What is Weighted Average Maturity (WAM)?

Weighted Average Maturity (WAM) is a financial term used to measure the average time it takes for the principal balance of a mortgage-backed security (MBS) to be repaid. It is an important metric for investors and lenders in the mortgage market as it provides insight into the expected duration of cash flows from the MBS.

Definition and Calculation

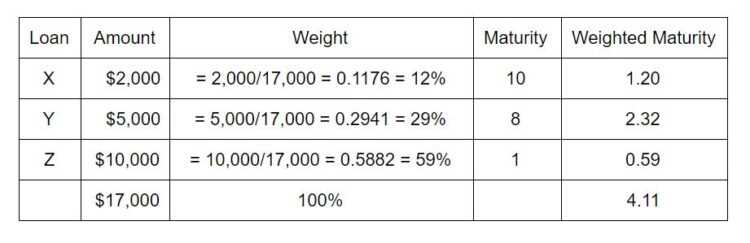

Weighted Average Maturity (WAM) is calculated by multiplying the time to maturity of each individual mortgage loan in the MBS pool by the proportion of the total principal balance that loan represents. These weighted values are then summed to determine the overall average maturity of the MBS.

For example, if a mortgage loan has a remaining term of 10 years and represents 20% of the total principal balance, its weighted maturity would be 2 years (10 years * 20% = 2 years). This calculation is performed for each loan in the MBS pool, and the weighted maturities are added together to obtain the WAM.

The WAM is expressed in years and provides an estimate of the average time it will take for investors to receive the principal payments from the MBS. A higher WAM indicates a longer average maturity and, therefore, a longer duration of cash flows.

In the context of mortgage-backed securities, the WAM is a crucial metric for investors and lenders. It helps them assess the risk and potential return of investing in a particular MBS. A higher WAM implies a longer duration, which means investors will have to wait longer to receive their principal payments.

Lenders also consider the WAM when originating mortgage loans and creating MBSs. They aim to match the maturity of the MBS with the expected duration of the underlying mortgage loans. This helps ensure a more stable and predictable cash flow for investors.

How is WAM Calculated?

The calculation of WAM involves determining the time to maturity for each individual mortgage loan in the MBS pool and weighting it by the proportion of the loan’s principal balance. This process is typically performed using specialized software or financial models.

First, the remaining term of each loan is determined by subtracting the current age of the loan from its original term. Then, the weighted maturity for each loan is calculated by multiplying the remaining term by the loan’s proportion of the total principal balance.

Finally, the weighted maturities are summed to obtain the overall WAM for the MBS. This calculation provides investors and lenders with a valuable measure of the average time it will take for the principal balance of the MBS to be repaid.

Importance of Weighted Average Maturity (WAM) in Mortgage-Backed Securities

The WAM is an essential metric in the mortgage-backed securities market as it helps investors and lenders assess the risk and expected duration of cash flows. It provides valuable information about the average time it will take for investors to receive their principal payments.

By considering the WAM, investors can make informed decisions about their investment strategies and risk tolerance. Lenders can also use the WAM to structure MBSs that align with the expected duration of the underlying mortgage loans, ensuring a more predictable cash flow for investors.

In summary, the WAM is a key measure in the mortgage market that provides insight into the average time it will take for the principal balance of a mortgage-backed security to be repaid. It is an important consideration for investors and lenders in assessing risk and expected cash flows.

Definition and Calculation

The Weighted Average Maturity (WAM) is a financial metric used in the context of mortgage-backed securities (MBS) to measure the average time until the principal of the underlying mortgages is expected to be repaid. It is a crucial factor in assessing the risk and performance of MBS investments.

To calculate the WAM, each mortgage within the MBS pool is assigned a weight based on its outstanding principal balance. The weight represents the proportion of the total pool balance that the mortgage contributes. The maturity of each mortgage is then multiplied by its weight, and the sum of these weighted maturities is divided by the total outstanding balance of the pool.

The formula for calculating the Weighted Average Maturity is as follows:

WAM = (M1 * W1 + M2 * W2 + … + Mn * Wn) / (W1 + W2 + … + Wn)

Where:

- WAM = Weighted Average Maturity

- M1, M2, …, Mn = Maturities of individual mortgages

- W1, W2, …, Wn = Weights of individual mortgages

The result of this calculation is expressed in months or years, depending on the preference of the investor or analyst.

The WAM provides valuable insights into the expected cash flow patterns of the MBS. A shorter WAM indicates that the mortgages within the pool are expected to be repaid sooner, leading to a faster return of principal to the investors. Conversely, a longer WAM suggests a longer duration until the principal is repaid.

Investors use the WAM to assess the prepayment risk associated with MBS investments. When interest rates decrease, homeowners tend to refinance their mortgages, resulting in higher prepayment rates. A lower WAM indicates a higher likelihood of prepayments, which can impact the expected cash flows and returns of MBS investments.

Furthermore, the WAM is also used to evaluate the interest rate risk of MBS. When interest rates rise, the duration of the mortgages within the pool becomes longer, leading to a higher WAM. This indicates that the MBS may experience greater price volatility in response to interest rate fluctuations.

In summary, the Weighted Average Maturity (WAM) is a crucial metric in the analysis of mortgage-backed securities. It provides insights into the expected repayment timeline of the underlying mortgages, helping investors assess the risk and performance of MBS investments.

Weighted Average Maturity (WAM) is a key metric used in the mortgage industry to assess the average time it takes for a pool of mortgage loans to fully mature or be paid off. It is an important measure for investors and lenders as it helps them understand the risk and cash flow dynamics associated with a mortgage-backed security (MBS) or a pool of mortgages.

