Cash-on-Cash Return in Real Estate Calculation and Definition

Cash-on-Cash return is a financial ratio that is commonly used in real estate investing to evaluate the profitability of an investment property. It is a measure of the return on the actual cash invested in the property, rather than the total value of the property.

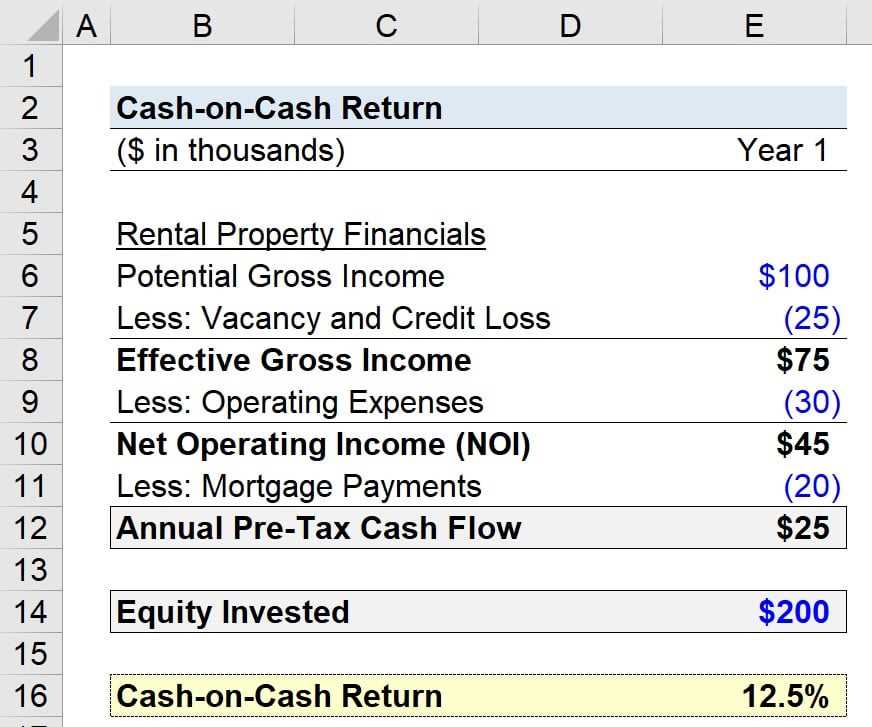

To calculate the cash-on-cash return, you need to know the amount of cash invested in the property and the annual cash flow generated by the property. The formula for calculating the cash-on-cash return is:

Cash-on-Cash Return = Annual Cash Flow / Cash Invested

The cash-on-cash return is expressed as a percentage, which represents the annual return on the cash invested in the property. A higher cash-on-cash return indicates a more profitable investment.

Calculating the cash-on-cash return is relatively simple. You need to determine the amount of cash invested in the property, which includes the down payment, closing costs, and any other upfront expenses. Then, you need to calculate the annual cash flow generated by the property, which is the net operating income minus any expenses such as property taxes, insurance, and maintenance costs.

There are several factors that can affect the cash-on-cash return. These include the property’s rental income, expenses, financing costs, and vacancy rates. It is important to consider these factors when evaluating the potential return on an investment property.

Cash-on-Cash return is a financial metric used in real estate investment analysis to evaluate the profitability of an investment property. It measures the annual return on the actual cash invested in the property, taking into account both the income generated and the expenses incurred.

To understand cash-on-cash return, it is important to know the components involved in its calculation. The numerator of the ratio is the annual cash flow, which is the difference between the property’s gross income and its operating expenses. The denominator is the total cash invested, which includes the down payment, closing costs, and any other upfront expenses.

The cash-on-cash return formula is as follows:

| Cash-on-Cash Return | = | (Annual Cash Flow / Total Cash Invested) * 100% |

For example, if an investor purchases a rental property for $200,000 and puts down a $40,000 down payment, resulting in a total cash investment of $50,000 after closing costs and other expenses, and the property generates an annual cash flow of $10,000, the cash-on-cash return would be calculated as follows:

| Cash-on-Cash Return | = | ($10,000 / $50,000) * 100% | = | 20% |

A cash-on-cash return of 20% means that for every dollar invested, the investor is earning a 20% return on their investment. This metric helps investors compare the profitability of different investment properties and make informed decisions.

Importance of Cash-on-Cash Return in Real Estate

Cash-on-Cash return is a crucial metric in the real estate industry that helps investors evaluate the profitability of their investment. It measures the annual return on the actual cash invested in a property, taking into account both the income generated and the expenses incurred.

There are several reasons why cash-on-cash return is important in real estate:

1. Assessing Investment Performance

Cash-on-Cash return allows investors to assess the performance of their investment property and compare it to other investment opportunities. By calculating this ratio, investors can determine whether their property is generating a satisfactory return on their invested capital.

2. Evaluating Risk and Return

Cash-on-Cash return helps investors evaluate the risk and return profile of a real estate investment. A higher cash-on-cash return indicates a higher return relative to the amount of cash invested, which can be an attractive factor for investors seeking higher returns. On the other hand, a lower cash-on-cash return may indicate a higher level of risk or lower profitability.

