What is Return on Average Capital Employed (ROACE)?

Return on Average Capital Employed (ROACE) is a financial ratio that measures the profitability and efficiency of a company’s capital investments. It is used to assess how effectively a company is using its capital to generate profits.

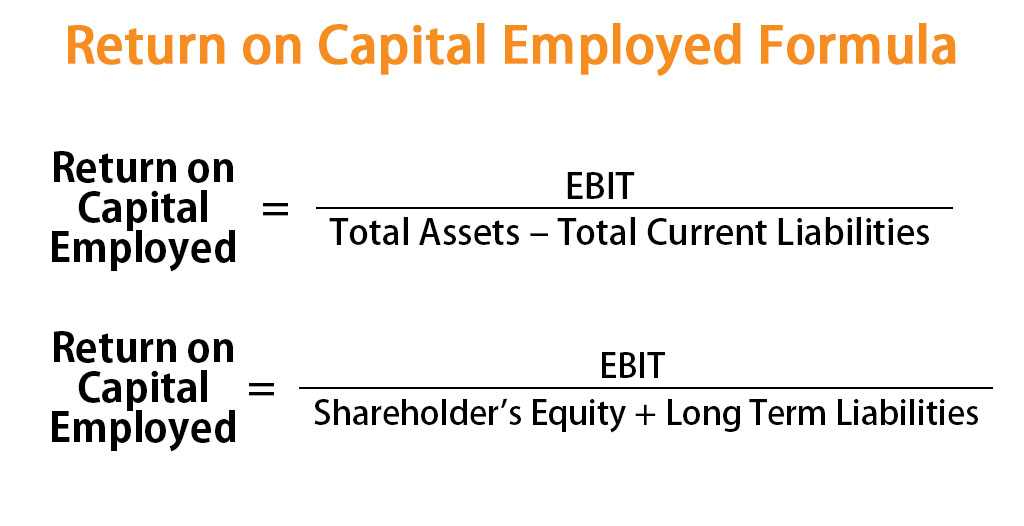

ROACE is calculated by dividing the company’s operating profit before interest and taxes (EBIT) by the average capital employed during a specific period. The formula for ROACE is as follows:

| ROACE = | (Operating Profit / Average Capital Employed) x 100 |

The average capital employed is calculated by adding the opening and closing capital employed for a specific period and dividing it by 2. Capital employed includes both equity and debt financing used by the company.

ROACE is an important metric for investors and analysts as it provides insights into a company’s ability to generate returns on its investments. A higher ROACE indicates that a company is efficiently utilizing its capital to generate profits, while a lower ROACE suggests inefficiency.

Interpreting ROACE can be done by comparing it with the industry average or the company’s historical ROACE. A company with a higher ROACE than its competitors or its own historical performance is considered to be more efficient and profitable.

Definition and Formula

Return on Average Capital Employed (ROACE) is a financial ratio that measures the profitability and efficiency of a company’s capital investments. It is used to assess how effectively a company generates profits from the capital it has employed.

The formula for calculating ROACE is:

ROACE = Net Operating Profit (NOPAT) / Average Capital Employed

Where:

- Net Operating Profit (NOPAT) is the company’s operating profit after taxes and interest expenses.

- Average Capital Employed is the average value of the company’s total capital over a specific period of time. It is calculated by adding the beginning and ending capital and dividing by two.

ROACE is expressed as a percentage, indicating the return on capital as a proportion of the average capital employed.

Example:

Let’s say a company has a net operating profit of $500,000 and an average capital employed of $2,000,000. The ROACE would be calculated as:

ROACE = $500,000 / $2,000,000 = 0.25 or 25%

This means that for every dollar of average capital employed, the company generates a return of 25 cents.

ROACE is a useful metric for investors and analysts to evaluate a company’s profitability and efficiency in utilizing its capital. A higher ROACE indicates that a company is generating more profits from its capital investments, while a lower ROACE may suggest inefficiency or poor financial performance.

Return on Average Capital Employed (ROACE) is a financial ratio that measures the profitability of a company in relation to the capital it has invested. It is an important metric for investors and analysts to assess the efficiency and effectiveness of a company’s capital utilization.

Definition and Formula

ROACE is calculated by dividing the company’s operating profit by its average capital employed, and then multiplying the result by 100 to express it as a percentage. The formula is as follows:

ROACE = (Operating Profit / Average Capital Employed) * 100

Operating profit refers to the profit generated by a company’s core operations, excluding any non-operating income or expenses. Average capital employed represents the average amount of capital invested in the business over a specific period of time, which is calculated by taking the sum of the opening and closing capital and dividing it by two.

Importance and Calculation

ROACE is an important metric for investors as it provides insights into how effectively a company is generating profits from the capital it has invested. A higher ROACE indicates that the company is utilizing its capital efficiently and generating higher returns for its shareholders.

