Gross Leverage Ratio Explained

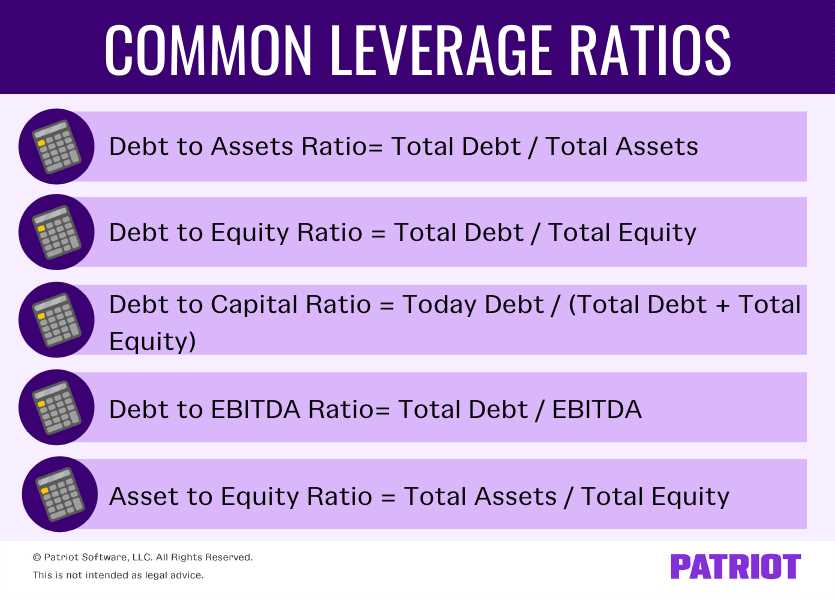

The gross leverage ratio is a financial metric that is used to assess the financial health and risk of a company. It is calculated by dividing the company’s total debt by its total assets. The ratio provides insight into how much debt a company has relative to its assets and can help investors and analysts evaluate the company’s ability to meet its financial obligations.

To calculate the gross leverage ratio, you need to know the company’s total debt and total assets. Total debt includes both short-term and long-term debt, such as loans, bonds, and other financial obligations. Total assets include all of the company’s assets, such as cash, inventory, property, and equipment.

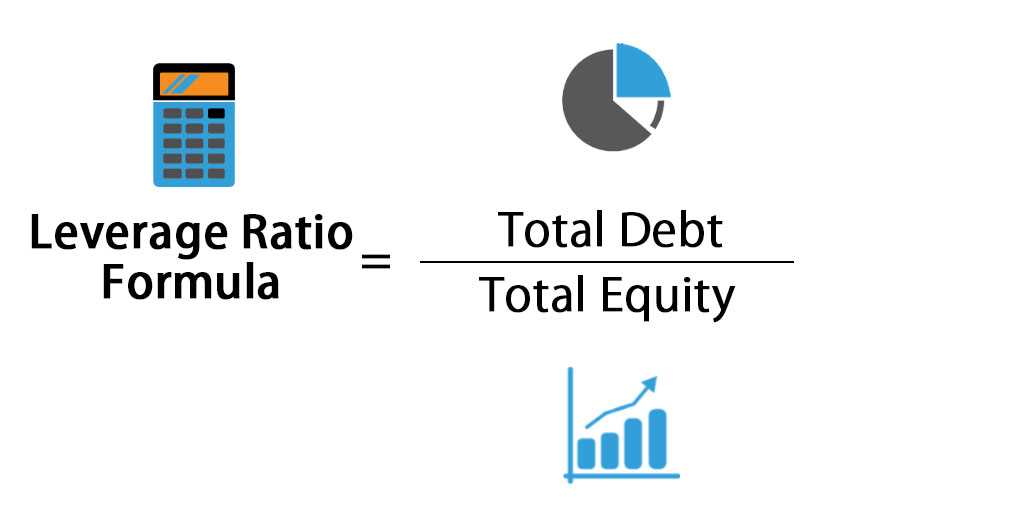

The formula for calculating the gross leverage ratio is:

Gross Leverage Ratio = Total Debt / Total Assets

For example, if a company has $1 million in total debt and $5 million in total assets, the gross leverage ratio would be 0.2, or 20%. This means that the company has $0.20 of debt for every dollar of assets.

The gross leverage ratio is an important metric for investors and lenders because it provides insight into a company’s financial risk. A higher ratio indicates that a company has more debt relative to its assets, which can be a sign of financial instability. On the other hand, a lower ratio suggests that a company has less debt and is in a stronger financial position.

The gross leverage ratio is a financial metric that is used to assess the level of debt a company has taken on in relation to its total assets. It is an important measure for investors and lenders as it provides insight into a company’s financial health and its ability to meet its debt obligations.

