Mortgage Originator: Definition, What It Does, Types

A mortgage originator is a professional who helps individuals and businesses secure financing for purchasing a property. They act as intermediaries between borrowers and lenders, assisting in the loan application process and ensuring that all necessary documents and requirements are met.

There are different types of mortgage originators, each specializing in a specific area of the mortgage industry:

- Bank Mortgage Originators: These are professionals who work directly for banks and financial institutions. They have access to a wide range of loan products and can offer competitive interest rates.

- Independent Mortgage Brokers: These are individuals or companies that are not affiliated with any specific lender. They have the flexibility to shop around and find the best loan options for their clients.

- Online Mortgage Originators: With the rise of technology, there are now online platforms that connect borrowers with lenders. These platforms streamline the loan application process and provide a convenient way to secure financing.

Regardless of the type of mortgage originator, their main role is to guide borrowers through the mortgage process. They help borrowers understand their options, gather the necessary documentation, and submit the loan application on their behalf.

Using a mortgage originator offers several benefits. They have in-depth knowledge of the mortgage industry and can provide valuable advice and guidance. They can also save borrowers time and effort by handling the paperwork and negotiations with lenders.

When choosing a mortgage originator, it is important to consider their experience, reputation, and the range of loan products they offer. It is also recommended to compare interest rates and fees to ensure the best deal.

Definition of Mortgage Originator

A mortgage originator is a financial professional or institution that helps individuals and businesses secure mortgage loans. They act as intermediaries between borrowers and lenders, facilitating the loan application process and ensuring that all necessary documentation is completed accurately and in a timely manner.

Responsibilities of a Mortgage Originator

The main responsibilities of a mortgage originator include:

- Educating borrowers about the mortgage process and available loan options

- Assisting borrowers in completing loan applications and gathering necessary documentation

- Evaluating borrowers’ financial information and credit history to determine loan eligibility

- Presenting loan options to borrowers and explaining the terms and conditions

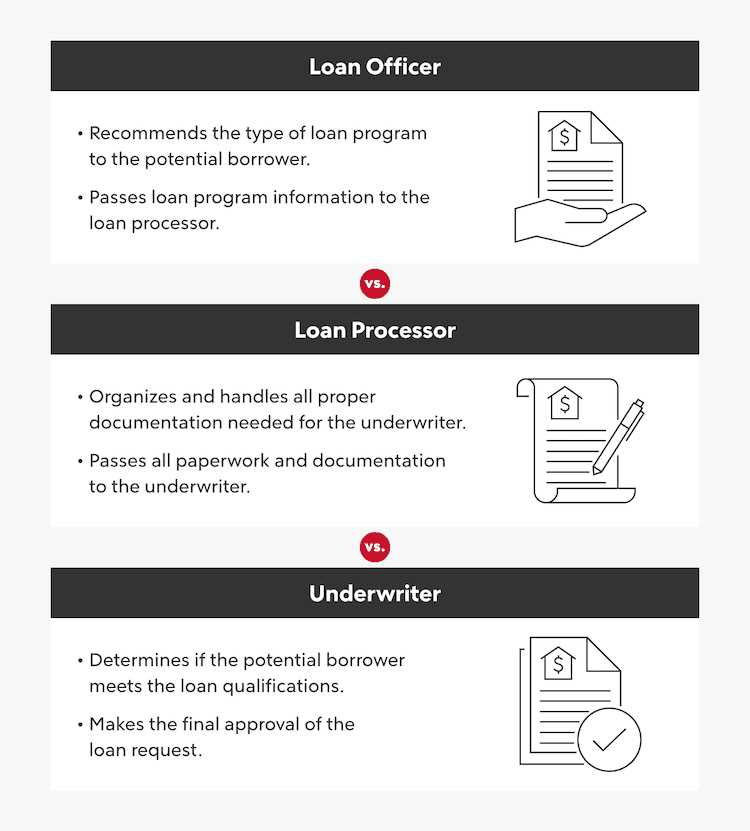

- Submitting loan applications to lenders and coordinating the underwriting process

- Communicating with borrowers, lenders, and other parties involved to ensure a smooth loan closing

- Adhering to all applicable laws, regulations, and ethical standards

Overall, mortgage originators play a crucial role in the mortgage industry by helping individuals and businesses navigate the complex process of obtaining a mortgage loan. Their expertise and guidance can make a significant difference in finding the right loan and securing favorable terms.

