What is Form 1098?

Why is Form 1098 important?

Form 1098 is important because it allows individuals and businesses to claim a deduction for the mortgage interest they paid on their tax return. This deduction can help reduce the amount of taxable income and lower the overall tax liability.

What information is included on Form 1098?

Additionally, Form 1098 may include information about any mortgage insurance premiums paid by the borrower, which may also be deductible under certain circumstances.

Who should receive Form 1098?

Form 1098 should be received by anyone who paid more than $600 in mortgage interest during the tax year. This includes individuals who have a mortgage on their primary residence, as well as those who have mortgages on rental properties or second homes.

It is important to note that not all lenders are required to issue Form 1098. However, most lenders will provide this form to their borrowers as a courtesy to help them accurately report their mortgage interest on their tax return.

How to use Form 1098 for tax purposes?

When filing taxes, individuals and businesses should carefully review the information on Form 1098 and ensure that it is accurate. If there are any discrepancies or errors, it is important to contact the lender to have them corrected.

Individuals and businesses should then use the information from Form 1098 to accurately report their mortgage interest deduction on their tax return. This can typically be done using Schedule A (Form 1040) for individuals or Schedule E (Form 1040) for businesses.

It is important to keep a copy of Form 1098 and any supporting documentation in case of an audit or if the IRS has any questions about the deduction claimed.

Overall, Form 1098 is an important document for individuals and businesses who have paid mortgage interest during the tax year. It allows them to claim a deduction and reduce their overall tax liability. It is important to understand the information included on Form 1098 and how to use it correctly for tax purposes.

In addition to reporting the total amount of mortgage interest paid, Form 1098 may also include other related information such as points paid on the mortgage, which may also be deductible. It is important for borrowers to review the form carefully to ensure that all the information is accurate.

When preparing their tax return, borrowers will need to enter the information from Form 1098 on Schedule A, which is used to itemize deductions. The amount of mortgage interest paid can be deducted from the borrower’s taxable income, reducing their overall tax liability.

It is important for borrowers to keep a copy of Form 1098 for their records and to provide it to their tax preparer if they use one. The form should be kept with other important tax documents, such as W-2 forms and 1099 forms, in case the IRS requests verification of the deductions claimed.

Filing Instructions for Form 1098

Form 1098 is an important document that is used to report mortgage interest paid by a taxpayer to the Internal Revenue Service (IRS). It is crucial to accurately complete and file this form to ensure compliance with tax regulations and to avoid any penalties or fines.

Here are the step-by-step instructions for filing Form 1098:

