What is GAPP?

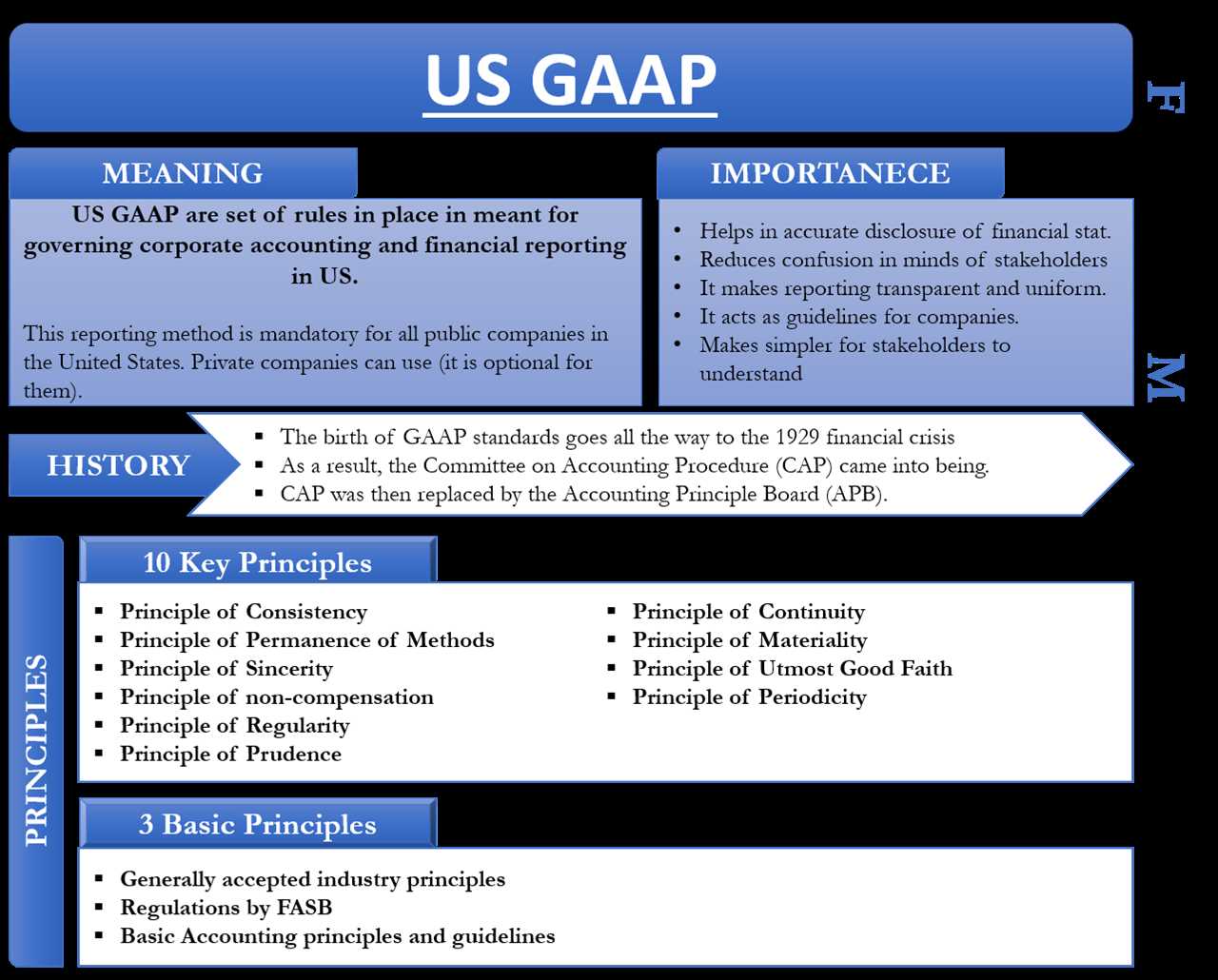

GAPP, which stands for Generally Accepted Principles and Practices, refers to a set of guidelines and standards that are widely recognized and followed in the business world. These principles and practices provide a framework for businesses to ensure transparency, accuracy, and consistency in their financial reporting and operations.

The Generally Accepted Principles and Practices cover various aspects of accounting and financial reporting, including revenue recognition, expense recognition, asset valuation, financial statement presentation, and disclosure requirements. These standards are designed to provide a common language and framework for businesses to communicate their financial performance and position to stakeholders, such as investors, lenders, and regulators.

By adhering to GAPP, businesses can ensure that their financial information is accurate, reliable, and comparable across different companies and industries. This allows stakeholders to make informed decisions based on the financial information provided by the business. GAPP also helps to promote transparency and accountability, as businesses are required to disclose relevant information about their operations and financial performance.

Overall, GAPP plays a crucial role in the business world by providing a standardized set of principles and practices that businesses can follow to ensure the integrity and transparency of their financial reporting. By adhering to these standards, businesses can build trust with stakeholders and enhance their reputation in the marketplace.

The Generally Accepted Principles and Practices (GAPP) is a set of guidelines and standards that provide a framework for businesses to follow in order to ensure ethical and transparent financial reporting. These principles and practices are widely recognized and accepted in the business world, and adherence to them is crucial for maintaining the trust of investors, stakeholders, and the general public.