Calculation

The gross leverage ratio is calculated by dividing a company’s total debt by its total assets. The formula is as follows:

Gross Leverage Ratio = Total Debt / Total Assets

For example, if a company has $500,000 in total debt and $1,000,000 in total assets, the gross leverage ratio would be:

Gross Leverage Ratio = $500,000 / $1,000,000 = 0.5

This means that the company has a gross leverage ratio of 0.5, indicating that it has taken on debt equal to 50% of its total assets.

Interpretation

The gross leverage ratio provides insight into a company’s financial risk and its ability to handle debt. A higher ratio indicates that a company has taken on a significant amount of debt in relation to its assets, which may increase its financial risk. On the other hand, a lower ratio suggests that a company has a lower level of debt and may be in a better financial position.

Investors and lenders typically use the gross leverage ratio to assess a company’s creditworthiness and determine its ability to repay its debt. A higher ratio may make it more difficult for a company to obtain financing or may result in higher borrowing costs.

Comparison with Industry Peers

Limitations

Conclusion

The gross leverage ratio is an important financial metric that provides insight into a company’s level of debt in relation to its assets. It is used by investors and lenders to assess a company’s financial health and its ability to meet its debt obligations. However, it should be used in conjunction with other financial metrics and industry comparisons to get a complete picture of a company’s financial position.

Calculating Gross Leverage Ratio

The gross leverage ratio is a financial metric that is used to measure the level of debt a company has relative to its total assets. It is an important indicator of a company’s financial health and risk profile. Calculating the gross leverage ratio involves a simple formula:

Gross Leverage Ratio = Total Debt / Total Assets

To calculate the gross leverage ratio, you need to know the company’s total debt and total assets. Total debt includes both short-term and long-term debt, such as bank loans, bonds, and other forms of borrowing. Total assets include all of the company’s assets, such as cash, inventory, property, and equipment.

Once you have the total debt and total assets figures, you can divide the total debt by the total assets to get the gross leverage ratio. For example, if a company has $500,000 in total debt and $1,000,000 in total assets, the gross leverage ratio would be:

Gross Leverage Ratio = $500,000 / $1,000,000 = 0.5

The gross leverage ratio is commonly used by investors, lenders, and analysts to assess the risk associated with a company’s debt levels. A higher gross leverage ratio indicates a higher level of debt and, therefore, a higher level of financial risk. On the other hand, a lower gross leverage ratio indicates a lower level of debt and a lower level of financial risk.

Importance of Gross Leverage Ratio

1. Assessing Financial Stability:

The gross leverage ratio helps assess the financial stability of an insurance company. By comparing the company’s total liabilities to its total assets, the ratio indicates the extent to which the company relies on borrowed funds to finance its operations. A high gross leverage ratio may indicate a higher risk of insolvency or financial distress, while a low ratio suggests a more stable financial position.

2. Evaluating Risk Exposure:

3. Comparing Performance:

The gross leverage ratio allows for the comparison of an insurance company’s performance with its peers. By analyzing the ratio across different companies in the industry, stakeholders can identify outliers and potential areas of concern. This benchmarking helps insurers, regulators, and investors make informed decisions and take appropriate actions to mitigate risks.

4. Regulatory Compliance:

Regulators often use the gross leverage ratio as a key measure of an insurance company’s financial soundness and compliance with regulatory requirements. By monitoring this ratio, regulators can identify companies that may be at risk and take necessary actions to protect policyholders and maintain stability in the insurance market.

5. Investor Confidence:

Application of Gross Leverage Ratio in Corporate Insurance

The gross leverage ratio is an important indicator of an insurance company’s financial strength and risk exposure. A higher ratio indicates a higher level of leverage, which means the company has a greater reliance on borrowed funds. This can increase the company’s vulnerability to market fluctuations and economic downturns.

Insurance regulators and rating agencies closely monitor the gross leverage ratio to assess the financial stability of insurance companies. A high ratio may indicate that the company is taking on excessive risk and may struggle to meet its financial obligations in adverse market conditions. Conversely, a low ratio suggests a more conservative approach to leverage and a stronger financial position.

Insurance professionals use the gross leverage ratio to evaluate the financial health of insurance companies before entering into business relationships or purchasing insurance policies. It helps them assess the company’s ability to honor claims and provide adequate coverage. Investors also consider the ratio when making investment decisions in the insurance industry.

The application of the gross leverage ratio extends beyond assessing financial stability. Insurance companies can use this ratio to benchmark their performance against industry peers. By comparing their ratio to that of competitors, they can identify areas for improvement and implement strategies to enhance their financial position.

Furthermore, the gross leverage ratio can be used as a risk management tool. Insurance companies can set internal limits on the ratio to ensure they maintain a healthy balance between leverage and financial stability. By monitoring the ratio regularly, they can identify potential risks and take proactive measures to mitigate them.

| Benefits of Applying Gross Leverage Ratio in Corporate Insurance: |

|---|

| 1. Assessing financial health and stability |

| 2. Evaluating risk exposure |

| 3. Benchmarking performance |

| 4. Setting risk management limits |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.