What is Shareholder Value?

Shareholder value refers to the financial worth that a company generates for its shareholders. It is a measure of how well a company is performing and creating value for its owners. Shareholder value can be calculated by considering the company’s profitability, cash flow, and the return on investment for shareholders.

Definition and Calculation

Shareholder value is calculated by subtracting the company’s total liabilities from its total assets. This gives the shareholders’ equity, which represents the value that shareholders have in the company. The shareholder value can also be calculated by dividing the company’s net income by the number of outstanding shares. This gives the earnings per share, which is a measure of how much profit each shareholder is entitled to.

Another way to calculate shareholder value is by considering the company’s stock price and dividends. The stock price represents the market value of the company, and if it increases over time, it indicates that the company is creating value for its shareholders. Dividends, on the other hand, are the portion of the company’s profits that are distributed to shareholders. If the company pays regular and increasing dividends, it is a sign of shareholder value.

Importance of Shareholder Value

Shareholder value is important because it reflects the success and profitability of a company. When a company generates value for its shareholders, it attracts more investors and increases its market capitalization. This, in turn, allows the company to raise more capital and invest in growth opportunities. Shareholder value also influences the company’s stock price, which affects the wealth of its shareholders.

Moreover, shareholder value is a key metric that is used by investors and financial analysts to evaluate the performance of a company. It helps them make informed investment decisions and compare different companies in the same industry. By focusing on maximizing shareholder value, companies can attract more investors and create long-term sustainable growth.

Overall, shareholder value is crucial for the success and growth of a company. It represents the financial worth that a company generates for its shareholders and is a key measure of its performance and profitability.

Definition and Calculation of Shareholder Value

Shareholder value is a financial metric that measures the worth of a company to its shareholders. It represents the value that shareholders receive from their investment in the company. Shareholder value is calculated by taking into account the company’s profits, dividends, and stock price appreciation.

Calculation of Shareholder Value

The calculation of shareholder value involves several key components:

- Stock Price Appreciation: The increase in the company’s stock price over time contributes to shareholder value. When the stock price rises, shareholders can sell their shares at a higher price, resulting in a capital gain.

Importance of Shareholder Value

The concept of shareholder value is of utmost importance in the world of finance and investing. Shareholder value refers to the value that a company creates for its shareholders, which is typically measured by the increase in the company’s stock price or dividends paid to shareholders.

There are several reasons why shareholder value is important:

1. Maximizing Returns:

Shareholder value is crucial because it represents the ultimate goal of any investment. Investors put their money into a company with the expectation of earning a return on their investment. By focusing on maximizing shareholder value, companies can attract more investors and increase their stock price, leading to higher returns for shareholders.

2. Accountability:

By prioritizing shareholder value, companies are held accountable for their performance. Shareholders have a vested interest in the success of the company and expect management to make decisions that will enhance shareholder value. This accountability helps to ensure that management acts in the best interests of shareholders.

3. Long-Term Sustainability:

Companies that prioritize shareholder value are more likely to focus on long-term sustainability rather than short-term gains. By making decisions that maximize shareholder value, companies are more likely to invest in research and development, innovation, and other initiatives that will drive long-term growth and profitability.

Companies that consistently create value for their shareholders have a competitive advantage in the market. They are able to attract and retain investors, access capital at lower costs, and have a stronger financial position. This competitive advantage allows them to invest in growth opportunities, expand their market share, and outperform their competitors.

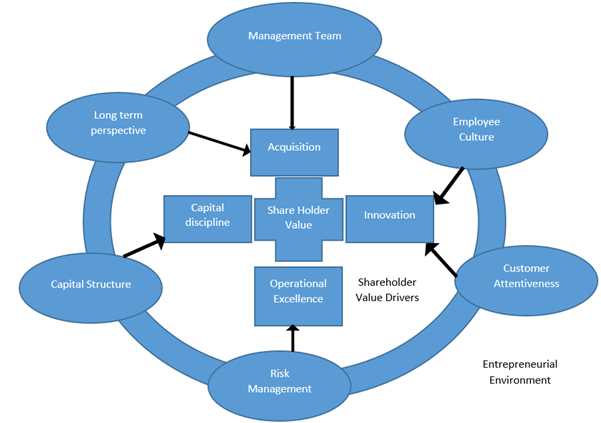

Maximizing Shareholder Value

Maximizing shareholder value is a key objective for any company. It refers to the goal of increasing the value of a company’s stock and providing maximum returns to its shareholders. Achieving this objective requires a strategic approach and a focus on long-term sustainable growth.

