---|

| $1,000 | $900 |

Example 2: Government Bond

Now, let’s consider a government bond with a face value of $10,000 and a discounted purchase price of $9,500. Using the discount yield formula, we can calculate the discount yield as follows:

| Face Value | Purchase Price | Discount Yield |

|---|---|---|

| $10,000 | $9,500 |

Overall, the discount yield formula provides investors with a useful tool for evaluating the profitability of bond investments. By comparing the discount yield of different bonds, investors can make informed decisions about which bonds to invest in based on their expected returns.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.