How Debt Financing Works: Examples, Costs, Pros & Cons

Debt financing is a method of raising capital by borrowing money from lenders. It is a common practice for businesses and individuals to use debt financing to fund various projects, investments, or expenses. This article will provide an overview of how debt financing works, along with examples, costs, and the pros and cons associated with this type of financing.

Debt financing involves borrowing money from a lender, such as a bank or financial institution, with the agreement to repay the borrowed amount over a specified period of time. The borrowed funds are typically used to finance business operations, purchase assets, or invest in projects.

Debt financing can take various forms, including loans, lines of credit, bonds, and mortgages. The terms and conditions of the debt financing arrangement, such as interest rates, repayment terms, and collateral requirements, are negotiated between the borrower and the lender.

Examples of Debt Financing

There are several examples of debt financing in both the business and personal finance realms. For businesses, debt financing can involve taking out a bank loan to expand operations, securing a line of credit to manage cash flow, or issuing bonds to raise capital for large-scale projects.

On the personal finance side, examples of debt financing include obtaining a mortgage to purchase a home, taking out a student loan to finance education, or using a credit card to cover everyday expenses.

Costs, Pros & Cons of Debt Financing

Debt financing comes with both costs and benefits that borrowers should carefully consider before taking on debt. The costs of debt financing include interest payments, fees, and potential penalties for late or missed payments.

However, there are also several advantages to debt financing. It allows businesses and individuals to access capital that they may not have otherwise, enabling them to pursue growth opportunities or make necessary purchases. Debt financing also provides the benefit of tax deductions on interest payments for businesses.

On the other hand, there are some drawbacks to debt financing. It increases the overall debt burden, which can lead to financial strain if the borrower is unable to make timely repayments. Additionally, excessive debt can negatively impact credit scores and limit future borrowing opportunities.

Debt financing is a method used by individuals and businesses to raise capital by borrowing money from lenders. It involves taking on debt in the form of loans or issuing bonds, which are then repaid over a specified period of time with interest.

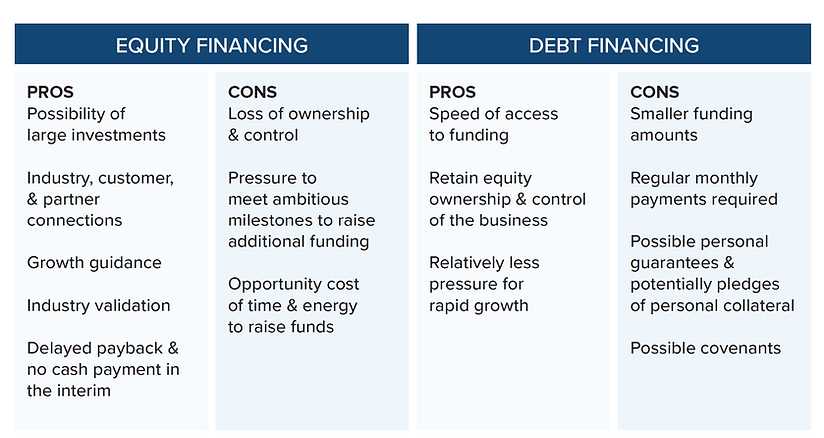

1. Debt vs. Equity

Debt financing differs from equity financing in that it involves borrowing money that must be repaid, whereas equity financing involves selling ownership shares in a company. Debt financing allows businesses to retain control and ownership while still accessing the funds they need.

2. Types of Debt Financing

There are various types of debt financing options available, including bank loans, lines of credit, bonds, and mortgages. Each type of financing has its own terms and conditions, interest rates, and repayment schedules.

3. Benefits of Debt Financing

Debt financing offers several advantages for individuals and businesses. It provides access to capital that can be used for various purposes, such as expanding operations, purchasing assets, or funding projects. Debt financing also allows businesses to take advantage of tax benefits, as interest payments on loans are often tax-deductible.

