Overview of Investing Regulations

Investing regulations are a set of rules and guidelines that govern the activities of investors in the financial markets. These regulations are put in place to protect investors, ensure fair and transparent markets, and maintain the stability of the financial system.

Investing regulations can vary from country to country, as each jurisdiction has its own regulatory framework. However, there are some common principles and objectives that are shared by most investing regulations around the world.

One of the main objectives of investing regulations is to protect investors from fraud and misconduct. This includes ensuring that investors receive accurate and timely information about the investments they are considering, as well as protecting them from fraudulent schemes and deceptive practices.

Investing regulations also aim to promote fair and transparent markets. This means that investors should have equal access to information and trading opportunities, and that market participants should not engage in manipulative or fraudulent activities that could distort market prices.

Another important aspect of investing regulations is the maintenance of financial stability. Regulators work to prevent excessive risk-taking and to ensure that financial institutions are adequately capitalized and able to withstand economic shocks. This helps to protect investors and the overall stability of the financial system.

Investing regulations can cover a wide range of activities and financial instruments. Some common areas that are regulated include securities markets, investment funds, derivatives, and investment advisory services. Regulations may require investors to meet certain eligibility criteria, such as minimum income or net worth requirements, and may also impose restrictions on the types of investments that can be made.

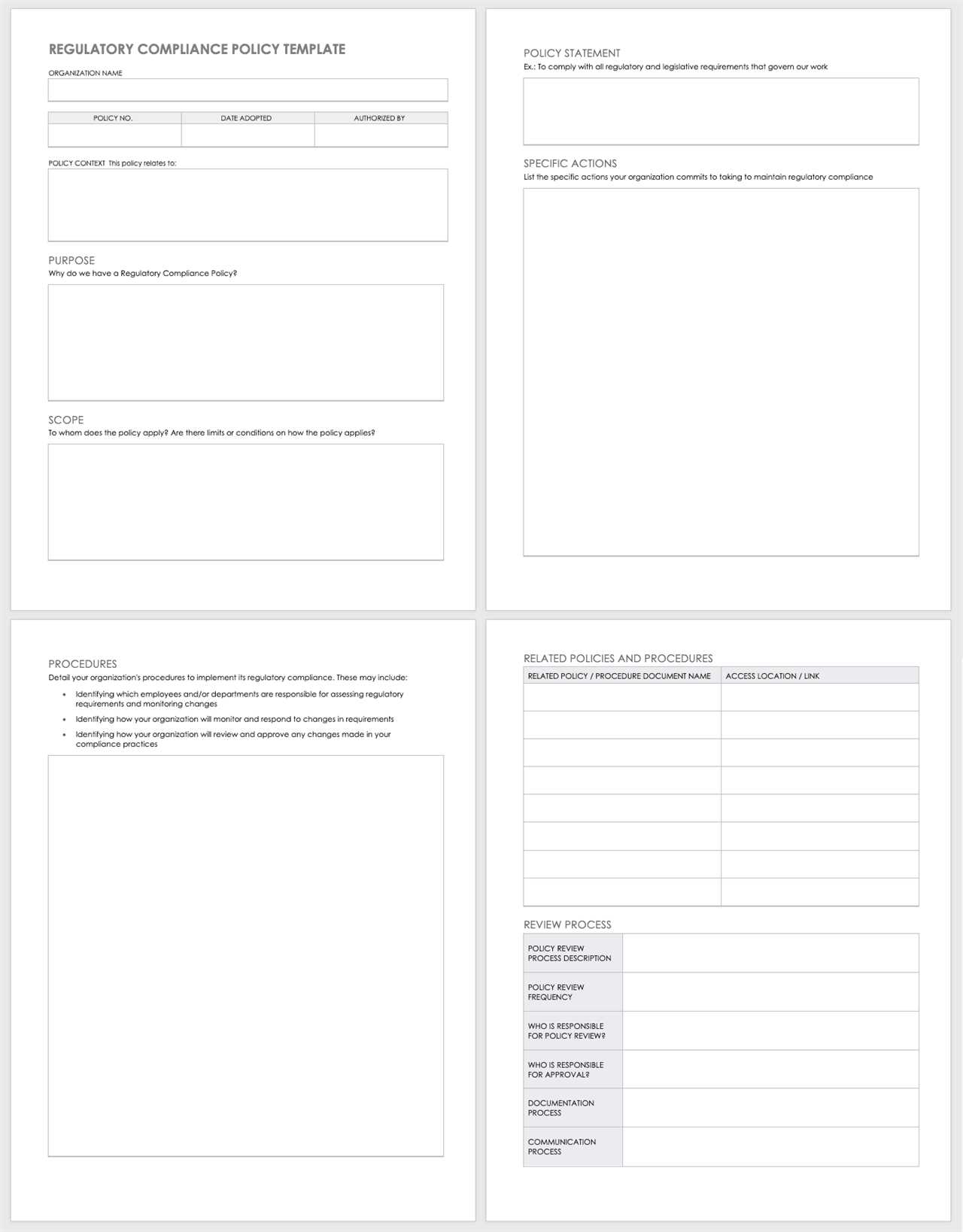

Compliance with investing regulations is important for both individual investors and financial institutions. Failure to comply with regulations can result in penalties, fines, and even criminal charges. It is therefore essential for investors to understand and adhere to the investing regulations that apply to their jurisdiction.

Key Requirements for Investors

Investing in financial markets requires individuals to meet certain key requirements. These requirements are put in place to protect investors and ensure the integrity of the investment process. Here are some of the key requirements for investors:

1. Minimum Age Requirement

One of the basic requirements for investors is to meet the minimum age requirement set by the regulatory authorities. This requirement varies from country to country, but typically individuals must be at least 18 years old to invest in financial markets.

2. Financial Knowledge and Experience

Investing in financial markets involves risks, and it is important for investors to have a certain level of financial knowledge and experience. This requirement ensures that investors understand the risks involved and are capable of making informed investment decisions.

3. Adequate Financial Resources

Investing requires capital, and investors must have adequate financial resources to participate in the market. The specific financial requirements may vary depending on the type of investment and the regulatory jurisdiction.