Role of Mortgage Originator

A mortgage originator plays a crucial role in the home buying process. They act as a middleman between the borrower and the lender, helping borrowers secure a mortgage loan that suits their needs and financial situation.

The role of a mortgage originator involves several key responsibilities:

Evaluating Borrower’s Financial Situation:

A mortgage originator assesses the borrower’s financial situation, including their income, credit history, and debt-to-income ratio. This evaluation helps them determine the type and amount of mortgage loan the borrower can qualify for.

Assisting with Loan Application:

The mortgage originator guides the borrower through the loan application process, helping them gather the necessary documents and complete the application accurately. They ensure that all required information is provided to the lender for underwriting.

Shopping for the Best Loan:

The mortgage originator has access to a variety of loan products from different lenders. They help the borrower compare and select the best loan option based on interest rates, terms, and fees. This ensures that the borrower gets the most favorable terms for their mortgage.

Negotiating with Lenders:

The mortgage originator negotiates with lenders on behalf of the borrower to secure the best possible terms. They leverage their relationships with lenders to obtain competitive interest rates and favorable loan terms, saving the borrower money over the life of the loan.

Managing the Loan Process:

Throughout the loan process, the mortgage originator acts as a liaison between the borrower, lender, and other parties involved, such as appraisers and title companies. They ensure that all necessary documentation is provided and deadlines are met, keeping the process on track and minimizing delays.

In summary, the role of a mortgage originator is to guide borrowers through the mortgage loan process, evaluate their financial situation, assist with the loan application, shop for the best loan options, negotiate with lenders, and manage the loan process from start to finish. Their expertise and support are invaluable in helping borrowers navigate the complex world of mortgage lending.