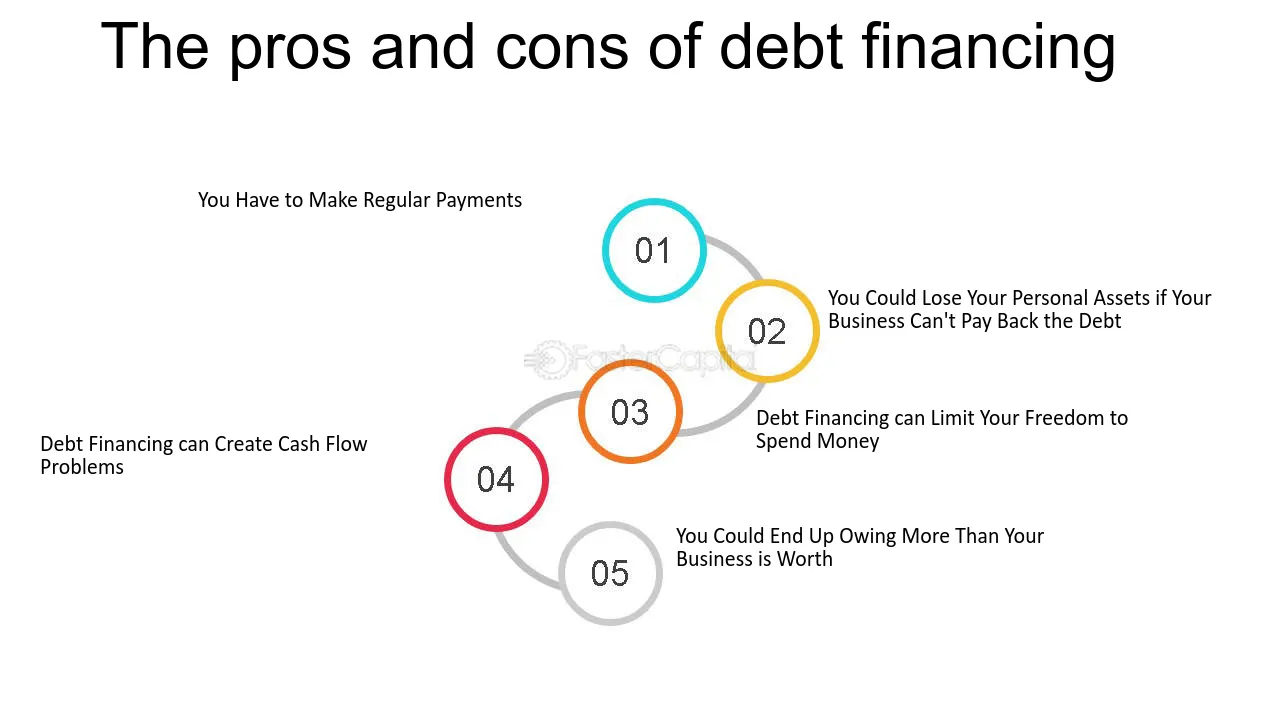

4. Risks of Debt Financing

While debt financing can be beneficial, it also carries certain risks. One of the main risks is the obligation to repay the borrowed funds, along with interest, which can put a strain on cash flow. Additionally, taking on too much debt can lead to financial instability and a higher risk of default.

Examples of Debt Financing

Debt financing is a common method used by businesses and individuals to raise capital. It involves borrowing money from lenders, such as banks or financial institutions, with the promise to repay the principal amount plus interest over a specified period of time. Here are some examples of debt financing:

| Example | Description |

|---|---|

| Business Loans | Many businesses obtain loans from banks to finance their operations, purchase equipment, or expand their facilities. The loan agreement specifies the amount borrowed, interest rate, repayment term, and any collateral required. |

| Mortgages | Individuals often take out mortgages to finance the purchase of real estate, such as a home or commercial property. The mortgage serves as collateral for the loan, and the borrower makes regular payments to repay the principal and interest. |

| Bonds | Companies and governments issue bonds to raise capital from investors. Bondholders lend money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity. |

| Credit Cards | Consumers can use credit cards to make purchases and borrow money from the card issuer. They are required to make regular minimum payments and pay interest on the outstanding balance if not paid in full. |

| Lines of Credit | Businesses and individuals can establish lines of credit with banks or other financial institutions. They can borrow money up to a certain limit and make repayments as needed. Interest is charged only on the amount borrowed. |

Costs, Pros & Cons of Debt Financing

Debt financing is a common method for businesses to raise capital, but it is important to understand the costs, pros, and cons associated with this type of financing. Here, we will explore the various factors to consider when deciding whether debt financing is the right choice for your business.

Costs of Debt Financing

When taking on debt financing, there are several costs to consider:

2. Fees: In addition to interest payments, borrowers may also be required to pay various fees associated with debt financing. These can include origination fees, underwriting fees, and prepayment penalties. It is important to carefully review the terms and conditions of the loan to understand all the fees involved.

3. Risk of Default: When taking on debt, there is always a risk of default. If a borrower is unable to make the required payments, they may face penalties, legal action, or even bankruptcy. Defaulting on debt can have serious consequences for a business, including damage to its credit rating and difficulty obtaining future financing.