3. Making Informed Investment Decisions

By considering the cash-on-cash return, investors can make more informed investment decisions. They can compare different properties or investment opportunities and choose the one that offers the highest cash-on-cash return. This metric helps investors prioritize their investment options and allocate their capital effectively.

4. Monitoring Property Performance

Cash-on-Cash return is also a valuable tool for monitoring the ongoing performance of a property. By regularly calculating this ratio, investors can track the changes in their investment’s profitability over time. If the cash-on-cash return decreases significantly, it may indicate issues such as rising expenses or declining rental income, prompting the investor to take appropriate action.

5. Attracting Financing

When seeking financing for a real estate investment, cash-on-cash return is often considered by lenders. A higher cash-on-cash return demonstrates the property’s ability to generate sufficient income to cover expenses and debt service, making it more attractive to lenders. This metric can increase the chances of obtaining favorable financing terms.

Calculating Cash-on-Cash Return

The cash-on-cash return is a financial ratio that measures the annual return on investment (ROI) of a real estate property. It is a useful tool for investors to evaluate the profitability of a potential investment. To calculate the cash-on-cash return, you need to follow these steps:

Step 1: Determine the Cash Flow

First, you need to calculate the annual cash flow generated by the property. This can be done by subtracting the property’s expenses (such as property taxes, insurance, maintenance costs, and management fees) from its annual rental income. The resulting amount represents the net operating income (NOI) of the property.

Step 2: Calculate the Cash Invested

Next, you need to determine the total cash invested in the property. This includes the down payment, closing costs, and any additional expenses incurred during the purchase. The resulting amount represents the initial investment.

Step 3: Divide the Cash Flow by the Cash Invested

Finally, divide the annual cash flow (NOI) by the initial investment to calculate the cash-on-cash return. Multiply the result by 100 to express it as a percentage.

For example, let’s say you purchased a rental property for $200,000. After accounting for all expenses, the property generates an annual cash flow of $20,000. The cash-on-cash return would be calculated as follows:

Cash-on-Cash Return = ($20,000 / $200,000) x 100 = 10%

This means that for every dollar invested in the property, you would receive a 10% return on your investment annually.

Interpreting Cash-on-Cash Return

The cash-on-cash return is expressed as a percentage and represents the annual return on the actual cash invested in a property. It takes into account the initial investment, including the down payment, closing costs, and any other upfront expenses.

High Cash-on-Cash Return

A high cash-on-cash return indicates that the property is generating a significant return on the cash invested. This is a positive sign for investors, as it suggests that the property is generating substantial income relative to the initial investment.

Investors often aim for a high cash-on-cash return to maximize their profits and mitigate risks. A high return can provide a cushion for unexpected expenses, vacancies, or economic downturns.

Low Cash-on-Cash Return

A low cash-on-cash return may indicate that the property is not generating sufficient income compared to the initial investment. This could be a red flag for investors, as it suggests that the property may not be as profitable or financially viable as initially anticipated.

Investors should carefully evaluate properties with low cash-on-cash returns and consider the potential risks and challenges they may face. It may be necessary to reassess the investment strategy or explore ways to increase the property’s income potential.

Conclusion

Investors should aim for a high cash-on-cash return, indicating that the property is generating a significant return on the cash invested. However, a low cash-on-cash return should be carefully evaluated, as it may indicate potential challenges or risks.

Ultimately, investors should consider the cash-on-cash return in conjunction with other financial metrics and factors affecting the investment to make well-rounded and informed decisions.

Factors Affecting Cash-on-Cash Return

1. Property Financing

The financing structure of a property plays a vital role in determining the CoC return. The interest rate, loan terms, and down payment amount directly impact the cash flow generated from the investment. Higher interest rates or larger down payments can decrease the CoC return, while favorable loan terms can increase it.

2. Operating Expenses

Operating expenses, such as property management fees, maintenance costs, insurance, and property taxes, can have a significant impact on the CoC return. Higher expenses reduce the net operating income, which in turn lowers the CoC return. Investors should carefully analyze and estimate these expenses to ensure they align with their investment goals.

3. Rental Income

The rental income generated by the property directly affects the CoC return. Higher rental income leads to a higher cash flow, resulting in a higher CoC return. Factors such as location, market demand, rental rates, and occupancy rates influence the rental income. Investors should consider these factors when evaluating the potential CoC return of a property.

4. Property Appreciation

Property appreciation refers to the increase in the value of the property over time. While CoC return focuses on the cash flow generated, property appreciation can significantly impact the overall return on investment. A property with higher appreciation potential can provide a higher total return, including both cash flow and capital appreciation.

5. Market Conditions

The overall real estate market conditions can affect the CoC return. Factors such as supply and demand dynamics, interest rates, economic stability, and local market trends play a crucial role. In a competitive market with high demand, rental rates may increase, resulting in a higher CoC return. Conversely, market downturns or oversupply can negatively impact the CoC return.

6. Exit Strategy

The chosen exit strategy for the investment can impact the CoC return. Different strategies, such as long-term rental, fix-and-flip, or short-term rentals, have varying levels of risk and return potential. The timing and method of selling the property can also influence the CoC return. Investors should consider their investment goals and risk tolerance when selecting an exit strategy.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.