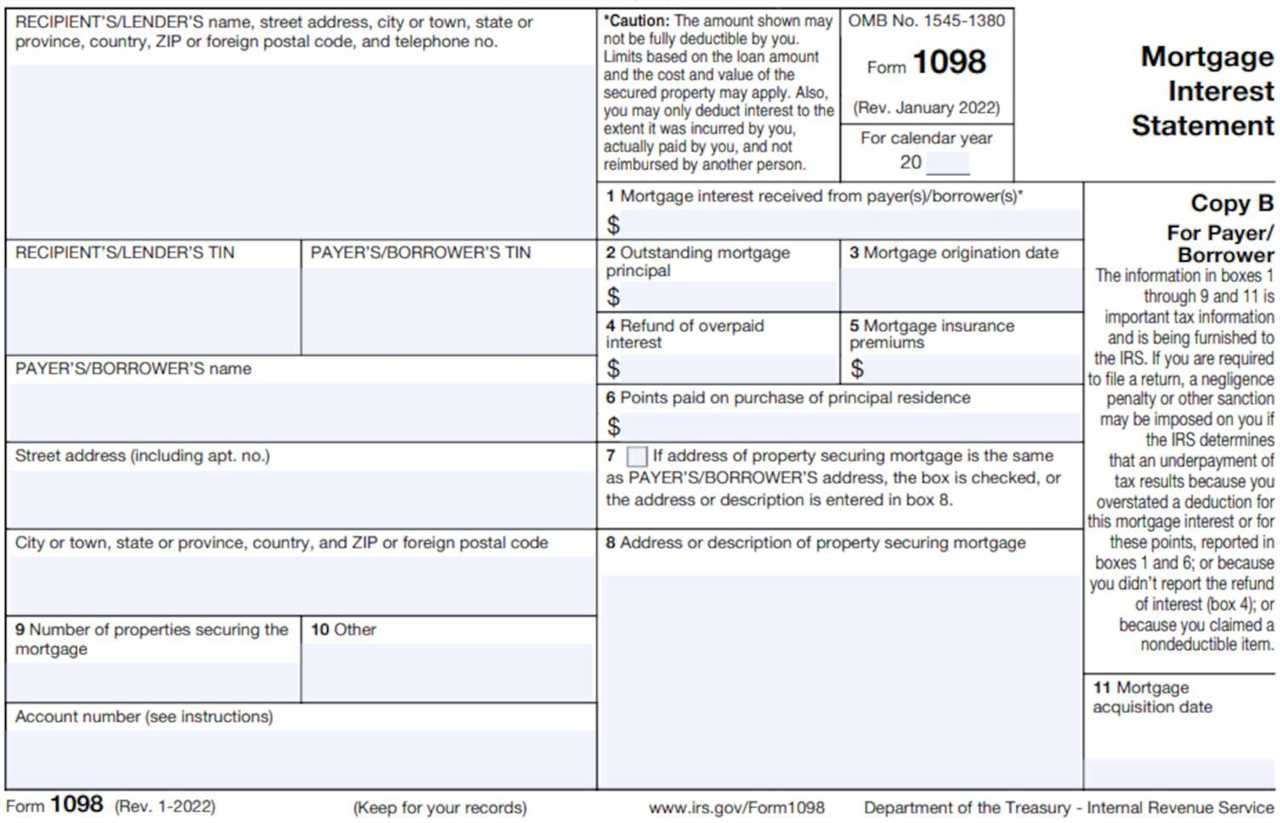

- Fill out the borrower’s information: Start by providing the borrower’s information in the designated fields on the form. Make sure to enter the correct name, address, and social security number to avoid any discrepancies.

- Enter the lender’s information: Next, provide the lender’s information, including their name, address, and taxpayer identification number. Double-check the accuracy of this information before proceeding.

- Indicate the mortgage insurance premiums: If the borrower paid any mortgage insurance premiums, you will need to enter the total amount in the designated field on the form. This information is also typically provided on Form 1098.

- Verify the accuracy of the form: Once you have completed all the required fields, carefully review the form to ensure that all the information is accurate and up-to-date. Any errors or discrepancies could lead to delays in processing or potential penalties.

- Submit the form: After verifying the accuracy of the form, you can submit it to the IRS. Make sure to keep a copy for your records.

It is important to note that Form 1098 must be filed with the IRS by the end of February each year for the previous tax year. Failure to file or filing an incorrect form may result in penalties or other consequences. If you have any questions or need further assistance, consult with a tax professional or refer to the IRS instructions for Form 1098.

Step-by-Step Guide to Completing the Form

Completing Form 1098 may seem daunting, but with this step-by-step guide, you’ll be able to navigate the process with ease.

- Start by entering your name, address, and taxpayer identification number in the designated spaces at the top of the form. Make sure to double-check this information for accuracy.

- Next, provide the payer’s name, address, and taxpayer identification number. This is the information of the entity or individual who made the mortgage payments.

- Enter the recipient’s name, address, and taxpayer identification number. This is the information of the entity or individual who received the mortgage payments.

- Indicate the mortgage interest received by the recipient in box 1. This should be the total amount of mortgage interest paid by the payer throughout the year.

- If there is any mortgage insurance premiums paid by the payer, enter the amount in box 5. This includes any premiums paid to the Department of Veterans Affairs, the Federal Housing Administration, or the Rural Housing Service.

- Check the appropriate box in box 6 to indicate the type of mortgage. This could be either a home acquisition debt, home equity debt, or grandfathered debt.

- If there is any outstanding mortgage principal as of January 1st, enter the amount in box 2. This is the remaining balance of the mortgage at the beginning of the year.

- Lastly, sign and date the form to certify that the information provided is true and correct.

Remember, accuracy is crucial when completing Form 1098, as any errors or omissions can result in penalties or delays in processing your tax return. If you have any questions or need further assistance, consult with a tax professional or refer to the filing instructions provided with the form.

Mortgage Interest Statement for MORTGAGE

Form 1098 contains important information about the mortgage loan, including the name and address of the homeowner, the name and address of the mortgage lender, and the loan number. It also includes the total amount of mortgage interest paid during the year, as well as any points paid on the loan.

Homeowners should carefully review the information on Form 1098 to ensure its accuracy. If there are any errors or discrepancies, they should contact their mortgage lender to have the form corrected.

Filing Instructions for Form 1098

When filing their federal income tax return, homeowners must include Form 1098 with their other tax documents. The form should be attached to Schedule A, which is used to itemize deductions.

It is important to note that homeowners can only deduct mortgage interest if they itemize their deductions on their tax return. If they choose to take the standard deduction, they will not be able to deduct mortgage interest.

Step-by-Step Guide to Completing the Form

- Review the information on Form 1098 to ensure its accuracy.

- If there are any errors or discrepancies, contact the mortgage lender to have the form corrected.

- Attach Form 1098 to Schedule A when filing your federal income tax return.

- If you choose to itemize deductions, include the total amount of mortgage interest paid during the year on Schedule A.

- Keep a copy of Form 1098 for your records.

By following these steps, homeowners can ensure that they accurately report their mortgage interest and take advantage of any available tax deductions.

Overall, Form 1098 is an important document for homeowners with a mortgage. It provides valuable information about the amount of mortgage interest paid during the year and allows homeowners to claim a deduction on their federal income tax return.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.