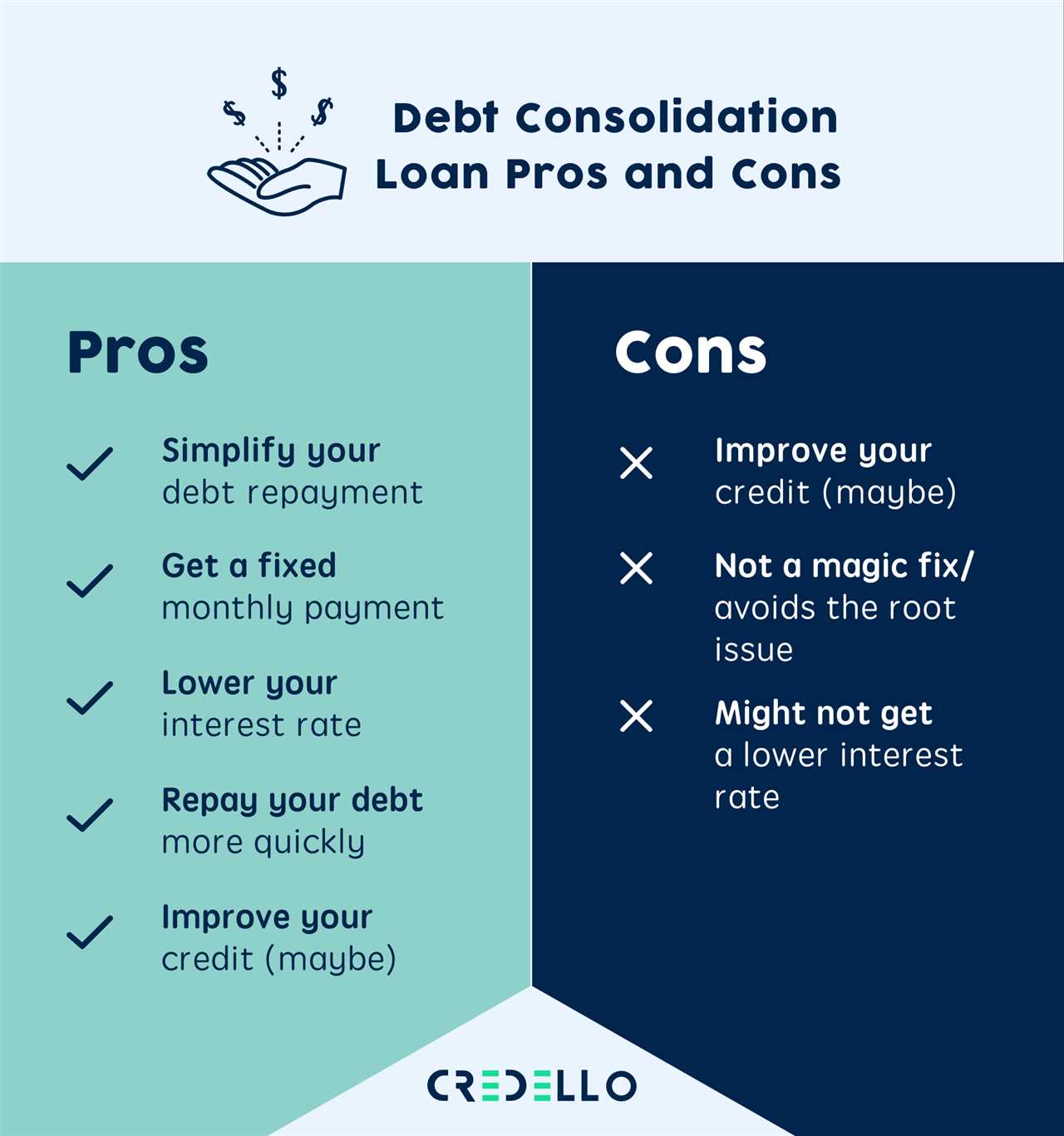

Pros of Debt Financing

Despite the costs and risks associated with debt financing, there are several advantages that make it an attractive option for businesses:

1. Retain Ownership and Control: Unlike equity financing, which involves selling a portion of the business to investors, debt financing allows the business owner to retain full ownership and control. This means that the profits and decision-making power remain in the hands of the business owner.

2. Tax Benefits: In many cases, the interest payments on debt financing can be tax-deductible. This can help reduce the overall tax liability of the business, making debt financing a more cost-effective option.

3. Flexibility: Debt financing offers flexibility in terms of repayment schedules and loan terms. Businesses can negotiate the terms of the loan to align with their cash flow and financial needs. This can be especially beneficial for businesses with seasonal or fluctuating revenue.

Cons of Debt Financing

While debt financing has its advantages, there are also some drawbacks to consider:

1. Debt Burden: Taking on debt adds a financial burden to the business. The business must generate enough cash flow to cover the interest payments and repay the principal amount. This can limit the business’s ability to invest in growth opportunities or respond to unexpected challenges.

2. Risk of Insolvency: If a business becomes heavily indebted, it may face the risk of insolvency. High levels of debt can make it difficult to meet financial obligations, leading to bankruptcy or liquidation of the business.

3. Loss of Flexibility: Debt financing comes with contractual obligations, including repayment schedules and interest payments. These obligations can limit the business’s flexibility in making financial decisions or pursuing new opportunities.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.