Types of Mortgage Originators

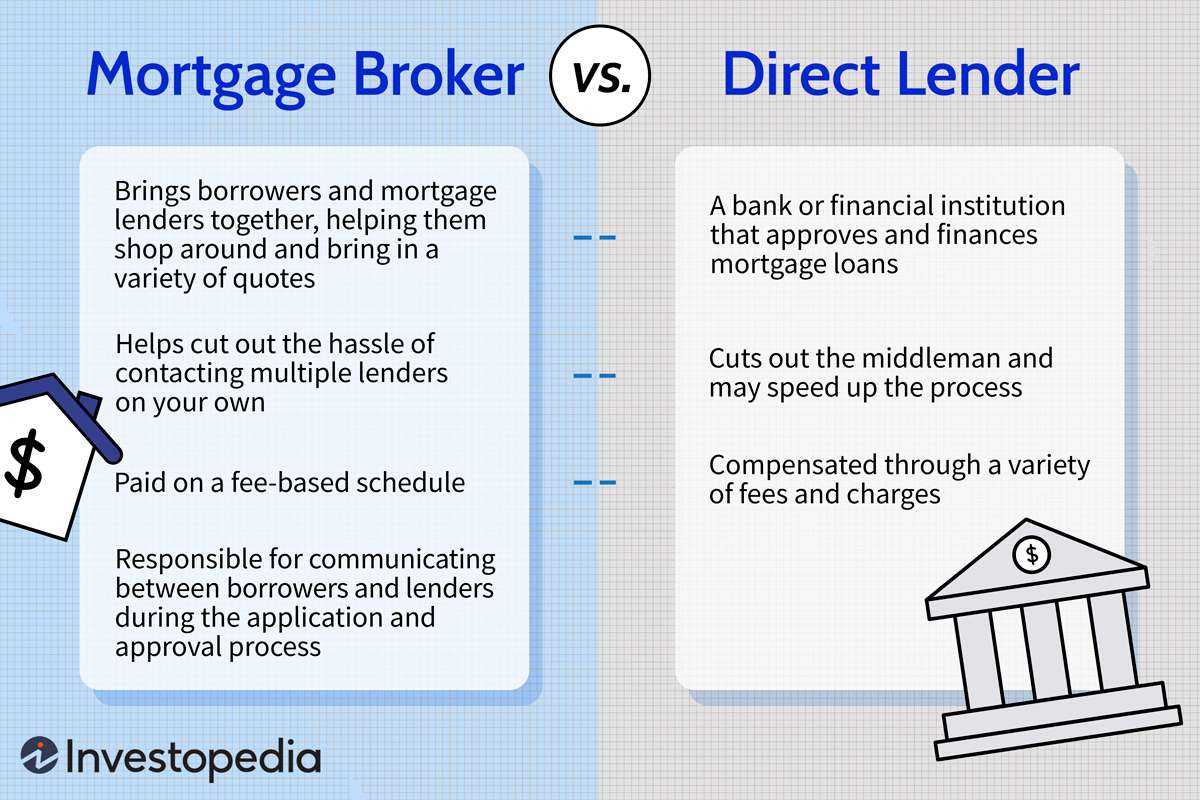

1. Mortgage Brokers

Mortgage brokers are independent professionals who work with multiple lenders to find the best mortgage options for their clients. They act as intermediaries between borrowers and lenders, helping borrowers navigate the mortgage process and negotiate favorable terms. Mortgage brokers have access to a wide range of mortgage products and can offer personalized advice based on the borrower’s financial situation.

2. Mortgage Bankers

Mortgage bankers are employees of a specific lending institution, such as a bank or credit union. They work directly for the lender and are responsible for guiding borrowers through the mortgage process. Mortgage bankers have in-depth knowledge of their institution’s mortgage products and can provide expert guidance and assistance. They can also help borrowers with the loan application and approval process.

3. Direct Lenders

Direct lenders are financial institutions that originate and fund mortgages directly to borrowers. They do not rely on intermediaries like mortgage brokers or bankers. Direct lenders can offer competitive interest rates and fees because they eliminate the need for a middleman. Borrowers who prefer a streamlined mortgage process and want to work directly with the lender may choose a direct lender.

4. Online Lenders

Online lenders are a relatively new type of mortgage originator that operate exclusively online. They offer a convenient and streamlined application process, often with fast approval times. Online lenders may have lower overhead costs compared to traditional lenders, which can result in competitive interest rates and fees. Borrowers who prefer a digital mortgage experience and value convenience may opt for an online lender.

| Type of Mortgage Originator | Advantages |

|---|---|

| Mortgage Brokers |

|

| Mortgage Bankers |

|

| Direct Lenders |

|

| Online Lenders |

|

Benefits of Using a Mortgage Originator

1. Expertise: Mortgage originators are professionals who specialize in the mortgage industry. They have extensive knowledge and experience in navigating the complex mortgage process. They can provide guidance and advice tailored to your specific financial situation.

2. Access to Multiple Lenders: Mortgage originators have access to a wide network of lenders, including banks, credit unions, and mortgage companies. This allows them to shop around and find the best mortgage rates and terms for you. They can save you time and effort by doing the research and negotiating on your behalf.

3. Personalized Service: Mortgage originators work closely with you to understand your financial goals and needs. They take the time to explain the mortgage options available to you and help you choose the one that best fits your situation. They can also assist with the paperwork and ensure that all the necessary documents are completed accurately and on time.

4. Faster Approval Process: Mortgage originators are familiar with the mortgage application process and can help streamline it for you. They know what documents and information are required by lenders and can help you gather everything you need. This can help speed up the approval process and increase your chances of getting approved for a mortgage.

5. Cost Savings: Mortgage originators can potentially save you money in several ways. They can help you find a mortgage with a lower interest rate, which can result in significant savings over the life of the loan. They can also help you avoid costly mistakes and ensure that you are getting the best deal possible.

6. Peace of Mind: Working with a mortgage originator can provide peace of mind throughout the mortgage process. You can rely on their expertise and guidance to make informed decisions. They can answer your questions, address your concerns, and provide support every step of the way.

How to Choose a Mortgage Originator

Choosing the right mortgage originator is a crucial step in the home buying process. Here are some important factors to consider when making your decision:

1. Experience: Look for a mortgage originator with a proven track record of success. Ask about their years of experience in the industry and their knowledge of the local market.

2. Reputation: Research the mortgage originator’s reputation by reading online reviews and asking for references. A good mortgage originator will have positive feedback from satisfied clients.

3. Communication: Effective communication is key when working with a mortgage originator. Make sure they are responsive to your questions and concerns, and that they keep you informed throughout the loan process.

5. Services Offered: Consider the range of services offered by the mortgage originator. Do they specialize in certain types of loans? Can they assist with pre-approval or refinancing? Choose an originator who can meet your specific needs.

7. Personal Connection: Trust and rapport are important when working with a mortgage originator. Choose someone who you feel comfortable with and who understands your financial goals and needs.

By carefully considering these factors, you can choose a mortgage originator who will guide you through the loan process and help you secure the best mortgage terms for your needs.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.