There are several strategies that can be employed to maximize shareholder value:

| 1. Efficient Capital Allocation | Companies need to allocate their capital resources effectively to generate the highest possible returns. This involves making informed investment decisions and prioritizing projects that have the potential to create value. |

| 2. Cost Management | Controlling costs is essential for maximizing shareholder value. By reducing unnecessary expenses and optimizing operational efficiency, companies can improve their profitability and enhance shareholder returns. |

| 3. Innovation and R&D | Investing in research and development (R&D) and fostering a culture of innovation can drive long-term growth and create value for shareholders. By continuously improving products and services, companies can stay ahead of the competition and attract more customers. |

| 4. Strategic Partnerships and Mergers | Collaborating with strategic partners or considering mergers and acquisitions can be a viable strategy for maximizing shareholder value. By combining resources and expertise, companies can achieve economies of scale, expand their market presence, and increase their profitability. |

| 5. Effective Risk Management | Managing risks is crucial for protecting shareholder value. Companies need to identify potential risks, develop contingency plans, and implement risk mitigation strategies. By effectively managing risks, companies can safeguard their assets and ensure sustainable growth. |

Overall, maximizing shareholder value requires a comprehensive approach that takes into account various factors such as capital allocation, cost management, innovation, strategic partnerships, and risk management. By implementing these strategies, companies can enhance their financial performance, attract investors, and create long-term value for their shareholders.

Strategies for Maximizing Shareholder Value

Maximizing shareholder value is a key goal for any company. By implementing effective strategies, businesses can enhance their financial performance and attract more investors. Here are some strategies that can help maximize shareholder value:

1. Focus on Profitability:

One of the most crucial strategies for maximizing shareholder value is to focus on profitability. Companies should strive to increase their revenue and reduce costs to improve their bottom line. This can be achieved through various means, such as increasing sales, optimizing operations, and implementing cost-cutting measures.

2. Efficient Capital Allocation:

3. Dividend Policy:

Implementing a sound dividend policy can also contribute to maximizing shareholder value. By distributing profits to shareholders in the form of dividends, companies can attract more investors and increase their stock price. However, it is important to strike a balance between dividend payments and reinvesting in the business to fuel future growth.

4. Effective Corporate Governance:

Good corporate governance is crucial for maximizing shareholder value. Companies should have a transparent and accountable management structure, with clear roles and responsibilities. This helps to ensure that decisions are made in the best interest of shareholders and that the company’s resources are used efficiently.

5. Innovation and Adaptability:

Innovation and adaptability are key drivers of shareholder value. Companies should continuously strive to innovate their products, services, and business models to stay ahead of the competition. By anticipating and adapting to market changes, companies can create new opportunities for growth and enhance their competitive advantage.

6. Stakeholder Engagement:

By implementing these strategies, companies can effectively maximize shareholder value and create long-term sustainable growth. It is important for businesses to regularly review and adapt their strategies to stay relevant in a dynamic and competitive market.

Investment Decisions

Factors to Consider

When evaluating investment opportunities, there are several factors that should be taken into consideration:

- Risk vs. Return: Assessing the potential risks and rewards of an investment is essential. Higher-risk investments may offer the potential for higher returns, but they also come with a greater chance of loss. It is important to strike a balance between risk and return that aligns with the company’s objectives and risk tolerance.

- Market Conditions: The current state of the market can influence the success of an investment. It is important to analyze market trends, economic indicators, and industry-specific factors to determine if an investment opportunity is favorable.

- Competitive Advantage: Evaluating a company’s competitive advantage is crucial in determining its long-term profitability and sustainability. Investments in companies with a strong competitive position in their respective industries are more likely to generate value for shareholders.

- Financial Performance: Analyzing a company’s financial performance, including its revenue growth, profitability, and cash flow, is essential in assessing its investment potential. Companies with a track record of strong financial performance are more likely to generate value for shareholders.

- Alignment with Business Strategy: Investments should align with the company’s overall business strategy and objectives. They should complement existing operations and contribute to the company’s long-term growth and profitability.

Evaluation Methods

There are various evaluation methods that can be used to assess investment opportunities:

| Method | Description |

|---|---|

| Net Present Value (NPV) | Calculates the present value of expected cash flows from an investment, taking into account the time value of money. |

| Internal Rate of Return (IRR) | Measures the profitability of an investment by calculating the discount rate at which the net present value of cash flows equals zero. |

| Payback Period | Estimates the time required for an investment to generate cash flows that recover the initial investment. |

| Profitability Index (PI) | Compares the present value of expected cash inflows to the present value of expected cash outflows to assess the profitability of an investment. |

By utilizing these evaluation methods and considering the factors mentioned above, companies can make well-informed investment decisions that maximize shareholder value.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.