Key Components of GAPP

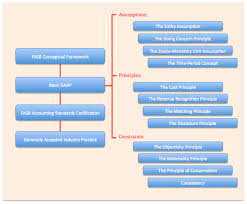

GAPP consists of several key components that businesses should understand and implement:

- Consistency: GAPP emphasizes the importance of consistency in financial reporting. This means that businesses should use the same accounting methods and principles consistently over time, allowing for comparability and reliability of financial statements.

- Relevance: Financial information should be relevant to the needs of users. GAPP requires businesses to provide information that is useful for decision-making and helps users understand the financial position and performance of the company.

- Reliability: GAPP places a strong emphasis on the reliability of financial information. Businesses should ensure that their financial statements are accurate, complete, and free from bias or manipulation. This requires the use of reliable accounting methods and the appropriate disclosure of relevant information.

- Transparency: GAPP promotes transparency in financial reporting. Businesses should provide clear and understandable financial statements that disclose all relevant information, including any potential risks or uncertainties. This helps users make informed decisions and increases the trust and confidence in the company.

Benefits of Following GAPP

Adhering to GAPP has several benefits for businesses:

- Improved credibility: Following GAPP standards enhances the credibility of a business by demonstrating its commitment to transparency and ethical financial reporting.

- Enhanced investor confidence: Investors are more likely to have confidence in a business that follows GAPP, as it provides them with reliable and relevant financial information for decision-making.

- Increased access to capital: Businesses that adhere to GAPP standards may have easier access to capital, as lenders and investors are more likely to trust their financial statements.

- Legal compliance: GAPP standards are often aligned with legal requirements, ensuring that businesses are in compliance with applicable laws and regulations.

- Better decision-making: GAPP provides businesses with a framework for preparing financial statements that are useful for decision-making, both internally and externally.

Importance of GAPP

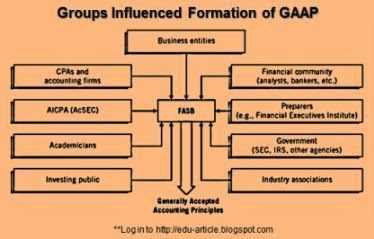

The Generally Accepted Principles and Practices (GAPP) play a crucial role in the business world. They provide a set of guidelines and standards that help ensure transparency, accuracy, and reliability in financial reporting and auditing. Adhering to GAPP is essential for businesses for several reasons.

1. Financial Integrity

GAPP promotes financial integrity by establishing clear and consistent accounting principles. These principles ensure that financial statements accurately reflect the financial position and performance of a business. By following GAPP, businesses can maintain the trust of investors, creditors, and other stakeholders.

2. Compliance with Regulations

3. Comparability and Consistency

GAPP provides a standardized framework for financial reporting, making it easier to compare the financial performance of different businesses. By following consistent accounting principles, businesses can ensure that their financial statements are comparable over time and across industries.

4. Decision-Making

GAPP enables informed decision-making by providing reliable and relevant financial information. By adhering to GAPP, businesses can ensure that their financial statements accurately reflect the financial health of the organization, allowing stakeholders to make informed decisions regarding investments, loans, and other financial matters.

5. Risk Management

GAPP helps businesses identify and manage financial risks effectively. By following established accounting principles, businesses can accurately assess their financial position and identify potential risks and vulnerabilities. This allows them to take proactive measures to mitigate risks and ensure the long-term sustainability of the organization.

Why Businesses Should Adhere to GAPP Standards

Adhering to Generally Accepted Principles and Practices (GAPP) standards is crucial for businesses in order to ensure transparency, reliability, and integrity in their financial reporting. GAPP provides a set of guidelines and best practices that help businesses maintain consistency and accuracy in their financial statements.

1. Enhances Credibility

By adhering to GAPP standards, businesses demonstrate their commitment to transparency and ethical financial reporting. This enhances their credibility and builds trust among investors, stakeholders, and potential business partners. When businesses follow GAPP, they provide accurate and reliable financial information, which is essential for making informed decisions.

2. Facilitates Comparability

GAPP standards ensure consistency in financial reporting across different businesses and industries. This facilitates comparability, allowing investors and stakeholders to analyze and compare financial statements of different companies. It enables them to assess the financial performance and position of a business accurately and make informed investment decisions.

Furthermore, adhering to GAPP standards also facilitates benchmarking, as businesses can compare their financial performance against industry standards and identify areas for improvement.

3. Mitigates Risks

Following GAPP standards helps businesses mitigate risks associated with financial reporting. GAPP provides guidelines on how to properly record and disclose financial transactions, ensuring compliance with relevant laws and regulations. By adhering to these standards, businesses reduce the risk of financial misstatements, fraud, and non-compliance, which can have severe legal and reputational consequences.

4. Improves Decision-Making

Accurate and reliable financial information, as ensured by GAPP standards, is crucial for effective decision-making. Businesses rely on financial statements to assess their financial performance, identify trends, and make strategic decisions. By adhering to GAPP, businesses can ensure that their financial statements provide a true and fair view of their financial position, enabling better decision-making.

5. Enhances Investor Confidence

Investors seek transparency and reliability in financial reporting when making investment decisions. By adhering to GAPP standards, businesses provide investors with the assurance that their financial statements are prepared in accordance with recognized accounting principles. This enhances investor confidence and attracts potential investors, increasing the chances of securing funding for business growth and expansion.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.