Bond Quote: How to Read Bond Quotes for Trading and Example

Bond quotes are typically displayed in a standardized format that includes various components. These components provide information about the bond’s characteristics and can help investors assess its value.

One of the key components of a bond quote is the bond’s price. The price is usually expressed as a percentage of the bond’s face value. For example, if a bond has a face value of $1,000 and is quoted at 98, the price would be $980. This price represents the current market value of the bond.

Another important component of a bond quote is the bond’s yield. The yield represents the return an investor can expect to earn from the bond. It is usually expressed as a percentage and can be either the current yield or the yield to maturity.

The current yield is calculated by dividing the bond’s annual interest payment by its current market price. For example, if a bond pays $50 in annual interest and is quoted at 98, the current yield would be 5.1% ($50 / $980).

The yield to maturity, on the other hand, takes into account the bond’s price, coupon rate, and time to maturity. It represents the total return an investor can expect to earn if the bond is held until maturity.

Key Components of a Bond Quote

The coupon rate is the annual interest rate paid by the bond. It is usually expressed as a percentage of the bond’s face value. For example, if a bond has a face value of $1,000 and a coupon rate of 5%, it will pay $50 in annual interest ($1,000 * 5%).

The maturity date is the date on which the bond will mature and the issuer will repay the bondholder the face value of the bond. It is an important factor to consider when assessing the bond’s risk and potential return.

The credit rating represents the issuer’s creditworthiness and the likelihood of default. It is assigned by credit rating agencies and can range from AAA (highest rating) to D (default).

Example of Reading a Bond Quote

Let’s take a look at an example of how to read a bond quote:

Bond Name: XYZ Corporation 5% Bond

Price: 98

Yield: 5.1%

Coupon Rate: 5%

Maturity Date: 2025

Credit Rating: AA

Bond quotes typically include the following information:

| Term | Description |

|---|---|

| Symbol | The symbol or ticker of the bond. |

| Price | The current price at which the bond is trading. |

| Yield | The yield or return on the bond. |

| Coupon | The annual interest rate paid by the bond. |

| Maturity | The date on which the bond will mature. |

| Rating | The credit rating assigned to the bond. |

By analyzing these components, investors can assess the risk and potential return of a bond. For example, a higher yield may indicate a higher risk bond, while a lower yield may indicate a lower risk bond. The credit rating can also provide insight into the bond’s creditworthiness.

Key Components of a Bond Quote

When reading a bond quote, it is important to understand the key components that make up the quote. These components provide valuable information about the bond and can help investors make informed trading decisions. Here are the key components of a bond quote:

1. Bond Name: The bond name refers to the specific bond being quoted. It typically includes the issuer’s name and the maturity date of the bond.

2. Coupon Rate: The coupon rate is the annual interest rate that the bond pays to its holders. It is expressed as a percentage of the bond’s face value.

3. Maturity Date: The maturity date is the date on which the bond will be repaid in full. It indicates the length of time until the bond reaches its maturity.

4. Yield: The yield is the rate of return that an investor can expect to earn from a bond. It is calculated by dividing the bond’s annual interest payment by its current market price.

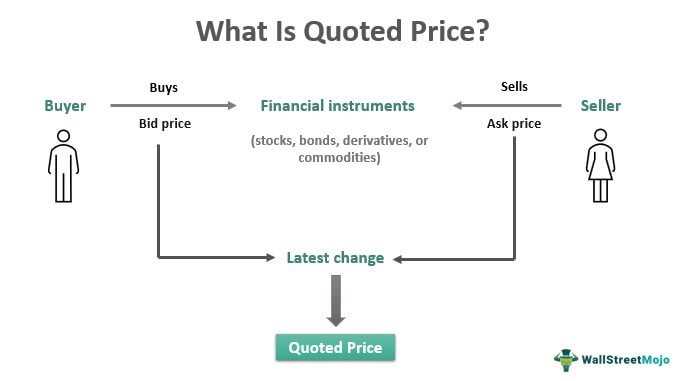

5. Price: The price of a bond refers to its current market price. It is expressed as a percentage of the bond’s face value. The price can fluctuate based on various factors such as interest rates and market conditions.

7. Rating: The rating of a bond indicates its creditworthiness. It is assigned by credit rating agencies and provides investors with an assessment of the bond’s risk level.

8. Volume: The volume refers to the number of bonds that have been traded during a specific period. It provides an indication of the liquidity of the bond.

Example of Reading a Bond Quote

- Bond Name: ABC Corporation 5% Bond 2025

- Bond Symbol: ABC2025

- Bid Price: $98.50

- Ask Price: $99.00

- Yield to Maturity: 4.75%

- Coupon Rate: 5%

- Maturity Date: December 31, 2025

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.