Option Premium Definition

An option premium is the price that an investor pays to purchase an option contract. It is the cost of buying the right, but not the obligation, to buy or sell an underlying asset at a specific price within a specific time period.

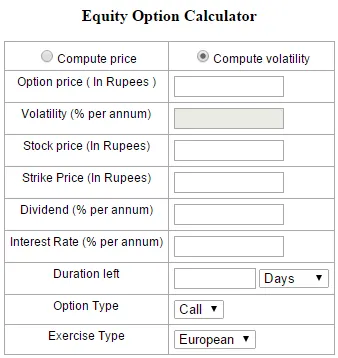

The option premium is determined by various factors, including:

| 1. Underlying Asset Price | The current price of the underlying asset affects the option premium. If the asset price is higher than the strike price (for a call option) or lower than the strike price (for a put option), the option will have a higher premium. |

| 2. Strike Price | The strike price is the price at which the underlying asset can be bought or sold. The difference between the strike price and the current price of the asset also affects the option premium. A larger difference will result in a higher premium. |

| 3. Time to Expiration | |

| 4. Volatility | |

| 5. Interest Rates | Interest rates also affect option premiums. Higher interest rates increase the cost of carrying the underlying asset, leading to higher premiums. |

Example: Let’s say an investor wants to purchase a call option on a stock with a current price of $50. The strike price is $55, and the option expires in 3 months. The volatility of the stock is high, and interest rates are low. All these factors will contribute to a higher option premium.

Factors Affecting Pricing of Option Premium

1. Underlying Asset Price

The price of the underlying asset is one of the most significant factors affecting the pricing of an option premium. If the price of the underlying asset is expected to increase, the option premium will also increase. Conversely, if the price of the underlying asset is expected to decrease, the option premium will decrease as well.

2. Time to Expiration

3. Volatility

Volatility refers to the degree of price fluctuations in the underlying asset. Higher volatility increases the chances of the option reaching its strike price and becoming profitable. As a result, options on highly volatile assets tend to have higher premiums compared to options on less volatile assets.

4. Interest Rates

Interest rates also play a role in determining the pricing of option premiums. Higher interest rates increase the cost of carrying the underlying asset, which in turn increases the option premium. Conversely, lower interest rates decrease the cost of carrying the underlying asset and result in lower option premiums.

5. Dividends

If the underlying asset pays dividends, it can affect the pricing of the option premium. When a dividend is paid, the price of the underlying asset typically decreases, which in turn decreases the option premium. This is because the chances of the option being profitable decrease when the price of the underlying asset decreases.

By considering these factors, investors can better understand the pricing of option premiums and make informed decisions when trading options and derivatives.

Example of Option Premium

Let’s consider an example to understand how option premium works. Suppose you are interested in buying a call option on a stock. The current price of the stock is $100, and the strike price of the option is $110. The expiration date of the option is one month from now.

Based on the current market conditions and various factors affecting option pricing, the option premium is determined to be $5. This means that you would need to pay $500 (5 * 100 shares) to purchase the call option.

Now, let’s explore the potential outcomes of this trade:

| Stock Price at Expiration | Profit/Loss |

|---|---|

| $90 | -$500 |

| $100 | -$500 |

| $110 | $0 |

| $120 | $500 |

| $130 | $500 |

If the stock price at expiration is below the strike price of $110, the call option would expire worthless, and you would lose the entire premium of $500. However, if the stock price exceeds the strike price, you would start making a profit. For every dollar the stock price increases above $110, your profit would increase by $100 (100 shares * $1).

Options and Derivatives

Options and derivatives are financial instruments that allow investors to speculate on the price movements of underlying assets without actually owning them. They provide a way to manage risk and potentially earn profits in volatile markets.

What are Options?

An option is a contract that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time period. There are two types of options: call options and put options. A call option gives the holder the right to buy the asset, while a put option gives the holder the right to sell the asset.

Options are often used as a hedging tool, allowing investors to protect their portfolios from adverse price movements. They can also be used for speculative purposes, as traders can profit from price fluctuations without owning the underlying asset.

What are Derivatives?

Derivatives are financial contracts whose value is derived from an underlying asset. They can be used to speculate on the price movements of various assets, including stocks, bonds, commodities, and currencies. Some common types of derivatives include futures contracts, forward contracts, and swaps.

Benefits and Risks

Options and derivatives offer several benefits to investors. They provide a way to diversify portfolios and manage risk, as well as potentially earn profits in both rising and falling markets. They also offer leverage, allowing investors to control a larger position with a smaller amount of capital.

Conclusion

Options and derivatives are powerful financial instruments that offer opportunities for investors to manage risk and potentially earn profits. However, they also come with risks and complexities that require careful consideration. It is important for investors to educate themselves and seek professional advice before engaging in options and derivatives trading.

Options and Derivatives

Options and derivatives are financial instruments that give investors the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time period. These instruments are commonly used in financial markets for hedging, speculation, and arbitrage purposes.

Derivatives, on the other hand, are financial contracts whose value is derived from an underlying asset. They can be used to speculate on the future price movements of the underlying asset or to hedge against potential losses. Derivatives can be traded on exchanges or over-the-counter (OTC) and include options, futures, forwards, and swaps.

Options and derivatives are priced based on several factors, including the current price of the underlying asset, the strike price, the time remaining until expiration, the volatility of the underlying asset, and the prevailing interest rates. These factors can impact the premium, or price, of the option or derivative.

Investors use options and derivatives for various purposes. Some use them to hedge their portfolios against potential losses, while others use them to speculate on the future direction of the market. Options and derivatives can also be used for arbitrage opportunities, where traders take advantage of price discrepancies between different markets or instruments.

Overall, options and derivatives play a crucial role in financial markets, providing investors with the flexibility to manage risk, speculate on market movements, and capitalize on arbitrage opportunities. However, it is important for investors to understand the risks and complexities associated with these instruments before trading them.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.