What is a Leveraged Buyback?

Firstly, a leveraged buyback can help increase the value of the remaining shares. By reducing the number of outstanding shares, the earnings per share (EPS) can be increased, which can lead to a higher stock price. This can be beneficial for existing shareholders, as it increases their ownership percentage and can result in capital gains.

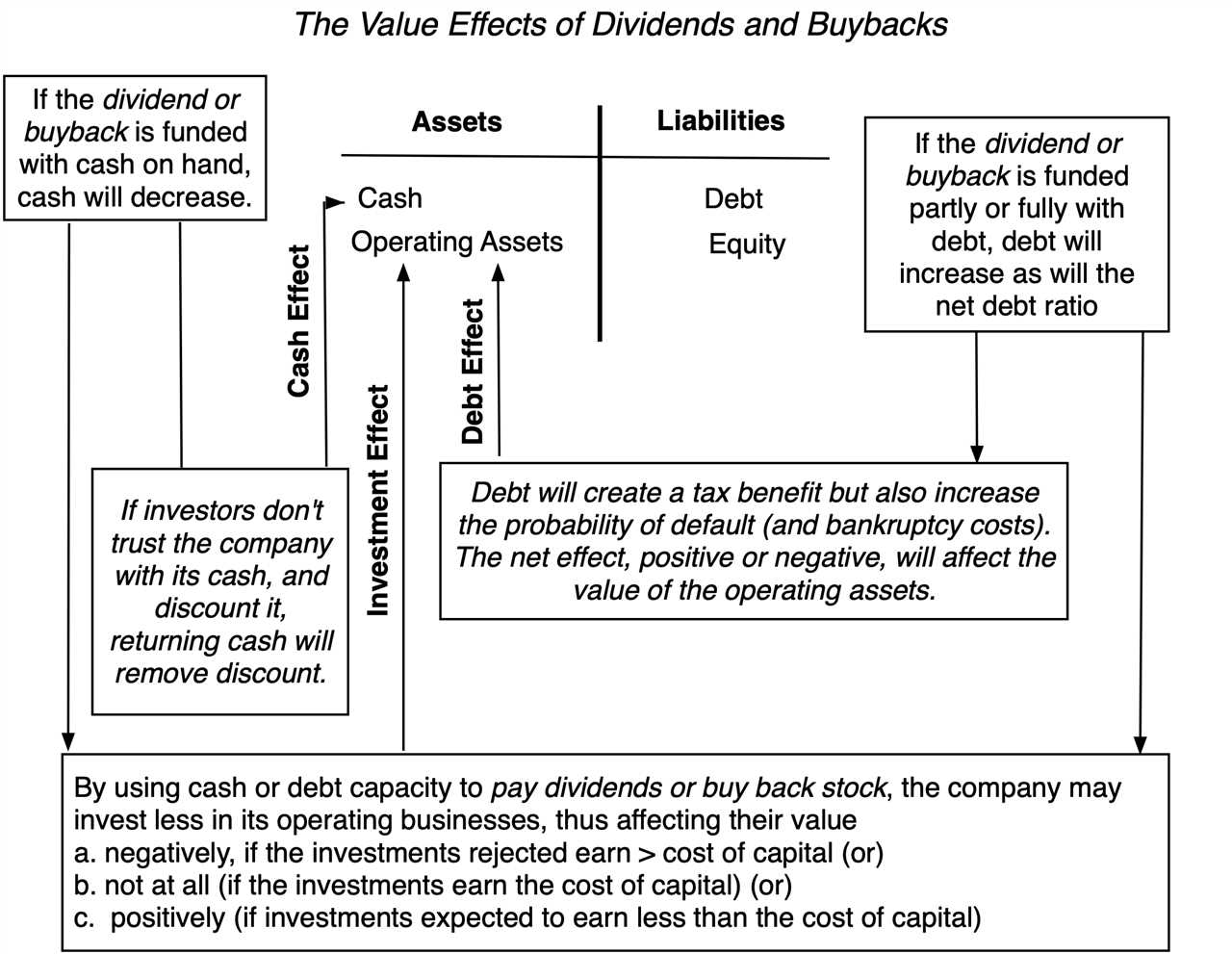

Secondly, a leveraged buyback can be a tax-efficient way for companies to return capital to shareholders. By using debt to finance the repurchase, companies can deduct the interest expense from their taxable income, reducing their tax liability. This can result in higher net earnings and potentially higher dividends for shareholders.

However, it is important to note that a leveraged buyback also carries risks. Taking on debt to finance the repurchase increases the company’s leverage, which can make it more vulnerable to economic downturns or changes in interest rates. Additionally, if the company’s stock price declines after the buyback, the debt burden may become harder to manage.

Returns of a Leveraged Buyback

A leveraged buyback is a financial strategy in which a company uses borrowed funds to repurchase its own shares from the market. This strategy can have various returns for the company and its shareholders, depending on the specific circumstances and execution of the buyback.

1. Increased Earnings Per Share (EPS): One of the primary benefits of a leveraged buyback is the potential to increase the company’s earnings per share. By reducing the number of outstanding shares through the buyback, the company’s earnings are distributed among a smaller number of shares, resulting in a higher EPS. This can be attractive to investors and may lead to an increase in the company’s stock price.

2. Enhanced Shareholder Value: A successful leveraged buyback can create value for shareholders. By repurchasing shares at a price below their intrinsic value, the company can effectively return capital to its shareholders. This can result in an increase in shareholder wealth and overall shareholder value.

3. Increased Control: Another potential return of a leveraged buyback is increased control for the company’s management or majority shareholders. By reducing the number of outstanding shares, the buyback can concentrate ownership and voting power in the hands of a smaller group of shareholders. This increased control can provide strategic advantages and influence over the company’s decision-making processes.

4. Tax Benefits: In some cases, a leveraged buyback can provide tax benefits for the company. By using borrowed funds to finance the buyback, the interest payments on the debt may be tax-deductible. This can result in a reduction of the company’s overall tax liability and potentially increase its after-tax returns.

5. Improved Financial Ratios: A leveraged buyback can also have a positive impact on the company’s financial ratios. By reducing the number of outstanding shares, the buyback can increase metrics such as earnings per share, return on equity, and return on assets. These improved ratios can enhance the company’s financial profile and make it more attractive to investors and lenders.

It is important to note that the returns of a leveraged buyback can vary depending on market conditions, the company’s financial position, and the execution of the strategy. Companies considering a leveraged buyback should carefully evaluate the potential returns and risks associated with the strategy before proceeding.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.