To calculate ROACE, you need to gather the company’s financial statements, including the income statement and balance sheet. From the income statement, you can find the operating profit, and from the balance sheet, you can find the opening and closing capital. By using the formula mentioned above, you can calculate the ROACE.

Interpreting ROACE

Interpreting ROACE requires comparing it to the industry average or the company’s historical ROACE. A higher ROACE than the industry average indicates that the company is performing well and generating higher returns compared to its competitors. On the other hand, a lower ROACE may suggest that the company is not utilizing its capital efficiently and may need to improve its operations.

It is important to note that ROACE should not be analyzed in isolation but should be considered along with other financial ratios and factors affecting the company’s performance. It is also important to consider the industry and economic conditions when interpreting ROACE.

Comparison and Analysis

ROACE can be used to compare the performance of different companies within the same industry or to analyze the performance of a company over time. By comparing the ROACE of different companies, investors can identify which companies are generating higher returns on their capital and make informed investment decisions.

Furthermore, analyzing the trend of a company’s ROACE over time can provide insights into its financial performance and management efficiency. A consistent increase in ROACE indicates that the company is improving its profitability and utilizing its capital more efficiently.

Importance and Calculation of Return on Average Capital Employed (ROACE)

Return on Average Capital Employed (ROACE) is a financial ratio that measures the profitability of a company’s capital investments. It is an important metric for investors and analysts as it provides insights into how effectively a company is utilizing its capital to generate profits.

The calculation of ROACE is relatively straightforward. It is calculated by dividing the company’s operating profit by its average capital employed, and then multiplying the result by 100 to express it as a percentage. The formula for ROACE is:

ROACE = (Operating Profit / Average Capital Employed) * 100

Operating profit is the profit generated from the company’s core operations, excluding any interest or tax expenses. Average capital employed is the average value of the company’s total assets minus its current liabilities over a specific period of time.

ROACE is a key performance indicator that helps investors and analysts assess the efficiency and profitability of a company’s capital investments. A higher ROACE indicates that a company is generating more profits relative to the capital invested, which is a positive signal for investors.

By comparing the ROACE of different companies within the same industry, investors can identify companies that are more efficient in utilizing their capital and generating profits. Additionally, ROACE can also be used to compare a company’s performance over time, helping investors track its profitability trends and evaluate its management’s effectiveness.

Interpreting ROACE

Return on Average Capital Employed (ROACE) is a key financial ratio that measures the profitability and efficiency of a company’s capital investments. It provides insight into how effectively a company is utilizing its capital to generate profits.

A high ROACE indicates that a company is generating strong returns on its investments, which is a positive sign for investors. It suggests that the company is using its capital efficiently and effectively to generate profits. This can be attributed to factors such as effective cost management, strong revenue growth, and efficient allocation of resources.

On the other hand, a low ROACE may indicate that a company is not generating sufficient returns on its capital investments. This could be due to various factors such as poor cost management, low revenue growth, or inefficient allocation of resources. A low ROACE could be a red flag for investors, as it suggests that the company is not utilizing its capital effectively and may not be generating sustainable profits.

It is important to note that the interpretation of ROACE can vary depending on the industry and the company’s specific circumstances. Comparing a company’s ROACE to its competitors or industry benchmarks can provide additional insights into its performance. A higher ROACE than competitors or industry averages may indicate a competitive advantage, while a lower ROACE may indicate a need for improvement.

Investors should also consider other financial ratios and factors when interpreting ROACE. For example, a company with a high ROACE but high levels of debt may not be as attractive as a company with a slightly lower ROACE but lower levels of debt. It is important to consider the overall financial health and risk profile of a company when making investment decisions.

Comparison and Analysis

When comparing the Return on Average Capital Employed (ROACE) of different companies, it is important to consider the industry norms and benchmarks. ROACE can vary significantly across industries due to differences in capital intensity and profitability levels.

For example, a capital-intensive industry like manufacturing may have a lower ROACE compared to a service-based industry like consulting. This is because manufacturing companies require significant investments in machinery, equipment, and inventory, which can reduce their profitability.

Additionally, ROACE can be influenced by external factors such as economic conditions, market competition, and regulatory changes. It is essential to analyze ROACE trends over time to assess a company’s performance and identify any potential issues or improvements.

Furthermore, comparing a company’s ROACE to its competitors can provide valuable insights into its relative performance and market position. If a company consistently has a higher ROACE than its competitors, it may indicate a competitive advantage or superior capital allocation strategies.

Investors and analysts can use ROACE as a tool for evaluating potential investment opportunities. A higher ROACE generally indicates a more efficient and profitable use of capital, making the company more attractive to investors.

Overall, ROACE is a valuable financial ratio that provides insights into a company’s ability to generate profits from its capital investments. By comparing and analyzing ROACE, stakeholders can make informed decisions and assess a company’s financial performance in relation to its industry peers.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.