Regulatory authorities may set minimum investment amounts or require investors to meet certain income or net worth thresholds to ensure that they have the financial capacity to withstand potential losses.

4. Compliance with Anti-Money Laundering (AML) Regulations

Investors are also required to comply with anti-money laundering regulations. These regulations are designed to prevent the use of financial markets for illegal activities such as money laundering and terrorist financing.

Investors may be required to provide identification documents, proof of address, and other information to verify their identity and ensure compliance with AML regulations.

5. Suitability Assessment

Some regulatory authorities require investors to undergo a suitability assessment to determine if a particular investment is suitable for their financial situation, investment objectives, and risk tolerance.

This assessment helps to ensure that investors are not exposed to excessive risks or investments that are not suitable for their individual circumstances.

Overall, these key requirements for investors aim to protect individuals and maintain the integrity of the financial markets. By meeting these requirements, investors can participate in the investment process with confidence, knowing that they are operating within the regulatory framework.

Examples of Investing Regulations

Investing regulations can vary greatly depending on the country and the specific industry. Here are some examples of investing regulations in different sectors:

1. Securities and Exchange Commission (SEC) Regulations:

The SEC is responsible for regulating the securities industry in the United States. They enforce rules and regulations to protect investors and maintain fair and efficient markets. Some key regulations enforced by the SEC include:

- Registration requirements for securities offerings

- Disclosure requirements for public companies

- Prohibition of insider trading

- Regulation of investment advisers and brokers

2. Financial Conduct Authority (FCA) Regulations:

The FCA is the regulatory body for financial services firms in the United Kingdom. They aim to protect consumers, ensure market integrity, and promote competition. Some key regulations enforced by the FCA include:

- Conduct of Business (COBS) rules for investment firms

- Client money and asset protection rules

- Disclosure requirements for financial promotions

- Regulation of crowdfunding platforms

3. European Securities and Markets Authority (ESMA) Regulations:

ESMA is an independent EU authority that aims to enhance investor protection and promote stable and orderly financial markets. Some key regulations enforced by ESMA include:

- MiFID II regulations for investment firms

- Transparency requirements for trading venues

- Regulation of credit rating agencies

- Regulation of central counterparties

4. Reserve Bank of India (RBI) Regulations:

RBI is the central banking institution of India and is responsible for regulating the financial sector in the country. Some key regulations enforced by RBI include:

- Foreign investment regulations

- Capital adequacy requirements for banks

- Regulation of non-banking financial companies

- Regulation of mutual funds

These are just a few examples of investing regulations in different jurisdictions. It is important for investors to understand and comply with the applicable regulations to ensure the legality and safety of their investments.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.