Definition and Calculation

WAM is calculated by multiplying the outstanding principal balance of each mortgage loan in a pool by the remaining term of the loan, and then summing up these values for all loans in the pool. The resulting sum is divided by the total outstanding principal balance of the pool to get the weighted average maturity.

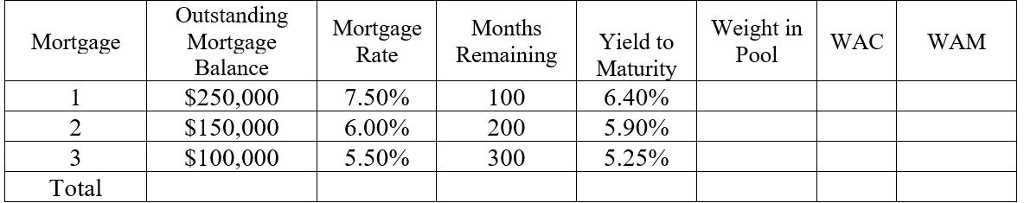

For example, let’s consider a pool of mortgage loans with three loans:

- Loan 1: Outstanding principal balance of $100,000 and remaining term of 20 years

- Loan 2: Outstanding principal balance of $150,000 and remaining term of 15 years

- Loan 3: Outstanding principal balance of $200,000 and remaining term of 30 years

To calculate the WAM for this pool, we would multiply the outstanding principal balance of each loan by its remaining term:

- Loan 1: $100,000 * 20 = $2,000,000

- Loan 2: $150,000 * 15 = $2,250,000

- Loan 3: $200,000 * 30 = $6,000,000

Next, we sum up these values: $2,000,000 + $2,250,000 + $6,000,000 = $10,250,000

WAM = $10,250,000 / $450,000 = 22.78 years

Therefore, the weighted average maturity for this pool of mortgage loans is approximately 22.78 years.

How is WAM Calculated?

The calculation of Weighted Average Maturity (WAM) is an important metric in the context of [MORTGAGE catname]. It provides insight into the average time it takes for the principal of a mortgage-backed security (MBS) to be repaid.

Step 1: Determine the Principal Amount

To calculate WAM, you first need to determine the principal amount of the MBS. This is the total amount of money that was initially borrowed through the mortgage loans that make up the security.

Step 2: Assign Weights to Each Mortgage Loan

Next, you need to assign weights to each individual mortgage loan within the MBS. The weight represents the proportion of the total principal amount that each loan contributes to the security. The weight is calculated by dividing the principal amount of each loan by the total principal amount of the MBS.

Step 3: Calculate the Weighted Average Time to Maturity

Once the weights have been assigned, you can calculate the weighted average time to maturity. This is done by multiplying the time to maturity for each loan by its corresponding weight and summing up these values for all the loans within the MBS.

For example, if a mortgage loan has a time to maturity of 10 years and contributes 20% to the total principal amount, its weighted time to maturity would be 10 years multiplied by 0.2, which equals 2 years.

Step 4: Interpret the WAM

The resulting weighted average maturity provides valuable information about the expected repayment timeline of the MBS. A higher WAM indicates that the principal of the MBS will take longer to be repaid, while a lower WAM suggests a shorter repayment timeline.

Investors and analysts use WAM as a tool to assess the risk and potential return of investing in a particular MBS. It helps them understand the average time it will take for the principal to be repaid, which can impact the cash flow and profitability of the investment.

Overall, the calculation of WAM is a crucial step in evaluating the characteristics and performance of mortgage-backed securities in the context of [MORTGAGE catname]. It provides valuable insights into the expected repayment timeline and helps inform investment decisions.

Importance of Weighted Average Maturity (WAM) in Mortgage Investments

The Weighted Average Maturity (WAM) is a crucial metric in the context of mortgage investments. It helps investors understand the average time it takes for the principal of a mortgage-backed security (MBS) to be repaid. This information is vital for investors as it allows them to assess the risk and potential returns associated with investing in a particular MBS.

One of the main reasons why WAM is important is because it provides insight into the prepayment risk of a mortgage investment. Prepayment risk refers to the possibility that borrowers will pay off their mortgages earlier than expected, which can impact the cash flows and returns of MBS investors. By knowing the WAM, investors can gauge the likelihood of prepayments and adjust their investment strategies accordingly.

Furthermore, WAM is also used to assess the interest rate risk of mortgage investments. Interest rate risk refers to the potential impact of changes in interest rates on the value of MBS. When interest rates rise, borrowers are less likely to refinance their mortgages, resulting in longer WAMs. Conversely, when interest rates fall, borrowers are more likely to refinance, leading to shorter WAMs. By monitoring the WAM, investors can anticipate the effects of interest rate changes on their investments.

Additionally, WAM is crucial for portfolio management purposes. It allows investors to diversify their mortgage investments by considering the WAMs of different MBS. By investing in MBS with varying WAMs, investors can spread their risk and potentially enhance their overall portfolio performance.

Lastly, WAM is used by rating agencies and regulators to assess the creditworthiness and risk profiles of MBS. A shorter WAM indicates a higher likelihood of prepayments, which can impact the cash flows and credit quality of MBS. Rating agencies and regulators consider the WAM when assigning ratings and determining regulatory capital requirements for MBS issuers.

| Benefits of WAM in Mortgage Investments |

|---|

| 1. Assessing prepayment risk |

| 2. Evaluating interest rate risk |

| 3. Portfolio diversification |

| 4. Creditworthiness assessment |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.